Advantages and disadvantages of ETFs: Is this a worthwhile investment for you?

ETFs (exchange-traded funds or index funds) have gained enormous popularity in recent years. But there are advantages and disadvantages of ETFs. This is hardly surprising, as they promise a low-cost and simple way to participate in the stock market.

But is investing in index funds really worth it for you? In this article, you will learn everything about the advantages and disadvantages of ETFs and how to decide whether they are right for your portfolio.

In brief:

- Index funds offer numerous advantages such as low costs, broad diversification and ease of use, making them particularly attractive to beginners and cost-conscious investors.

- The variety of ETF types allows investors to implement individual investment strategies and tailor their portfolios to their personal preferences.

- ETF savings plans offer a flexible way to invest regularly and with small amounts, making it easier to enter the stock market and benefit from the cost average effect.

Advantages of ETFs: Why they are so popular

The best ETFs offer a range of advantages that make them attractive to many investors.

- Attractive returns: The average return on the MSCI World ETF has been over 6% per year for the last 20 years.

Performance of the MSCI World Index for selected periods:

| Period | Score (before) | Annual performance | Compound performance |

| 5 years | 2.178,35 | 9,61 % | 58,22% |

| 10 years | 1.743,42 | 7,05% | 97,62% |

| 15 years | 964,05 | 8,86% | 257,37% |

| 20 years | 1.062,51 | 6,06% | 224,24% |

| 30 years | 615,19 | 5,89% | 460,01% |

| 40 years | 174,88 | 7,74% | 1.869,98% |

| 50 years | 97,48 | 7,39% | 3.434,37% |

- Low costs: One of the main reasons for the popularity of ETFs is their low costs. Compared to actively managed funds, the fees for ETFs are significantly lower. While active funds often charge annual management fees of 1.5% to 2%, ETFs usually charge less than 0.5%. Even with smaller amounts, ‘just’ 1% can make the difference between hundreds or thousands of pounds in the future.

- No front-end load: For active funds, this can be up to 5%. ETFs do not have this charge. This is money you save on ETFs and can invest directly. These cost savings have a positive impact on your returns in the long term.

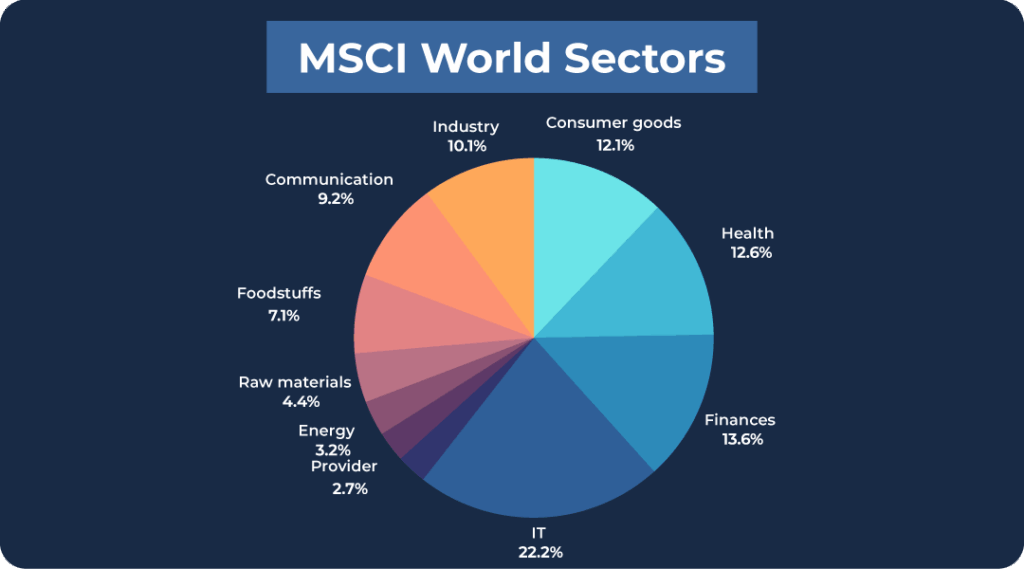

- Broad diversification: Index funds also offer an easy way to spread your investment risk. With a single ETF purchase, you invest in hundreds or even thousands of companies at once. An MSCI World ETF, for example, contains over 1,600 stocks from 23 developed countries. This broad diversification significantly reduces risk.

