TOP crypto ETFs for private investors in comparison (ETC/ETN)

You can now easily add Bitcoin, Ethereum and other coins to your own portfolio via ETFs. In this article, you will find out what choices are available for investors in Germany, Austria and Switzerland. I will also explain how crypto ETFs work and which ones are good for your portfolio – or not.

How crypto ETFs work!

Buying and storing coins can be expensive and quite complicated. What’s more, if you lose the key to your wallet, the coins are gone too! You don’t run this risk with crypto ETFs. The costs are also predictable. In Germany, however, there is not yet much choice. I’ll introduce you to all the authorised ones today!

ETF is actually the wrong name for the products presented here, as they are ETNs (Exchange Traded Notes) and ETCs (Exchange Traded Commodities). These work like ETFs, but have the important difference that they are bearer bonds. This means that everyone who holds securities here has a certain number of Bitcoin, Ethereum and so on, which must be physically deposited with the provider.

All products in this article are fully collateralised! It is very important to me not to present you with any unsecured or partially secured products. In addition, all products are authorised for sale in Germany and therefore meet German quality standards.

If you are interested in such tips and comparisons or simply want to know where you can invest your money profitably, you should also take a look at our free forum for personal loans. There you can exchange ideas with other investors and keep up to date with the latest developments.

As with other commodities, you will not receive any dividends or similar payments. After all, the coins are not lent out. I have brought you similar and comparable products that all guarantee you the right to cryptocurrencies!

Legal categorisation

Before I show you the first product, I would like to briefly explain the legal particularities of ETCs and ETNs. While the familiar ETFs are protected as special assets against the insolvency of the provider and represent equity, the situation is somewhat more complicated with ETCs and ETNs. As already mentioned, ETCs and ETNs are debt securities. The protection in the event of insolvency is worse here and these products are traded as certificates without a time limit.

However, this information should not put you off too much! Because all commodities on the stock exchange, such as XETRA gold, are structured in this way. The securities presented here are all subject to the German minimum standards! So let’s get started!

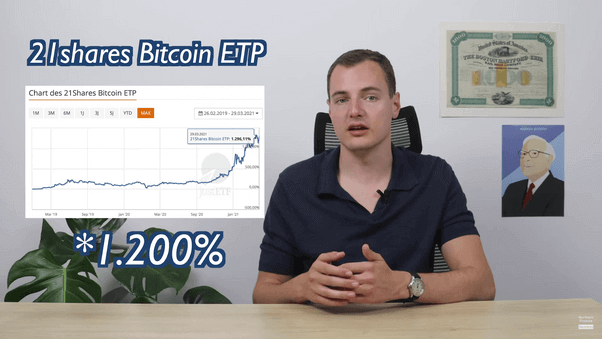

Let’s start with the Bitcoin ETP from 21Shares! 21Shares is one of the few providers that is very active on the German, Austrian and Swiss markets and specialises in cryptos. 21Shares is also based in Switzerland. As usual, the assets here are managed separately from the company’s assets.

Nevertheless, you should know that 21Shares made losses in the first half of 2020 and in previous years. This could lead to the products being closed in the coming years. If this happens, you will get your money paid out and have to look for a new product!

The 21Shares Bitcoin ETP is the first and best-known product from 21Shares. It exclusively replicates Bitcoin! Physical holdings of Bitcoin are deposited. The ETP was founded in February 2019 and has now reached a fund size of approx. 260 million euros. That’s good! Because these products are profitable for the provider from a size of around 100 million euros and the risk of them being closed decreases!

With a Total Expense Ratio (TER) of 1.49% p.a., the ETP is very expensive. This price is more reminiscent of actively managed funds! Unfortunately, this is not an outlier! All the products presented have a relatively high price level. Unfortunately, you have to be prepared for this if you want to invest in crypto! And you should know: The costs are always incurred, even if the price falls! Your own research is therefore very important, even if, according to some, Bitcoin is set to triple in value!

The ETP pursues a long-only strategy. This means that it only bets on price gains. And this has paid off so far! A performance of over 1,200% since inception is on paper!

VanEck Vectors Bitcoin ETN

The direct competitor to the 21Shares Bitcoin ETP is the VanEck Vectors Bitcoin ETN! VanEck is based in Liechtenstein and only launched the ETN in November 2020. Nevertheless, it already has a fund size of 144 million euros and is therefore over the 100 million mark!

With a TER of 1.00% p.a., the VanEck Vectors Bitcoin ETN is almost a third cheaper than its direct competitor! This is important when making an investment decision! Since the launch of the ETN, the VanEck Vectors Bitcoin ETN has returned 145%!

HANetf BTCetc Bitcoin Exchange Traded Crypto

Behind the complicated name is an ETC that was launched in June 2020 and has performed over 450% since then! HANetf offers distribution for BTCetc, as these are not authorised in Germany. Hence the long name!

BTCetc was one of the first providers of Bitcoin ETCs. Like all the products presented, this one is also based on a long-only strategy. This means that it is betting on rising prices! With a fund volume of over 1 billion euros, this ETC is definitely profitable. The rather high costs of 2.00 p.a. TER provide the provider with income of around 20 million euros annually. So this ETC should not be affected by the closure any time soon!

HANetf ETHetc ETC Group Physical Ethereum

Another ETC with a very complicated name! This ETC is a simple way to invest in Ethereum. So if you think that Ethereum will outperform Bitcoin, you should take a closer look at this product!

This is a very young ETC that has yet to prove itself. It was only launched in February 2021 and so far only has a fund size of around 2 million euros. It will therefore have to grow soon if it is not to be closed due to its lack of profitability for the provider! The HANetf ETCetc ETC Group Physical Ethereum also pursues a long-only strategy and costs you 1.49% p.a. TER.

Here we have a direct competitor to the HANetf product, which also invests in Ethereum! The ETP with a less complicated name was launched in March 2019 and has performed over 1000% since its inception! The ETP, which is also long-only, has a TER of 1.49% p.a. TER.

Despite its longer existence, the ETP, with a fund size of 92 million euros, has not yet exceeded the magic 100 million mark. Here you can see that Ethereum is still much less popular with investors than Bitcoin! For me, this product is not an option!

The last product I want to introduce to you was launched in July 2019. Since then, however, the ETP has only performed 13%. That’s nothing for crypto! At 6 million euros, the volume of the fund is also quite small!

2.50% p.a. TER make the 21Shares Bitcoin Cash ETP the most expensive product! The costs combined with the poor performance do not paint a good picture. I would stay away from it!

Conclusion: How to invest in crypto products the right way!

Due to the phenomenal price developments in recent years and months, Bitcoin, Ethereum and Co. have become really interesting for many! There are now also some exchange-traded products that make trading easier for you. I would still advise caution here: Only invest what you can afford to lose!

My personal opinion on cryptos is: they can have their place in the portfolio, but you should be careful with the proportion of the overall portfolio! The price rally can’t go on forever. You also need to be able to withstand price corrections of a good 70%. The most interesting crypto investment product for me is the VanEck Vectors Bitcoin ETN. Here you are 100% collateralised with bitcoins and have the lowest costs!