Trade Republic alternatives 2026: Who can do more?

As one of the first neobrokers on the German market, Trade Republic has quickly become one of the most popular providers. However, Trade Republic is no longer the only choice when it comes to selecting the right neobroker. In recent years, exciting Trade Republic alternatives have established themselves.

In brief:

- For share and ETF trading, Trade Republic alternatives such as Finanzen.net zero offer a wider range of savings plans and higher savings rates.

- Consorsbank stands out from the competition as a Trade Republic alternative thanks to its flexible card options, sub-accounts and personalised support.

- Significantly higher interest rates than those offered by Trade Republic are available via P2P platforms such as Bondora Go & Grow or Monetfit SmartSaver.

- For genuine cryptocurrencies with more choice and often better terms, crypto exchanges such as Coinbase or Binance are often superior to neobrokers.

Trade Republic alternatives: the best brokers compared

When it comes to investing, Trade Republic is often the centre of attention. The provider currently serves 10 million customers in 18 countries and manages €150 billion. However, several Trade Republic alternatives have also established themselves as serious competitors, ironing out Trade Republic’s frequently cited weaknesses.

Trade Republic may be one of the most popular platforms for securities trading, but the provider is repeatedly shaken by negative headlines.

One of the biggest drawbacks that users repeatedly mention is the slow customer service response time. Customers looking for personal support are in the wrong place at Trade Republic – because it doesn’t exist. If you choose to contact them by email, you can expect long waiting times, which often causes frustration.

Another weakness of the neobroker is trading outages during periods of high demand. In April 2025, for example, Trump’s tariff increases led to a temporary surge in demand on the platform. However, the platform was not technically equipped to handle the rush, which meant that investors were unable to trade via the app for several hours.

These and other disadvantages mean that investors often look for better alternatives to Trade Republic. We have taken a closer look at the best ones for you.

Trade Republic alternative: Scalable Capital with greater flexibility

In addition to Trade Republic, the German neobroker Scalable Capital, founded in Munich in 2014, has developed into an attractive Trade Republic alternative for investors, already trusted by over 1 million customers.

The broker also allows you to invest in numerous asset classes such as shares, ETFs, funds, derivatives and crypto, as we have already shown in our Scalable Capital vs. Trade Republic comparison.

What makes Scalable Capital superior?

With Scalable Capital and Trade Republic, you can invest in thousands of share and ETF savings plans starting from as little as €1 per month. However, Scalable has the edge when it comes to maximum savings rates, and Scalable Capital also offers its customers the greatest flexibility in the execution of savings plans, which is another point in its favour.

Direct debit is possible with both providers, and the costs for executing savings plans are identical at €0 for both Trade Republic and Scalable Capital, making it all the more interesting to take a look at the spread.

Finding out the spread wasn’t such an easy task, but after some research, I found the details. The spreads at Trade Republic vary widely: in the best case, they can be lower than at Scalable Capital, but in the worst case, they can also be higher.

Overview: Trade Republic vs. Scalable Capital

| Trade Republic | Scalable Capital | |

|---|---|---|

| Minimum savings rate | 1 € | 1 € |

| Max. Savings rate | 5.000 € | 10.000 € |

| ETF savings plans | 2.700 | 2.700 |

| Share savings plans | 3.000 | 3.000 |

| Spreads | 0,10 % – 0,30 % | 0,16 % – 0,27 % |

Good to know:

The spread is the difference between the purchase price and the selling price of a security. The larger the spread, the more expensive the trade is for you.

What do we like less about Scalable Capital?

In terms of costs, both providers are neck and neck, which definitely points to positive market development. Just 10 years ago, free savings plans for shares and ETFs in the thousands would have been simply unthinkable.

Many investors were also concerned that Trade Republic might have hidden costs. Investors are now benefiting much more from increased competition and greater transparency.

However, in our opinion, Scalable Capital does have one disadvantage, and that is the significantly slower account opening process. With Trade Republic, this happens immediately after verification, whereas with Scalable it can take up to three banking days.

