Fintown review: generate returns through rental properties

Are you interested in investing in real estate but don’t know how? You may also be looking for high-yield investments with an average return of 10 to 14 per cent. In this article, I’ll share my Fintown review, what you should consider, and the pros and cons!

In brief:

- Are you looking for a high-yield investment? With real estate projects through Fintown, you can achieve returns of between 10 and 14 per cent.

- Various real estate projects in Prague are supported: properties that are currently under construction or apartments that are rented online for short periods of time.

- We show you the pros and cons and everything you need to know about the provider.

Fintown Test – P2P lending

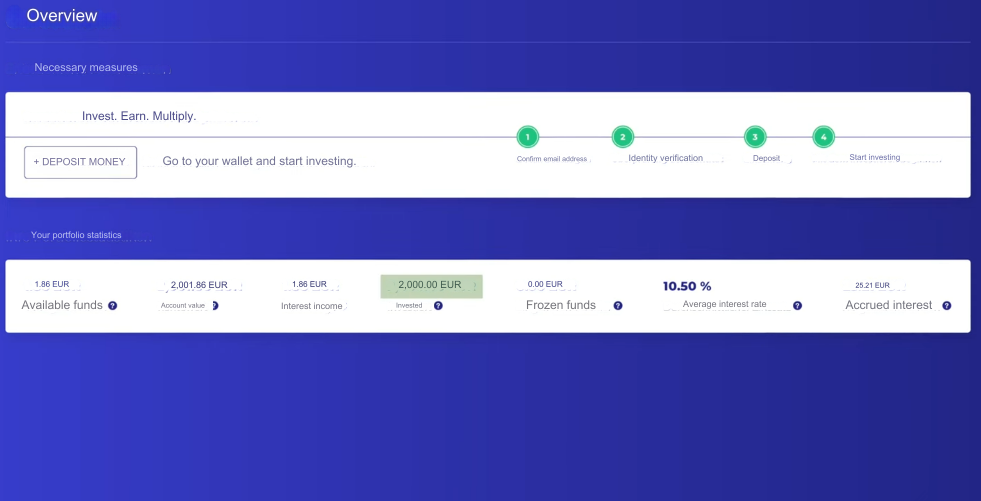

The provider Fintown

Fintown is one of these P2P platforms. What makes it different from the rest is that it specialises in real estate. It works with the Vihorev Group and offers loans from this company.

The Vihorev Group has been developing real estate in the Prague area since 2014. In addition, they themselves have a 20 per cent stake in each of the loans offered on Fintown. This is particularly important for investors to know, as it shows that there is a great interest in ensuring that the projects are successfully implemented and the loans repaid.

There are two different ways to invest in real estate. On the one hand, you can invest in development projects that are currently under construction. Here you can expect returns of 10 to 14 per cent. These funds are used to buy equipment for the properties.

On the following screenshot, you can see the current projects and some important data about them. You can see that the terms are relatively short and what the interest rates are.

If you would like to learn more about the projects, you can find significantly more information by clicking on ‘Show details’, the button in the bottom right corner.

On the other hand, you can invest in real estate that is already rented out. You can look up the individual projects on the Fintown website, by the way. In the screenshot below, you can see what this might look like, for example.

I am particularly interested in the properties that have already been let. After construction is complete, the development projects also become real estate projects that are regularly let. For me personally, the system works in a similar way to Gow & Grow.

You can view photos of the properties and get information about them, such as the rent and size. What I particularly like are the detailed descriptions, which give you a good overview of the projects. You also have access to detailed documents, which ensures transparency.

In addition to real estate investments, you can diversify by exploring alternative solutions such as our review of Ventus Energy.

