My Maclear review: 14% for Swiss P2P lending

Switzerland’s P2P platform Maclear is attracting new customers with interest rates above 14%. A new player in the highly competitive market for personal loans must, of course, be scrutinised closely: How reputable is the company, what is its regulatory status, how secure is it, and much m

I put the provider through its paces, invested €1,000 and am reporting back to you on my Maclear review!

In brief:

- Maclear is a P2P provider based in Switzerland, founded by proven financial experts.

- Interest rates are very high, averaging over 14%, and can even rise to over 18% thanks to my sign-up bonus and the loyalty programme.

- The company’s location offers many advantages for investors, as the regulatory environment is considered excellent and there is no withholding tax.

- A young platform always carries a certain risk. Investors need to gather reviews about Maclear before a final judgement can be made.

My Maclear review: Who is the new P2P provider?

A glance at my quarterly P2P comparison over the last few years shows that the market for personal loans is divided among a small number of high-quality providers. New competitors tend to be few and far between. For us investors, this is ideal and offers security and reliability. It allows us to build up assets or passive income in a stress-free and continuous manner.

But a new P2P platform wants to shake up the market in the future: Maclear allows investors to finance loans for companies via crowdfunding. In return, we can earn interest rates of over 14%! What makes this special is that, unlike most of its competitors, the company is not based in the Baltic States, but in Switzerland.

It has been open to investors since 2023. As is usual for new service providers, the number of users is still manageable, but growing rapidly. I have already invested £1,000 in P2P lending here and would like to share my Maclear review with you.

Here are the key figures:

| Year of foundation | 2022 |

| Headquarters: | Wallisellen, Zurich, Switzerland |

| CEO: | Denis Ustjev, founder |

| Annual report: | Pending (2023) |

| Regulated: | From the Swiss Financial Market Supervisory Authority FINMA |

| Number of investors: | + 11.400 |

| Withholding tax: | 0 % |

| Returns: | 15.6% according to Maclear, 14.4% in my own test |

| Buy-back guarantee: | Indirectly via the planned provision fund |

| Minimum investment amount: | 50 € |

| Managed client capital: | Around €27,9 million |

| Lending financed: | Approximately €6.3 million |

| Auto-Invest: | No, but it should be coming soon. |

| Secondary market: | Yes, with a fee of 2.5% for the seller. |

| Issuing a tax certificate: | No (but there is a bank statement) |

| Loyalty programme: | Up to 2% additional interest and a further 1.5% for recruiting additional investors |

| Starting bonus: | 1.5% extra interest for 90 days on your investment via my link |

These are the people behind the platform

A key factor when considering a P2P provider is the team behind it. Above all, the question of who runs the company and what qualifications and practical experience these people have says a lot about the quality of a platform.

There is no question that the founders of Maclear have experience in the financial world:

Denis Ustjev has worked for TCF Bank in the United States in the areas of business credit management and capital investment, among other things – ideal for a company whose business model is lending!

Co-founder Aleksandr Lang has worked in risk management and hedging for an oil company in Estonia, among other things. This is also very useful experience that will certainly benefit Maclear!

The rest of the team consists mainly of banking and risk experts from Switzerland, who also review potential loan projects. All in all, this is a highly qualified team that has come together in the Zurich area.

Business model

Maclear follows the experience of numerous other P2P platforms, but also has its own special features. The basic concept is quickly explained: companies in Europe regularly need capital that they can borrow from banks or other sources.

P2P providers bring these companies together with private lenders. You can use the platform to invest your capital in individual loans and thus provide the companies with money. Due to the high sums involved (business loans are usually well over €100,000), several investors have to join forces.

In return, you receive substantial interest, which at Maclear can be over 14% per annum. The platform also takes care of security: if a loan defaults (for example, because the borrower becomes insolvent), it takes over the sale of collateral to pay out investors.

For long-term success, Maclear needs numerous companies and investors on the platform – to support this growth, there is currently an attractive 1.5% additional interest rate if you register via my link! If investments are made regularly and defaulted loans are recovered, Swiss investors could eventually generate a nice profit for themselves.

