Bondora Go & Grow review: How I earned €2,262

Bondora is fully focused on Go & Grow, the popular P2P product with 6% interest and maximum liquidity. I’ve been with them since the beginning and will share my personal experiences with the platform. You’ll also find out which investors might benefit from investing and what you need to bear in mind!

In brief

- Bondora’s Go & Grow programme is a P2P investment with a fixed interest rate of 6.75% and high liquidity

- Many investors find the mix of return, flexibility and risk ideal and use the offer for a long-term investment or as an alternative to a call money account

- Bondora is one of the oldest P2P providers, enjoys an excellent reputation and is highly successful with Go & Grow and other financial products

- Despite the success story so far, there is always a risk, as there is no deposit protection! In the event of a real crisis, an investment can be lost

What is Bondora Go & Grow

P2P lending has been growing in popularity for years: investors lend their money to private individuals or companies and receive high interest rates in return. The transactions are handled via special P2P platforms.

One of the oldest, largest and best-known providers is Bondora:

- Bondora is a P2P pioneer from Estonia that has been active on the market since 2008.

- With its ‘Go & Grow’ product, it has already attracted almost half a million investors.

- To date, over €1.5 billion has been financed in loans!

- It has already weathered several crises well and proven how resilient the P2P model is.

- Only competitor Mintos is larger, but it is struggling with its own problems. Read more about this in my Mintos review.

Unlike most P2P platforms in our P2P lending ranking, with Bondora you don’t have to select individual loans. You simply deposit money and receive your interest immediately, from day one. Payouts are just as quick and easy.

As is usual with P2P platforms, we need to get a good overview of the company and its business – after all, we want to entrust Bondora with our money! In my experience, you can’t be too careful here. So here’s an overview of the most important facts:

| Foundation | 2008 |

| Company headquarters: | Tallinn, Estonia |

| Executives: | CEO Pärtel Tomberg (founder) |

| Financed credit volume: | +EUR 28 million (10/2025) |

| Regulated: | Fully regulated |

| Annual report: | Audited annual report available; profit of €1.3 million |

| Investors: | + 530,000 users |

| Yield: | 6 % |

| Buy-back guarantee: | Not applicable |

| Minimum investment amount: | 1 EUR |

| Auto-Invest: | Yes |

| Secondary market: | No |

| Tax certificate: | Yes |

| Bonus programmes: | 5 € registration bonus via my link |

How the Bondora Go & Grow business model works

Bondora generated a profit of approximately €1.3 million last year. How does that work? It’s simple:

- Every borrower who borrows money from Bondora pays very high interest rates and various fees.

- The company keeps a substantial portion of this income for itself.

- Only 6% is distributed to investors like you and me.

A glance at my P2P lending ranking shows just how lucrative this business model is: numerous platforms offer high, often double-digit interest rates for us investors while raking in massive profits for themselves!

Sign up and secure your bonus

If you want to build up a passive income or simply ‘park’ your money wisely, Bondora Go & Grow is the right place for you. In my review, registration only takes a few minutes.

You will need the following items:

- An identity card, passport or residence permit.

- A smartphone with a working internet connection.

- A mobile phone number that can receive text messages.

- A working email address.

- A bank account in the EU, Switzerland or the United Kingdom that you can use to deposit money later (online banks such as Wise, Revolut, N26, etc. are not permitted).

How it works:

1. Basic information

Get started by clicking on my registration link, which will immediately give you 5 euros in additional capital. This will take you to the registration page, where you will find the ‘Register’ button in the top right-hand corner.

Willst du dich über dein Handy anmelden, musst du zunächst auf das Menü oben rechts und anschließend auf “Registrieren” klicken.

Whether you are using your smartphone or desktop computer, you will now need to enter your email address, first and last name, and phone number. All three will be confirmed later, so please ensure that the information you enter here is correct:

- Dein Vor- und Nachname sollte zum Ausweisdokument passen, mit dem du später deine Identität bestätigen willst.

- Deine Handynummer muss echt sein, um Bestätigung-SMS empfangen zu können

- Auch deine E-Mail-Adresse muss funktionieren, da du hier später eine E-Mail empfangen und einen Bestätigungslink klicken musst.

Hast du die Infos abgeschickt, begrüßt dich schon das Bondora Maskottchen. Bestätige hier noch die Nutzungsbedingungen, Datenschutzrichtlinien und Risikoerklärung und schon bist du angemeldet!

3. Confirm identity

You are now on your dashboard, the overview page of Bondora Go & Grow. Before you can collect your first interest, you must first verify your identity.

If you already have reviews of P2P lending or online brokers such as Freedom24, you know the drill: the provider has to make sure that you really are who you say you are!

