The most popular ETF strategies – advantages and disadvantages

When investing in ETFs, as with other financial instruments, your own strategy is crucial. There are many different ways to achieve your personal financial goals.

Today we have taken a closer look at what this can look like in practice, what the most popular and best-known methods are and how they perform in reality.

Northern Finance YouTube channel

If you are interested in these and other financial tips and advice or simply have questions that you cannot find the answer to, you should also take a look at our forum for personal loans.

There you can exchange ideas with other investors and find valuable knowledge. You can also learn a trick or two there.

The dividend strategy

One of the simplest and best-known investment methods is the dividend strategy. If everything goes according to plan, it is also one of the most useful, as it provides investors with a stress-free, passive income.

The concept is quickly explained: by buying shares that pay a dividend, we regularly receive the corresponding amount. As the amount increases, so does this additional income, until we can theoretically make a living from the dividend alone.

Even those who have less ambitious goals and only want to cover part of their costs in this way have good opportunities here. The selected

Shares must of course pay a correspondingly high dividend. Many well-known companies such as Coca Cola, Roche and McDonalds can be found in a portfolio organised in this way.

As this is a long-term strategy, the focus is on established names with consistently high (and regularly rising) dividends. Risky items are less likely to be considered.

The advantages naturally include these dividend payments, which provide us with a corresponding income. We can also take a much more relaxed view of the actual price of our shares, as gains are not our primary goal here. And beginners in particular also benefit from the current tax-free allowance of 801 euros.

On the negative side, there is a lack of diversification across sectors and regions. This is because the shares that are eligible for the dividend strategy tend to be very closely ‘clumped’.

When searching for suitable companies, most people look to the USA. And even there, it is almost impossible to find a suitable candidate in some sectors. You usually end up with titles from the communications or oil and gas sectors and are at the mercy of developments in these categories.

In addition, the dividend strategy incurs costs if income is to be reinvested. If we implement this strategy using ETFs, we also have significantly less room for manoeuvre when selecting companies. In addition, these ‘dividend ETFs’ in particular are often somewhat more expensive than other offerings.

Possible ETFs for the dividend strategy

If you want to achieve a strong dividend through ETFs, the ‘Dow Jones U.S. Selected Dividend UCITS’ from iShares is usually a good choice. In recent years, this ETF has not only posted decent price gains; the dividend is also impressive – otherwise I would not recommend it here.

Another option is the ‘iShares Emerging Markets Dividend UCITS ETF’. This invests in 100 shares from emerging markets, which should offer a corresponding distribution. Unfortunately, this candidate is quite expensive at 0.65 % costs.

The ‘megatrend strategy’

A whole range of developments can be categorised as ‘megatrends’: the digital transformation, the climate catastrophe, gender equality, demographic change and many more. Predicting their impact can be entertaining – but it is rarely reliable.

If you bet on the right sectors, you have the chance to be part of a huge boom and multiply your capital. If, on the other hand, you choose the wrong shares and ETFs, you won’t get rich quick. There is also the risk of heavy losses.

Self-proclaimed cash prophets explain on every corner of the internet what the new megatrend is and why you should bet everything on it to guarantee that you will become rich. However, it has actually been scientifically proven that you cannot outsmart the market – at least not in the long term.

However, it is possible to back the right horse in the short term and take the corresponding profits. However, outperforming the rest of investors in the long term by selecting the right ETFs and shares is unlikely.

The additional disadvantages also include the high costs for ETFs that track such a trend sector. Fees of 0.8 % are not uncommon here. These sums must first be offset by better returns.

And the diversification of such trend ETFs also looks rather bleak.

