Benefit from digitalisation with semiconductor ETFs: How it works

The number of semiconductors in our everyday lives is unmanageable, as they are required for the operation of all electronics. And demand continues to rise! No wonder that many investors want to profit from this trend!

Semiconductor ETFs offer an ideal entry point. But how good are they really, which is the best semiconductor ETF and what are the future prospects? We have scrutinised the industry for you!

In brief:

- Semiconductors are needed for all electronics such as smartphones, computers, cars, machines…

- They are important for the function of almost all devices and demand is exploding.

- The industry is changing and market shares are shifting, which makes investment difficult.

- Semiconductor ETFs avoid this problem because they invest in the entire industry.

What are semiconductors and why are they so important?

Semiconductors are materials that have both conductive and insulating properties. They are used as the basis for the construction of computer chips. The term ‘semiconductor’ is therefore no longer used today in its original, chemical context, but is a synonym for all computer chips and circuit boards.

As a result, semiconductors and the companies that produce them are incredibly important in our society: all smartphones, computers and electronic devices through to the control of machines, cars and more rely on them.

The number of such devices has been increasing for years. No wonder, as more and more areas of our lives are being networked as part of the digital transformation. Additional sensors, networks and the like also require additional semiconductors.

Due to their function as the basic building block of electronic devices, semiconductors therefore play a central role in our technical progress: new applications and innovative technologies require more computing power and more semiconductors. Their speed is therefore decisive for the quality and availability of new applications.

Complex production ensures a concentrated market

The manufacture of semiconductors is an extremely complex field. Only a few companies have the enormous technical expertise and highly qualified employees required for production.

The financial hurdle to start building semiconductors is also huge: several hundred million euros are needed to purchase the necessary equipment in the first place! What’s more, the manufacturing expertise is almost completely protected by patents.

It is therefore no wonder that only a handful of companies have divided the semiconductor market among themselves. Heavyweights such as Nvidia, Intel and AMD account for the lion’s share of this extremely lucrative sector.

Although new players occasionally enter this market, they remain the exception. As a rule, market shares are only shifted between the established players. The most important manufacturing centres are primarily located in Asia and the USA.

Increasingly high demands on the quality and quantity of semiconductors pose major challenges even for leading companies, but also mean constant demand and enormous sales.

Profiting from the shortage with semiconductor ETFs?

The difficulty of production is most evident in the form of the ongoing chip shortage: despite steadily increasing demand, manufacturers are unable to supply the required quantity of circuit boards.

The supply bottleneck affects not only computers and smartphones, but also the automotive and many other industries. The shortage of semiconductors is even being felt in medical technology, the energy sector and scientific research.

Private individuals experience the inadequate supply when waiting for a new car or buying a Playstation 5: although the games console has been on the market for more than two years, interested parties around the world still have difficulties getting hold of a device.

A previously unthinkable situation in our capitalist valorisation system! However, production figures simply cannot be increased any further without sufficient semiconductors.

Investors are betting on precisely this huge demand when entering this sector. In recent years, however, this has not led to any notable successes! Most of the companies, shares and semiconductor ETFs involved have suffered heavy losses.

Automatic re-balancing: the advantage of semiconductor ETFs

The supply bottleneck (and other influences) has had a severe impact on companies’ results. Nevertheless, the sector is worth investing in due to its central role in our society and its constant further development.

The companies involved will have to fulfil orders for years to come. Both a semiconductor ETF and individual shares are very well suited to profit from this situation. A combination, for example a semiconductor ETF as a basis plus individual shares of Nvidia and Co. is also very popular.

As the market is limited to just a few, important participants in Asia and the USA, investors can acquire their securities individually. However, this exposes them more to the shifts in the industry and they must, for example, correct themselves (re-balancing) when companies gain or lose market share.

With this exchange-traded fund, this step can be bypassed as rebalancing is carried out automatically. As a result, investors benefit from the success of the entire sector and have significantly less effort. Such a semiconductor ETF also requires significantly less starting capital than individual shares, as we can acquire a share with just a few euros.

