Freedom24 is shaking up the German brokerage market with its focus on choice and customer service! At the same time, its fees can certainly keep up with the low-cost neo-brokers. But how is this possible and what is the catch?

I have summarized my personal Freedom24 experiences for you: costs, selection, service, availability and more. And of course, I address the question of whether it is even a reputable broker.

In brief:

- The new broker impresses with a huge selection, good service and fair prices. My Freedom24 experiences have been overwhelmingly positive so far.

- This is a foreign broker. You have to pay tax on your profits yourself and your capital is only protected up to €20,000.

- Freedom24 has experience in the CIS market (former Soviet Union) and offers access to shares there, as well as US ETFs that are otherwise difficult to obtain.

- You get very high interest on your capital here. Elsewhere, however, there are some hidden costs

Who is the broker? My Freedom24 experience

The German brokerage market has always been fairly simple: on the one hand, we have the neo-brokers, who offer attractive conditions but completely neglect customer support. On the other hand, there are the direct banks and financial institutions, which take good care of their customers but retain a large portion of our profits in fees.

Freedom24 is completely disrupting this structure! The broker has been operating successfully worldwide for more than 15 years, but has only recently become available in Germany. Its offering combines extremely favorable conditions with a huge selection and excellent service.

In my experience, Freedom24 combines two aspects that previously seemed incompatible. This is due to the structure and history of the broker: it started out in Russia more than 15 years ago as the first real online broker. Other markets in Eastern Europe and Asia were quickly added.

Today, the parent company Freedom Holding is based in Cyprus, listed on the US NASDAQ exchange, and highly successful internationally with its financial services. This is also reflected in the group’s share price: it has increased 550-fold since 2017!

Freedom Holding’s share price has increased 550-fold since 2017

Germany and other EU countries are the latest field of activity. Freedom24 is using its experience from other nations very successfully here as well and is seeing a growing customer base of now over 350,000 users. In broker comparisons, the company is one of the larger providers. So don’t be put off by the fact that Freedom24 is not yet well known in Germany!

Good to know:

Freedom24 was founded in Russia, but has long since left that market and is now based in the USA and Cyprus. So you don’t have to worry about the war in Ukraine, sanctions, etc.

The company is regulated in three ways: In the US, where Freedom Holding’s shares are listed, it is regulated by the SEC; in Cyprus, CySEC is responsible; and in Germany, BaFin monitors Freedom24. In addition, there are 126 branches in 17 other countries, each of which is monitored by the local authorities. Our experiences during the 2008 financial crisis have shown how important such controls are.

It should be noted that, legally, this is not a German broker. This has two main implications: the German deposit guarantee of €100,000 does not apply here! Instead, your non-invested capital is only protected up to €20,000 according to the EU directive.

In my experience, however, this is more than enough, as it is rare to have more than €20,000 lying around unused in a securities account. Your shares, ETFs and the like are safe in any case and do not count towards this amount. Should the broker go bankrupt, you can simply transfer your assets to another provider.

Furthermore, Freedom24 does not automatically pay the flat-rate tax. You must therefore declare your profits in your next tax return. This means more work, but also higher profits: it takes many months before you have to transfer the tax to the tax office. During this time, you can continue to invest the capital and generate returns.

In terms of tax, I have had very good experiences with a mix of German and foreign brokers such as Freedom24. This allows you to combine their respective advantages well. You can find the best domestic brokers by taking a look at my reports on Scalable Capital vs. Trade Republic and the broker comparison.

This is how it works: create an account and get your bonus

If you follow my registration link, you will currently receive up to 20 free shares, depending on how much you deposit at the beginning. On average, the bonus ranges from 79 to a whopping 529 euros! So opening a securities account is very worthwhile and comparatively easy.

As usual with such offers, everything works online. You only need an e-mail address and your cell phone. Later, you will have to confirm your identity and place of residence, so it’s best to have your passport or ID card and a document with proof of address (e.g. utility bill, bank statement…) ready. Of course, this can also be done online and is completed in a few seconds.

