Trade Republic disadvantages – is this broker worth it?

Since its inception, Trade Republic has quickly become a popular online broker, attracting mainly young and price-conscious investors. With its user-friendly app and innovative technology, the broker offers low fees and access to popular financial products, from stocks and ETFs to derivatives and cryptocurrencies. However, there are some Trade Republic disadvantages.

Although the broker is praised for its low-cost services and ease of use, there are aspects that you, as an investor, should be aware of. From technical difficulties and limited customer service to legal challenges and restricted trading options, you will learn everything you need to know.

In brief:

- Low order fees, but higher spreads due to limited trading venues

- Current lawsuits regarding misleading advertising and lack of transparency

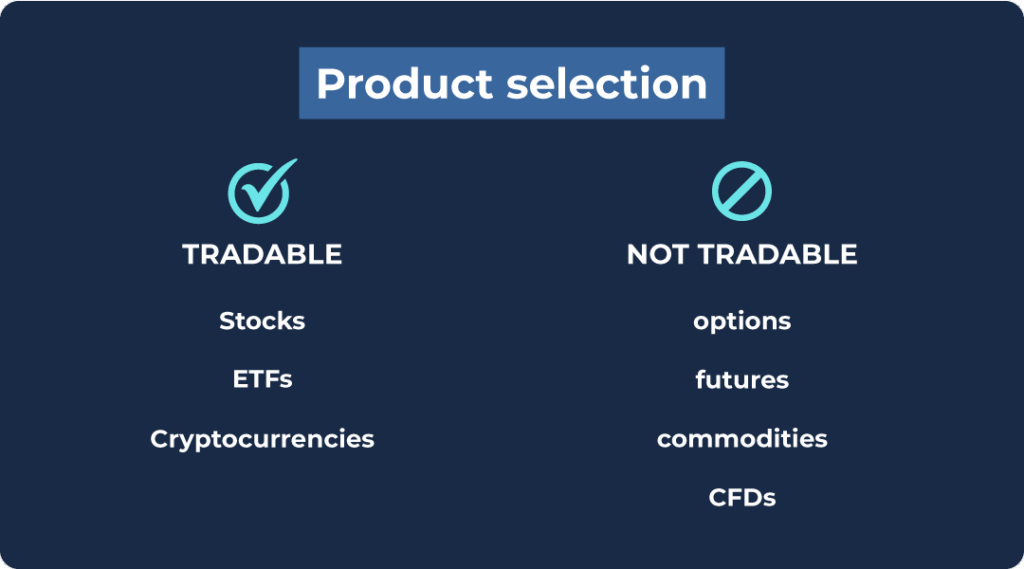

- Limited product selection: no options, futures or CFDs tradable

- Customers report problems with customer service and technical issues.

Current legal disputes

Trade Republic, once celebrated as an innovation driver in the German financial market, is increasingly coming under fire. In addition, the neo-broker is currently facing lawsuits on several counts. Many investors are therefore considering a comparison between Trade Republic and Scalable Capital or Trade Republic in order to make an informed decision.

Lawsuits for misleading advertising

Trade Republic is facing several lawsuits that look at key aspects of its business practices, especially how it advertises its financial products.

One critical issue was the advertising of current accounts promising high interest rates without adequately highlighting the variability of these rates or the associated risks.

Such practices were deemed misleading by consumer protection organisations and led to legal disputes.

This information can usually be found in publicly available court documents and press releases from consumer protection associations, which report on these cases on their websites and in their newsletters.

Impact on customer confidence

These legal problems can seriously undermine customer confidence. In the financial sector, transparency is one of the most important factors in building long-term customer loyalty.

As soon as investors get the impression that a broker is not communicating fully or is even spreading misleading information, uncertainties arise that can lead to investors leaving.

What makes this particularly problematic is that financial investments are not just about numbers, but also about emotional security. Many people trust their brokers to act in their best interests and protect them from potential risks.

However, if it turns out that important details have been concealed or inadequately communicated, such as interest rates or fee structures, this can have negative consequences for the broker’s reputation.

Previously limited accessibility and quality of support

Although Trade Republic is known for its innovation and low fees, customer service has often been perceived as a weak point.

Customer support was primarily available via email, which is insufficient in today’s fast-paced trading world. In urgent cases where quick decisions are required, this limitation can lead to significant delays and associated frustration.

Many modern online brokers already offer solutions such as live chats or even 24/7 hotlines to guarantee their users immediate support.

However, Trade Republic has since responded to user feedback and significantly improved the availability and quality of its support. Chat support is now available to you as a user.

Technical problems with the neo-broker Trade Republic

Technical stability is essential for an online broker, because even the best trading conditions and lowest fees are of little use if the platform does not work when it matters most.

Users have reported technical issues in the past that have affected the trading experience. These issues range from app crashes and disconnections to extremely slow loading times and faulty order execution.

In volatile market phases, this can have fatal consequences, as users are unable to place their trades in time or manage their positions.