This is because the P2P provider retains part of the interest for itself. At the beginning, when a platform is still young, this source of income is initially insufficient and losses are to be expected. However, once the platform has grown sufficiently, it is possible to achieve solid returns. As experience with Mintos, Bondora, EstateGuru and others has shown, this can take some time with Maclear.

The next few years will therefore be a growth phase in which the new provider will have to prove itself. As an investor, you can benefit from numerous bonuses during this period, but you must also be prepared to accept the risk of the service provider becoming insolvent.

Registration and bonus

As already mentioned, Maclear has a bonus waiting for you – and it’s a good one! You will receive 1.5% additional interest for the first 90 days if you sign up via my link. For comparison: 1.5% is roughly equivalent to the interest rate you currently receive for overnight money at a bank. Here, this value is added on top of the average 14% interest rate!

Once you have registered, you can also refer other people as part of a loyalty programme and increase your interest rate by a further 1.5%. Combined, this means you can easily achieve interest rates of 18% or more. The first steps take just a few minutes. Here’s how it works:

Step-by-step guide + bonus

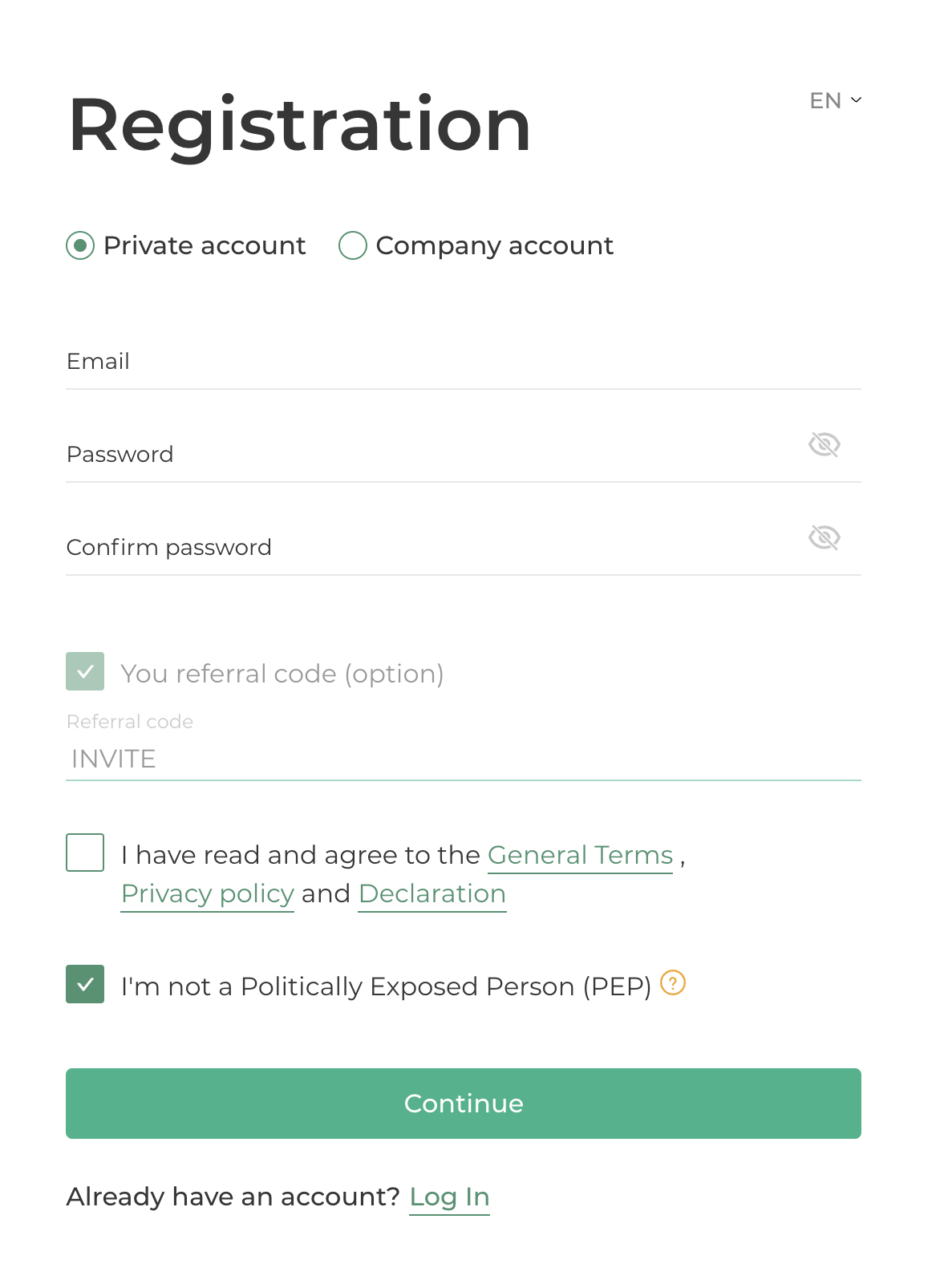

After clicking on my link, you will be redirected to the registration page. Here, you first enter your email address and a password (at least 8 characters, including special characters, numbers and capital letters). You will then receive an email containing a confirmation link that you must click on.

The next step is identification, because Maclear needs to know who you are and where you live. This is required by every financial institution in Europe, but it is doubly important for Swiss providers: the company must report this information to the Swiss federal tax authorities – otherwise, they would deduct 35% withholding tax from your profits!

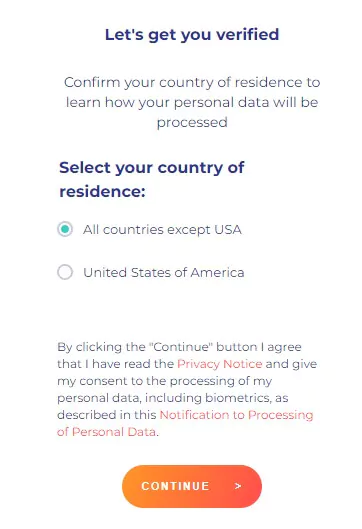

The next steps are handled by the service provider ‘Sumsub’. However, this service is currently only available in English. But don’t worry: the entire process only takes a few clicks. First, select ‘All countries except USA’ as your place of residence – unless, of course, you live in the USA.

