Robocash: My review of the P2P platform 2025

Due to the current situation in Ukraine and Russia, I am withdrawing my investments here and therefore also from Robocash. Instead, I am now investing more in Bondora Go & Grow(click this link to open*) with 6.75% interest with daily liquidity and EstateGuru(click this link to open*) with 10% interest and first-class property as collateral.

Although many investors have had very good experiences with Robocash, the P2P platform remained ‘under the radar’ for a long time. However, this has changed in recent months and Robocash is currently one of the fastest growing providers and clear winners of the coronavirus crisis.

I have also been using Robocash for some time now to invest in P2P loans – my experiences have been consistently positive. So it’s high time to shed some light on all aspects of Robocash in an in-depth review and give you some tips along the way!

In brief

- Robocash is a lender based in Croatia where we can invest in personal loans – which are rewarded with high interest rates

- Compared to the competition, yields are high and supply is large

- Higher risk, as only loans from a single company are offered – but this company is very successful and profitable

Who is Robocash anyway?

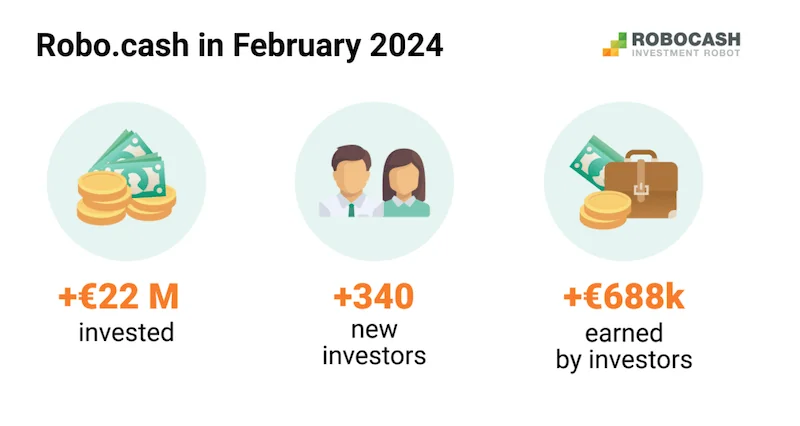

Since 2017, Robocash has been offering users the opportunity to invest in personal loans from Asia and Europe and thus achieve attractive returns – currently 11.8 per cent is possible. Over 36,000 investors have already taken advantage of this opportunity! The Robocash Group behind the offer has even been in existence since 2013 and currently has over 1,000 employees, so it is safe to say that it is a heavyweight in the industry with a great deal of experience. Among P2P providers, however, Robocash is much less well-known than its competitors.

Due to the current situation in Ukraine and Russia, I am withdrawing my investments here and

therefore also from Robocash. Instead, I am now investing more in Monefit Smartsaver (Get with this link*) with 7.25% interest with daily liquidity and Viainvest (Get with this link*) with 13% interest and first-class real estate as security.

The company is based in Croatia and is subject to local regulations. However, the loans are currently financed in Spain, Kazakhstan, the Philippines, Indonesia and Singapore. The Robocash Group is also active in Sri Lanka, Vietnam, India and Kenya. It is also represented in Russia, where it even leads the P2P market. None of these locations are yet available to us as investors on the in-house Robocash P2P platform.

The countries marked with an arrow are not yet available to us as investors, although the Robocash Group is active here. Although Robocash looks like a P2P marketplace, it is actually a direct provider for the loans of the Robocash Group. All available loan originators on the platform belong to this parent company.

This means that it is not one of the platforms such as Mintos or Peerberry, where several loan originators are active, but is positioned between competitors such as Bondora and Kviku, which also only sell their own loans. In my experience, however, this is not necessarily a bad thing.

Although the investment could be lost in the event of major problems or even insolvency, the Robocash Group’s figures look very good. There have also been no major problems in the past. However, there is always a fundamental risk with P2P loans, because otherwise such high returns would be inconceivable.

| Founded | :2017 |

| Headquarters | :Zagreb, Croatia |

| Regulated | :No |

| Number of investors | :+ 41,100 investors |

| Financed loan volume: | More than EUR 56 million |

| Returns: | 10,04% return according to official platform data |

| Minimum investment amount: | EUR 1 |

| Buyback guarantee: | Yes |

| Auto Invest: | Yes |

| Secondary market: | Yes |

| Issue of a tax certificate: | Yes |

| Loyalty programme for investors: | Yes (up to 1.3 percent higher return) |

| Starting bonus: | Yes, 1.0% cashback after 30 days via (Get it with this link*) |

| Rating: | See our P2P platform rating |

In day-to-day business, our investments are secured by a buyback guarantee. If a borrower is 30 days overdue with their payment, Robocash steps in and makes the payment. In my experience, this process works smoothly.