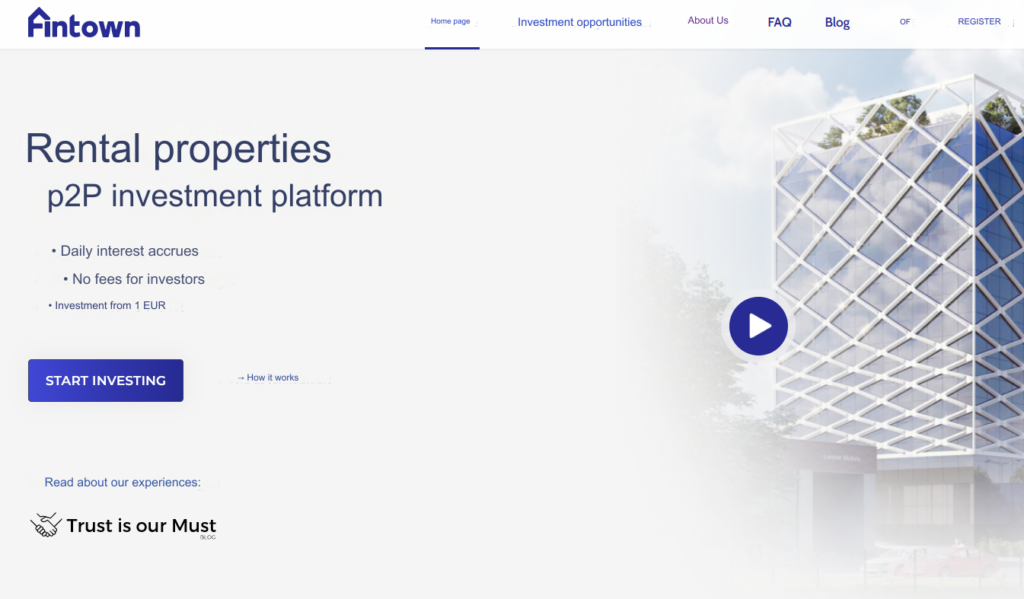

My Fintown Portfolio – the FLEXI model in the Fintown test

At this point, I would like to show you a specific example. In the so-called FLEXI project, money is collected from investors, which can generate 8 percent interest. The attractive thing about this investment is the low minimum amount: you can invest as little as 1 euro!

These are mainly short-term loans, which can also be interesting for investors. In this example, you must have been invested in the project for at least 30 days. Interest payments are calculated daily and distributed monthly. After the 30 days have expired, you can withdraw your money at any time. The short maturities are particularly attractive for some investors.

You can see an example project in the screenshot below. The wealth of information provided offers you transparency, for example, you can see how much money has already been invested. In this specific example, over €160,000 has already been collected.

Fintown opens these projects as and when required. This also means that you have to be quick if you are interested in a specific project. The ‘Min. term’ shows you the minimum time you have to invest in the corresponding project.

In contrast to Go & Grow, I believe that investors are more secure here because it is not just a portfolio of consumer loans. Instead, actual, physically existing properties serve as collateral. The 8 per cent interest rate, calculated daily, makes the whole project quite attractive.

The property is already being used and rented out to interested parties on real estate websites such as Booking.com, as you can see in the screenshot below. This is a project in which not one tenant pays for years, but a house with several individual apartments that are rented out weekly.

Of course, renting out via platforms requires management, which can increase costs. In the end, however, there is still a significantly higher return for us investors, which is due to the short-term rentals. These are an advantage because more money can be charged than for a long-term rental apartment.

The valuations of rented flats are particularly important in this context:

- This example currently has a rating of 8.9/10 stars based on over 2,000 ratings.

- Surely you also know the situation when you are looking for a rental apartment for your next holiday and you read the reviews carefully before deciding on an apartment.

- Therefore, whether or not you would rent such a flat yourself is an important criterion. Take enough time to look at the project closely and get an overview.

Personally, I think it’s very good that a lot of information is provided and that every investor gets the opportunity to view the properties. This makes the project very exciting for investors, as everyone can easily understand exactly what they are investing in.

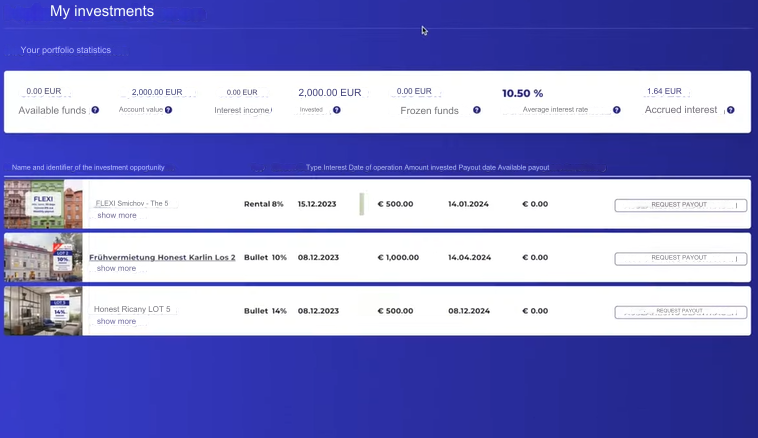

I also find the project exciting, especially the FLEXI model, and have invested in it myself. I would like to briefly show you my portfolio with the provider here. As you can see, I have invested a total of 2,000 euros.