You also have the great advantage of top-class customer service at every step. So if you have any problems, you can contact the English-speaking support team at any time. In my experience, Freedom24 offers a unique service among low-cost online brokers!

Good to know:

Freedom24 is known to check everything very carefully. It is therefore not uncommon for documents to have to be resubmitted or for the check to take several hours. So patience is required here – but I see it as a mark of quality.

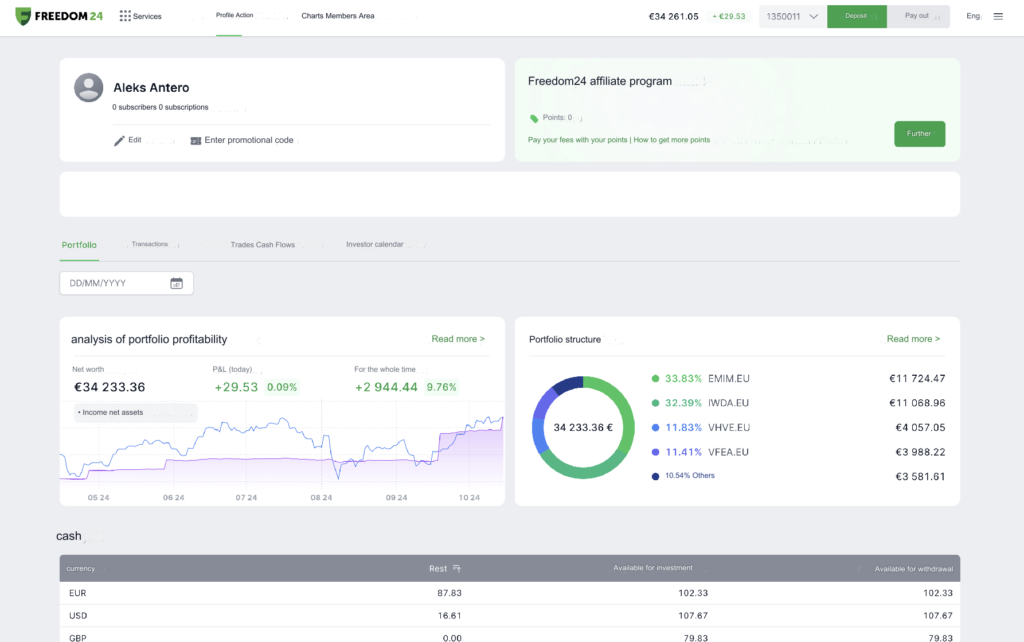

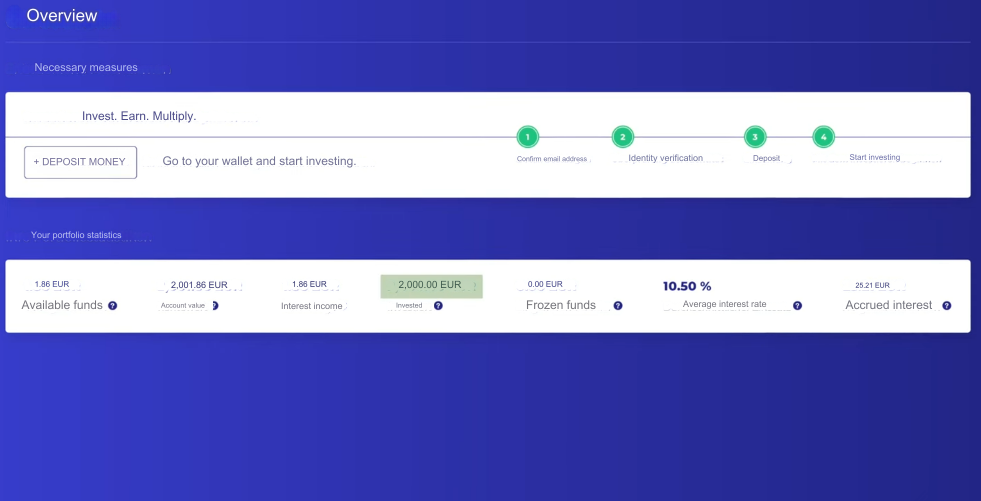

To help you understand my experience with Freedom24, I have also created a new account and funded it with €3,000. Of course, the deposit is free of charge. After you have logged into your account, you will be greeted by the clear web interface.