What is particularly problematic is that these disruptions did not occur only sporadically, but were reported frequently during times of crisis or high trading activity. Online forums and review sites such as Trustpilot and Reddit contain numerous reports from users who were unable to access their accounts during important market movements.

In such moments, platform failure can mean that investors suffer losses that they could have avoided by adjusting their strategy in good time.

However, these reports are becoming increasingly rare. This shows that the neo-broker is responding to this issue and has improved the reliability of its infrastructure.

The desktop version was also a long time coming, but it is now available. While many brokers offer both an app and a web platform, Trade Republic has long relied on its mobile app.

Good to know:

Trade Republic is a good starting point for beginners and passive savings plans. However, the neo-broker quickly reaches its limits when things get more demanding.

Further disadvantages of Trade Republic: Platform limitations

An online broker must not only offer low fees and a simple user interface, but also a comprehensive trading infrastructure to meet the needs of all investors. Unfortunately, this provider reaches its limits here.

No direct access to trading venues such as gettex and Xetra

As a Trade Republic user, you have another disadvantage: no direct access to important stock exchanges such as gettex and Xetra. This means that you cannot execute your securities orders via these established trading platforms, but only via Trade Republic’s partner Lang & Schwarz.

This may be problematic for you as an investor, as gettex and Xetra are known for their high liquidity, tight spreads and a wide range of tradable securities.

If you could trade on a platform such as gettex or Xetra, you might get better prices and a wider selection of financial products.

The lack of this access limits your trading opportunities, especially if you want to use special order types or benefit from a wide range of market offerings.

No transfer of cryptocurrencies to other wallets

If you purchase cryptocurrencies via Trade Republic, you should be aware that you cannot transfer them to an external wallet. Many crypto investors place great importance on managing their digital assets in their own wallets to ensure maximum security and control.

With Trade Republic, however, you are forced to keep your cryptocurrencies within the platform. This is a clear disadvantage.

This means that you do not have full control over your coins and cannot use them for decentralised financial applications or other blockchain projects outside of the broker, for example.

This restriction makes the platform less attractive to many crypto enthusiasts. While other brokers and crypto exchanges now allow transfers to external wallets, Trade Republic falls short of expectations in this regard.

Would you like to learn more about cryptocurrencies? Then you will definitely find the article on crypto ETFs interesting.

Restricted day trading and scalping options

If you are an active day trader or pursue scalping strategies, Trade Republic does not offer you the ideal environment. The platform has several limitations that make it difficult for day traders and scalpers to trade efficiently. These include:

- Delayed order execution: Users repeatedly report slight delays in order processing, which is particularly problematic when the market is moving quickly.

- No advanced order types: While other brokers offer numerous order types such as stop-limit orders or trailing stops, the options at Trade Republic are very limited.

- Technical limitations: During periods of high volatility, users report connection interruptions and limited responsiveness of the app. This can have significant financial disadvantages, especially for scalpers who depend on millisecond-fast reactions.

For long-term investors who only trade occasionally, these restrictions are unlikely to be significant. However, for active traders who buy and sell frequently, fast and reliable order execution is essential.

Do you see yourself as a long-term buy-and-hold investor who may only invest passively through a savings plan? Then you should definitely familiarise yourself with the topic of rebalancing.

No demo account: An expensive disadvantage for beginners

If you are new to trading, you will probably want to test how the market works and which strategies are best suited to you. Many brokers offer this risk-free opportunity to simulate real trading without putting real money at risk.

However, Trade Republic does not offer a demo account. This means that you are forced to invest with real money right away, without first gaining experience or trying out trading strategies.

This can quickly become a disadvantage and expensive, especially for beginners. Without practice or a basic understanding of market mechanisms, you are likely to make mistakes and lose money unnecessarily.

If you don’t have any trading experience, you should think carefully about whether a platform without a demo account is the right choice for you, or whether it makes more sense to start with a broker that offers a risk-free trial.

Limited product selection: These trading opportunities are not available on Trade Republic

The selection of tradable financial products is one of the most important factors when choosing a broker. A wide range of asset classes allows you to optimally diversify your portfolio, minimise risks and benefit from different market movements.

Unfortunately, there is another disadvantage here. However, this can be offset with a European ETF or real estate ETF, for example, if index funds are sufficient for your diversification needs.

While established providers offer a wide range of financial instruments, Trade Republic largely limits itself to stocks, ETFs and cryptocurrencies.

This means that you cannot trade many asset classes that can play an important role in a diversified portfolio.

This can be a significant disadvantage of Trade Republic, especially for experienced investors who want to invest in financial instruments beyond stocks and ETFs.

No options trading: No hedging and speculation opportunities

A major disadvantage for active traders is the lack of options at Trade Republic. Options are essential for many investors, as they can be used as hedging instruments against market movements and allow speculation on price changes using leverage.

