Trade Republic trading hours: When is the best time to trade?

The time at which you buy or sell a stock can have a big impact on the price you actually pay. Imagine you want to buy a stock, but when you make your move, you suddenly pay more than you expected. Or you sell and get less than you planned. Why does this happen? It’s simple: trading hours affect the prices you get.

In this article, you will learn everything you need to know about Trade Republic’s trading hours. You will learn about the advantages and disadvantages of certain times and how to strategically place your trades to get the best prices. We will also highlight the risks outside of peak hours and explain why certain markets behave differently than others.

In brief:

- The best Trade Republic trading hours are during Xetra hours (9:00 a.m. – 5:30 p.m.).

- Stocks & ETFs: Monday to Friday, 7:30 a.m. to 11:00 p.m.

- Derivatives: Monday to Friday, 8:00 a.m. to 10:00 p.m.

- Cryptocurrencies: 24/7 – around the clock

- Spreads are often wider outside core hours

- No trading on public holidays and weekends (except crypto)

The importance of trading hours for successful trades

Knowing trading hours is essential for every investor in order to make optimal trading decisions. Not only local market hours, but also global market hours play an important role, as they have a direct influence on price structures and market liquidity.

Reduction of high spreads

Spreads (the difference between the buy and sell price of a security) are a significant cost factor in investing. During peak trading hours, when most trading activity takes place, spreads are typically tighter.

This is because the increased number of market participants and high trading volume create greater liquidity, which in turn leads to a reduction in spreads. Tighter spreads mean that you spend less money buying and selling securities, potentially increasing your profit margins.

An example of how trading hours affect spreads is the forex market, which is open practically around the clock. Currency pairs involving the euro or the US dollar often have the tightest spreads during European and North American business hours.

Market activity is at its highest during these phases, which leads to a reduction in cost differences. Investors who take advantage of these periods can significantly reduce their trading costs, which is particularly important for frequent traders.

You can also reduce your investment costs by familiarising yourself with the tips and tricks on Trade Republic taxes and setting up a Trade Republic exemption order today.

Influence of global markets on the best Trade Republic trading hours

The trading hours of German stock exchanges cannot be viewed in isolation, as financial markets are globally interconnected. The opening hours of markets in the US and Asia also have a major impact on liquidity and volatility on German stock exchanges.

This is particularly relevant for companies and securities that are heavily involved in international markets or for those whose business results are closely linked to global economic developments.

During the overlap between the American and European markets, for example, trading activity often increases significantly, which can lead to increased volatility but also to better trading opportunities.

Good to know:

These phases can be particularly attractive for day traders, as rapid price movements can be exploited.

Asian markets also have a significant impact on European trading hours, as political or economic news from Asia can influence opening prices in Europe.

A good understanding of how the trading hours of different global markets interact allows traders to adapt their strategies and potentially profit from the resulting price movements.

However, this requires continuous monitoring of market dynamics and global economic news in order to be able to react quickly and effectively.

When and where can you trade with Trade Republic?

Once you have opened a Trade Republic account, you can start trading stocks, ETFs, derivatives and cryptocurrencies. Different trading hours apply depending on the asset, as Trade Republic is connected to various stock exchanges and trading platforms.

In order to choose the optimal time to buy or sell a security, it is important to know the exact trading hours.

Trading hours for stocks and ETFs

Trading in stocks and the best ETFs is possible at Trade Republic daily from 7:30 a.m. to 11:00 p.m. However, this does not mean that all securities can be bought or sold at the best conditions at all times. The actual liquidity and the size of the spreads depend heavily on the trading venues.