Then select an identity document that you have to hand. ‘ID card’ refers to your identity card, “Passport” refers to your passport and ‘Residence Permit’ refers to a settlement permit. Now follow the steps on your screen to complete the process.

Once your identity has been verified, you are a full investor with Maclear. In my review, the entire process took no more than five minutes. You can now deposit money and start financing loans.

You will receive your bonus automatically when you sign up via my link. The additional 1.5% interest will be credited to your account for all investments made during the first 90 days without any further action on your part. It is therefore worth investing larger sums, especially at the beginning. Once the bonus period has expired, you can withdraw your money again if necessary.

Good to know:

By far the easiest way to register is via your mobile phone!

How the Maclear platform works

If you have already reviewed P2P lending, you know that providers want to make it as easy as possible for you to invest your money. Maclear is no exception: it is extremely easy to use, the design is clear and the help functions are comprehensive.

As a result, there are still a few linguistic issues in some areas. However, based on my reviews, Maclear is working on a better and more complete German version – at least I see regular updates.

The ‘Primary Market’ tab on the left-hand side takes you to the projects currently available. At the time of writing my Maclear review, there were only three loans available, i.e. not yet financed. The rest had already been fully invested. Demand is therefore quite high, and you should act quickly if you see attractive offers.

For every project (whether open or already funded), the platform provides you with comprehensive information: what it is about, who is behind it, what the target term is, how high the interest rates are, and much more.

The collateral deserves special attention. Every loan you invest in here is secured. Possible collateral includes machinery, real estate, stocks or other assets that can be converted into cash in the event of default.

You can read through all the details for each project and check them yourself, or simply trust Maclear’s reviews – both approaches work well. However, I would definitely recommend investing in several loans to ensure good diversification.