Of course, there is also an app for your cell phone that offers all the important functions. You can even use advanced analysis tools here and thus trade effectively while on the go. However, I am using the browser for my Freedom24 experience report so that you can follow my steps better.

The question of how to invest money properly and which forms of investment are the best is beyond the scope of this review. So for my test, I’m buying two real ETF classics: the “Vanguard FTSE Developed World” and the “Vanguard FTSE Emerging Markets”, one of my favorite emerging market ETFs.

With the powerful search, you can quickly and easily find these and other titles. After that, we can also check the current charts and data. However, in this case, this is not necessary because I am convinced of both products anyway. I have only selected them to better demonstrate my Freedom24 experience.

Good to know:

Which of the many investment options is right for you? You can find the answer in my posts on the best ETF for 2025, the best funds and, of course, investing money in shares.

To complete the purchase, I first have to carry out two-factor authentication. This is an important point that provides additional security! Various order types are available for execution – an important advantage of Freedom24! I prefer to use limit orders. They are executed when the specified value is reached.

You will get the specified price or a better one, but never a worse one. With Freedom24, such orders are not a problem, but in my experience, many other brokers do not have them in their program.

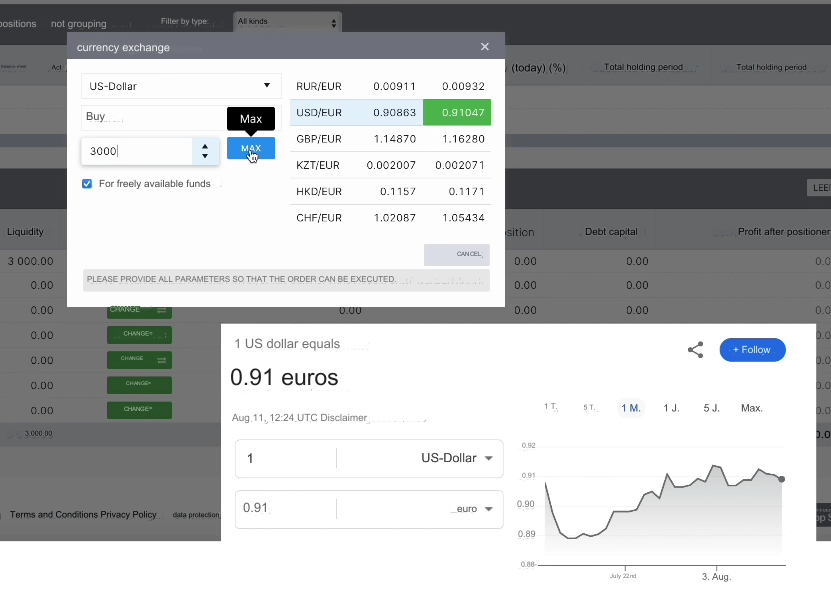

Since I have selected an ETF that is listed in US dollars, I have to quickly exchange my euros for US dollars before completing the transaction. This can be done in just a few clicks and at no additional cost. You get a very good exchange rate here.

This step is not necessary for European shares and ETFs. The exchange process is completed in a few seconds and my purchase is finalized. Of course, you could also make further settings, such as the duration of the order. For this experience report, however, I will limit myself to the basics.

