How safe can P2P loans with 12% interest be?

P2P loans with 12% interest. At first glance, that sounds too good to be true, doesn’t it? But how safe can unsecured loans actually be for you as an investor? And what is being done to minimise the risks? I’ll show you today with a practical example!

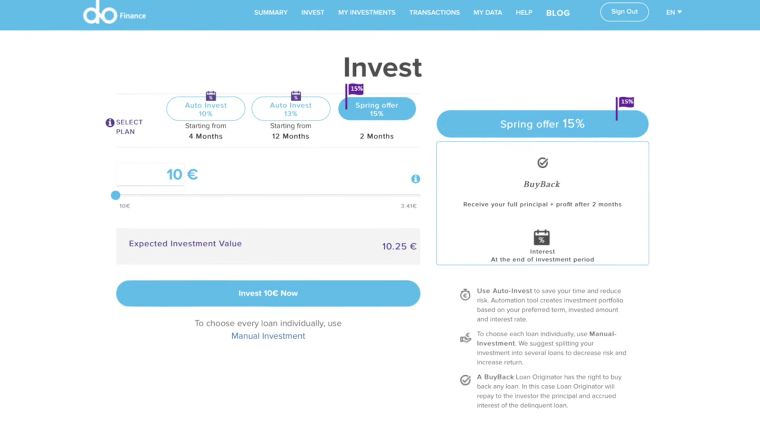

As an investor, you usually only get a view that looks similar to the one in the picture above. There are a few figures in front of you, you can invest and see how your portfolio is doing. You can also change some settings and your auto-invest. If you are interested in a loan, i.e. you select a loan that you would like to invest in, you usually don’t see more than the borrower’s gender, age and previous number of loans for consumer loans.

It’s clear that you can’t see all the information about the person. After all, these are very short-term loans with a term of around 30 days – and not large-scale financing with an entry in the land register and the like! Here you are investing in consumer loans without collateral, which are concluded quickly and also repaid quickly!

However, this information is not enough for me as an investor! I want to know more about what criteria there are for borrowers, how many borrowers are rejected and what security mechanisms are in place here!

That’s why I asked around and today I’m giving you a look behind the scenes of the P2P platform DoFinance. DoFinance grants loans in the emerging market of Indonesia, with which investors normally earn between 10-12% per year. Currently, there is even up to 15%. If you want to secure this 15% plus a small bonus, use this link to sign up!

A look behind the scenes at DoFinance

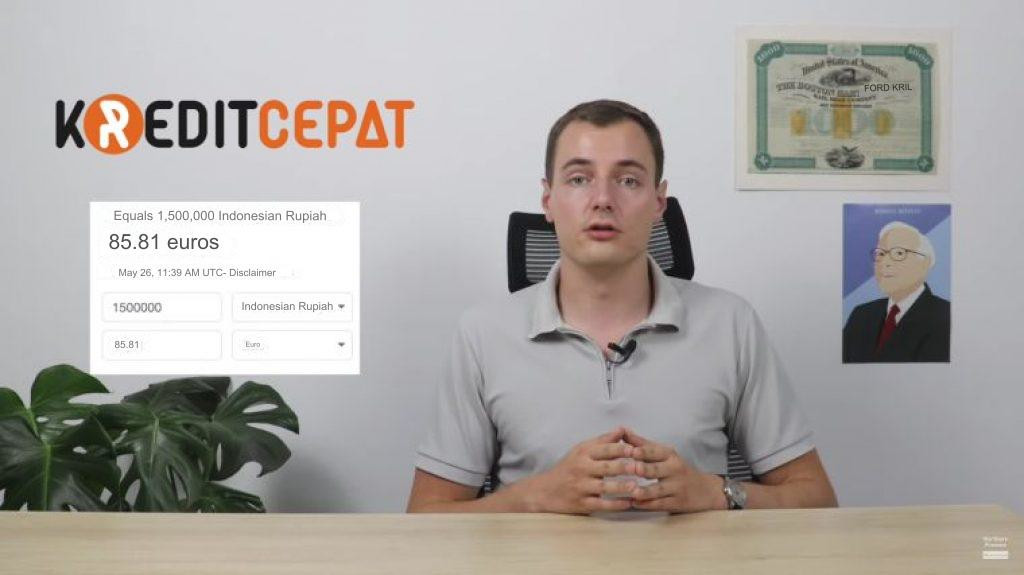

I was wondering: What does it look like when someone wants to take out a loan with DoFinance? The local lender in Indonesia is called Kreditcepat. It’s an online lender where you download an app that guides you through the entire loan process. Very convenient for borrowers as it works quickly and from anywhere!