Bondora uses the service provider Onfido to verify your identity. In my experience, this works quickly and easily. You don’t have any contact with a real person – everything is done automatically.

Then you can make a simple transfer from your bank account to Bondora Go & Grow. Now all you have to do is answer a few questions and your account will be fully activated! The whole process takes about 5 minutes.

Good to know:

As an investor, there is only one fee when using Bondora Go & Grow: withdrawing capital costs €1 per transaction. Otherwise, the service is completely free!

How the investment works: My personal experience with Bondora Go & Grow

Among P2P platforms, Bondora is probably the simplest provider. Your investment is completely passive: you don’t have to set anything up, select anything or do anything. All you have to do is deposit money!

Here’s how it works:

- With Bondora Go & Grow, you do not invest in loans yourself.

- The company operates its own portfolio of P2P investments.

- The money you deposit is used to finance such loans.

- In return, you receive a small share of the profits, which are credited automatically on a daily basis.

- Since you are not investing directly in P2P lending, but in the Bondora company itself, you can withdraw your capital at any time.

This is in stark contrast to P2P service providers such as Ventus Energy or EstateGuru, where investors invest in individual projects. Here, you need to check the loans very carefully before investing your money!

You can find more information in my posts about my Ventus Energy review and Fintown review.

Due to this unique business model, Bondora Go & Grow works a little differently! You won’t find an auto-invest feature here, as all investments are automatic. Of course, there is no secondary market either, as you are not investing in individual loans.

Are there any es at Bondora?

The problems facing investors include, for example:

- You do not have to pay any fees or charges on your investments.

- You receive 6% interest on your money right from the start.

- Only when you make a withdrawal is a symbolic fee of €1 charged.

All in all, a very simple fee model. No wonder: a simple structure is the recipe for success at Bondora Go & Grow!

Bondora Go & Grow: How I earn a 6% return

I have written many reviews – after all, my Northern Finance portfolio alone contains €64,000 in P2P lending with all well-known providers! Normally, at this point, I would explain the criteria I use when investing.

Unfortunately, this does not work with Bondora, as there are no options to choose from. You only have two options here:

- Deposit money and receive 6% interest per year.

- Withdraw money and no longer receive interest.

I have been with Go & Grow since it started. Back then, the interest rate was 6.75%. Over the years, I have deposited various amounts and made regular deposits and withdrawals.

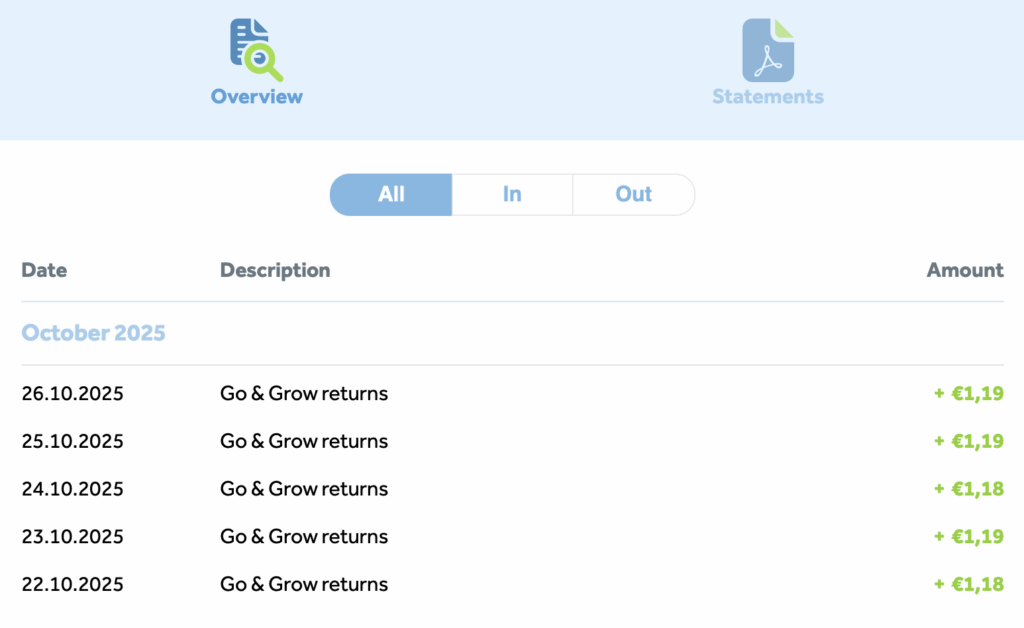

In total, I received €2,262 in interest! My account is currently worth around €7,430. I will be increasing this amount again in the near future.

My reviews have been very positive across the board: I have never had any problems! The interest was always credited as promised.

Only during the COVID-19 crisis were payments limited to a certain amount. Overall, however, this was not a disadvantage for me, as I generally approve of such security measures.

