13% return with agricultural loans– my LANDE review

LANDE is one of the few providers of P2P loan that offers physical collateral. Here, money is lent to farmers and rewarded with double-digit interest rates! I have summarised for you whether this system works, what you need to bear in mind and what my personal experience with LANDE has been.

In brief:

- Lande is a P2P platform from Latvia where you can finance agricultural loans.

- The potential interest rates are among the highest in the entire industry.

- The loans are secured by tangible assets (farmland, agricultural machinery, buildings, etc.) which are sold in the event of default.

- The young company has delivered good results so far. My reviews of LANDE have also been positive.

- The presentation is not yet as professional as that of the competition.

What is LANDE?

LANDE is a P2P platform based in the Baltic States, the unofficial centre of private loan. The company has been offering agricultural loans since 2008. However, it only appeared on the radar of European investors after launching its online service and merging with a similarly positioned provider, LandSecured.

The two founders of LANDE have experience in agricultural loan: they have been successfully active in this field for more than ten years. According to the experts, there is a great need for fast loans for small and medium-sized farmers and entrepreneurs. They are also well versed in debt collection, as LANDE accepts tangible assets as collateral.

A low loan-to-value ratio ensures that private investors get their money back in the event of an emergency. If a payment default occurs, the collateral is sold and the investors are paid out. The company has been highly successful with this approach for many years!

Currently, loan originates from the company’s locations in Latvia, Lithuania and Romania. The European Crowdfunding Services Provider Licence was granted in February 2024.

More than 7,500 private investors use the platform and have an average investment portfolio of around €3,900. This clearly places Lande among the very small P2P platforms. Several large ‘anchor investors’ are also active in the background. These wealthy individuals contributed the necessary financing capital at the outset and are still invested today. This ensures that sufficient capital is always available and borrowers do not have to wait too long when they want to borrow money.

| On the market since | :2008, first company founded by the two founders; renamed and launched online in 2019 |

| Company headquarters: | Riga, Latvia as“Secured Finance MGMT“ |

| Regulated: | Not yet regulated |

| Number of investors: | + 8.400 (05/2025) |

| Financed lending volume: | +978.000 Euro (04/2025) |

| Return: | approx. 11,2% |

| Minimum investment amount: | Primary market €50 / Secondary market €2 |

| Buy-back guarantee: | no |

| Auto Invest | :Yes |

| Secondary market | :Yes |

| Issue of a tax certificate | :Yes |

| Loyalty programme for investors | :No |

| Investing in Lande: | Open an account now (Start with this link*) |

How LANDE works

The basic concept of P2P loan is extremely successful and is implemented in very different ways by different providers. While many platforms offer short-term consumer loans and try to prevent defaults through extensive screening, other companies rely on ‘real’ collateral.

EstateGuru has demonstrated very successfully how this can work: houses and land have been listed here for years. If a borrower is unable to repay their debts, these properties are sold and the investors are paid. LANDE uses the same principle, but focuses exclusively on agricultural and development loans.

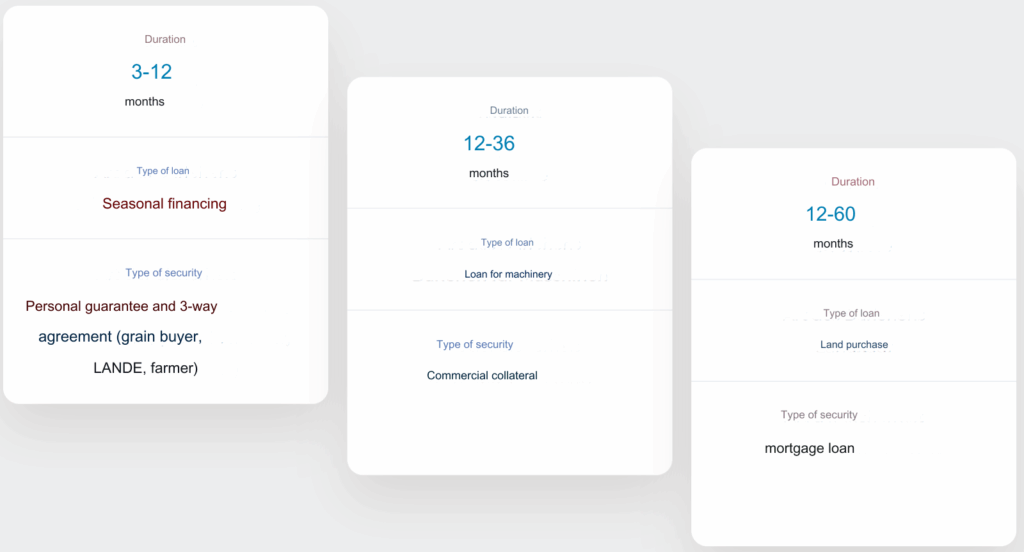

If farmers need money for new machinery, seeds, construction and repair work or similar and have something to offer as collateral, they turn to LANDE. Its experience and expertise in the agricultural sector enable the company to filter out worthwhile investments among the applicants. Only just under five percent of applications are actually approved and included in the portfolio!

