My Scalable Capital review in 2025: ETF savings plan, shares and more from the online broker

Scalable Capital is making waves in the investment world with its unique subscription-based model and smart robo-advisor. As a Munich-based fintech, it’s been steadily gaining popularity—and with good reason. Many users report a seamless experience, a modern interface, and surprisingly low costs. Whether you’re a beginner or a seasoned investor, this scalable capital review will give you a complete picture of what makes this broker stand out.

What are the strengths and limitations of Scalable Capital? How do the different pricing models compare, and which one suits your strategy best? In this post, I’ll walk you through my personal experience with Scalable after several years of use—and help you decide whether it’s the right platform for your financial goals.

In brief:

- Scalable Capital is a German neobroker that allows investors to pay per transaction. Alternatively, there is a fee-based flat-rate subscription with various benefits.

- A ‘robo-advisor’ offers automated investments on request.

- The Scalable Capital Broker is extremely affordable when purchased by subscription and leaves its competitors behind.

- However, the offer is limited to one trading centre.

- Scalable Capital is regulated by the BaFin and deposits are protected up to

What Is Scalable Capital? Company Background and Growth Story

In today’s crowded investment landscape, choosing the right platform can feel overwhelming. From ETF savings plans to active stock trading, the options are endless—especially with the rise of intuitive mobile platforms. Among the growing number of so-called neobrokers, one name stands out for its unique approach and consistent user satisfaction: Scalable Capital.

Founded in Munich in 2014, Scalable Capital first made headlines with its innovative robo-advisor. This feature—now branded as Scalable Wealth—uses dynamic risk management to automatically invest based on your personal preferences. While it’s still part of the offering, especially for beginners, the focus has since shifted toward more active and self-directed investing.

Today, the Scalable Capital platform is best known for its flat-rate pricing model, which can deliver substantial savings to frequent traders. If you’re using the Scalable Capital app regularly, this subscription-based model quickly pays off. But even casual investors can benefit: trades outside the subscription cost just €0.99—still highly competitive.

If you’ve ever used Trade Republic , you’ll recognize the landscape. The competition is fierce, with both platforms offering rock-bottom fees and sleek, user-friendly apps . But in this Scalable Capital review , what sets it apart is the combination of flexibility, pricing, and a strong user experience backed by a wide product selection.

Whether you’re a buy-and-hold ETF investor , a hands-on stock picker, or just getting started as a beginner , the Scalable Capital investment app provides a streamlined way to manage your portfolio — all from your phone or desktop. From its early days as a robo-advisor to its current role as a leading mobile platform for investing , Scalable has carved out a unique place in the fintech space .

My experiences in the following report focus accordingly on the use as a broker, the offer, cost models and co. Here, a lot has been added in recent years: Today there are shares, ETFs, bonds, funds, derivatives, foreign currencies, commodities and even cryptocurrencies – an unusually wide range for a neobroker!

The company’s good reputation also contributes to its popularity: a long company history (for the industry), supervision by the BaFin and the large investors Blackrock and Tengelmann as financiers speak for quality. The cooperation with Baader Bank, which is responsible for managing the capital, also makes a good impression.

Investors’ experiences with Scalable Capital are correspondingly positive and the number of users is growing steadily. In view of the favourable conditions, many investors are willing to overlook the biggest shortcoming – the restriction to two trading venues.

Scalable Capital Review: History, Mission & How It Works

Scalable Capital was founded in Munich in 2014 with the vision of making investing more accessible, automated, and affordable. It began offering its robo-advisory service in 2016, allowing users to invest according to personal preferences—without needing to actively manage their portfolios. This smart, hands-off approach attracted many first-time investors.

In 2020, Scalable took a major leap by launching its own brokerage platform , enabling users to buy and sell ETFs, shares, and other assets directly through the now widely used Scalable Capital app .

Compared to most neobrokers, Scalable Capital has a relatively long and stable company history. Over the years, it has built a strong reputation and avoided major scandals. Many early users and independent Scalable Capital reviews have highlighted a positive user experience, citing the platform’s ease of use, transparency, and fair pricing.

