Mintos Alternative: Where can you find higher interest rates and greater security?

Mintos is currently the largest and best-known P2P platform, but not necessarily the best! Investors looking for high interest rates, good security or a flexible investment can achieve better results with some competitors. Below, I present the best Mintos alternatives!

In brief:

- Mintos is a peer-to-peer lending platform with hundreds of thousands of users, a wide range of offerings, and years of review.

- Many users want better security, higher liquidity, greater returns or simply to diversify their portfolio.

- If you are looking for an alternative with higher interest rates, Ventus Energy is the right choice. Here you can earn up to 19% per annum (with bonus promotions).

- Are you looking for more security? Monefit is an exciting alternative to Mintos, which is very stable thanks to its high profitability.

Why do you need a Mintos alternative?

The idea behind P2P lending has been around for a long time, but it has only become truly successful in recent years. One provider that has driven and shaped this process like no other is Mintos: with over 500,000 users, it is the largest P2P platform in Europe!

Since its founding in 2014, the Latvian company has financed over €11 billion in lending! Private individuals like you and me provided the capital for this and were rewarded with high interest rates in return. But there were also problems:

- If a borrower fails to repay their loan, there is still no cause for concern. Thanks to buy-back guarantees, we still receive our capital and interest.

- However, during the COVID crisis, there were significant losses of over 80 million euros in a short period of time.

- Several lending originators (companies that grant lending and refinance through Mintos) went bankrupt.

- Buy-back guarantees were now useless, as there was no longer a credit initiator who could repurchase the receivables.

- Mintos did a good job of recovering capital, but several million euros were returned very slowly or were lost entirely.

These negative reviews have permanently scared off many investors. None of the possible Mintos alternatives had such intense problems. The biggest competitor, Bondora, for example, showed how well investors could get through the crisis with P2P lending. After a few weeks, everything was back to normal here.

New platforms make many things better

Another reason why it is worth looking for a Mintos alternative: the P2P market has grown significantly in recent years and now includes dozens of platforms. These offer different areas of focus and are simply better in some categories.

That doesn’t mean that Mintos is bad or not worth investing in! I am also invested here and am achieving good results, as a glance at my portfolio shows. But the large number of possible alternatives offers us additional opportunities:

- Security: Several platforms strive for maximum security. They rely on additional regulation, improved testing mechanisms or build up massive reserves for bad times.

- Interest rates: There are several Mintos alternatives that offer significantly higher interest rates. Some P2P marketplaces can even offer almost double!

- Liquidity: P2P providers that allow you to withdraw your money at any time became popular thanks to Bondora and are now very well known. Numerous Bondora alternatives offer such highly liquid P2P lending.

Even if you are satisfied with Mintos, there are good reasons to consider the possible alternatives.

| Mintos | Ventus Energy | Monefit | |

| Interest | 10 – 14 % | 18 % | 7,5 – 10,5 % |

| Distribution | Monthly | Daily | Daily |

| Foundation | 2014 | 2023 | 2006 |

| Number of investors | Over 600,000 | 3.600 | 20.000 |

| Monthly credit volume | Approximately €100 million | Unknown | Unknown |

| Annual financial statements? | ✅ | ❌ Present, but not accessible | ✅ |

| Last profit | – 2.7 million € | Unknown € | €8.1 million |

| Balance sheet total | €12 million | Unknown € | €367 million |

| Repayment problems? | Yes, in 2020 | No | 2003 on Mintos |

| Payment in … | After the end of the lending or upon sale | Same day | 10 working days |

| Translations? | ✅ | ❌ | ✅ |

| Regulated platform? | ✅ | ❌ | ❌ |

| Regulated parent company? | ✅ | ❌ | ✅ |

You should know about these Mintos alternatives

Are you considering signing up with Mintos, or are you already active here but not entirely satisfied? Fortunately, there are dozens of possible alternatives that might suit you better!

They solve the biggest problems investors have with Mintos:

- At Mintos, we receive an average interest rate of 11.4% on P2P lending. For P2P lending, that’s not particularly high!