This is also worthwhile for investors. This is because the app is authorised to collect important data that is important for investing. All borrowing data is recorded here. For example, the amount of the loan, the term and the costs incurred. The borrower then enters further personal data such as e-mail and telephone number.

These are run through a database. This works in a similar way to the German Schufa: Kreditcepat then receives information on how many loans the person has already taken out, whether there have been any problems with repayment and what the person’s current financial situation is.

Other data, such as the number of the identity card (called E-KTP in Indonesia) is also utilised. In addition to the employer details, it is checked that the income is at least €200 per month. This is not a lot, but it is only the minimum amount! The income is checked by uploading the last payslip and other parameters. Finally, photos of your identity card and yourself are required for verification.

After the whole procedure, if everything has worked out, a loan of up to the equivalent of €85 will be granted. That’s not much! Later loans can also have higher amounts than €85. As a rule, however, smaller loans tend to be financed. For borrowers, the first loan can be completely free – if it is repaid on time and in full! In addition, Kreditcepat charges between 34% and 36% annual interest. This then finances the return for you and me!

To find out this information and details, I spoke to the Chief Risks Manager of DoFinance, Rudolfs Kriegers, who is currently in Indonesia. He also explained to me that it usually only takes a few minutes for a credit decision to be made after this whole procedure.

In many areas, such as document analysis or risk scoring, this is automated! And even more importantly, machine learning is used here! I think it’s important that the companies we entrust with our money are also at the forefront of technology and can therefore boost their profitability! That means fewer avoidable risks for investors!

This whole process filters out many people who do not want to be given a loan. The rate of requests for confirmed loans is less than 30%. I had expected more! So 70% of all enquiries don’t get a loan. Either because, for example, they have too long a history of loans that have not been repaid on time or they earn too little.

For existing customers, the acceptance rate for further loans is also only around 50%. That’s more, but not everyone is simply accepted again! And: During the corona crisis last year, Kreditcepat did not accept any new customers at times and only granted loans to existing customers! That makes sense, because these customers are naturally more predictable for the company. That shows me that a company can definitely regulate and adjust the risk in which it operates!

And if borrowers don’t pay on time?

From the first day in arrears, the borrower receives a notification that they are in arrears. They then have the option of extending the loan for a further 30 days. This will of course cost him some money. However, if the borrower defaults again after that or does not exercise the extension option at all, the loan is sold to another company. This means that if you and I, as investors, trigger the buyback guarantee, DoFinance sells the loan to a debt collection company that takes over the recovery!

The loans that are in arrears and therefore highly risky are all bundled together and sold to the debt collection company at a discount. The loans are then no longer on DoFinance’s books. This also provides more liquidity! And it can also be worthwhile for the debt collection company: In many cases, 30% – 70% of the outstanding amount can be recovered. Depending on the quality of the borrower – and of course on how well the debt collection company does its job!

Conclusion: P2P loans, there is so much risk in unsecured loans!

Even unsecured loans, like the ones here, go through many steps that ensure that, despite the lack of collateral, you have some security from the borrowers who ultimately get a loan! For example, a borrower’s job or salary. It was very interesting for me to get a look behind the scenes! As an investor, you often know very little about the process – this shed some light on the darkness!

This makes my decision to continue investing with DoFinance much easier! If you also want to invest at the current 15% interest rate and secure a small bonus, simply register via my link!

DoFinance offers really high interest rates. Some of the highest on the market for P2P loans! But of course there are always risks. So my final piece of advice is this: Always invest only the money you have available!