Business model and fees

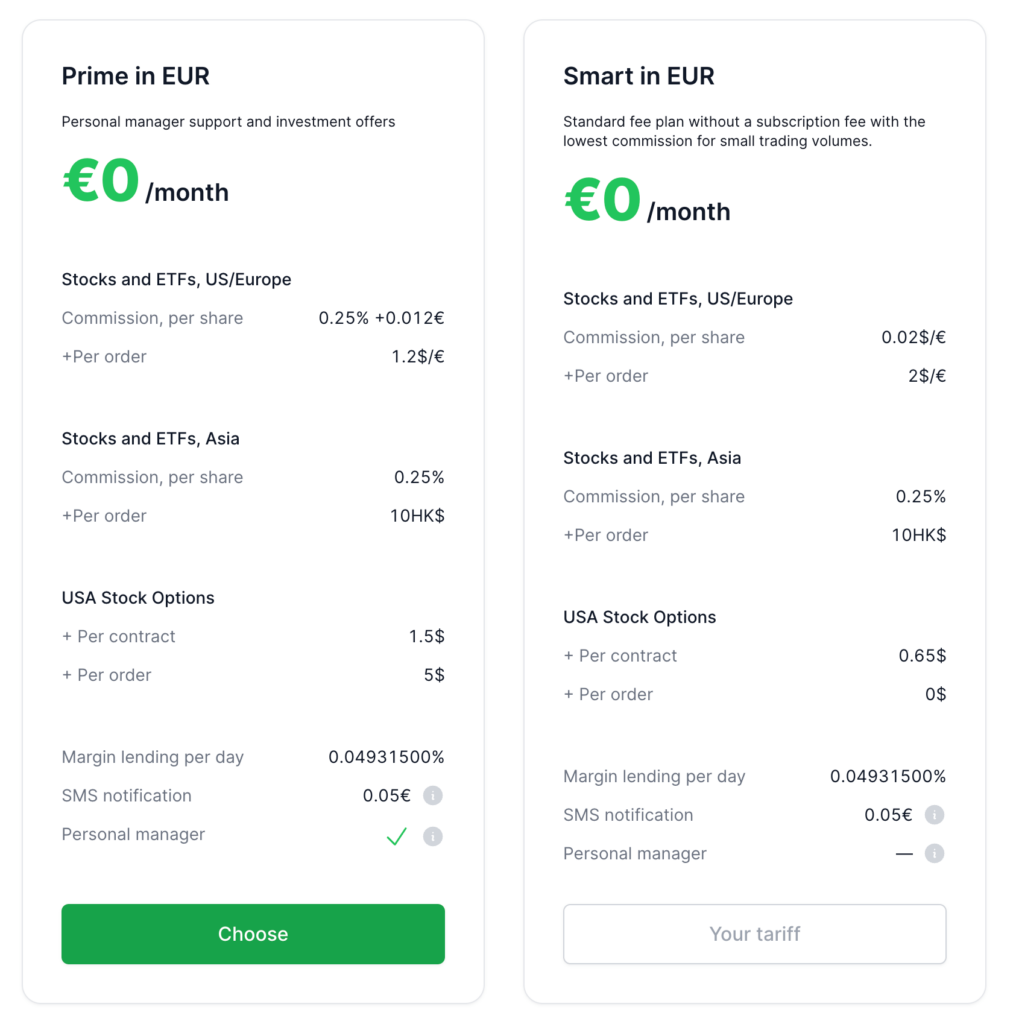

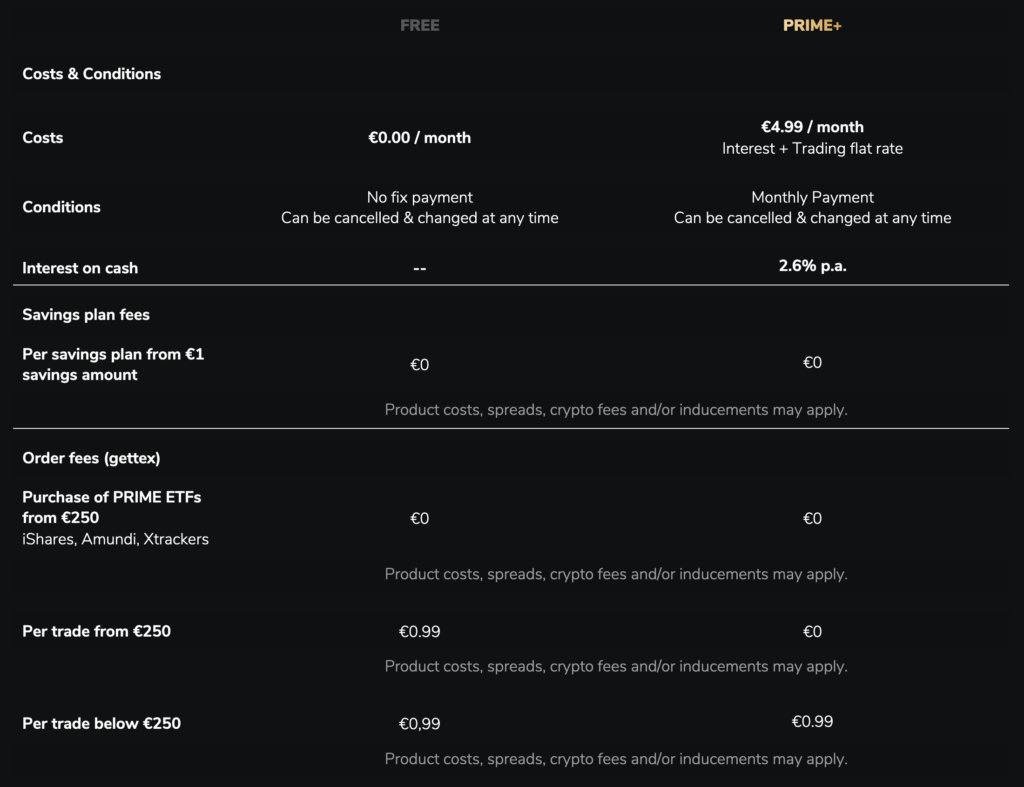

Even a broker like Freedom24 wants to make money in the end and charges fees accordingly. However, these remain quite manageable and predominantly fair. You have the choice between the “Prime” and “Smart” cost models. The concept You may know the “Prime” subscription from the report on my Scalable Capital experience. In fact, the only thing it has in common with the German competitor is the name of the plan!

I will keep my Freedom24 experience on this topic as brief as possible: Both offers are very similar. For example, if I invest my €3,000 from this experience report in shares, I would have the following costs:

SMART

6 orders of €500 each (6 different securities to ensure sufficient diversification): 6 x €2.00 = €12 basic fee

Number of shares: 60 (estimated value) = €1.20 (€0.02 per share)

Total cost: 13.20 euros!

PRIME

6 orders of 500 euros each: 6 x €1.20 = €7.20 basic fee

Number of shares 60 = €0.72 (€0.012 per share)

Volume fee 0.25% = €7.50

Total cost: 15.42 euros!

In both cases, I get away with extremely low costs. A broker like TradeRepublic could offer even more favorable conditions (6 orders would cost €6 here), but it cannot offer the same selection and service.

However, an important point is trading in share options from the USA: here, Prime customers pay significantly more! So if you are interested in such derivatives, you should definitely choose the Smart plan.

Attention!

Freedom24 charges an incredibly high fee of €250 if you want to participate in a shareholder meeting. This is, for example, ten times more than its competitor Trade Republic charges. I therefore strongly recommend that you get your cards from a different broker.