The loans are then made available to private investors on the LANDE platform. If you invest your money in one of these projects, you will be rewarded with a return that is usually around 11%. However, lower interest rates of 9% are just as possible as very high rates of 14%!

Security at LANDE

The fact that tangible assets are deposited as collateral at LANDE is a major advantage for investors. If a loan cannot be repaid as agreed, the company sells the collateral and settles the debt with the investors.

But how does this work, for example, if ‘grain’ is specified as collateral? LANDE has experience in dealing with agricultural loans and has developed appropriate methods: farmers can pledge their next (or next but one) harvest, even though it does not yet exist or has yet to be grown!

If payment is not made, the profits from this harvest are used to settle the debt. In my experience, LANDE loans have terms of between 6 and 18 months, so there is rarely much time between harvests.

As an extra safety net, crops are also insured against storms and similar damage. Farm animals can also be used as collateral and, if you can’t pay, they’ll be taken by the bailiff and auctioned off through official channels (there’s an EU portal for auctioning off stuff from bankruptcies).

Good to know:

In the event of a borrower’s insolvency, LANDE uses the established structures and laws of the EU (bailiffs, auctioning of the insolvency estate via a public web portal, etc.) to recover the funds.

Most loans are also secured by machinery, buildings or similar assets, meaning that if the farmer were to become completely insolvent and no harvest could be brought in, the debts would be paid off by selling his equipment.

These multiple safeguards are particularly effective because LANDE offers a very low loan-to-value ratio. This means that the collateral is worth significantly more than the loan amount that would have to be repaid in the event of default.

On average, 44% of properties on the platform are overcollateralised. Loan-to-value ratios of less than 60% are generally considered safe in the financial world. In practice, this could look like this:

A loan of €44,000 is secured by agricultural machinery worth €100,000. The borrower is no longer able to make payments. LANDE therefore sells the machinery to meet the private investors’ claims. They only need to raise €44,000, which should not be a problem given the €100,000 value of the machinery.

Good to know:

A loan-to-value ratio (LTV) of less than 60% is generally considered safe.

Does LANDE have any experience with returns?

The success of this approach is also reflected in the reviews that investors have given LANDE to date: the value of defaulted loans currently stands at 5.9% (September 2024). This is a good figure, but it can of course fluctuate, as the loans are overcollateralised. However, investors can still earn good returns even with defaulted loans.

A total of around 1,100 loans have been successfully processed via the platform to date. This has enabled LANDE to gain experience in financing – but how does it deal with payment defaults?

Only one borrower has been unable to repay their debt to date. The security mechanisms worked as planned and the pledged assets were sold. Investors received their capital back plus 11 per cent interest, meaning that the entire process can be considered a clear success.

However, it should not be forgotten that this is only a single ‘emergency case’ and that LANDE is still a very young provider. In the coming years, with an increasing number of loans and investors, defaults are likely to become more frequent and even a total default, in which the recovery fails, could theoretically occur.

Attention!

Investors’ reviews of LANDE have been positive so far – even when borrowers have defaulted, the money has been returned. However, this is no guarantee of future security!

My LANDE reviews with the primary and secondary market so far

Initially, I only invested 500 euros in LANDE a few months ago. However, the concept behind the platform and the high interest rates quickly won me over! Since then, I have continued to increase my capital here.

Like many P2P platforms, LANDE has a so-called ‘secondary market’. Here, investors can sell their investments in current loans ahead of schedule. This is useful, for example, if you need money unexpectedly and want to exit as quickly as possible.

Loan that is in arrears and therefore has an increased probability of default is also often sold. Here, courageous investors can often pick up real bargains, but they have to live with the possibility of delays or even the risk of complete default.

Actually, my LANDE reviews are limited to the primary market, i.e. direct loan. However, to give you a complete insight into the platform, I also used the secondary market.

LANDE also performs well in this area: unlike many other P2P providers, it does not charge any additional fees for secondary trading. This means that you can sell your investment to another investor or purchase one from them at any time without incurring any additional costs.

In my opinion, both the primary and secondary markets are performing well. Attractive loan opportunities arise almost daily, meaning that your capital is invested within a few days. Repayments have always been excellent so far, and even if a payment is delayed, you continue to receive interest, so you shouldn’t suffer any real loss. My review of LANDE has therefore been very positive so far!

Auto-invest feature delivers mixed results

Auto-invest features are now standard in the P2P sector. If you have uninvested funds in your account, this feature ensures that they are automatically reinvested.