That said, recent user feedback has pointed out a few growing pains. Specifically, delays in customer service response times and long waits for tax documents have caused frustration for some users. While these issues don’t affect the core functionality, they are worth considering when choosing your broker.

Interesting:

You hardly ever hear anything negative about the app and the actual trading! The application is simple and the structure is clear considering the extensive range of offers. I have been able to gain several years of experience with the programme and have nothing to criticise here.

The business model is built on several revenue streams. The Scalable Wealth robo-advisor charges a management fee of 0.75% per year, and as of now, the platform manages over €20 billion in assets—equivalent to at least €1.5 million in annual income from that product alone. However, the bulk of Scalable’s revenue likely comes from its flat-rate subscription plans and non-subscription trades at €0.99 each

Another important source of income is Scalable’s partnership with the Gettex and Xetra exchanges , through which all trades are processed. For every completed transaction, the broker receives a commission—also known as a kickback . This model enables Scalable Capital and similar platforms like Trade Republic to offer low-cost investing without hidden fees for users.

Scalable Capital combines automation, low-cost trading, and a modern interface to deliver a powerful all-in-one investing experience. Whether you’re exploring a Scalable Capital platform review or deciding on the best app for your needs, this provider offers a well-balanced solution for both beginners and active investors.

Scalable Capital Costs and Subscription Plans Explained

One of the key differences between Scalable Capital and other online brokers lies in its transparent and flexible fee model. Investors can choose from three subscription plans, each designed to fit a different investment style — whether you’re just getting started or actively trading every week.

| Depotgebühren/ Grundgebühren | order fees | crypto fees | term | |

| FREE BROKER | 0,99 € | 0,99 € | 0,99 % | Can be cancelled monthly |

| PRIME+ | €0.00 (for orders over €250) | €0.00 (for orders over €250) | 0,69 % | Can be cancelled monthly |

Additional fees for trading on Xetra: €3.99 order fees plus 0.01% trading venue fee (min. €1.50) for each transaction, regardless of the selected subscription!

FREE BROKER: For Beginners and Occasional Traders

The free broker model is aimed at investors who only trade rarely, only use savings plans or have no experience of the stock markets and want to execute their first trades. You benefit from free savings plans and can buy ETFs from the providers iShares, Amundi and Xtrackers free of charge, provided the order volume is over €250.

- No custody fees

- No fees for savings plans

- ‘Prime ETFs’ free of charge for order volumes of €250 or more

- 0.99 euro order fee per purchase or sale of shares via Gettex

- 3.99 € order fee via Xetra + trading centre fee of 0.01 % (at least 1.50 €)

PRIME+: The Flat Rate for Active Traders

With the PRIME+ model, Scalable Capital offers a trading flat rate that, in my experience, is particularly worthwhile for active traders. You pay €4.99 per month, receive all the benefits of FREE BROKERS and can also trade free of charge if the order volume exceeds €250. Furthermore, you receive interest of 2.6% per year on your non-invested capital.

- Basic fee of €4.99 per month, monthly billing/can be cancelled monthly

- All the advantages of FREE BROKER (free savings plans, premium ETFs…)

- No order fees when buying or selling via Gettex, if the order volume is over €250.

- 2.6 % p.a. interest on uninvested capital

- Better conditions for crypto trading

- Additional analysis tools, more price alerts and similar goodies

- 3.99 € order fee via Xetra plus 0.01 % trading venue fee (at least 1.50 €)

Cryptocurrencies are a special case:

You can also trade Bitcoin and other cryptocurrencies at Scalable Capital. An additional spread applies here: with FREE BROKER you pay 0.99%, with PRIME+ 0.69% on each order.

If you have not yet gained any experience with scalability or generally only trade very rarely, the ‘FREE BROKER’ is the best option for you . Here, no custody fee is charged, but each transaction with shares, derivatives and the like costs you an order fee of one euro. The offer is therefore the same as the costs of TradeRepublic , with which I have had similar experiences.

FREE BROKER is ideal for those taking their first steps; however, anyone who already has experience of Scalable and trades more frequently is likely to be more interested in PRIME+. The additional costs of around five euros per month are recouped after just five trades.

