Total Expense Ratio (TER): The Ultimate Guide for Investors

If you invest in funds or ETFs, you will often come across the term Total Expense Ratio (TER). In this comprehensive guide, we will explain exactly what the TER is, how it is calculated and what costs it includes. You will also receive valuable tips on how to integrate the TER into your investment strategy and what to look out for when selecting funds and ETFs.

In brief:

- The total expense ratio (TER) is an important indicator of the annual costs of a fund or ETF.

- A low total expense ratio is advantageous because it can lead to higher long-term returns.

- The TER is calculated as a percentage of the fund assets and deducted directly from the fund assets.

- In addition to the TER, there are other costs such as transaction costs and performance fees that are not included in the TER.

- For ETFs, a TER below 0.5% is ideal, while actively managed funds often have higher costs.

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

0 % without

Points

0 % without

Points

Points

Points

Points

Points

What is total expense ratio?

The total expense ratio (TER) is an important indicator that helps you as an investor to better understand the annual costs of a fund or ETF. It shows what percentage of the fund’s assets is spent each year on the management and operation of the fund.

A low TER is advantageous because it means that less of your invested capital is used for fees and administrative costs, which can lead to higher ETF returns in the long term.

Funds and ETFs often have specific fee structures. The TER helps you to make these fees transparent and thus make informed decisions for your ETF portfolio.

Good to know:

A high TER can have a significant impact on your returns, especially in the long term, as it deducts a portion of your investment each year.

Definition and significance of TER

The TER is the percentage of the fund’s assets that is used annually to cover administrative fees, management costs and other operating expenses of a fund or ETF. It includes all ongoing costs incurred in connection with the management of the fund. It is important to note that these costs are deducted directly from the fund’s assets, so you do not have to pay them separately.

The TER is particularly important for ETF investors, as ETFs generally have lower costs than actively managed funds due to their passive investment strategy.

The cost structure is a particularly important criterion for ETFs used for retirement provision, as you are investing over many years with an ETF savings plan and the TER has a significant impact on performance.

Legal basis for TER

In many countries, including Germany, fund providers are required by law to publish the TER in fund prospectuses and annual reports.

This provision ensures that you, as an investor, receive transparent information about the costs of a fund and can obtain a clear overview of the expenses.

In Germany, information on TER is enshrined in the Asset Investment Act (VermAnlG). This law requires providers to update the TER each year and make it available to the public.

You can view these at online brokers, for example. At this point, you may find it interesting to compare Scalable Capital and Trade Republic. This shows you what options are available and how high the costs are when it comes to trading ETFs.

Good to know:

Every ETF must publish its TER transparently.

Calculation and composition of the TER

ETF costs are calculated by dividing the total costs of the fund, including management fees and other operating costs, by the average fund assets and then multiplying by 100. This gives the percentage of the fund’s assets that is spent annually on management and other costs.

TER ETF calculation example

Let’s assume you invest in an ETF with fund assets of €10 million and annual costs of €50,000, i.e. half a percent.

In this example, the total expense ratio of the ETF is 0.5%, which means that 0.5% of the ETF’s assets are used to cover ongoing costs each year.

However, if you invest in another ETF with a lower TER of 0.3%, this can make a big difference over time.

The following chart shows the price performance of both ETFs. A one-time investment of €10,000 is made for 30 years.

ETFs are characterised by their low management costs, making them an attractive choice for long-term investors who want to maximise their returns.

Which fees are not covered by the TER?

In addition to the TER, there are other costs that are not directly recorded. These should also be taken into account, as they can influence the actual total costs of your investment. These costs include:

- Transaction costs: These arise when the fund or ETF buys or sells securities. These costs vary depending on the frequency of transactions and are not included in the TER.

- Performance fees: Some funds charge additional fees if the fund achieves a certain level of performance. These fees are also not included in the TER.

- Issue fees and redemption fees: Many funds charge issue or redemption fees when shares are bought or sold. These fees are also not included in the TER.

When is the TER deducted?

The total expense ratio is not debited directly from your account, but is deducted proportionally from the fund assets. This means that you see the impact of the total expense ratio in the form of a lower net asset value (NAV).

The TER is therefore applied indirectly to your investment without a separate debit being made. This means that when you invest in a fund, the value of your share is reduced by the total expense ratio each year.

Impact of unrecorded costs on total return

Even though the total expense ratio is an important indicator, you should also keep an eye on other fees, as they can also have a significant impact on the overall return.

Transaction fees and performance fees can play a significant role, particularly with active funds. ETFs are generally cheaper, but here too you should pay attention to the actual total costs, which are often influenced by additional fees.

How high should the TER be?

The TER should be as low as possible to ensure that a high proportion of your invested capital is used for the actual investment strategy and not for management fees and operating costs. For ETFs, a total expense ratio of less than 0.5% is ideal.

However, actively managed funds may incur higher costs, which can generally be justified by more intensive management and the opportunity for better performance.

A sensible approach is to always consider the TER in the context of your investment objectives. If you want to invest for the long term and benefit from a regular savings plan, it is particularly important to compare the ETF’s return with its TER. An ETF with a high total expense ratio could be less profitable in the long term than an ETF with a low TER, despite good returns.

Alternative key figures to total expense ratio

The TER is not the most meaningful indicator for evaluating and comparing investment funds.