Risk with Bondora

As already mentioned, you make your money available directly to Bondora. Accordingly, investors become dependent on the company: If the P2P platform were to experience financial problems or even go bankrupt, our capital would also be at risk!

Here, we can currently give the all-clear:

- Bondora has been operating profitably for years: Last year, it generated a profit of €1.3 million.

- The company has substantial reserves: Insiders estimate that investors could be paid out for at least a year, even if the entire business were to collapse.

- Bondora is seeking an official banking licence: it is already actively preparing for this and has introduced additional monitoring mechanisms and security measures. This is a positive sign for investors.

Despite the positive signs, P2P investors should always remain vigilant. Problems can arise relatively quickly – even a giant like Bondora is, in my experience, never 100% secure! However, if doubts arise later, you can withdraw your money at any time.

Taxes with Bondora Go & Grow

When it comes to taxes, Bondora stays true to its business model and makes everything as simple as possible: The provider does not deduct any taxes from your profits. Instead, you must declare your income yourself in your tax return.

You can easily view your winnings:

- Select ‘Account statements’ from the menu.

- In the following window, you can generate a tax report.

- Enter the appropriate start and end dates (usually from 1 January to 31 December of a year) and click on ‘Generate report’.

Advantages and disadvantages

Based on my extensive experience with Bondora Go & Grow, I can identify the following advantages and disadvantages.

Advantages:

- Bondora is one of the safest P2P providers, having already weathered several crises and built up extensive reserves for difficult times.

- Deposits and withdrawals are possible at any time and are extremely fast. In my experience, the money is usually in your account on the same day!

- Interest is paid daily, resulting in a comparatively strong compound interest/snowball effect.

- The service is extremely easy to use and works completely without any active involvement on your part. All you have to do is deposit money to receive interest.

- The company invests heavily in additional security and is applying for a banking licence.

- Overall, it is increasingly establishing itself as an alternative to traditional instant access savings accounts and offers significantly better interest rates.

- All information about the company is freely and transparently available.

- In my experience, customer service is fast and reliable. In addition, there is a good English translation of all functions.

- There are no costs for investors, with the exception of a €1 fee for withdrawals.

- Uninvested capital is protected up to £100,000 by the deposit guarantee scheme. However, as your money is immediately invested, this is of little practical significance.

Disadvantages:

- The interest rate of 6% is very low compared to other P2P providers.

- There is no way to diversify your investment – you are completely dependent on one company.

- Most recently, the interest rate was lowered from 6.75% to 6%. Further reductions are conceivable in the future, as the company wants to become an official bank.

- As with all P2P lending, there is a serious risk with Bondora. Interest rates depend on repayments from borrowers. In the event of a serious crisis, these could fail to materialise, leading to high losses or complete collapse.

Alternatives to Bondora Go & Grow

In my review, Bondora Go & Grow has only one real competitor: Monefit Smartsaver! Both platforms focus on ease of use and quick availability of your money. In return, however, both offer only modest interest rates (for the P2P sector).

While Bondora has been moving increasingly towards becoming an official bank in recent months, with additional collateral but lower interest rates,

- Here, the interest rate remains at an attractive 7.25% with daily payouts. Alternatively, you can increase this amount to up to 10.52% if you can do without your money for a longer period of time.

- At the same time, however, Monefit makes no attempt to offer more collateral. It focuses entirely on higher interest rates with excellent availability.

- In a direct comparison between Monefit and Bondora, both providers are somewhat risky, flexible and offer average interest rates. However, there are differences in all areas that can help you make your decision.

Community reviews on Bondora Go & Grow

Many investors in the Northern Finance Community, like me, have been reviewing Go & Grow for many years. Many of them have reacted negatively to the interest rate cut. As a result, numerous investors want to withdraw or reduce their capital.

Some others, however, welcome the new steps towards greater security. These measures will enable Bondora to set itself apart from the competition and create or further expand its own attractive niche in the P2P market.

It therefore remains exciting to see how business will develop for the P2P giant in the future. In any case, I will increase my investment again.

Conclusion of my Bondora Go & Grow review: Different, but not automatically better

Bondora Go & Grow takes a unique approach among P2P platforms: it pays lower interest rates than its competitors, but instead offers greater security and excellent availability of deposited funds.

This establishes the company as an attractive alternative to normal instant access savings accounts and less so to P2P competitors such as Mintos, Ventus or Debitum. Only Monefit Smartsaver takes a similar approach.

Is it worth joining Bondora Go & Grow? The answer depends on your personal goals! If you are looking for high interest rates because you want to grow your money as quickly as possible, then this is definitely not the right place for you.

However, if you are interested in a call money account with significantly higher interest rates than your regular bank offers (with a higher risk), Bondora could be ideal for you.