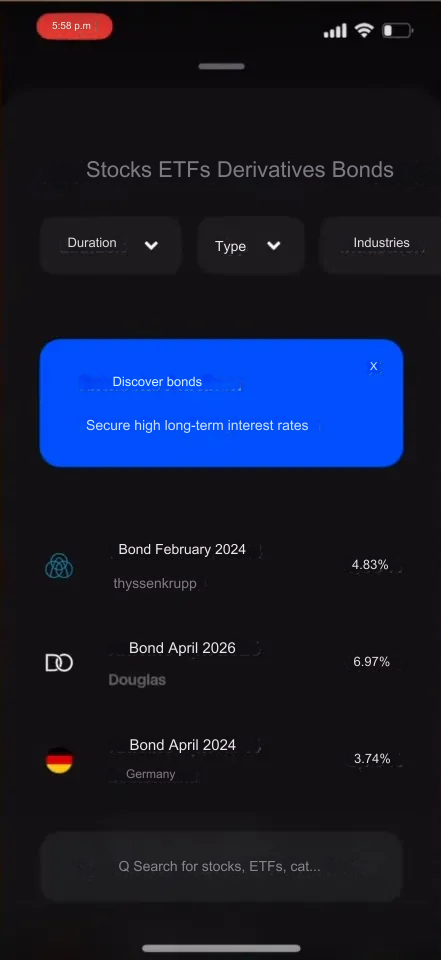

My experience with the Freedom24 product range

If your broker offers a wide selection, you can always find the best investment at the moment. If there are also various trading centers available, you can trade the respective shares, ETFs or derivatives on the cheapest exchange and save a lot in the process.

In my experience, Freedom24 far surpasses most providers in this respect: more than a million tradable assets, at least 40,000 of which are shares, are available to you here! In addition, there are 15 available trading venues. You also get access to areas that are difficult for German investors to access:

- Freedom24 offers titles from the CIS countries (Commonwealth of Independent States), i.e. Armenia, Azerbaijan, Kazakhstan, Russia, etc. Here you will find many interesting companies that specialize, among other things, in the natural resources there, such as oil, gas or precious metals. With costs starting at 0.8 percent per order, in my experience these securities are offered at significantly lower prices than those of the competition.

- You can trade US ETFs directly. A luxury that should not be taken for granted: most providers in Germany only give you access to ETFs based in Europe. In the ETF depot comparison, Freedom24 can thus expand your selection and offer better prices.

However, anyone relying on savings plans will be mightily disappointed: Freedom24 currently does not have a single one in its program! It is therefore hardly surprising that it comes in last among brokers in the savings plan comparison.

Instead, the term ‘savings plan’ is used for a fixed-term deposit product, i.e. a financial investment with a fixed interest rate and term. Although it is a very attractive offer, with which you can receive up to 5.56% interest on euros and an incredible 7.97% on US dollars, I don’t like this deception. They are apparently trying to get a few clicks on the topic of savings plans with this inaccurate description.

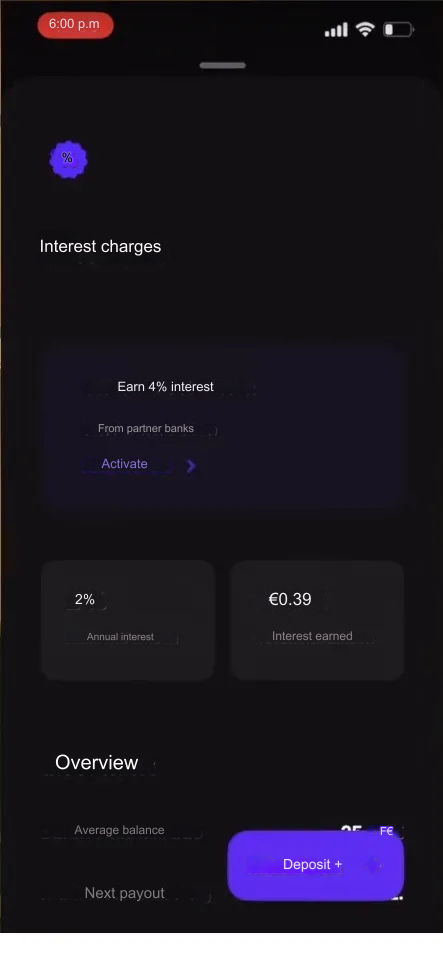

Freedom24 Call Money: Up to 4.84% interest per year

With the so-called “D-Account”, Freedom24 offers a call money account with attractive interest rates and short-term availability. The interest rates here are regularly and dynamically calculated and are currently 3.34% per year for euros and 4.84% p.a. for US dollars. You receive this interest credited to you every day, which greatly accelerates the compound interest effect!