I only received 1.86 euros in interest. On the far right, you will find the so-called ‘accrued interest’ in the amount of 25.21 euros. I am already entitled to this, but, as is usual with real estate projects, it will be distributed at the end of the term.

I have diversified into three different projects, as can be seen below. So far, I have invested €500 in the FLEXI project, but I would like to increase this further. The project involves refinancing the owners’ equity, which is subordinate to the senior loan.

This means that this loan is riskier than the senior loan. It is therefore important that the project is also profitable. To this end, values can be checked.

The average occupancy rate of the apartments and the average daily rental income, for example, can be used here. The annual rental income and net values are also given. In the specific example, an occupancy rate of 91.44 per cent is given here.

My Fintown experiences about security

Are these secure investments? The security for these loans is provided by Czech real estate. In addition, the Vihorev Group offers a guarantee that you can see as a buy-back guarantee.

So if the project is no longer profitable and the flats can no longer be rented, the Vihorev Group will step in. You should know that since the parent company was founded, all investors have been paid on time and so far no loan has defaulted.

Currently, no audited financial statements of the Vihorev Group are available in English. When I asked about this, I was informed that the 2023 financial statements would be available online in the second quarter, in order to further increase transparency.

If you have any further questions, the Fintown website has a clear FAQ that answers many of the questions you may have, for example regarding security, registration or more information about the investment product.

The disadvantages of Fintown

Fintown is a relatively new platform. This is reflected, for example, in the fact that the translation on the German versions is sometimes incorrect.

Due to its young age, the provider has not yet been able to prove itself in many areas. For example, only time will tell how Fintown will handle an increasing number of loans and investors and how well it can scale. The provider has also not yet had to deal with major challenges.

Some critics complain that there are not many projects available yet. However, this is understandable, as the provider is still quite young. Further projects are in the planning stage.

Another disadvantage is the lack of consolidated annual accounts to provide investors with more information. Although a lot of data and documents are made available via Fintown, information about the parent company would also be beneficial.

Depending on the investor, the lack of an auto-invest function may also be a disadvantage:

- Many P2P platforms offer an automated investment function.

- Investors can simply enter their desired parameters and investments are made automatically according to the individual strategy, saving the investor time and effort.

- However, it should also be mentioned that the effort is minimal.

Furthermore, Fintown is not subject to any regulation. However, a high degree of transparency is required and collateral is guaranteed by the existing properties and a kind of buy-back guarantee.

The advantages of Fintown

If you are generally interested in property shares, investing in P2P loans in the property sector could be an alternative. A clear advantage is the comparatively high potential returns on investment in development projects.

You can expect a return of 10 to 14 per cent. As you can see, this is an attractive alternative to conventional investments and is therefore a good idea as part of your return strategy in your own portfolio.

Fintown’s experience to date has shown that all investors have been paid on time. Even loan defaults or other difficulties have not yet been recorded, which is particularly positive, even though the platform is still comparatively young.

On the internet, customer contact is often described as good and committed in the Fintown experience. You can contact the provider, who has so far responded openly and addressed enquiries from interested parties. Questions are answered and if there are any problems, the provider helps quickly and reliably.

The investment is transparent and easy to understand. You have access to a whole range of documents. You can view the information and documents on the official websites.

Another positive aspect is the low minimum investment that investors have to pay in order to be able to invest in the fund. This means that investors with fewer assets can also start investing.

The fact that you are only tied to the loan for a short period of time for the most part can also be an advantage. Accordingly, you can withdraw your share at any time after 30 days and react flexibly.

You can find the provider’s website here. If you are interested in this type of investment, you can register by clicking on the ‘Register’ button in the top right corner. You will find a useful FAQ with some relevant information in the same bar further up.

Conclusion: My Fintown experience – attractive opportunities for returns through interesting real estate projects

To summarise, the Fintown test shows that this is an interesting project. It is definitely profitable to rent out flats on online websites and thereby generate rental income.

Care is taken to ensure that investors have transparent access to some documents and important data so that they can realistically assess the projects. To do this, check, for example, the valuations of the properties and whether the booking is at full capacity so that the properties are rented out frequently.

The attractive potential returns are a particular incentive. Since you are investing in real estate, you can make good use of P2P lending to diversify your portfolio so that you are not only invested in shares or similar.

On the downside, it must be mentioned that the platform is not regulated and is comparatively young. The provider has not yet been able to prove itself when it comes to crises or difficult situations. There are securities in the form of real estate and a kind of buy-back guarantee.

You have not yet invested and are also interested in other investments? Learn more about ETFs for beginners here!