- High flexibility and transparency: Unlike traditional investment funds, you can buy and sell ETFs at any time during trading hours. This gives you maximum flexibility in your investment decisions. With index funds, you also always know exactly what you are investing in. The composition of the fund is transparent and corresponds to the underlying index.

- Ideal accessibility: You can invest with as little as £1 per month! This allows investors with limited budgets to enter the stock market.

- Cost average effect – Another advantage of ETF savings plans: by making regular, consistent payments, you automatically buy more shares when prices are low and fewer when they are high. Over the long term, this effect can smooth out returns and help minimise the risk of unfavourable entry points. This can be a valuable advantage, especially in volatile market phases.

- Lucrative historical performance: When comparing performance with actively managed funds, ETFs often come out on top. According to the S&P Indices Versus Active Funds (SPIVA) Europe Scorecard, 90% of active funds based in the United Kingdom failed to beat the global equity benchmark over a 10-year period. Furthermore, 83% of large-cap managers in the United States failed to beat their benchmark over the same period.

This low barrier to entry makes ETF savings plans an ideal option for young investors or those looking to get their first review of the stock market.

Disadvantages of ETF funds

Although ETFs offer many advantages, it is important to be aware of their potential disadvantages. These aspects should be considered when deciding whether or not to invest in ETFs.

- Price fluctuations: ETFs are directly linked to the performance of the underlying index. This means that they are exposed to the full fluctuations of the market. In times of market turbulence or economic crises, ETFs can therefore suffer significant losses in value. Unlike actively managed funds, there is no fund manager who can take countermeasures in such situations and adjust the portfolio.

- Counterparty risk: This risk is particularly prevalent in synthetic index funds that use derivatives such as swaps to replicate the performance of an index. If the swap partner, usually a bank, gets into financial difficulties or even becomes insolvent, this can lead to high losses for the ETF. Investors should therefore carefully check the creditworthiness of the swap partner and the collateralisation of the index fund.

- Exchange rate risk: ETFs that invest in foreign markets are exposed to currency fluctuations. For example, if an index fund denominated in euros invests in US stocks, a depreciation of the US dollar against the euro may reduce the ETF’s return, even if the underlying stocks increase in value. This risk can be mitigated by currency hedging, but such hedging incurs additional costs.

- Not a short-term investment: ETFs are designed for long-term investments and are not suitable for short-term speculation. Due to price fluctuations, investors with a short-term investment horizon run the risk of having to sell at an unfavourable time. In addition, frequent buying and selling can lead to higher transaction costs, which reduce the overall return.

- Tracking difference: Although index funds aim to replicate the performance of their benchmark index as closely as possible, deviations may occur. This tracking difference arises from factors such as management fees, transaction costs and differences in the weighting of the index components. In some cases, a significant tracking difference may occur and affect the expected return of the ETF.

- Herding behaviour: In times of crisis or when the market is highly volatile, herding behaviour can occur, whereby many investors sell their ETF shares at the same time. This can lead to an increased price decline that goes beyond the actual market movement. This effect can lead to increased volatility and wider spreads between bid and ask prices, particularly for less liquid ETFs.

- No voting rights: Investors in index funds generally do not have direct voting rights in the companies in which the ETF invests. This means that they have no influence on important corporate decisions or corporate governance. This can be a disadvantage for investors who value active influence and responsible investing.

- Default risk in securities lending: Many ETF providers lend securities from the fund portfolio to generate additional income. Although this can improve the overall return, it also involves risks. If the borrower becomes insolvent and cannot return the borrowed securities, this can lead to losses for the index fund. Investors should therefore carefully review the securities lending practices and security measures of the ETF provider.

