Recalculated – this is how much you lose with CFD trading

Various financial instruments are repeatedly advertised in full-bodied terms. Usually by people who claim to have made incredible profits with them – but who can rarely substantiate these claims. CFD trading is a prime example.

This is reason enough for us to take a closer look at this story and check what figures are left at the end of such a transaction. And particularly important: whether there is a plus or a minus in front of it.

If you want to know more about other forms of investment, have questions or are simply looking for a good investment, it’s worth visiting our forum for personal loans. Because there you can exchange ideas with other investors and certainly learn something new.

This is what CFD trading is all about

CFD stands for ‘contract for difference’. Put simply, these are bets on the price development of a share, commodity, currency… pretty much anything that has a variable price. If the respective value changes as you predicted in your bet, you can win large sums of money. On the other hand, if it goes wrong, your entire stake is gone.

You do not buy the share, currency, etc. yourself, but simply conclude a contract with a broker. As you are only betting on the price performance and no securities change hands, these transactions do not take place on the exchanges themselves, but are traded ‘over the counter’ (otc).

Numerous, often very dubious figures advertise this form of investment on the internet and sometimes even in private. However, this bad reputation alone does not necessarily mean anything – other forms of investment, such as cryptocurrencies, are also notorious in many places and still offer good returns for courageous investors. So there is nothing left to do but compare CFD trading in scientifically accurate figures.

This is what it really looks like

Prominently placed internet adverts tell us that around 75% of small investors who try their luck with CFDs lose their money. As if that wasn’t enough of a deterrent, the French financial regulator AMF even found in a study that 89% of the investors involved actually walk away from these transactions with losses.

The size of these amounts should also give pause for thought: the average investor (more than 14,000 were analysed in the study) lost just over €10,000 through CFDs. A look at the distribution chart shows a very small group making high profits, followed by even fewer investors making minimal profits. We then see large numbers of investors who lose huge sums, right up to the particularly unfortunate group on the left.

These losses for the majority of investors, often totalling EUR 20,000 or more, should actually deter investors quickly – or so one would think. Nevertheless, CFDs continue to be diligently advertised and new interested parties are constantly being lured into the trap.

Who does that to themselves?

In view of such figures, one could argue that it takes a lot of experience and constant learning to become successful with CFDs. However, another chart from the AMF impressively disproves this assumption: as the number of trades executed increases, profits do not increase; only more and more losses are generated.

The losses are already over 10,000 euros with the first completed transaction. This increases with every further milestone. With one hundred completed trades, not only have 30 % of investors already exited the market;

They also lost an average of € 15,000. After a thousand trades, only 23% of the original investors have stuck with it, the rest have already left. No wonder: on average, €31,000 had already been lost at this point.

The situation is no less tragic for the real veterans with more than 5,000 completed transactions: €75,000 has already been lost here.

It is therefore no wonder that only 4 % of all investors who start with CFDs make it this far. The assertion that profits will be realised as soon as you have enough experience can therefore clearly be classified as false.

Significantly better alternatives

CFDs are therefore a money pit for almost every investor and are only suitable for the absolute masochists among private investors. This is reinforced by the fact that numerous new, interesting financial products have been added to the already extensive selection in recent years. There is therefore no need to resort to such dubious gambles.

Modern investment methods include P2P loans, where investors make their own money available to facilitate (usually short-term) loans at high interest rates. A large proportion of the return collected in this way goes to the investor, enabling lucrative gains to be made with a reasonably manageable level of risk.

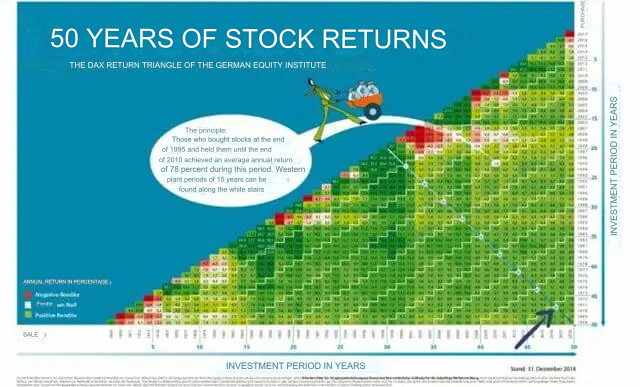

But traditional forms such as shares are also a good option. Those who invest here for the long term are very likely to earn a positive return of usually 6 to 9 per cent. ETFs, which can track shares (and many other investments), are also a quick way to get your money’s worth.

Our recommendation

In view of the bare figures, CFDs are clearly not recommended. Many other, more sensible financial products are waiting to be saved instead. If you are afraid of taking too much risk but still don’t want to miss out on an attractive return, P2P loans are recommended. We have extensively investigated one of the most important providers, Bondora, and its ‘Go and Grow’ programme – an ideal introduction to the topic!

If you think that starting with Bondora is worthwhile for you, you should click on this link. Not only will it take you to the right registration page – you’ll even receive a €5 starter bonus!

Mintos is another provider that we can confidently recommend. Other investors see it the same way – the company is the market leader in the P2P sector.

If you are more of a long-term investor, ETFs are a good way to invest your savings wisely. TradeRepublic is one of the most popular brokers today – and no wonder: the offer is completely free. In addition to ETF savings plans, there are even shares and more available.