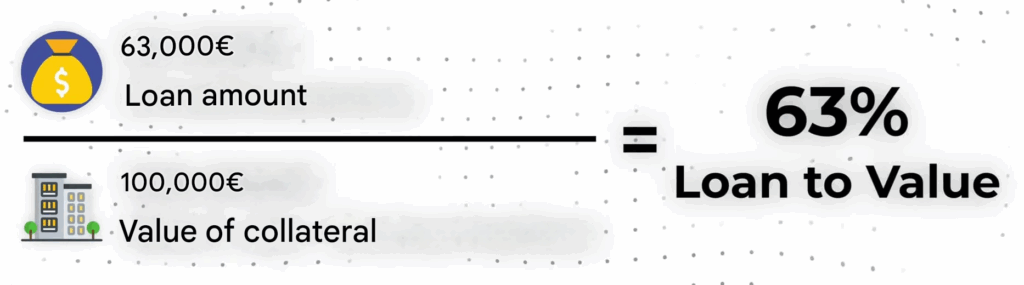

In this context, the loan-to-value ratio (LTV) is very important: it describes how large the loan is in relation to the collateral provided. An LTV of 63%, for example, means that the loan amount accounts for 63% of the collateral. With collateral of €100,000, this would be a loan amount of €63,000.

The lower this percentage, the better. In the event of default, Maclear will conduct a foreclosure sale or sale of the deposited security. In our example, the company only needs to receive 63 cents for every euro in order to pay out all investors.

Good to know:

The collateral assets, such as land or buildings, are checked by an expert before the loan is published. This ensures that there is sufficient value to service the investors in the event of default.

Auto-Invest and other extras

Auto-investments are a popular feature offered by many P2P providers, whereby your money is automatically invested in available loans based on your specifications. Service providers such as Swaper and Vianinvest, which offer private consumer loans, rely heavily on this option. Otherwise, it would be difficult for investors to manually invest in hundreds of small projects.

You can find out more about consumer loan providers in my reviews of Swaper and Viainvest.

However, Maclear takes a different approach: here, you invest in a small number of high-quality business loans. Most investors want to review and select these themselves. An auto-invest function is therefore less important and has not yet been incorporated. However, the provider has assured us that this feature will follow at a later date.

In the meantime, users are being treated to other very useful extras:

- There is a secondary market at Maclear. In my review, this marketplace for already financed loans is usually only introduced later, when a platform already has enough investors and loans. It is very nice that you can sell your investments (or buy already financed projects) right from the start. However, the 2.5% fee for the seller is less pleasant.

- Two-factor authentication is available. Unfortunately, this important security feature is still far from standard in P2P lending comparisons!

- There is an early buyback guarantee for investments over €2,500. At the earliest three months after a project has been fully financed, you can reclaim half of your capital from the borrower. They must pay you the amount within 30 days, but may retain 5% as a fee. This is a process that entails considerable losses, but could be very important in an absolute emergency!

Maclear interest rates: How I achieve a 14.3% return

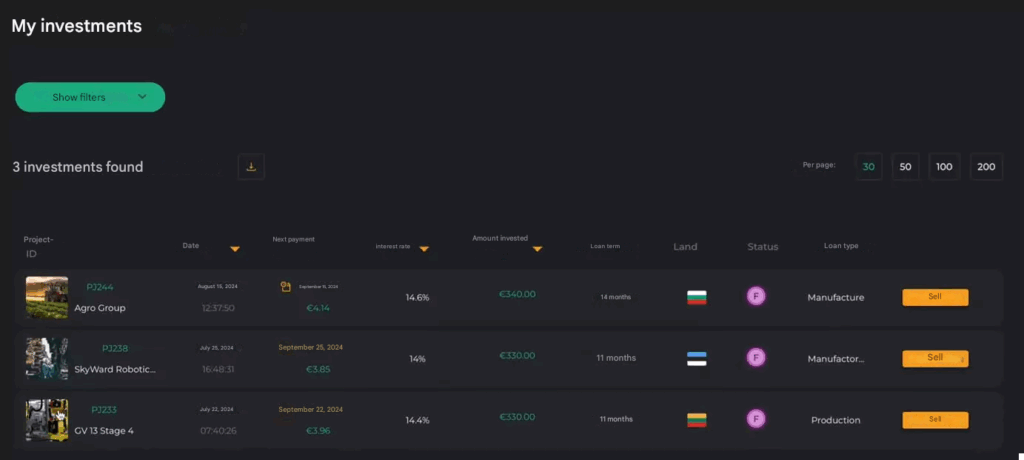

To gain some initial experience with Maclear, I deposited €1,000 immediately after opening my account. I then invested this capital in three projects in Estonia, Lithuania and Hungary, each worth around €330.

