Covered call ETF: Distribution yield of 12.16% plus?

Investment strategies involving covered call ETFs have been the talk of the town lately. These index funds promise high distributions generated by forward transactions. We have taken a closer look at this topic and are sharing our findings with you. You will learn how they work, what you need to look out for, and whether they can really generate double-digit distribution yields.

In brief:

- Covered call ETFs offer particularly high distributions, in some cases over 10% per annum.

- They combine traditional ETF investments with premiums from covered calls.

- This strategy ensures stable returns but limits profit potential during periods of strong growth.

- Covered call ETFs are particularly attractive in extremely negative or sideways markets, while traditional ETFs usually perform better when prices are rising sharply.

What is a covered call ETF?

A covered call ETF combines traditional ETFs with the covered call option strategy. The ETF invests in a specific index, such as the S&P 500 or the NASDAQ 100, as usual.

In addition, the ETF regularly sells call options on the shares it holds in its portfolio. For each option sold, the fund receives a premium, which is included in the distribution as ‘additional income’. This means that the ETF earns not only from dividends but also from option premiums.

How covered calls work in detail

The buyer of a covered call wants to secure the opportunity to purchase a specific share at a predetermined price, even if the market price later rises significantly.

For him, it’s like a ‘lucky break’: if the share price rises sharply, he makes a guaranteed profit because he gets the shares at a low price. The buyer’s goal is therefore:

- A potential bargain purchase if the share price rises sharply.

- Predictable investment costs, because he knows the price in advance.

You receive an option premium from the buyer. This is like an insurance premium. The premium is always paid, regardless of whether the option is exercised or not.

The three possible scenarios for covered calls

With covered calls, there are three typical situations that you as an investor may encounter in futures trading. In two out of three cases, you benefit from the premium without anything else happening.

- The price falls: In this case, the option simply expires worthless. You can book the premium as extra profit and keep your shares in your securities account as normal.

- The price stagnates: This is the preferred scenario for many, as you can retain the premium and benefit from a moderate price increase.

- The price rises: the buyer of the option wants to buy your shares at the predetermined price, and you have to sell your shares. You receive the premium and the price gain up to the strike price, but you miss out on potential gains that would have exceeded this amount. This is the price you pay for the regular income from the premiums.

How does the covered call ETF differ from passive ETFs?

Passive ETFs are very popular with most investors because they track an index in a cost-efficient and transparent manner, offering broad market diversification with low fees. They generally aim to replicate the performance of a benchmark index, making them a simple and stable long-term investment.

Active ETFs, on the other hand, are actively managed by fund managers who select specific securities and flexibly adjust the portfolio to market conditions in order to achieve higher returns or manage risks. This active management usually leads to higher costs, but offers the potential for additional returns.

Covered call ETFs are typically active ETFs, as they go beyond pure index replication and actively participate in forward trading.

These are the advantages and disadvantages of covered call ETFs.

Before we give you deeper insights into our experiences and introduce specific covered call ETFs, you will learn about the most important strengths and weaknesses. This will give you a quick feel for how this special ETF strategy works and what you should pay attention to.

Your advantages as an investor:

- High monthly distributions: Compared to traditional ETFs, covered call ETFs can offer significantly higher and, above all, regular returns.

- Risk reduction: The option premium received generates additional income.

- More stable portfolio with high volatility: Price fluctuations are lower than with traditional ETFs. This brings greater stability and peace of mind, especially during corrections.

In addition to their advantages, covered call ETFs also have disadvantages. These are:

- Limited profit potential: If the prices of the shares included in the ETF skyrocket, you will usually profit less than with traditional ETFs, because the ETF loses part of the potential price gains when the options are sold.

- No complete protection against losses: In the event of sharp downturns or crashes, even a covered call ETF can fall sharply. The premiums are then often not sufficient to offset all losses.

- Higher costs and complexity: Due to the active strategy, higher management fees (TER) and transaction costs are usually incurred. The products are less transparent and often still relatively new to the market.

