Debitum Bonus 2025: How to get 2.5% cashback!

Would you like to get started as an investor with Debitum and are looking for possible bonuses? Then you’ve come to the right place, because you can get 2.5% cashback via my link. Not only will you benefit from an attractive introduction to P2P lending, but you’ll also receive a small Debitum bonus for your first investment.

The most important facts at a glance:

| Company headquarters | Riga, Latvia |

| Regulation | Regulated by the Latvian Financial Supervisory Authority |

| Foundation | 2019 |

| CEO | Erik Rengitis |

| Return for investors | 14,83 % (XIRR) |

| Financed credit volume | + €11 million (Q2 2025) |

| Number of investors | + 24.500 (07/2025) |

| Financed corporate loans | + 10.900 (07/2025) |

| Minimum investment amount | 10 per lending |

| Extras | ✔ Secondary market✔ Auto-Invest app✔ German translation |

| Buyback obligation | Yes, for 100% of the capital |

Conclusion: Why I invest in Debitum myself

To be honest, I only looked at Debitum from the outside for a long time before I decided to give it a try. What immediately convinced me was the clarity of the platform and its professional appearance.

Debitum deliberately focuses not on microloans to private individuals, but on corporate loan, which is often backed by real collateral. That’s exactly what gave me a good feeling from the start, which is ultimately why I decided to invest. Added to this is the fact that it is fully regulated by the Latvian Financial Supervisory Authority, which is a big plus for me.

How reliable is Debitum?

Reliability is a key issue in P2P lending. With Debitum, you can tell right away that this is taken seriously. If a borrower defaults, the platform will take over your repayment.

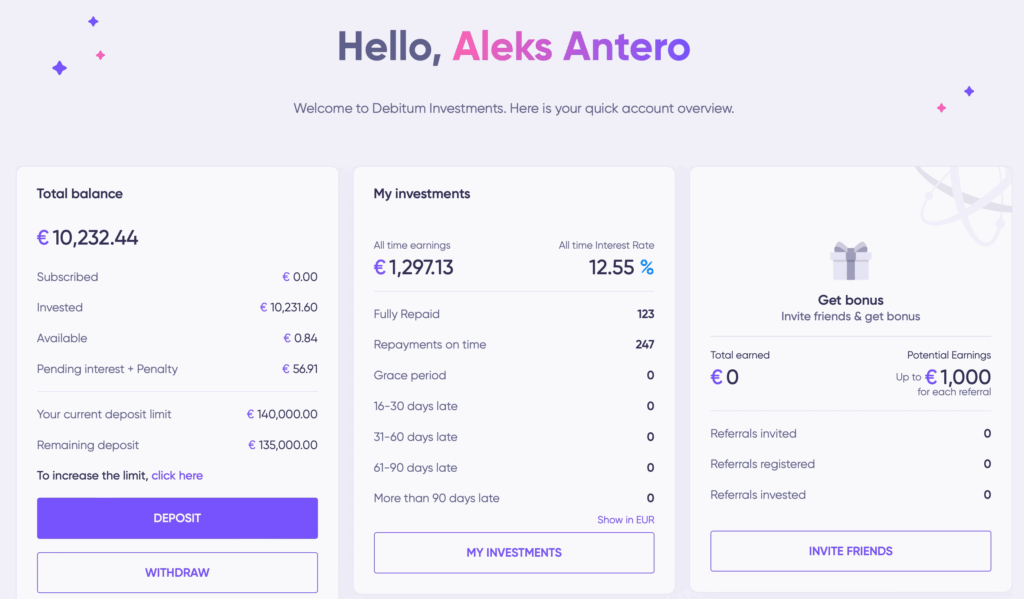

For me as an investor, this provides a good level of security, even though there are of course no guarantees. But so far, I have not experienced any defaults with Debitum.

What interest rates are possible with Debitum?

Debitum offers interest rates of up to 15% per annum. The platform generally offers corporate loans with terms of between 3 and 24 months, with interest rates usually between 8% and 12%.

My Debitum review: 12.25% interest

So far, I have invested around €10,000 with Debitum, spread across many different lendings. I have always received my interest on time for all investments. All in all, I am very satisfied. The platform seems solid, responds quickly to support requests and the returns arrive in my account on time.

How Auto-Invest works at Debitum

If you don’t want to browse through new projects every week, you can use the Auto-Investor. Simply specify the interest rates, terms and credit ratings you want, and Debitum will take care of the rest. This way, your money stays in circulation without you having to constantly intervene.

Are there any fees for Debitum?

No. And that’s one of the things I particularly like about Debitum. There are no hidden costs, such as fees for deposits or withdrawals. The interest you see is what you get credited.

The offer at a glance

Debitum focuses clearly on corporate lending rather than consumer loans, unlike other P2P providers. The projects often originate in the Baltic states, but also in Spain and Poland.

I like that the platform remains clear and concise. There aren’t 1,000 projects all at once, but rather a well-thought-out selection that prioritises quality over quantity. The project descriptions are easy to understand and there is sufficient information about the company and the purpose of the funding.

I use Debitum to complement my investment strategy and would recommend the platform to others.