You always receive the interest on the platform on a monthly basis; the borrowed money is repaid at the end of the term. A reserve fund guarantees that your interest payments arrive on time, even if the borrower is in default. This is an extra feature that scores important points in my Marclear review!

So it’s hardly surprising that my payments have always been on time so far. The deposit of capital and a withdrawal I made for testing purposes also went smoothly. The money was even back in my account in less than one working day!

Overall, my initial review of Maclear is clearly positive. However, as is usual in the P2P sector, a new platform first has to prove itself over a longer period of time.

Maclear Taxes: The special situation with Swiss withholding tax

Withholding tax This is a problem for investors who invest in other countries. This is because almost every country levies its own tax on the profits you earn there. In the worst case, you may end up paying double tax if the German tax authorities also claim their share.

Switzerland, where Maclear is based, also normally charges significant fees: 35% withholding tax is actually payable. Fortunately, however, there is a very simple way to avoid this deduction!

The P2P platform simply has to report this to the relevant German tax authorities. The Swiss tax office then waives the 35%. All of this happens in the background. The result: you only pay tax on the profits you earn with Maclear in your country of residence!

If you live in Germany, that’s 25% withholding tax plus solidarity surcharge and, if applicable, church tax. So you’ll find one of the simplest P2P tax systems at Maclear. Investors’ reviews of other platforms are significantly worse, as there is much more bureaucracy to deal with.

Security at Maclear: The reserve fund limits risk

Maclear’s experienced team has drawn on reviews of other platforms and introduced an important security feature: the reserve fund.

This fund is made up of the service provider’s income, fees from the secondary market and commissions received. If there are delays in interest payments, the reserve fund steps in and ensures that you receive your interest on time.

In the background, Maclear continues to work on repayment by the borrower and, if necessary, even initiates foreclosure of the collateral. If this worst-case scenario actually occurs, you will have to wait for the securities to be sold before you get your capital back.

If the amount recovered is not sufficient to pay out the investors, the reserve fund will also be used. If everything goes according to plan (and the fund is sufficiently funded), your investments and interest would be very secure. In the worst case, you may have to wait a little longer for repayment.

In future, the repayment fund is set to grow significantly and could then offer considerable security. Depending on the sums held here, it could even be possible to protect against complete platform insolvency!

However, this is likely to be a long way off at present, as the service provider has only been on the market for a few months. I would therefore continue to rate the risk as high. Overall, I really like the idea of the fund and the associated buy-back guarantee, but it first needs to prove itself and the necessary reserves need to be built up.

Regulation

One of the biggest advantages of the new platform is its location: as a Swiss company, we have to meet the high requirements of the local authorities. As investors, we benefit from this because we can be more confident that everything is above board.

Firstly, the Swiss Financial Market Supervisory Authority FINMA is keeping a close eye on Maclear. It has been in existence since 1934 and enjoys a particularly good reputation in the international financial world. Incidents such as the Wirecard scandal in Germany have shown that even such authorities are not infallible, but it is nevertheless good to know that the P2P platform is being monitored in this way.

It is also a member of the self-regulatory association Polyreg. This institution monitors whether the financial institutions that have joined it comply with the provisions of the Swiss Money Laundering Act. At first glance, this may not seem to be of much help to us as investors, but in practice, violations of the law are a serious threat to Maclear. Voluntary membership is therefore another positive sign.

Overview of the pros and cons

After gaining some experience with Maclear and putting the platform through its paces, it’s time for an overview of the pros and cons. First, the things I like:

- Regulated P2P provider from Switzerland

- A team with high qualifications and extensive experience in finance, particularly in lending and credit assessment.

- No withholding tax in Switzerland. You only pay the usual tax on capital gains in your country of residence.

- The minimum investment for a project is €50, which is well within the range for a crowd investing platform.

- The return is phenomenal: the regular 14% can easily be increased to over 18% through the loyalty programme and my sign-up bonus!

- Speaking of loyalty programmes: you can earn a lot of extra interest by referring friends and acquaintances.