- Safety is questionable. During the Covid crisis, it has already become apparent that failures are possible.

- Our money is tied up with Mintos for a long period of time. Early exit via the secondary market incurs fees and can result in losses.

I have compiled a list of the best competitors for you. Depending on where the shoe pinches, you will find the best alternatives here:

1. Mintos alternative with higher interest rates: Ventus Energy

What’s better than interest? More interest, of course! My Mintos review shows that you can earn an average of 11.4% and a maximum of 14%. Other platforms, however, offer significantly more.

In my current P2P lending ranking, you will find several offers with interest rates between 12 and 16%. But one platform leaves its competitors in the dust: Ventus Energy currently offers 18% per annum, which you can temporarily increase to 19% with my sign-up bonus!

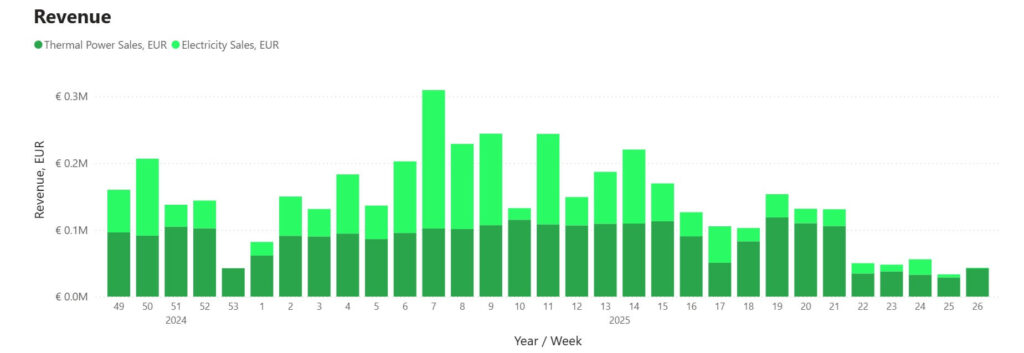

What’s behind Ventus Energy:

- The company is active in the energy sector and operates power stations, combined heat and power plants, solar power plants and the associated infrastructure in the Baltic States.

- New properties are purchased or modernised with money from private investors and banks.

- The power stations are already operational and generating revenue. So this is not just a theoretical concept for the future!

- The demand for electricity and heat is enormous and is being fuelled, among other things, by the loss of Russian gas.

- There are comprehensive subsidies from the European Union, from which energy projects benefit.

So we are investing here in a rapidly growing company in a very lucrative sector. I am convinced that Ventus Energy will become a profitable player in the energy market in the foreseeable future. These are not just empty words for me: I have invested over €11,000 in the project!

Currently, I am credited with just under €6 in interest per day.

I have already visited Ventus Energy myself and had the opportunity to examine the various projects. This transparency is exemplary and is also reflected in the comprehensive and up-to-date data that we can access at any time.

Before investing, however, you should consider two important points:

- There is a serious risk: 19% interest does not come without a price! Ventus Energy must first prove that its growth strategy will work. If it fails, bankruptcy looms and your capital is at risk.

- You need to raise a high minimum amount: To get started with Ventus Energy, you need at least €1,000. This Mintos alternative is therefore only interesting for investors who have a considerable amount of capital at their disposal!

If, despite these two disadvantages, you are still interested in the very high interest rates, it is best to register directly via my link and secure an additional 1% cashback.

2. Mintos alternative with better security and liquidity: Monefit

The problems during the COVID crisis are still a painful memory for many investors. Accordingly, there is considerable interest in a Mintos alternative with greater security.

There are several approaches to better protect investors. I like the concept of competitor Monefit best:

- Monefit is an investment platform of the Creditstar Group, which has been granting lending with great success for many years.

- The group is represented on platforms such as Lendermarket and Mintos, among others.

- Through the in-house Monefit service, you invest directly in the Creditstar Group’s loan portfolio. In return, you are rewarded with 7.5% interest.