Overview: Trade Republic vs. Scalable Capital

| Trade Republic | Finanzen.net zero | |

|---|---|---|

| Minimum savings rate | 1 € | 1 € |

| Max. Savings rate | 5.000 € | unlimited |

| ETF savings plans | 2.700 | 2.500 |

| Share savings plans | 3.000 | 8.200 |

| Spreads | 0,10 % – 0,30 % | 0,18 % – 0,23 % |

In terms of costs, both providers are identical and allow both direct debit payments and free savings with share and ETF savings plans.

Trade Republic Alternative 1: Bondora Go & Grow with high liquidity

If 2% interest is not enough for you, you also have the option of higher-interest P2P lending with daily availability. The market leader in this area is Bondora Go & Grow. If you are willing to take a higher risk, you can earn a whopping 6% interest per year here.

The advantage of Bondora is that you invest in a pool of loans and can withdraw your money just as quickly as you invested it. Thanks to the provider’s high liquidity reserves, your money is usually back in your account within a few seconds. For me, this is the biggest advantage of this interesting Trade Republic alternative.

Another advantage for me is the daily crediting of interest, which gives me a certain sense of security. In total, I have already invested over €9,000, of which €2,300 is interest.

Trade Republic Alternative 2: Monetfit SmartSaver with automatic payout

With 1.4 million users in Europe, Monetfit SmartSaver is now Bondora’s biggest competitor and one of the other Trade Republic alternatives that may be of interest to you as an investor.

With just one click, you can invest in loans from the Creditstar Group, which operates in eight European markets, including Sweden, Finland, Estonia and the United Kingdom.

Monetfit SmartSaver offers investors an attractive 7.5% interest rate, which, as with its competitor Bondora, is paid out daily. You can withdraw up to €1,000 per month immediately, with anything above that taking up to 10 working days. However, if you only want to receive your interest, you can have it paid out automatically into your current account.

I currently have around €15,000 invested with Monetfit, which brings me just over €100 per month.

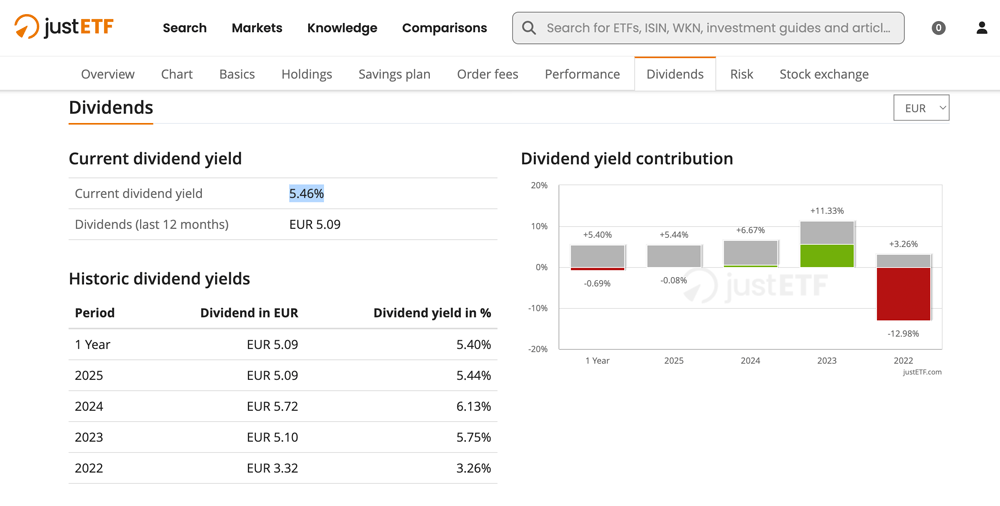

Trade Republic Alternative 3: EU high-yield corporate bonds with good interest rates

A slightly riskier but also more profitable alternative to Raisin is EU high-yield corporate bonds. High-yield EU corporate bonds, i.e. those below investment grade, currently offer a return of 5.2%, which corresponds to an effective interest rate of 4.8% after costs.