Possible ETFs for the megatrend strategy

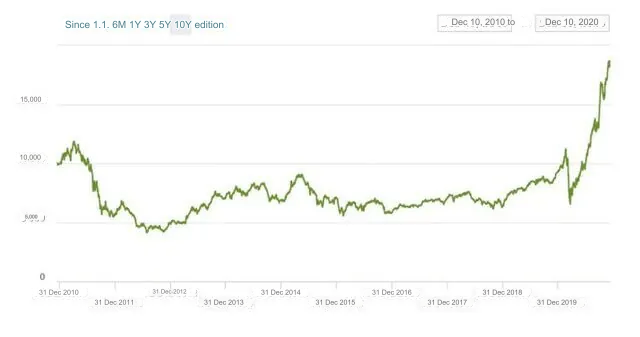

If you want to jump on the bandwagon and invest in a megatrend, you can do so in the form of the iShares Global Clean Energy ETF, for example. This contains 30 of the largest companies investing in clean energy and now has a volume of 3.3 billion euros.

These include stocks such as Siemens Gamesa and Vestas, which, however, also have annual fees of 0.65 %. The performance is also not outstanding: after 9 rather lean years, there was only a noticeable upturn in 2019.

Another trend ETF is the iShares Automation and Robotics UCITS ETF, which contains 130 companies totalling 2.8 billion. The investment in automation and robotics has produced very good growth here so far and is also affordable at 0.4 % costs.

The ETF World Portfolio Strategy

My personal favourite strategy is the ETF World Portfolio, which tracks a large part of the global economy as realistically as possible. This method is ideal for a buy-and-hold approach, where you buy once and then hold.

There are two ways for investors to map this particularly crisis-proof approach using ETFs: firstly, the industrialised and emerging countries can be weighted according to market capitalisation, and secondly according to their gross domestic product.

The latter approach also includes unlisted local companies – and this can have a significant impact! In the classic global ETF ‘MSI World’, for example, the share of the USA would then fall from 60% to 40% and German shares would be represented twice as strongly.

One of the major advantages of this strategy is that it is easy to set up: if you believe in the global economy, you can sit back and relax – the savings plan does the rest. This passive approach can save us a lot of stress and is therefore popular with some investors.

The long history of positive results of the MSI World in particular – since its launch in 1970, no investor who has invested for at least 15 years has made a loss – is impressive and contributes to the good reputation of this strategy.

Unfortunately, there is a lack of flexibility here, for example in times of crisis. If the worst comes to the worst, you have to hold on to your investments with an iron will. If you don’t have this stamina, you should choose another option.

Possible ETFs for the World Portfolio Strategy

The Vanguard FTSE Developed World UCITS ETF is the counterpart to the MSI World, but is much cheaper. Its more than 2,000 shares from 25 industrialised countries cost us just 0.12 % per year.

The Vanguard FTSE Emerging Markets UCITS ETF is recommended for covering emerging markets. It brings around 1,800 companies with a total volume of 1.9 billion euros into our portfolio and yields just 0.22% per year.

The core satellite strategy

The core satellite strategy is a mixture of the previous variants and many other options. It is represented by a broadly diversified core with a good interest rate, around which individual, risky satellites orbit.

While this core can be well represented by a global portfolio, for example, we can confidently invest in megatrend ETFs, focus on diversification or make other bets in the peripheral area.

The biggest advantage here is the relative security provided by the core, without having to forego the flexibility and opportunities offered by satellites. The other side of the coin, however, is the effort involved – only those who like to actively tweak their portfolio will be happy here.

How practical implementation works

Of course, the strategies mentioned above do not have to be strictly adhered to – mixed forms are also permitted. Ultimately, only the investor himself decides which strategy is best for him.

The recommendations given here can help you find the right ETFs for your goals.

But no matter which candidate you ultimately decide on: It’s definitely worth taking a look at our article ‘How to find the best ETF for you’.

It explains all the important aspects so that you can drastically increase the chances of success with your next investment.

Once you are ready to put your carefully planned strategy into practice, you will quickly find yourself faced with a sea of brokers. Finding the right one for you can be a mammoth task.

We therefore recommend Smartbroker, with which all the strategies and ETFs discussed here can be easily mapped. The fact that some of the 600 different ETF savings plans are available from as little as 0 euros makes Smartbroker one of the best providers for newcomers. You can get started right away by clicking on this link.