Due to the current situation in Ukraine and Russia, I am withdrawing my investments here and

therefore also from Robocash. Instead, I am now investing more in Monefit Smartsaver (Get with this link*) with 7.25% interest with daily liquidity and Viainvest (Get with this link*) with 13% interest and first-class real estate as security.

How the investment works

If you already have experience with P2P investments, Robocash has no surprises in store for you. However, even newcomers will have no problems, as Robocash is very easy to use. The Robocash website has a very simple structure and is easy to use even for investors with no previous experience.

The way it works is comparable to other providers. The first step is registration, which is quite quick and involves typical steps such as verifying your email address and entering a password. After registering, you can deposit money with Robocash via bank transfer. A short time later, this capital will be available for you to invest.

In my experience, the waiting time here is less than 2 days. In the various countries in which Robocash is active, private individuals can apply for loans from the Robocash Group. These are usually short-term consumer loans for which high interest rates are payable.

You can make your deposited money available to these people via the platform. In return, Robocash ‘rewards’ you with high returns: The company itself keeps part of the interest for itself and pays out the rest to us investors. We can currently receive up to 11.8 % per year in this way and even increase this figure to 13.3 % through the bonus programme.

If a borrower is unable to repay their loan, Robocash will cover the costs. This ensures that your money is not lost without further ado. However, 30 days must have passed before this buyback guarantee takes effect. During this time, you cannot invest your capital elsewhere.

Everything runs via ‘Auto-Invest’

As the name suggests, Robocash invests automatically. This makes sense, as there are consumer loans that usually only have a short term. These are very similar – a manual selection would have no advantages. The auto-invest function can be set according to personal preferences. For example, you can select different interest rates. Higher yields are of course tempting for investors – but in practice they are more frequently affected by defaults. As the buyback guarantee only takes effect after 30 days, lower interest rates can also be worthwhile. Such loans generally have lower default rates.

By selecting lenders, you can also specify the countries in which you want to invest and where your money should not go. There is also a secondary market where you can buy already financed loans from other investors. The amount of capital invested can be set per loan: 1 euro is the minimum amount. At the same time, you can divide your entire investment into different portfolios, in which you can also use different strategies.

Robocash offers several options here: ‘Balance’, ‘Payout’ (automatically to your bank account as soon as 50 euros have been collected), ‘Reinvest main amount’ and ‘Reinvest total amount’ are available. This wide range of options is exemplary!

My tip:

You can get started with as little as one euro per loan, but in my experience, between 10 and 100 euros (depending on the size of your portfolio) gives the best results

Due to the current situation in Ukraine and Russia, I am withdrawing my investments here and

therefore also from Robocash. Instead, I am now investing more in Monefit Smartsaver (Get with this link*) with 7.25% interest with daily liquidity and Viainvest (Get with this link*) with 13% interest and first-class real estate as security.