Interest is paid out every six months and, if you wish, you can sell the product back on a daily basis.

Trade Republic alternatives: The best alternatives for crypto trading

Last but not least, let’s take a look at the best Trade Republic alternatives for crypto trading. First things first: there are huge differences between the respective providers.

We took a look at the most popular providers and made the most important comparisons. Let’s start with the range and costs for the various coins.

Offer and costs

If you want to invest in cryptocurrencies with Trade Republic, you can do so in a total of 50 coins. With Scalable Capital, on the other hand, there are only 32 coins. It is important to note that with Scalable, you are not investing in real cryptocurrencies, but in ETPs, which probably makes the provider unattractive to many crypto investors.

Good to know:

ETPs (=Exchange Traded Products) are exchange-traded investment products that are based 1:1 on an underlying asset. Investors do not receive actual coins, but only exchange-traded securities.

When comparing Finanzen.net zero vs. Trade Republic, the former broker offers the largest selection with 59 coins. However, compared to the world’s largest crypto exchanges, Coinbase and Binance, this number is also marginal. At Coinbase, you can invest in a total of 275 tradable cryptocurrencies, and at Binance, in as many as 500.

There are also significant differences in the spread and execution costs, as illustrated in the table below.

Usual spread (also for savings plans) and execution costs for the selected crypto providers

| Providers | Spread | Implementation costs |

| Trade Republic | 0.8% (BTC) – 2% (Alt) | 1 € |

| Scalable Capital | 0,1 % – 0,2 % (ETP) | 0,99 % + 0,99 € |

| Finanzen.net zero | 0,3 % | 1 % |

| Coinbase | 0,1 % – 0,5 % | 0,49 % |

| Binance | 0,1 % | 0,1 % + 1 € (SEPA) |

The total costs for a €1,000 purchase at Trade Republic are €9 for Bitcoin and €21 for altcoins, which is the most expensive in our comparison. Scalable charges €12-13, which is quite a lot considering that these are only ETPs. Finanzen.net zero, on the other hand, offers real coins at the same price. At Coinbase, the cost is €7.30, which Binance can undercut once again with a strong €3.10.

Another very important aspect is the delivery of the coins, because as they say: ‘Not your keys, not your coins’. Delivery is possible with Trade Republic, but not with Scalable due to the ‘unreal’ coins, and also not with Finanzen.net zero. For me, this is a real disadvantage. Coinbase and Binance offer their investors this option.

Savings plans with brokers

Whether you want an ETF savings plan or a one-off investment, you can do both with Trade Republic and all Trade Republic alternatives. As with the costs, the savings rate varies greatly, as you can see in the table.

| providers | Savings rate |

| Trade Republic | 1 € – 10.000 € |

| Scalable Capital | 1 € – 5.000€ |

| Finanzen.net zero | 1 € – unlimited |

| Coinbase | €5 – €25,000 per day |

| Binance | 10 € – unlimited |

In terms of execution, Binance once again offers maximum flexibility and allows customers to execute their savings plans on a daily or hourly basis. German brokers allow their users to set up savings plans via direct debit, which is not possible with Coinbase and Binance. The savings plan costs are €0 for all providers.

Conclusion: These are the best Trade Republic alternatives in 2026

There are now numerous Trade Republic alternatives, all of which may be more or less relevant to you depending on your interests. When it comes to choosing the best broker, Finanzen.net zero stands out with a wide selection of share savings plans and maximum freedom in terms of investment amounts.

Consorsbank could be an exciting alternative to Trade Republic, particularly due to its strong customer support – a clear weakness of Trade Republic. Those who want the best interest rates must be prepared to take on a higher level of risk.

If you agree to this as an investor, Bondora Go & Grow and Monetfit SmartSaver offer interest rates of 6% and 7.5% respectively. If you are looking for the best Trade Republic alternatives for 2026, it is definitely worth taking a moment to compare them. If you are interested in this topic, click on my current P2P lending ranking with the 10 best P2P platforms.