- Your capital is spread across thousands of lending, minimising the risk of default.

- You can withdraw your money at any time and do not have to wait for the lending to be repaid. Monefit is therefore a very good alternative to instant access savings accounts.

- The high level of security is primarily due to the company itself. The Creditstar Group has been very profitable for years and most recently achieved a profit of over 10 million euros per year!

Its high level of security and liquidity makes Monefit a particularly exciting alternative to Mintos. I currently have over €11,000 invested here. Around €3,000 of this is in the so-called ‘Vaults’: here I receive up to 10.52% interest, but have to forego my capital for up to two years. I receive up to 10.52% interest, but have to forego my capital for up to two years.

The major disadvantage here is clearly the lower interest rate of “only” 7.5%. However, this is more than offset by the excellent collateral and the option to withdraw my money at any time.

Monefit is therefore an ideal Mintos alternative for anyone who wants to park their capital safely while earning good interest rates.

Mintos or alternatives? Here is an example of what a portfolio could look like

There is no doubt that both Mintos and the numerous alternatives have interesting offers. But what is the final verdict? Which platform is the right one? The answer depends, of course, on your goals and possibilities!

I can only give you my personal recommendation. It is as follows:

30 to 50% with Monefit

The first step is to register with Monefit. Although this highly secure platform offers “only” 7.5% interest, you can withdraw your money at any time. It should therefore be part of every lucrative P2P portfolio.

The key question is: how much of your assets should you invest here? My recommendation:

- If you want to invest in both Mintos and the highly lucrative alternative Ventus Energy at the same time, 30% with Monefit is sufficient.

- If you want to play it safe, you should invest at least 50% with Monefit.

- Even for those who wish to forego Mintos, a 50% stake in Monefit is available.

Maximum 50% at Ventus Energy

With Ventus Energy, you can optimise your returns, but you also add a little more risk to your portfolio. You should adjust the proportion according to your risk appetite.

- Those who also invest with Monefit and Mintos can invest one third everywhere, thus ensuring good diversification.

- Not interested in Mintos? A half-and-half portfolio promises high returns thanks to 50% Ventus Energy and good security thanks to 50% Monefit.

- Investors who want to minimise risk should avoid Ventus Energy or keep their investment very small (e.g. 10%).

Good to know:

Due to the minimum investment of €1,000 at Ventus Energy, it can be difficult to adjust the share percentage accurately, especially with smaller assets.

Optional: Up to 33% Mintos

Some investors want to replace Mintos entirely, while others just want to reduce their investment. If you want Mintos to remain part of your portfolio, a share of up to one third makes sense. The 11.4% interest rate complements the offerings from Ventus Energy and Monefit very well.

Overall, a sample portfolio could look like this:

| Monefit | Mintos | Ventus Energy | |

| Without Mintos | 50 % | 0 % | 50 % |

| Balanced | 33 % | 33 % | 33 % |

| Safety | 50 % | 30 % | 20 % |

Conclusion: Mintos alternatives are an exciting addition

Mintos is not fundamentally a bad platform. You can earn solid interest rates of up to 14% and enjoy a good selection of lending. However, some other platforms offer attractive alternatives that have advantages due to their special focus!

- Monefit is an excellent alternative to Mintos due to its higher security. This P2P provider pays you slightly less interest, but offers you immediate access to your money. The company behind it is extremely successful and generates profits of over €10 million per year! Mintos, on the other hand, recently posted a loss.

- If, on the other hand, you are looking for the highest possible returns, Ventus Energy is a good option. With this Mintos alternative, you can currently earn up to 19% interest! An investment involves a slightly higher risk, but I personally am convinced of the platform’s success.

If you don’t like Mintos (for example, due to rather poor reviews during the COVID crisis), there are more than enough alternatives available to you.. Of course, a combination of the aforementioned providers also makes sense!

A good mix ensures a stable P2P portfolio that will perform well even in the event of a crisis. It allows you to build up passive income with P2P lending without any stress, or simply to increase your capital quickly!