However, this requires an order volume of 250 euros each . To make the flat rate worthwhile, you would have to invest 1,250 euros per month or more – a sum that only a few investors are likely to reach! The interest rate of currently 2.6 per cent is not worth mentioning and falls into the category ‘better than nothing’.

Nevertheless, the PRIME+ model can be worthwhile: additional analysis tools such as security comparison, portfolio analysis or shopping via ‘Smart Predict’ are available here and can create real added value. Even if you regularly trade cryptocurrencies, the flat rate quickly pays for itself thanks to the 0.3% lower fees.

My tip: Take advantage of the option to change your subscription every month! This way, you can build up a new portfolio affordably with PRIME+ or invest larger sums. The following month, when there are no more trades to be made, you can switch back to the FREE model. This process can be repeated as often as you like!

Good to know:

PRIME ETFs and no-fee savings plans, even if you only use the FREE BROKER.

Scalable Capital Offer Review: What You Get and When It Pays Off

Whether Scalable Capital is the right online broker for you largely depends on your trading habits and investment goals. While the platform offers a broad selection of assets and tools, there are a few important limitations to be aware of. Here’s what you need to know before you start investing.

Trading Platforms: Gettex vs Xetra

When you open a Scalable Capital brokerage account, you get access to two trading venues: Gettex and Xetra. Most users will find Gettex to be the more attractive option — not only because of the significantly lower fees, but also due to the extended trading hours from 8:00 a.m. to 10:00 p.m. on weekdays.

In contrast, Xetra comes with higher costs:

€3.99 in order fees plus a 0.01% trading venue fee (minimum €1.50), and trading is only available from 9:00 a.m. to 5:30 p.m. on weekdays.

It’s worth noting that you can place orders outside trading hours, but they’ll only be executed during the next available trading window. For most investors, Gettex serves as the default marketplace, while Xetra is more of a specialist option, useful in unique scenarios.

Attention!

For each order via Xetra, Scalable Capital charges trading venue fees of 0.01%, but at least 1.50 euros! These are independent of the selected subscription!

Investment Product Range: Solid, Not Overwhelming

So, what exactly can you trade on these platforms? Scalable Capital offers access to a wide variety of investment products, including:

- 7,500+ stocks

- 2,500+ ETFs

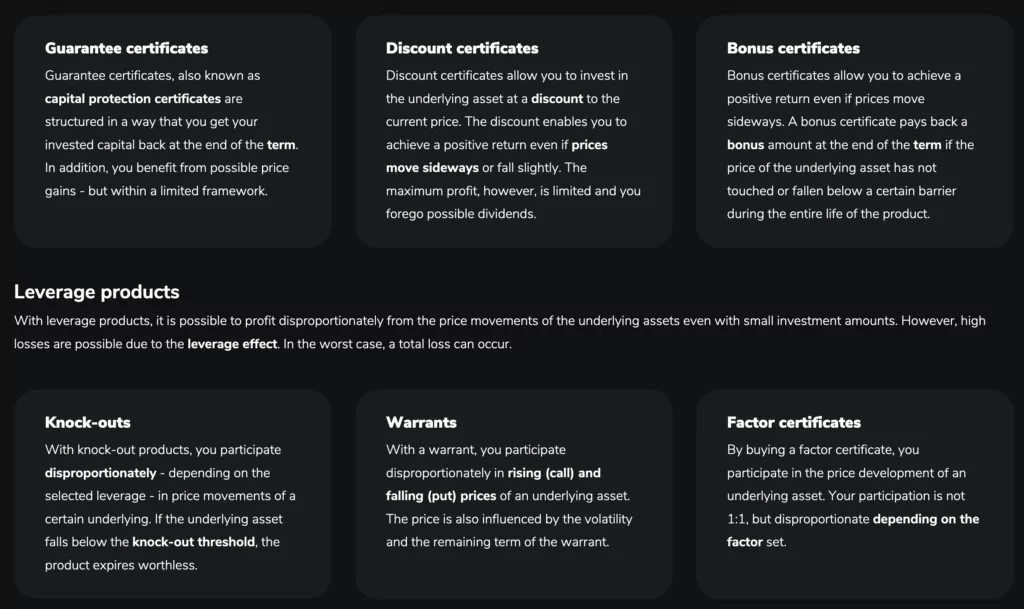

- 375,000+ derivatives

- Currency trading via ETPs

- Commodity ETPs

- 14 cryptocurrencies via ETP

- 3,000+ mutual funds

- One step-up bond (with more expected soon)

The selection of shares and ETFs forms the core of Scalable’s offering, and while it may not be the largest on the market, it’s more than sufficient for most long-term investors or those using ETF savings plans .