Last but not least, it should be noted that the entire industry is very innovative and constantly changing. Anyone who decides to invest in individual shares must therefore invest a lot of time and energy in order to maintain an overview. A semiconductor ETF also offers advantages.

These semiconductor ETFs are available

Anyone looking for a semiconductor ETF is faced with a limited choice. Products are available from various providers, but with a strong focus on the USA. The most interesting ETFs include:

1. VanEck Semiconductor UCITS

| VanEck Semiconductor UCITS |

| ISIN: IE00BMC38736 |

| Size: 614 million euros |

| Total costs (TER): 0.35% p.a. |

| Start: 01 December 2020 |

| Distribution: Accumulating |

This semiconductor ETF is based on the ‘MVIS US Listed Semiconductor 10 % Capped’ index and provides access to semiconductor companies listed on US stock exchanges. This does not necessarily mean that only companies from the United States are included! Some stocks from the Netherlands or Taiwan have also crept in.

However, with more than 75%, the USA is clearly the main focus of the VanEck Semiconductor UCITS. That sounds like a considerable clustering risk. However, anyone opting for a semiconductor ETF will hardly be able to avoid this problem, as the entire industry is highly regionally concentrated.

The small size of just 25 companies is also significant. The largest positions in this semiconductor ETF are ASML Holding, Nvidia and Taiwan Semiconductor, each with a share of almost 10%. In addition, this offer is filtered according to social/ecological aspects, although this has no significant effect in practice.

The VanEck Semiconductor UCITS is a relatively young semiconductor ETF that was only launched in 2020. However, it currently already has a volume of over 600 million euros, making it one of the largest semiconductor ETFs! Its costs of 0.35% per year also make a good impression.

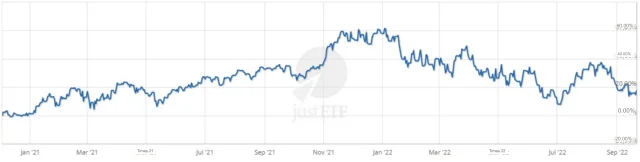

Like all semiconductor ETFs, however, VanEck Semiconductor is currently weakening in terms of performance: investors have already made a loss of 25% in 2022. On the other hand, a whopping 60% gain was possible at the turn of 2021/22! Anyone opting for this exchange-traded fund must therefore have strong nerves and be able to withstand these fluctuations.

The VanEck Semiconductor UCITS peaked at the turn of 2021/2022 and has performed rather poorly since then.

2. HSBC Nasdaq Global Semiconductor UCITS

| HSBC Nasdaq Global Semiconductor UCITS |

| ISIN: IE000YDZG487 |

| Size: 13 million euros |

| Total costs (TER): 0.35% p.a. |

| Start: 25 January 2022 |

| Distribution: Accumulating |

A semiconductor ETF without an extreme US focus seems almost impossible, but HSBC offers a good interim solution with its ‘Nasdaq Global Semiconductor UCITS’: only 60 % of the companies included come from the United States.

Taiwan, the Netherlands and Japan make up a large proportion of the other nations. With a total of 80 companies, this semiconductor ETF is comparatively extensive. Nevertheless, the largest companies ASML Holding, Nvidia and Broadcom each hold more than 8 per cent of the shares!

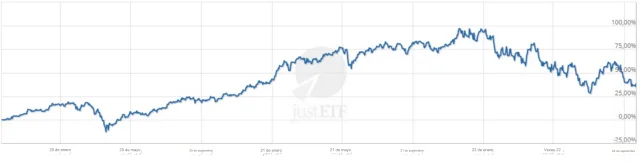

The performance of the HSBC Nasdaq Global Semiconductor has been quite a disaster so far: investors have lost more than 20 per cent so far. However, these figures are of little significance, as this exchange-traded fund was only launched in January 2022. Accordingly, a volume of just 13 million euros is still manageable. The costs of 0.35 per cent per year are also easy to get over.