Which is the best covered call ETF?

The selection of covered call ETFs in Europe is still manageable, but three products currently stand out in particular. We list these below in chronological order according to the best distribution yield. In doing so, we have ensured that the minimum fund volume of around €200 million is significantly exceeded.

This threshold is important because ETFs with a smaller fund volume carry a higher risk of being closed due to low liquidity or profitability, which can lead to losses.

| ETF Name | ISIN | Fund size (€ million) | TER (costs/year) | Annual distribution yield | Annual total return | Replication |

| Global X Nasdaq 100 Covered Call UCITS ETF D | IE00BM8R0J59 | 500 | 0,45 % | 12,16 % | 30,12 % | Swap-based (synthetic, does not hold shares directly) |

| JPMorgan Nasdaq Equity Premium Income Active UCITS | IE000U9J8HX9 | 1.984 | 0,35 % | 9,72 % | 2,51 % | Complete, physical (real shares) |

| JPMorgan Global Equity Premium Income Active UCITS | IE0003UVYC20 | 1.103 | 0,35 % | 6,78 % | 14,96 % | Complete, physical (real shares) |

Good to know:

The JPMorgan Nasdaq Equity Premium Income Active UCITS ETF USD (ISIN: IE00B9J8HK09) is currently the most popular among investors.

Performance comparison: covered call ETF vs. standard ETF

The chart below illustrates the differences between a traditional index ETF and a covered call ETF, using the US market since 2008 as an example:

- SPDR S&P 500 ETF Trust (ISIN: US78462F1030): The blue line shows the performance of the Standard S&P 500 ETF. It has achieved a return of around 648% over the last 15 years and mirrors the market return one-to-one.

- CBOE S&P 500 BuyWrite ETF (ISIN: US4642863729): The orange line shows a typical covered call ETF that tracks the corresponding option strategy on the S&P 500. Here, the increase in value over the same period was around 150%.

The differences stem primarily from the fact that covered call ETFs benefit from option premiums, but their profit potential is capped when prices rise rapidly. In calm or weak market phases, the strategy cushions losses, but in the long term, classic standard ETFs such as the SPDR S&P 500 perform significantly better.

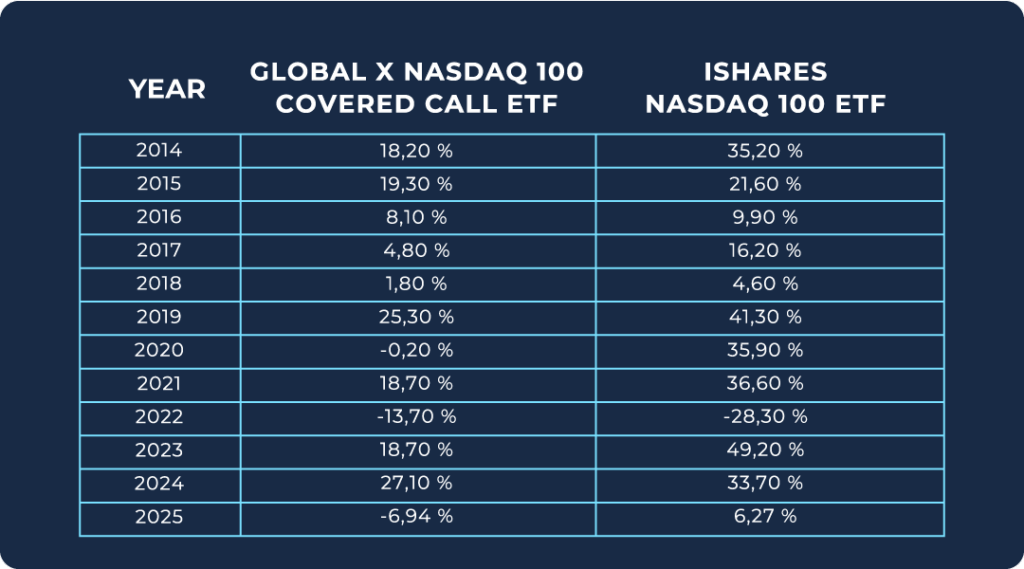

When looking at another ETF comparison between the Global X NASDAQ 100 Covered Call ETF (ISIN: IE00BM8R0J59) and the iShares Nasdaq 100 ETF (ISIN: IE00B53SZB19), the following results should also be noted:

The results show that in most years, especially when markets are rising sharply, the iShares Nasdaq 100 ETF achieved significantly higher returns than the Global X NASDAQ 100 Covered Call ETF. The covered call strategy limits growth potential, which is particularly significant in boom times.

It is also noteworthy that the covered call ETF incurs fewer losses than the pure index ETF, particularly in weak market phases such as 2022. The option premiums have a stabilising effect and can cushion declines.

Caution: Potential risk with covered call ETFs

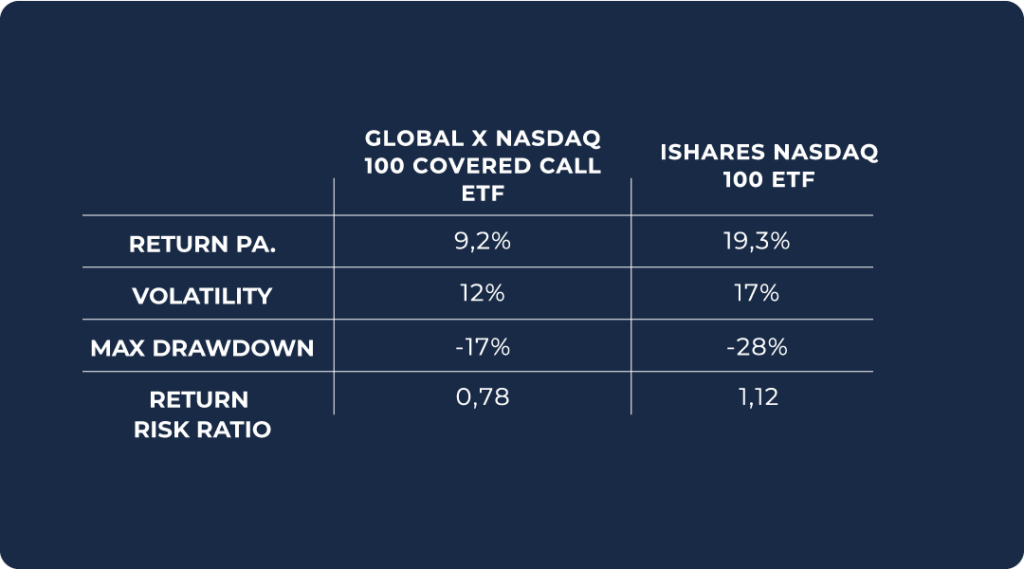

Covered call ETFs are attractive to many investors because they reduce volatility in portfolios while enabling regular distributions. Looking at the chart below, one might get the impression that these ETFs are less risky than traditional ETFs.

Due to limited price growth, recovery from a crash or correction may take longer than with passive index funds. If the underlying index rises sharply, positions are often sold at the strike price of the options, meaning that a significant portion of the upward movement is no longer reflected in the fund.

In the long term, this can result in an unfavourable risk/return ratio, as the following chart shows. Covered call ETFs are therefore more suitable as an addition to the portfolio of income-oriented investors.

My recommendation: Open an account with Freedom24

If you would also like to trade covered call ETFs, you must first open a securities account. Freedom24 offers you an attractive opportunity to trade such ETFs at low cost and with access to many marketplaces. You can also benefit from the current bonus for new customers in the form of free shares worth over €500.

- Huge selection: Over a million different shares, ETFs, bonds, and options are tradable on Freedom24.