Professional traders often use options to hedge their portfolios against price losses or to specifically bet on rising or falling markets.

Since Trade Republic does not offer options trading, you are missing out on one of the most important strategies for risk minimisation and speculation. Many competing providers offer options on a wide range of underlying assets, such as stocks, indices or commodities.

So if you want to use advanced trading strategies, the lack of this feature could be a valid reason to choose another broker.

No futures: Lack of opportunities for professional traders

Futures are among the most important trading instruments for advanced investors. They allow you to speculate on future price movements of commodities or currencies, for example.

Many institutional and professional traders use futures to hedge against market fluctuations or to profit from the smallest price movements using leverage.

As Trade Republic does not offer futures, you do not have the option of using these advanced strategies.

No trading in commodities: Lack of diversification with gold, oil or silver

Commodities such as gold, silver and oil are popular asset classes because they often serve as a hedge against inflation or as a crisis currency. Many investors specifically target commodity markets to diversify their portfolios and maintain stable investments in uncertain times.

Unfortunately, Trade Republic does not offer direct trading in commodities. While you can buy gold or silver from other brokers, for example, with this neo-broker you are limited to stocks and ETFs. Nevertheless, fans of dividend ETFs will get their money’s worth with Trade Republic.

This represents a major limitation for investors who want to diversify broadly or speculate specifically on commodity prices. The absence of this asset class can be problematic, particularly in times of economic uncertainty, when commodities are often a safe haven.

No CFDs: No leveraged products for speculative investors

CFDs (Contracts for Difference) are a popular financial instrument for traders who want to leverage short-term market movements. They allow you to speculate on both rising and falling prices without directly owning the underlying asset.

Many brokers offer a wide range of CFDs on stocks, indices, commodities and cryptocurrencies.

This can be a significant disadvantage for speculative investors who focus on short-term market movements and want to take advantage of high return opportunities through leveraged positions.

Good to know:

Due to the disadvantages mentioned above, Trade Republic is less suitable for advanced strategies.

Higher spreads at Trade Republic: Why you pay more than you think

When choosing a broker, fees play a key role. Many investors pay attention to obvious costs such as order fees or custody fees, but one factor that is often overlooked is spreads.

Trade Republic’s fee structure: cheap or expensive?

Officially, Trade Republic does not charge traditional order fees. Instead, there is only a flat fee of €1 per trade to cover external costs. This sounds attractive at first compared to many traditional brokers.

However, the real Trade Republic costs lie elsewhere: orders are executed exclusively via the trading partner Lang & Schwarz, which means that you do not have the option of executing your trades via other stock exchanges.

Higher spreads due to restricted trading venues

A spread is the difference between the buy and sell price of a security. The narrower the spread, the better for you as an investor, because you buy and sell at almost identical prices. However, when spreads are wide, you pay more to buy and get less when you sell, which can reduce your return.

Since Trade Republic processes its orders exclusively through Lang & Schwarz, you do not have direct access to trading venues such as Xetra or gettex, where tighter spreads are often offered.

This means that for every transaction, you may receive worse prices than investors who use brokers with access to multiple trading venues. This can have a particularly negative impact in volatile markets or with stocks that are rarely traded.

Why higher spreads affect your returns

Higher spreads ultimately mean higher hidden costs for you. Let’s say you buy a stock with a spread of 0.3% instead of 0.1%. That may not seem like much at first glance, but over time, those additional costs add up significantly.

These differences can have a significant impact on returns over months or years, especially for day traders or investors who buy and sell frequently.

Imagine you regularly buy and sell stocks worth €10,000. With a spread of 0.3%, you effectively pay €30 per trade, whereas with a spread of 0.1%, you would only pay €10.

If you make 50 trades a year, you pay €1,500 in spread costs with Trade Republic, compared to just €500 with a broker offering lower spreads.

This shows that a broker with wide spreads can be much more expensive in the long run, even if the order fees appear low at first glance. This is a significant disadvantage for your long-term returns.

However, you can optimise the spread by trading during Trade Republic’s trading hours. If you invest via a savings plan or only open new positions occasionally, the spread is negligible. This may only be slightly unfavourable for very active traders who trade several times a week.

Good to know:

Take spreads into account in your cost calculation to know the actual trading costs.

Conclusion: Is Trade Republic the right choice for you?

Trade Republic offers low fees, an intuitive app and an easy way to invest in ETFs and stocks. The broker is an attractive choice, especially for beginners, long-term investors and users of savings plans. Conclusion: Is Trade Republic the right choice for you?

Customer service and IT infrastructure have now been significantly improved, meaning that technical problems are now rare.

Although trading via Lang & Schwarz may result in slightly higher spreads, this is of minor importance for long-term investors who invest during trading hours.

Trade Republic may be less suitable for very active traders or investors who want to implement complex strategies involving options, futures or commodities.

However, if you are investing for the long term, regularly use savings plans or want to trade shares simply and cheaply, you will find a solid and reliable platform here.