If you’re aiming for exotic assets or complex strategies, however, the range might feel limiting. In that case, premium brokers like CapTrader could be considered — though they come with higher fees.

That said, for everyday investing and building a diversified portfolio, Scalable’s range is practical and reliable.e figure. A wide range of certificates and warrants are available, enabling many different strategies. Active traders can achieve excellent results by combining derivatives with the low-priced trading flat rate!

When it comes to cryptocurrencies, commodities, and FOREX, Scalable takes a slightly different approach. Instead of trading these assets directly, you’ll invest via ETPs (Exchange Traded Products) — instruments that are structured similarly to ETFs but focus on a single underlying asset.

For example, when you invest in a Bitcoin ETP, you’re not actually buying Bitcoin itself. Rather, you’re purchasing a share of a fund that tracks Bitcoin’s price. That means you cannot transfer Bitcoin to your private wallet, as you don’t directly own the asset — just the ETP.

This setup may be seen as a drawback by crypto purists, but it offers several advantages. ETPs are regulated, making them safer and easier to handle for less experienced investors. Plus, by trading them through a regulated broker like Scalable Capital, you benefit from a high level of transparency and security.

For many users, this structure strikes the right balance between accessibility and control — especially if you’re looking for long-term exposure rather than short-term speculation.

How Safe Is Scalable Capital? Risks, Regulation & Reliability

When it comes to entrusting a company with your hard-earned money, safety is essential. Whether you’re buying shares, setting up ETF savings plans, or using the robo-advisor offered by Scalable Capital, you want to feel confident your investments are in reliable hands.

In terms of security, Scalable Capital is well positioned. The Munich-based company is regulated by BaFin (the German Federal Financial Supervisory Authority), a financial regulator with a solid international reputation despite past scandals like Wirecard. Choosing a broker based in Germany provides an added layer of investor protection, thanks to strict compliance standards and legal safeguards.

A further plus is that all securities are held in custody by Baader Bank. This setup ensures that, even in the event of bankruptcy—whether it’s Scalable Capital or Baader Bank—your investments remain protected and cannot be accessed by creditors. Additionally, your uninvested cash is insured up to €100,000, covered by the German Banks’ Compensation Scheme, which follows EU-wide regulatory norms.

Another signal of credibility is the backing from prominent investors. Scalable Capital is supported by major global players such as BlackRock, HV Capital, Tencent, and Tengelmann Ventures. Their involvement speaks volumes about the company’s financial health and long-term vision.

That said, Scalable Capital’s record isn’t spotless. In 2020, the platform suffered a data breach, affecting the personal data of at least 23,000 customers. Sensitive information was accessed, though thankfully, no passwords or financial assets were compromised, and no monetary losses occurred. The company responded with transparency and responsible communication, which helped limit the reputational damage.

Still, the incident remains a concern for some investors, particularly those with a strong focus on data privacy and digital security. It’s a reminder that, like all online platforms, even regulated brokers are exposed to cyber risks.

Overall, Scalable Capital stands out as a secure and regulated broker, backed by institutional trust and operating under robust legal frameworks. While past data issues should be acknowledged, the platform offers a high level of protection for both invested and uninvested funds, making it a solid option for long-term investors who value both convenience and oversight.

Understanding Taxes with Scalable Capital

One of the convenient advantages of using Scalable Capital is its tax-friendly structure for residents in Germany. Since the platform is a German-regulated broker, capital gains tax (Abgeltungssteuer) is automatically deducted and forwarded to the tax authorities.

For most investors, this means that your tax obligations are already taken care of — there’s no need to file a separate report with the Finanzamt for your capital gains.