- Good collateral: All loans are secured by collateral at Maclear. In my review, the loan-to-value ratio is very low, so there is a good chance that you will get your money back in the event of default.

- All payments have been made as promised to date, and investors have always received their money.

- The provision fund is an ingenious idea that can offer a high level of security. If Maclear manages to continue filling it in the future, this would be an enormous advantage over its many competitors.

Of course, there are also a few points that, in my opinion, speak against the new provider:

- Young platform, so it is difficult to assess how and whether it can withstand a crisis and whether it will be successful in the long term.

- Despite all security measures, the total loss of an investment and even your entire capital is theoretically possible. You should therefore only invest here if you are willing to take risks!

- No annual financial statements are available yet, which makes it difficult to gain insight into the company’s structures and finances.

- The provision fund is a great idea, but it depends heavily on how much money is ultimately available in the security fund. Unfortunately, this figure is not available, making it impossible to assess the risk.

- There are only a few projects on the platform. This means that you either have to invest larger amounts in fewer loans, which reduces your diversification and increases your risk. Alternatively, you can wait for new offers to come in. In this case, your money remains unused and your overall return decreases significantly (known as ‘cash drag’).

57/100PointsSwiss P2P platform with over 14% interestHigh protection with a loan-to-value of 63%1.5% additional interest for the first 90 days on your investmentREDEEM BONUS*

57/100PointsSwiss P2P platform with over 14% interestHigh protection with a loan-to-value of 63%1.5% additional interest for the first 90 days on your investmentREDEEM BONUS*

Alternatives to Maclear: My reviews of other P2P providers

Maclear offers business loans and thus occupies a niche in the P2P market that is less competitive. Nevertheless, there are a handful of providers with whom it must compete:

1. Debitum

The cross-border P2P platform Debitum is the only provider in my P2P lending comparison that offers business loans. Thanks to Maclear, this will finally change in the future!

Debitum has been active since 2018 but has not yet managed to generate a profit – not a good sign for its long-term prospects! However, investors still receive solid interest rates of around 13%. The collateral is also good.

The Swiss are currently making a better impression, not least thanks to higher interest rates, strong bonus payments and better growth prospects in the coming months. Although my experience with Debitum has always been positive, I therefore see more potential in Maclear – but it is only a slight advantage.

Mein Tipp: Debitum bietet Asset Backed Securities an und hat damit etwas andere Produkte als Maclear. Sie funktionieren ideal in Kombination! Hol dir am besten beide in dein Portfolio für maximale Diversifikation.

2. Lande

With Lande, you also invest in commercial ventures, but exclusively in the agricultural sector. The loans are needed for agricultural machinery, seeds, land or livestock. Parallels to Maclear can be seen, among other things, in the minimum investment amount of 50 euros.

Lande has been active since 2020 and has provided its investors with stable interest rates of around 11% since then. Individual projects even achieve 14% or 15%. Collateral in the form of land, livestock, machinery, etc. can be sold quickly if necessary to ensure payments.

This step has actually been necessary on several occasions. Lande has proven that it can deal with payment defaults and recover its customers’ money. My experience with Lande has also been largely positive; however, compared to Maclear, the lower interest rates are particularly noticeable.

Conclusion: Good Maclear experiences so far – platform needs to prove itself in the future

My experience with Maclear after several months of investment and 1,000 euros invested has been very positive so far. The interest rates are high, thanks in part to the extremely attractive loyalty programme, and the collateral makes a solid impression. You can invest in business loans here and earn 14% interest and more.

I consider the buyback guarantee in the form of a provision fund to be an excellent idea. However, in order for it to work in the long term, the company must first fill the fund with sufficient capital. The next few months are therefore likely to be decisive for the long-term success of the platform.

Switzerland is also a major advantage as a location: the Swiss Financial Market Supervisory Authority FINMA monitors the provider. However, payment defaults and even the loss of your capital are still possible.

The team behind Maclear has extensive experience in finance and comes across as competent. The platform itself is also appealing, even if the German translation still needs some work.

Overall, I consider the new Swiss platform to be a very attractive investment, albeit one that comes with considerable risk. If you can live with this risk, high returns of up to 18% are possible! If you would prefer a little more security, the alternatives Lande, Debitum or InSoil might be more suitable for you.