- Overexposure: Market-capitalised indices may be overweight in certain sectors or companies. This can result in an ETF that tracks such an index being insufficiently diversified. For example, technology companies may be disproportionately represented in some indices, which increases the risk for investors if this sector comes under pressure. Such concentration can partially offset the benefits of broad diversification that index funds normally offer.

- Market risk: ETFs are exposed to general market risks and may lose a significant amount of their value in difficult economic times. As they are passively managed and aim to replicate the performance of an index, they have no way of positioning themselves defensively in the event of negative market developments. In times of recession, geopolitical crises or other economic shocks, ETFs may therefore suffer significant losses in value. Investors must be aware that the broad market exposure offered by ETFs entails both opportunities and risks.

- Emotion-driven bad decisions: Regular investing requires discipline, especially during times of market turmoil. When prices fall, it can be emotionally difficult to continue investing money. Many investors tend to reduce or suspend their investments in such situations, which contradicts the principle of the cost average effect. It is important to keep a cool head during such phases and stick to your long-term strategy.

Special types of ETFs and their characteristics

In addition to traditional index funds, which track well-known indices such as the DAX or S&P 500, there are now a variety of specialised variants tailored to specific investment strategies or areas of interest.

This diversity is a clear advantage of index funds. It allows investors to tailor their portfolios specifically to their individual needs and convictions.

Dividend ETF

Dividend ETFs, which focus on companies with high payout ratios, are a popular type. These ETFs are particularly attractive to investors who are interested in regular income and want to generate passive income.

They offer the advantage of potentially stable cash flows, as companies that pay high dividends often operate in established industries. However, this often goes hand in hand with lower growth potential, as these companies distribute a larger portion of their profits rather than reinvesting them.

ETF pension insurance

ETF-based insurance products such as ETF pension insurance are an innovative development. These products combine the cost efficiency and flexibility of ETFs with the tax advantages of traditional insurance products. They are particularly suitable for long-term retirement provision, but also involve higher costs and less flexibility compared to pure investments in index funds.

Thematic ETFs

Thematic index funds have gained considerable popularity in recent years. They focus on specific sectors or future trends such as technology, renewable energies or artificial intelligence.

These index funds offer investors the opportunity to invest specifically in growth areas and benefit from potential future opportunities. However, they also involve higher risks due to their concentration on individual sectors and may be subject to greater fluctuations than broadly diversified indices.

ESG-ETF

Another important trend is sustainable ETFs, also known as ESG ETFs. These invest in companies that meet strict criteria in the areas of environmental, social and corporate governance (ESG).

They meet the growing need of many investors to align their investments with their ethical and environmental principles. However, restricting the investment universe through ESG criteria can lead to lower diversification.

Further details

It is important to emphasise the advantages and disadvantages of ETFs. Although specialised index funds can be a useful addition to a broadly diversified portfolio, they also require careful selection and regular monitoring. Sector or thematic index funds in particular can be more volatile than traditional global index funds.

A balanced mix of different types of ETFs can help you take advantage of opportunities while minimising risk. As an investor, you should always tailor your investment strategy to your personal goals, risk tolerance and investment horizon.

Conclusion: These advantages and disadvantages of ETFs outweigh each other

ETFs offer numerous advantages that make them attractive to many investors. Their low costs, broad diversification and ease of use make them an excellent option for long-term wealth accumulation.

ETFs can be an ideal option for long-term wealth accumulation, especially for ETF beginners and cost-conscious investors.

The variety of ETF types also makes it possible to implement individual investment strategies, whether by focusing on dividends, sustainable investments or specific sectors.

ETF savings plans also offer a flexible way to invest regularly with small amounts.

However, investors should also be aware of the potential disadvantages, such as passive replication of indices without active risk management. There is also exchange rate risk and tracking error.

The decision to invest in ETFs should always be based on personal financial goals, risk tolerance and the planned investment horizon.

Overall, index funds offer many investors a cost-effective, transparent and efficient way to participate in the stock market and build long-term wealth.