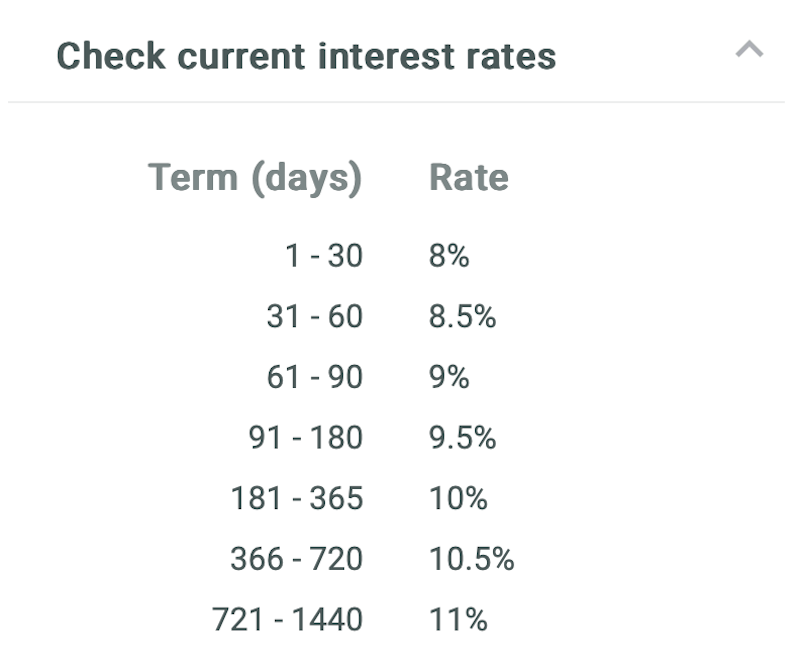

These returns are possible

As investors, we are naturally very interested in the return we can expect from Robocash. Here we follow a simple pattern: the longer the term of a loan granted, the higher the amount we earn. For personal loans over two years – the longest period available – we earn 11.8 %. This puts Robocash in a very good position compared to other reputable providers. What is extraordinary is that we can increase this value even further through an extensive bonus programme.

There are four levels depending on the amount of our investment. If we have invested at least 5,000 euros, we receive 0.3 % additional interest. If we invest 10,000 euros, an extra 0.5 % awaits us. Anyone who invests 15,000 euros can look forward to 0.7 % more and with 25,000 euros there is even a full per cent on top!

This is the state of the Robocash Group

As Robocash only distributes loans from the parent group, its financial situation is extremely important for us as investors. Should serious difficulties arise here, our capital could be jeopardised! At present, however, there seems to be no cause for concern: The Robocash Group shines with good business figures and appears to be operating profitably. For example, the reserves currently amount to USD 42 million, more than double the amount of loans utilised.

The income flows from several sources at once:

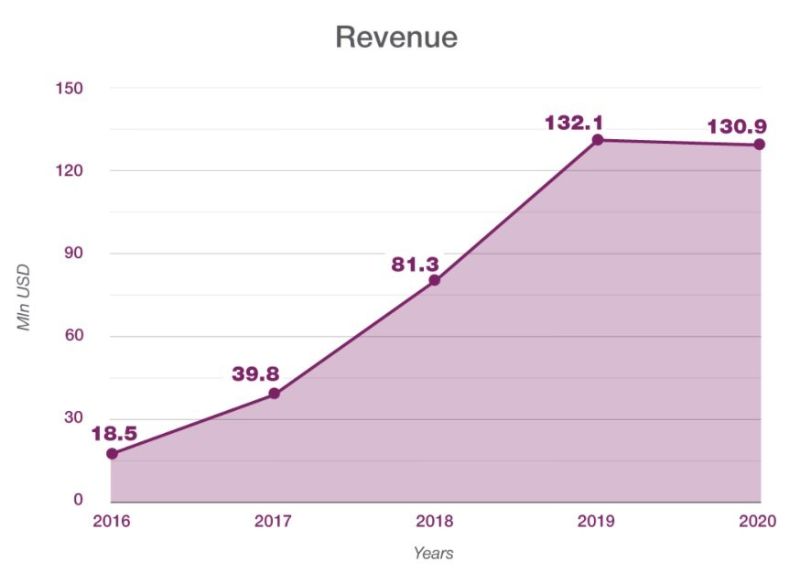

The highest sums are generated by the interest business, i.e. the difference between the interest paid by borrowers and the payouts to investors. Although Robocash pays out up to 11.8 per cent to investors, those who borrow money from Robocash have to pay significantly higher interest. The company retains the difference.

In 2020, 128 million dollars were generated in this way. Fees and other costs charged by Robocash added another 5.5 million dollars. Another 3.2 million dollars were also recorded under ‘other’ operating income.

Important:

Robocash does not charge any fees for investors! The stated income from fees relates to borrowers who have to incur additional expenses.

The Group’s net profits have risen significantly in recent years. It is interesting to note that profits also increased significantly in the coronavirus year 2020, even though Robocash’s turnover also fell slightly.

