My €400,000 portfolio: how I achieve +35%

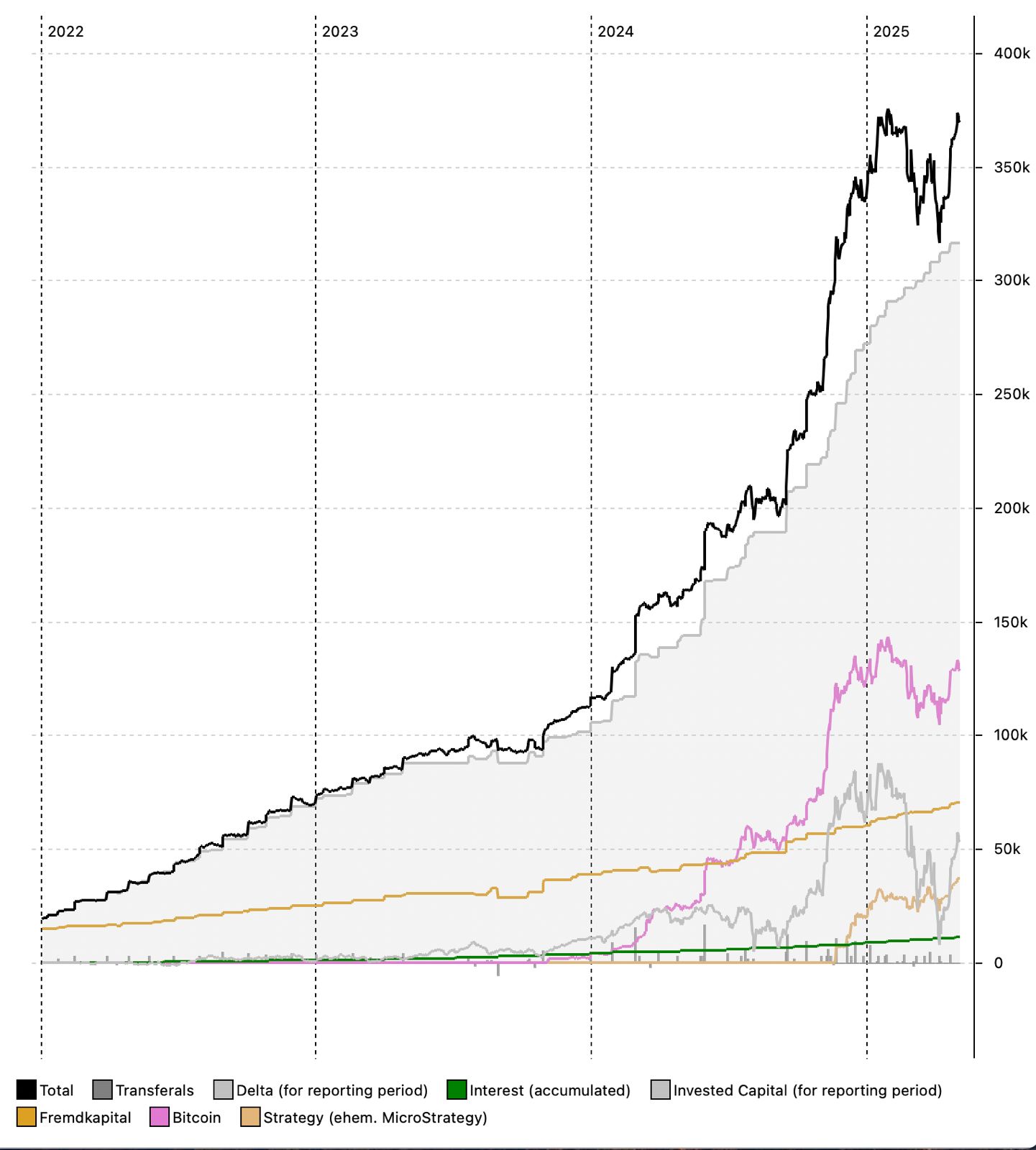

With my investment strategy, I generated a strong 35 % return in 2024. Here I show you exactly which investments were used to achieve this and how you can easily replicate this success.

What you can expect:

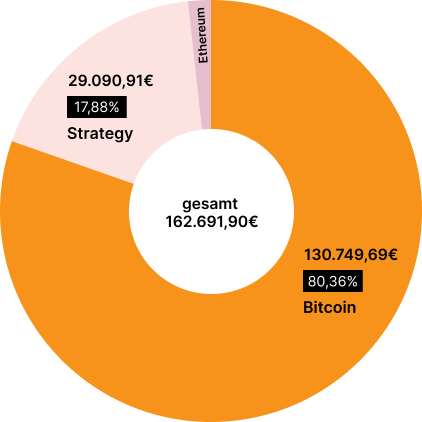

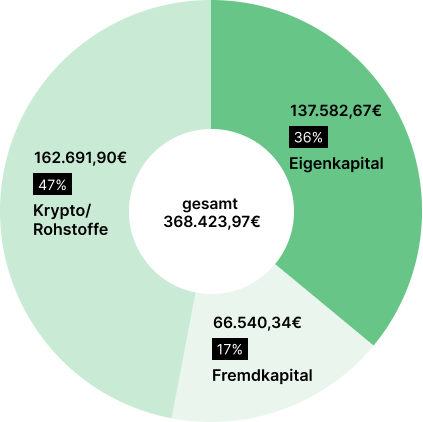

- High profit: My portfolio mix, with which I achieved a 35% return in 2024, with all details transparently visible

- Demonstrable success: No “theory portfolio”! I have invested a total of € 176,000 and increased it to over € 375,000

- Easy to follow: You can simply copy my strategy or adapt it for yourself