This saves you a lot of work, as you don’t have to invest your money manually every few days. You can also preset your desired parameters, such as the term or interest rate.

LANDE also offers you this kind of auto-invest feature. They seem to be following the successful P2P provider EstateGuru and divide their offer into two levels: You can use the ‘simple’ auto-invest feature starting at just €50 per loan. You have NO settings options here, except for the maximum amount you want to invest in a loan.

The ‘extended’ auto-invest function is only available for loan amounts of €250 or more. Unlike the simple version, this function truly deserves its name, as it allows you to specify the desired interest rate, term and loan-to-value ratio of the collateral in addition to the loan amount. Your assets will then be invested automatically in accordance with your specifications.

To the delight of investors, EstateGuru, which serves as a role model, abolished a similar subdivision several months ago. Perhaps LANDE will come to the same conclusion and also offer investors more opportunities starting with smaller sums.

The auto-invest feature at LANDE is available, evolving and getting better all the time. Both the availability from an investment amount of €250 (the ‘basic’ version from €50 offers no settings options at all) and the available options could be expanded further!

Risk with LANDE

Like all P2P providers, LANDE is subject to a fundamental risk: loans may default if the borrower becomes insolvent (or unwilling to pay). However, thanks to the collateral provided for each project, this risk is lower than with many competitors!

LANDE additionally checks these securities before a loan even finds its way onto the platform. According to the company, 95% of applications are rejected beforehand. An investment can only be made if the collateral provided is sufficient.

In my opinion, this means that the company offers a very good security concept. Investors’ positive reviews of LANDE confirm this. Of 1,000 financed projects, only 5.8% have failed.

These excellent statistics are sure to change over the next few years. After all, LANDE is still a very young platform. However, the company’s basic security concept appears to be sound.

Another positive factor worth mentioning is the unique environment of agriculture. Agricultural loans, for example, performed significantly better than consumer loans during the financial crisis. In addition, farmers are considered reliable borrowers in the financial sector, as they tend to act prudently and do not recklessly put their family businesses at risk.

Of course, there are no absolute guarantees with LANDE, just as there are with other P2P platforms. However, various factors (tangible assets as collateral, low loan-to-value ratio, environment, historical results, etc.) speak in favour of the Latvians. In particular, when you weigh up the risks against the very attractive interest rates of 11 percent on average, I believe the picture is positive.

Attention!

Although the risk of a complete failure at LANDE appears to be very low, there is no absolute certainty!

Advantages and disadvantages of LANDE

Although my review of LANDE has been overwhelmingly positive so far, not everything is perfect with this young platform from Latvia. I have summarised what I consider to be the most important advantages and disadvantages:

- The loans have a very low loan-to-value ratio and therefore offer comparatively good collateral in the event of default.

- Agricultural loans are a good way for most investors to diversify their portfolios, and they’re totally new to most people. With returns of over 11%, they’re also super lucrative.

- LANDE has integrated the payment provider Lemonway, which ensures, among other things, that the company’s capital and investors’ money are kept strictly separate.

- Agricultural loans are an extremely exciting investment environment, as they traditionally perform very well.

- LANDE has more than 10 years of experience in the agricultural sector and a team with the necessary expertise to operate successfully in the P2P business in the long term.

- Extensive collateral is available for all LANDE projects. This concept has proven successful to date, even in cases of insolvency, and no total losses have been recorded.

- LANDE is still a young platform. This makes it difficult to make long-term predictions about the provider’s success. Its small size also makes assessment difficult.

- The young age is also noticeable in other areas: the registration process is still quite bumpy, and although a German translation of the website is available, it is only half complete.

- LANDE appears to be profitable; however, the annual reports have not been audited.

- The platform is regulated and supervised by the Latvian Central Bank, which protects investor funds.

Conclusion: My LANDE review

LANDE is undoubtedly still at the beginning of its long journey to becoming a major P2P player. However, in my view, the Latvian company has what it takes to achieve sustainable success in an equally sustainable industry.

Because when you invest in LANDE, you are investing in agriculture and thereby providing a positive boost to an enormously important industry. One could undoubtedly argue that this contribution makes sense in light of the global hunger crisis. At least it makes more sense than financing the purchase of televisions, PlayStations and the like via other P2P platforms…

LANDE makes this morally correct decision extremely easy for us with very attractive interest rates averaging 11 percent! As always when high returns beckon, investors become suspicious: Can this be safe?

I too had my doubts at first and would by no means claim that the platform is 100% secure. However, my reviews of LANDE have been overwhelmingly positive so far, as the use of low loan-to-value ratios seems to work extremely well.

Although there are still some teething problems in certain areas and long-term success remains to be seen, the overall impression is very positive. I will therefore continue to increase my investment in LANDE and am even considering becoming a shareholder in the company itself.

I hope my LANDE review has helped you make a personal decision for or against this young platform.