To address this problem, more advanced concepts such as the Real Total Expense Ratio (RTER) and Total Cost of Ownership (TCO) have been developed. These metrics aim to provide a more comprehensive and accurate picture of the costs associated with a fund investment.

Real Total Expense Ratio (RTER)

The RTER was designed as a further development of the conventional total expense ratio in order to more accurately reflect the actual costs of an investment fund.

Features and benefits of the RTER

- Comprehensive cost disclosure: The RTER takes into account all actual fund costs, including those that may not be included in the TER. These may include transaction costs, performance fees or other hidden costs.

- Specific calculation method: The RTER is calculated using a specific formula designed to provide as realistic a picture as possible of the total costs. This formula takes into account various cost factors and their impact on fund performance.

- Improved comparability: By including all relevant costs, the RTER enables a fair comparison between different funds, especially if they have different cost structures.

Disadvantages and challenges of RTER

- Lack of disclosure: A major disadvantage of RTERs is that they are not disclosed in official fund documents. This makes it considerably more difficult for the average investor to access this information.

- Need for own calculation: As the RTER is not officially disclosed, investors must calculate it themselves. This not only requires additional time, but also specific knowledge and access to detailed fund information.

- Lack of disclosure requirements: Fund companies are not required to disclose all information necessary for calculating RTER. This can make it difficult or even impossible for outsiders to accurately determine RTER.

- Complexity: Calculating the RTER can be complex and may require expertise that not all investors have.

Total Cost of Ownership (TCO)

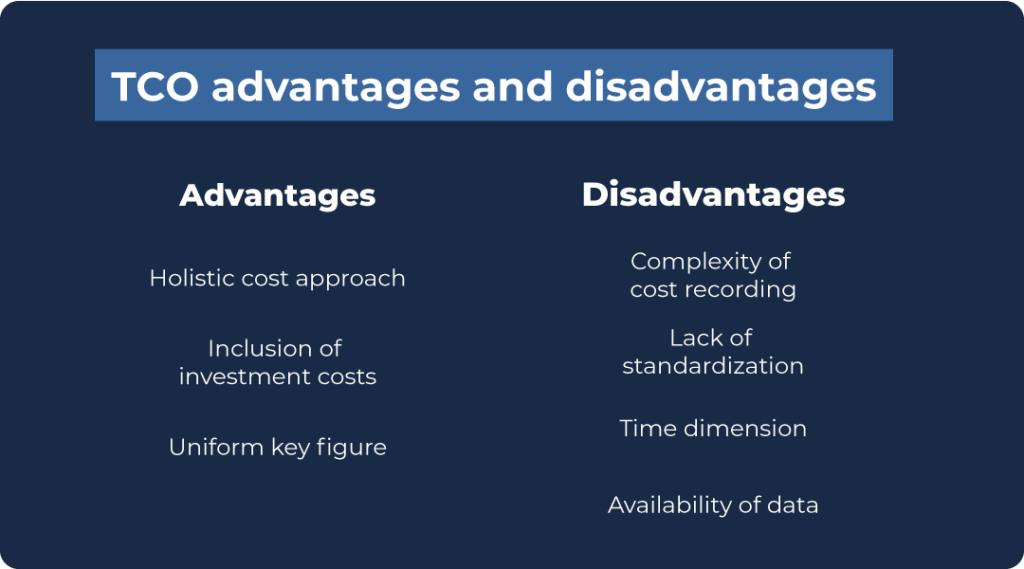

The concept of TCO goes one step further than RTER and attempts to paint a comprehensive picture of all costs associated with an investment.

Characteristics and objectives of TCO

- Holistic cost approach: TCO aims to capture all costs associated with owning and managing an asset. This includes not only direct fund costs, but also indirect costs incurred by the investor.

- Inclusion of investment costs: Unlike RTER, TCO also takes into account costs incurred by the investor. These may include:

- Transaction costs when buying and selling fund units

- custody fees

- Tax implications

- Any consulting costs that may arise

- Uniform key figure: The aim of the TCO is to summarise all relevant costs in a single, easily understandable figure. This should enable investors to compare different investment options on a more comprehensive basis.

Challenges and problems of TCO

- Complexity of cost recording: Recording all relevant costs can be extremely complex. Some costs may vary from person to person or be difficult to quantify, such as future tax burdens.

- Lack of standardisation: There is no generally accepted, standardised method for calculating the TCO for investment funds. This makes it difficult to compare different investments and providers.

- Time dimension: TCO can change over time, especially if market conditions or regulatory requirements change. A one-time calculation may not reflect long-term costs.

- Availability of data: Similar to RTER, it can be difficult to obtain all the information necessary for an accurate TCO calculation, especially when it comes to fund-specific or investor-specific costs.

Good to know:

There are alternatives to the total expense ratio, but these are more complex to calculate. For most investors, however, the reported TERs provide a good guide for a quick overview.

Would you like to invest now? Then read our article on the best securities account for beginners!

Conclusion: Total expense ratio and its significance for your investment success

The total expense ratio is a key criterion when selecting funds and ETFs. A low TER can lead to higher returns in the long term, as less capital is used for administrative costs.

However, investors should also consider other cost factors such as transaction costs and performance fees, which are not included in the TER.

More advanced concepts such as the real total expense ratio and total cost of ownership offer a more comprehensive view of costs, but are more complex to calculate and less standardised.

Ultimately, it is important to consider the total expense ratio in the context of individual investment objectives and to take it into account as one of several factors when making investment decisions.