If you want to reduce your tax burden further, you can easily submit a Freistellungsauftrag (exemption order) or a Nichtveranlagungsbescheinigung (non-assessment certificate) directly in your account settings. It only takes a few clicks and can help you stay within your tax-free allowance.

Need a tax certificate for your records or for filing your annual return anyway? No problem. Since your portfolio is held by Baader Bank, they’ll provide a clear and detailed tax certificate upon request — making tax season that much easier.

Scalable Capital makes tax handling seamless, especially for those who prefer a hands-off, automated investing experience.

Scalable’s practical experience: this is how you invest

1. Registration and verification

Your investment in Scalable Capital starts as soon as you sign up. Click on the banner to get additional

To get started with Scalable Capital, the first step is a quick and easy registration process. Simply enter your email address, and within seconds you’ll receive a confirmation email to activate your account.

Once confirmed, you’ll be prompted to choose a subscription plan. If you’re new to the platform, I recommend starting with the FREE BROKER — it’s ideal for beginners and requires no monthly fees. However, if you already know your strategy and want to unlock more features, one of the paid plans might be worth exploring from the start.

Next, enter your personal details, including your name, address, nationality, date of birth, and mobile phone number. You’ll also create a secure password for your account. One step that might seem unusual is the request for your bank account details. Don’t worry — this is only for your first deposit, which is processed via SEPA direct debit and can be set to any amount you choose.

This bank connection also serves as a way to verify your account. Later on, if you set up a savings plan for shares or ETFs, the monthly contributions will be automatically withdrawn from this linked account. It’s a hands-off setup that ensures your investments continue seamlessly.

To finalize your registration, you’ll need to verify your identity, as required by German financial regulations. This is usually done via a video identification process where you show your ID to the camera and follow a few simple steps. For me, this only took a few seconds — a smooth experience that added to my overall satisfaction with Scalable.

If you prefer not to use video verification, there’s also the option to complete the process via POSTIDENT. This involves visiting a post office with your ID document. It’s a bit more time-consuming, but a reliable alternative if Video-Ident isn’t convenient for you.

2. Deposit and invest

Once your Scalable Capital account is set up, it’s time to deposit funds and prepare for your first investment. If you’ve already made an initial deposit during registration for account verification, you can skip this step — or come back to it later when you’re ready to invest.

To add funds, simply go to the ‘Payments’ section in your Scalable Capital app or through the web platform. You’ll have two funding options:

- SEPA direct debit

- Manual bank transfer

While both are easy to use, I recommend making an active transfer — it’s typically quicker and gives you more control over the process. Keep in mind that it may still take up to two business days for your funds to become available.

Your personal IBAN is visible in your account dashboard. Once your bank transfer arrives, the funds are instantly credited to your securities account and ready for investing.

Buying your first stock, ETF, or setting up a savings plan is refreshingly straightforward. Simply type the name of the asset in the search bar — or use the ISIN for precision. When you find the right security, you’ll see a basic overview with key data and prices. However, this info is often limited.

For a more detailed view, click through to the product data sheet. I highly recommend reviewing it carefully before purchasing. It’s the only way to ensure you’re making an informed decision — especially if you’re new to investing or evaluating new assets.

Attention!

Scalable Capital provides only a little information about the individual shares and ETFs in its app. You should therefore always follow the external link and check the key data of the security to avoid confusion and bad buys!

To make your purchase, just click on ‘Buy’ — simple as that! If you’re interested in automating your investments, use the ‘Set up savings plan’ button instead. This feature allows you to invest regularly and effortlessly, helping you build long-term wealth with consistency.

Whether you’re using the Scalable Capital mobile platform or desktop version, the process is smooth, intuitive, and beginner-friendly — making it one of the highlights of the overall Scalable Capital user experience.

3. Sale and payment

Selling assets with Scalable Capital is just as intuitive as buying them. Simply select the asset from your portfolio, open it, and click ‘Sell’. Once the transaction is complete, the money is immediately available in your account and can be reinvested right away.