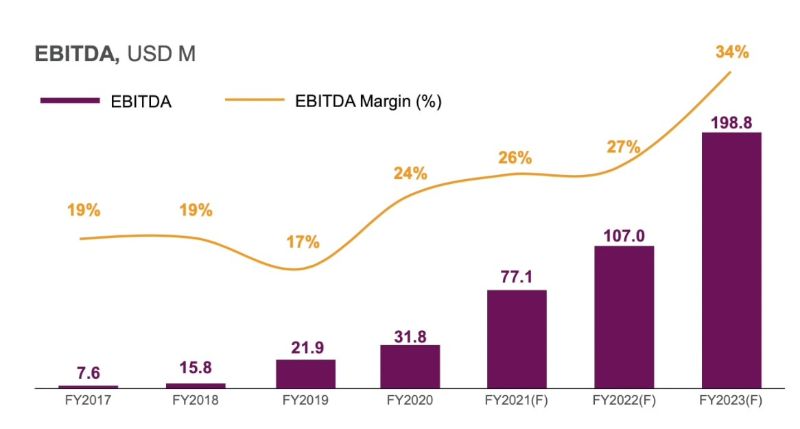

Another interesting figure that does not usually appear in the superficial analyses is EBITDA. This describes the amount of earnings before interest, taxes, depreciation and amortisation, as these can fluctuate depending on the region and circumstances.

The EBITDA figure therefore provides a good overview of the actual profits. Robocash is performing very well here. The company’s forecasts for the next few years are also ambitious and appear to include major investments in the next two years.

How secure is Robocash?

P2P loans are always associated with risk, which can be particularly noticeable in difficult economic times. However, the consumer loans that Robocash sells are among the more stable personal loans, as there is demand for personal purchases even in times of crisis.

In 2020, during the coronavirus pandemic, Robocash was able to demonstrate this impressively: Competitors such as Bondora, Mintos and Co. often recorded significant slumps and in some cases had to introduce far-reaching emergency measures. Robocash, on the other hand, only had to cope with comparatively slight declines in business figures.

Furthermore, the Robocash Group, which also operates the P2P platform Robocash, appears to be on a stable footing. Profits have risen steadily in recent years and the company is operating profitably. At the same time, however, risks always remain: Personal loan providers often reduce returns without warning. In such cases, an investment becomes significantly less attractive, but investors can usually withdraw their capital without any problems.

However, the structure of Robocash could prove to be even more dangerous: The predominantly Russian company has relocated its headquarters to Croatia after new legal regulations were announced at its original location in Latvia.

The laws that led Robocash to ‘flee’ were specifically aimed at preventing money laundering, corruption and price gouging of borrowers. The fact that these measures were used as an opportunity to switch to Croatia’s barely regulated financial market leaves an unpleasant aftertaste for investors. Robocash’s attempts to conquer the comparatively strong market for personal loans in the Philippines have also failed to date due to the company’s dubious practices.

In 2019, the local financial supervisory authority SEC revoked Robocash’s ‘licence for financing companies’. It turned out that 32 branches of the credit company had been opened without the necessary authorisation. Particularly brazen: Robocash seemed to be fully aware of the illegality of its own expansion.

The seemingly relaxed approach to regulations and legal provisions could also theoretically become a problem for investors. Should the authorities one day come knocking at one of the locations due to the dubious practices, it is doubtful whether repayments and profits would continue to be distributed as usual…

Investors must therefore always weigh up whether the high returns are worth the risk. P2P loans have proven to be a very lucrative investment in recent years, clearly outperforming most other forms of investment even in times of crisis. However, personal loans remain a high-risk financial product and should only be used as part of a well-diversified portfolio.

Due to the current situation in Ukraine and Russia, I am withdrawing my investments here and

therefore also from Robocash. Instead, I am now investing more in Monefit Smartsaver (Get with this link*) with 7.25% interest with daily liquidity and Viainvest (Get with this link*) with 13% interest and first-class real estate as security.

Alternatives to Robocash

If the risks with Robocash are too high for you or there is another argument against your investment, there are numerous alternatives available to you. As Robocash only offers loans from a single company, it primarily has to compete with competitors in the same category.

Kviku, Swaper and ViaInvest are particularly worthy of mention here. All three companies mainly offer consumer loans with short terms and therefore have clear parallels with Robocash. The lenders behind the respective platforms have also been active for several years and have a lot of experience in the P2P market.

Swaper offers the highest interest rate of 14%, but is also considered by experts to be a slightly riskier option. ViaInvest also performs well at 12% and offers interesting alternatives with new investment opportunities such as the purchase of property loans in repossession. Kviku, a platform that is still relatively unknown, has stabilised at 10 to 12% in recent weeks and is also performing well.

If a P2P platform on which only a single lender is active is too risky for you, there are also marketplaces for personal loans. PeerBerry, for example, always has 4 loan originators available, which spreads the risk somewhat. Unfortunately, PeerBerry also recently moved to Croatia, which is less heavily regulated, which also leaves a bad aftertaste. The market leader Mintos could be a less risky alternative here. Several dozen loan originators are available there and there are also various forms of loan to choose from.