The HSBC Global Semiconductor ETF has not performed well so far. However, it is only a few months old.

3. Lyxor MSCI Semiconductors UCITS ETF

| Lyxor MSCI Semiconductors UCITS ETF |

| ISIN: LU1900066033 |

| Size: 26 million euros |

| Total costs (TER): 0.45% p.a. |

| Start: 28 March 2007 |

| Distribution: Accumulating |

The Lyxor MSCI Semiconductors UCITS is also a very small exchange-traded fund, but has been in operation since 2007 and is therefore one of the older offerings. In all this time, however, it has not achieved a volume of more than 26 million euros. However, this has not stopped Lyxor from launching a second, dividend-paying variant.

Attention!

If an ETF only has a low volume (less than 300 million) even after several years, it is often closed by the operator!

Unfortunately, the Lyxor MSCI Semiconductors has also shown the typical crisis since the beginning of 2022. It has already lost 30 %, a considerable disappointment for investors who were used to handsome gains in recent years (almost 40 % in 2019, over 20 % in 2020 and almost 35 % in 2021!)

Anyone who has been in the market for a while could also realise attractive gains with this semiconductor ETF. The current low could also offer an attractive entry point for newcomers.

If you decide to buy the Lyxor MSCI Semiconductors, you will invest 64% in US companies, 18% in companies from Taiwan and just under 10% in the Netherlands. Taiwan Semiconductor and Nvidia are disproportionately strongly represented with 15 and 14 per cent respectively.

This exchange-traded fund is therefore particularly suitable for investors who would like to invest more in these two companies anyway. However, those who already own enough Nvidia and Taiwan Semiconductor shares could jeopardise their diversification here.

4. iShares MSCI Global Semiconductors UCITS ETF

| iShares MSCI Global Semiconductors UCITS ETF |

| ISIN: IE000I8KRLL9 |

| Size: 239 million euros |

| Total costs (TER): 0.35% p.a. |

| Start: 03. August 2021 |

| Distribution: Accumulating |

The semiconductor industry is dominated by a few large companies, but there are definitely smaller providers that can be worthwhile! The MSCI Global Semiconductors UCITS from iShares is the best proof of this.

With over 250 companies included, it is one of the most comprehensive ETFs. It also specifically includes small and medium-sized companies. Nevertheless, with ASML Holding (8 %), Nvidia (8 %) and Broadcom (7 %), the industry’s heavyweights also account for significant shares.

Almost 60 % of the companies are from the USA, which should no longer surprise us. With its strategy of focusing on all sizes of companies, the still young semiconductor ETF has cut a solid figure: The iShares MSCI Global Semiconductors seems to be coping much better with the current slump in share prices in the sector.

The performance of the iShares MSCI Global Semicondcutor ETF was significantly better than many of its competitors during the crisis at the beginning of 2022. Although the exchange-traded fund was only launched in August 2021, it has already achieved a volume of more than 230 million euros. At 0.35%, the costs are comparable with competitor products.

If you are also interested in other future ETFs, then read the articles on ETFs for electric mobility or ETFs for renewable energy. If you prefer economic ETFs, I recommend the article on financial sector ETFs and industrial ETFs.

Conclusion: future industry with obstacles

The importance of the semiconductor industry for all areas of our lives can hardly be emphasised enough. Nevertheless, investors have often found it difficult to profit from this important sector in the past.

Even ETFs, which normally represent a comparatively low-risk and simple way of investing in an entire sector, have been showing negative results of late. However, semiconductor ETFs have recently shown predominantly negative results.

Although the future of this key industry is secure, the further development of the companies involved is difficult to predict. As a result, investors have repeatedly suffered heavy losses on individual shares and semiconductor ETFs.

However, it is precisely this volatility that makes the field very exciting for investors who have strong nerves or are looking for a long investment horizon. They are likely to benefit from the semiconductor companies’ order books, which will be full for years to come.