Of course, if you prefer to withdraw your funds, that’s easy too. Just head to the customer area in your Scalable Capital app or via browser — the same place where you made your deposit. With a few simple clicks, you can initiate a free withdrawal. The process is quick and seamless, though in some cases, it may take up to two business days for the money to reach your bank account.

Alternatively, you can choose to leave the funds in euro form within your securities account. This is especially smart during market downturns, when you’re waiting for a better entry point before reinvesting.

And here’s a real bonus: Scalable Capital does not charge negative interest on your uninvested cash — a rare and welcome feature that gives you the flexibility to pause and plan without penalties.

Whether you’re managing your portfolio through the Scalable Capital mobile platform or the web version, the process of selling and withdrawing is a testament to the platform’s user-friendly experience — making it ideal for both new and seasoned investors.

Scalable Capital Review Summary: Key Pros and Cons

My overall experience with Scalable Capital has been very positive — though it’s important to note that this depends on how you use the platform. I’ve worked extensively with both the FREE BROKER and the PRIME+ models, and each serves a different type of investor well.

They’re designed for distinct user needs, and both offer real value depending on your strategy. Here’s a breakdown of the key advantages and disadvantages I’ve found during my time on the platform.

Advantages

- No custody fees for your securities account, which is securely managed by Baader Bank, a German institution that also provides deposit protection up to €100,000.

- The Scalable Capital app is incredibly intuitive, yet packed with professional tools. Features like price alerts and time-based tracking make portfolio management smarter and more efficient.

- Deposits and withdrawals are fast, free, and user-friendly, especially with real-time SEPA transfers.

- Trading costs are impressively low under the PRIME+ model, making it ideal for frequent investors.

- The FREE BROKER option is great for those who invest occasionally or stick to ETF savings plans.

- Savings plans are commission-free, and you can start investing with just €1 per month — a feature that puts most competitors to shame.

- Scalable Capital is a regulated German company with a strong reputation and a solid infrastructure — something that offers real peace of mind.

- With PRIME+, crypto trading fees are reduced to just 0.69%, which makes the flat-rate model cost-effective for those trading digital assets.

Disadvantages

- The limited choice of trading venues can lead to less competitive pricing, especially for foreign stocks. A broader selection would be welcome.

- Trading via Xetra costs €3.90 + trading venue fees, which can feel steep if you’re not taking advantage of the flat rate.

- The PRIME+ flat rate only applies to trades over €250. For smaller orders, the €0.99 fee still applies, which reduces the benefit of unlimited trading.

- The fee structure is slightly more complex than with other online brokers. You’ll need to have a clear idea of your trading volume to determine if it’s cost-effective for you.

- Lastly, customer service is a mixed bag. My own experiences have been fine — not outstanding, but acceptable. Like many neobrokers, support isn’t their strongest point, so I’d rate it as neutral.

Scalable Capital offers a powerful combination of low fees, great tools, and strong regulation, making it a solid choice for both beginners and more active investors. Just be sure to choose the right pricing model for your strategy to make the most of its features.

Conclusion: a low-cost broker with its own niche

Scalable Capital has proven itself as one of the most forward-thinking brokers on the German market. Its transparent subscription model, powerful investment platform, and wide product offering make it a compelling choice for both beginners and experienced investors. Whether you’re interested in ETFs, stocks, or even crypto, the platform offers efficient, low-cost access to the markets.

The flat-rate pricing is particularly attractive if you place trades regularly or work with larger investment volumes. Even occasional traders can benefit from its simplicity and savings compared to traditional fee structures. Meanwhile, the FREE Broker model is ideal for long-term investors who focus on savings plans or a buy-and-hold approach.

Of course, it’s not without limitations—the restricted number of trading venues and the additional Xetra fees are worth noting. Also, keep in mind that for trade volumes under €250, the €0.99 per order still applies.

Still, as this scalable capital review shows, the advantages far outweigh the drawbacks. From the intuitive app to the huge product selection, Scalable Capital combines innovation with investor-friendly pricing. If you’re looking for a modern broker that grows with your financial journey, this could be the platform for you.

For more insight into the broker market, you should also take a look at my other reports on Freedom24 experiences , JustTrade experiences, Trade Republic experiences and of course my broker comparison.