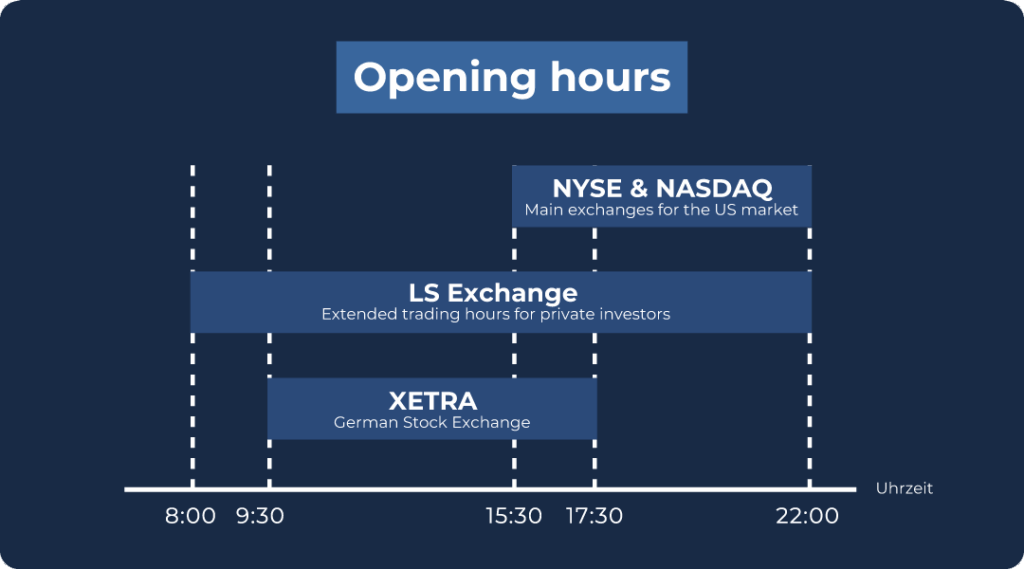

Trade Republic uses the LS Exchange (Lang & Schwarz Exchange) as its primary trading venue for stocks and ETFs. Although this allows for extended trading hours, the market still follows the regular trading hours of the major trading venues:

During Xetra trading hours, spreads are narrowest and liquidity is highest. Anyone trading outside these hours must expect higher costs, as fewer market participants are active.

Trading hours for derivatives

Derivatives can be traded on Trade Republic between 8:00 a.m. and 10:00 p.m. Here too, orders are processed via the LS Exchange trading venue, with liquidity depending heavily on the underlying assets.

Since derivatives are often used for hedging or speculation, you should make sure to trade them during the peak trading hours of the respective underlying assets. Otherwise, you may experience wider spreads and price fluctuations.

Trading hours for cryptocurrencies

Crypto trading on Trade Republic is available around the clock, regardless of stock exchange opening hours or public holidays. This differs fundamentally from stock trading, as cryptocurrencies are not tied to a central exchange.

However, liquidity is not always at the same level. Price movements are often more pronounced during US trading hours, as many institutional investors are active at this time.

The optimal Trade Republic trading hours

The optimal Trade Republic trading hours offer different phases throughout the day, each with specific characteristics and trading dynamics. These are particularly relevant for investors who want to optimise their trading strategies in terms of timing.

- Start of trading (opening phase): Stock exchanges in Germany and other European countries usually start trading between 9:00 and 9:30 a.m. Trading also begins during this phase on US stock exchanges such as the New York Stock Exchange (NYSE) and NASDAQ, although due to the time difference, this is not until around 3:30 to 4:00 p.m. German time. This first phase of the trading day is characterised by high liquidity and numerous transactions, which can also lead to increased volatility. The large price fluctuations offer experienced traders good entry opportunities, but may be less suitable for risk-averse investors.

- Lunchtime (lunch break): Between approximately 12:00 and 14:00 German time, the market tends to experience lower liquidity. During this period, spreads often widen slightly, which means that the difference between the buy and sell prices increases. This period is less suitable for placing large orders, as market depth decreases and larger orders can therefore have a greater impact on the market. However, for smaller positions or long-term investments, this can be a good time to take advantage of favourable entry points.

- Afternoon (US market opening): The opening of the US stock exchanges at around 3:30 p.m. German time marks another important phase. Due to the overlap in trading hours in Europe and the US, liquidity on the financial market reaches its daily peak. This constellation is particularly advantageous for trading US stocks and international ETFs, as the increased liquidity leads to more efficient price discovery and lower spreads.

- Closing time (closing auctions): The closing phases of stock exchange trading in Germany take place between approximately 5:00 p.m. and 5:30 p.m., while the US stock exchanges close between 9:30 p.m. and 10:00 p.m. German time. In these last few minutes of trading, trading activity often increases significantly, which can lead to stronger price movements. This time is particularly interesting for traders who focus on short-term price movements. However, caution is advised here, as volatility can also lead to unexpected price shifts that increase risk.