Instructions: Starting with Robocash

Registering with Robocash is very similar to other financial service providers. Even without experience, it can be completed quickly. Firstly, you need to enter your name, email address, gender and telephone number.

Robocash must establish your identity and requires verification with an ID card or passport. You will then need to provide this number. Your address is also required. There are now a few more questions, such as the origin of your money, which can be answered quickly. You must then confirm your e-mail address in your mailbox.

Finally, you need to upload a photo or scan of your ID document. You have now completed all the registration steps and are probably eager to start investing. To do this, you can transfer capital from your bank account to your newly created Robocash account.

The recipient address is provided by the platform and the subject line should also be exactly as stated in the instructions in your profile. Depending on the speed of your bank, it may take one to two working days before your money is available.

Important:

The bank account from which your deposit is made is then considered ‘verified’. Withdrawals can only be made to a verified account from which you have made at least one deposit.

The advantages of Robocash at a glance:

- Attractive interest rates that can be raised to over 13 % when registering with a bonus code.

- Repurchase guarantee ensures that we get our money back if a borrower defaults.

- The Robocash Group has been profitable for many years and has already gained a great deal of experience in the P2P business.

- The founders and employees also have a lot of experience and are experts in their field.

- Robocash Group’s good business figures and long-standing success story convey a sense of security

- Very good values were also achieved during the coronavirus pandemic, while competitors often had significantly greater problems. Robocash therefore appears to be comparatively crisis-proof.

- The business figures are audited and, like other important documents, are publicly accessible. Management and other information are also communicated transparently.

- As the majority of consumer loans offered are short-term, there are many options with a 30-day term. As a result, Robocash offers very high liquidity if required.

- The forecasts for the Robocash Group are for growth, as many new markets are being developed and are currently being expanded.

There are these disadvantages to consider:

- Robocash operates in Croatia, where the actual regulation of the company is at least questionable. In addition, the actual company is based in Russia – not a particularly trustworthy structure.

- Although there are several loan originators on the platform, they all belong to the Robocash Group, to which you are entrusting your money.

- The website looks old-fashioned and the German translation is inadequate in many places.

- Among others, the company works with the Latvian ‘BlueOrange’ bank, which has already been penalised for failing to prevent money laundering, and has also had its own run-ins with the authorities (for example in the Philippines).

- Although the secondary market does exist, it does not offer purchasing with discounts, as is customary in the industry.

- As it only offers consumer loans, Robocash alone is not suitable for building a broadly diversified portfolio.

Due to the current situation in Ukraine and Russia, I am withdrawing my investments here and

therefore also from Robocash. Instead, I am now investing more in Monefit Smartsaver (Get with this link*) with 7.25% interest with daily liquidity and Viainvest (Get with this link*) with 13% interest and first-class real estate as security.

My Robocash experience and rating

Over the past few years, Robocash has consistently served me well and generated reliable profits. Thanks to the excellent cashback programme, with which you can even increase the available return of 12.3 percent even further, I have also been satisfied with the level of interest.

Robocash is much less active in terms of marketing than other competitors such as Bondora, Mintos or EstateGuru. This lower profile can quickly give the impression that Robocash is lagging behind its competitors in the P2P market, but my experience is different! The company from Croatia has nothing to hide here.

Thanks to a buy-back guarantee for defaulted loans and audited and public annual reports, Robocash cuts a solid figure in terms of security. However, the complete dependence on the parent company, which provides all loans, can become a problem in times of crisis. However, this does not appear to be the case at present: the strong business figures have a positive effect.

The move to Croatia after Latvia introduced new regulations against money laundering and corruption, as well as the corporate structure, also give cause for concern. However, Robocash is endeavouring to dispel any doubts through a very transparent communication policy.

As only consumer loans are available, most of which only have a short term, Robocash is not exactly broadly positioned. However, anyone who has already diversified their portfolio with other investments will be pleased with the considerable returns.

If you want to invest with Kviku, use this link and benefit from my Robocash bonus

Due to the current situation in Ukraine and Russia, I am withdrawing my investments here and

therefore also from Robocash. Instead, I am now investing more in Monefit Smartsaver (Get with this link*) with 7.25% interest with daily liquidity and Viainvest (Get with this link*) with 13% interest and first-class real estate as security.