- Global access: The broker offers you access to a total of 15 international stock exchanges, including major markets in Europe, the US and Asia.

- Cost-effective: There is no mandatory minimum deposit, which makes getting started easy. The order fees are very attractive: you only pay €2 per buy order plus a minimum of €0.02 per share purchased. Custody account management is completely free of charge.

- User-friendliness: Freedom24’s trading platform is easy to understand and can also be used on the go via smartphone or tablet.

- Especially for new customers: As a new customer, you can currently benefit from free shares worth more than €500 (median value).

With these features, I believe Freedom24 is the ideal choice for beginners and advanced users alike when it comes to securities accounts.

Can the covered call ETF beat the index?

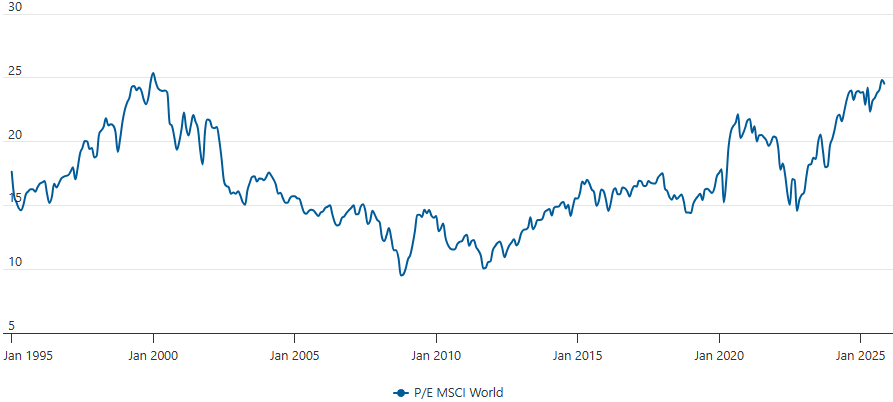

The chart comparison above clearly shows that the classic S&P 500 ETF generates much higher returns than the covered call ETF. However, this does not mean that the covered call strategy is less attractive. In November 2025, share valuations are at a record high.

When markets fall or stagnate

The shares in the MSCI World Index have a combined price-earnings ratio of almost 25. This figure was last this high shortly before the dotcom bubble burst at the beginning of 2000.

The high valuation could indicate that the chances of further strong price gains are potentially limited and setbacks are becoming more likely. It is precisely in such market phases that covered call ETFs demonstrate their advantages.

The more overheated and uncertain the stock markets are, the more the covered call ETF plays to its strengths. A classic ETF is suitable for maximising profits in a boom phase, whereas covered call ETFs are a useful addition for defensive or income-oriented strategies. This is particularly true in times of high valuations and potential price corrections.

If you would like regular distributions

Covered call ETFs distribute regular income mainly from option premiums and dividends, which makes them particularly attractive to income-oriented investors. The following points illustrate the factors that influence the level and sustainability of covered call ETFs.

- Sources of distributions: Income is primarily derived from option premiums received from the sale of covered call options on the shares in the ETF portfolio. Dividends from the companies included in the portfolio make an additional contribution.

- Distribution amount: Typically, monthly distributions amount to up to 1% of the capital invested, which corresponds to approximately 12% on an annualised basis.

- Sustainability of distributions: However, such high distributions are often not sustainable in the long term and can lead to capital depletion if the income is not covered by current premiums and dividends.

Conclusion: Who really benefits from covered call ETFs?

Covered call ETFs are more than just a short-term hype, as they offer real advantages for investors who value stable and predictable additional income and want to protect their portfolios against sharp fluctuations. Their risk buffer function is particularly useful in overvalued markets, where the risk of corrections is increasing.

If you value passive income, risk limitation and planning security, covered call ETFs are the ideal addition to your portfolio. They offer you a degree of financial independence without requiring professional knowledge of options.

It is important that you do not invest 100% in covered calls during upward trends so that the growth potential of your assets is not limited.