These different phases of the trading day each offer specific opportunities and risks that traders can exploit depending on their risk appetite and trading strategy. It is important for investors to understand the characteristics of each phase in order to plan their trades accordingly and pursue their investment goals effectively.

| Phase | Period DE/EU | Period US | Liquidity | Transaction volume | Volatility | Suitable for |

| Start of trading (opening phase) | approx. 9:00 – 9:30 a.m. | approx. 3:30 p.m. – 4:00 p.m. | High | Very high | Increased | Experienced traders |

| lunchtime (lunch break) | approx. 12:00 p.m. – 2:00 p.m. | – | Low | Medium | Low | Long-term investments |

| Afternoon (US market opening) | approx. 3:30 p.m. – 4:00 p.m. | approx. 3:30 p.m. – 4:00 p.m. | Very high | Very high | Normal | Trade US stocks and international ETFs |

| Closing time (closing auctions) | approx. 5:00 p.m. – 5:30 p.m. | approx. 9:30 p.m. – 10:00 p.m. | High | Very high | Increased | Short-term trading strategies |

Don’t have a securities account yet, but want to start investing? Then find out more about Trade Republic’s services now and benefit from the attractive Trade Republic bonus for new customers.

When does the stock market close at Trade Republic?

Unlike cryptocurrencies, stocks, ETFs and derivatives are bound by fixed trading hours, which are limited by both weekends and public holidays. These restrictions arise because most international stock exchanges, such as the New York Stock Exchange, the London Stock Exchange and the Frankfurt Stock Exchange, do not operate on weekends.

This means that although investors can place orders at any time, they are only processed and executed by the exchanges on the next working day.

Why is there no stock trading on weekends?

The question of why there is no stock trading on weekends can be explained by historical developments and market needs. Stock exchanges follow a fixed schedule that allows traders and institutional investors to prepare for and analyse trading.

In addition, the weekend break allows for a respite during which information and events can be digested, leading to well-informed investment decisions during trading hours.

Some investors strategically use the closed market hours on weekends by placing orders in advance, hoping that these will be executed at the start of the new trading week.

However, this strategy carries risks, such as price gaps. These gaps are sudden price jumps that can occur between the close of trading on Friday and the reopening on Monday, especially if important news or events occur over the weekend.

Trade restrictions on public holidays

Trading restrictions during holidays vary depending on the country and stock exchange, but are typically observed on public holidays. In Germany and the United States, for example, two of the world’s largest financial markets, holidays often lead to a complete halt in trading. Holidays on which no trading activities are possible at Trade Republic include:

- New Year’s Day (1 January)

- Easter Friday & Easter Monday

- Labour Day (1 May)

- Christmas (24th, 25th and 26th December)

- New Year’s Eve (31 December)

No orders will be processed on these days, and any orders placed after the close of trading on the previous day will remain untouched until the next trading day.

Optimisation of trading strategies

To get the most out of trading opportunities on Trade Republic or other exchanges, investors should take advantage of peak trading hours. It is not without reason that many investors ask themselves: When does the stock market open on Trade Republic? These times usually offer tighter spreads and higher liquidity.

Furthermore, it is recommended to avoid placing market orders outside core trading hours, as this may result in unfavourable price execution, especially during periods of low liquidity.

Insert a chart here that visualises the volatility of a stock over the course of a day.

Beware of market risks

It is important that investors are aware of the risks associated with placing orders outside regular trading hours. In particular, the risk of price gaps can be significant when orders are placed over the weekend or before public holidays.

You should therefore consider whether it makes sense to maintain a certain degree of control over the execution prices by using limit orders or other strategies in order to avoid unwanted surprises.

To get the most out of trading hours at Trade Republic, you should keep the following points in mind:

- Take advantage of peak trading hours to benefit from tight spreads and high liquidity.

- Avoid placing market orders outside core hours, as this can lead to poor price execution.

Conclusion: Are you investing during the best Trade Republic trading hours?

Trading hours have a decisive influence on your returns when investing. To get the best prices and optimise your profits, you should ideally invest during the opening and shortly before the close of trading, as this is when liquidity is highest and spreads are narrowest.

In addition, it is advisable to take into account the trading hours of international markets such as the USA or Asia in order to benefit from price movements and higher liquidity.

If possible, avoid trading outside these core hours, as higher spreads and price risks may occur.

Overall, it is worthwhile for investors to plan their trading times strategically and monitor the market regularly in order to effectively take advantage of the optimal entry and exit points and invest more successfully in the long term.

If you would like to learn more about attractive neobrokers, be sure to read the article on Scalable Capital vs Traderepublic.