If you don’t have US dollars, you can exchange currencies directly in your account area. This means that the better dollar interest rates are also available to you at all times.

The offer is not officially referred to as a call money, but it works exactly the same: deposits and withdrawals are possible within one day, making the D-account ideal for a “nest egg” (the cash reserve for unexpected costs). It is also the perfect place for capital that is lying around unused because you are still waiting for the right time to invest.

There is no maximum investment amount, so you can also profitably invest large sums here. However, keep in mind that the deposit insurance only covers up to a maximum of €20,000! You are entrusting Freedom Holding with money in excess of this amount. The group is worth around four billion US dollars and is audited and monitored by numerous financial authorities – however, a small residual risk remains.

The interest rates are very good for an investment product with daily availability. Freedom24 ranks among the top providers when compared with Scalable Capital, DiBa ING Tagesgeld or Trade Republic.

Freedom24 fixed-term deposit for even higher returns: up to 7.99% interest per year

3.34% is not enough for you, but you can do without your money for a few months? Then Freedom24 fixed-term deposit could be the right choice for you! You invest a minimum of €1,000 for a fixed period and receive extremely high interest in return.

Your euros will earn 5.51 % per year, and your US dollars as much as 7.99 %! This makes Freedom24 one of the highest-yielding offers on the entire German financial market.

As with instant access savings, you can easily exchange your currencies. So if you want to take advantage of the higher interest rate for US dollars, you simply convert your capital. During market hours, you get an excellent exchange rate; however, for transfers on weekends and holidays, the rate may be slightly worse.

The interest rate is linked to the European key interest rate at the beginning of the Even if you lower it later, your interest rate remains the same for the entire investment. You have three terms to choose from:

3 months – the key interest rate is multiplied by a factor of 1.1

6 months – the key interest rate is multiplied by a factor of 1.25

12 months – key interest rate x 1.5

| Euro | US-Dollar | |||

| Under 100,000 | More than 100,000 | Under 100,000 | More than 100,000 | |

| 3 months | 3,67 % | 4,04 % | 5,32 % | 5,86 % |

| 6 months | 4,17 % | 4,59 % | 6,05 % | 6,65 % |

| 12 months | 5,01 % | 5,51 % | 7,26 % | 7,99 % |

In the current environment of falling interest rates, a long investment over 12 months would make sense, as it allows you to lock in the higher rate for a longer period. Of course, it depends on your personal strategy and goals.

Freedom24 promises even higher interest rates for investments of more than €100,000. In this case, 5.51% is possible for euros and an incredible 7.99% for US dollars. However, since the deposit guarantee only covers amounts up to €20,000, there is a theoretical risk for the remaining €80,000. Such an investment is therefore only worthwhile if you really trust the broker completely.

Exemplary: If you wish to withdraw your investment prematurely, your interest will of course expire. However, there is no penalty on your capital, so you can cancel the fixed-term deposit without major losses.

Investment ideas from Freedom24

Do you want to invest money the right way, but don’t want to spend a lot of time and energy looking for the best investment opportunities? Then Freedom24’s investment ideas could be right for you! They include recommendations from a team of analysts with extensive experience in the financial markets.

According to the broker, the experts have been active in the securities market for an average of 10 years. These professionals select particularly exciting investments for you. The investment ideas include both shares and complex financial tools such as options – so there is something for everyone!

The accuracy and average return of 16% are outstanding. For example, the team was able to accurately predict the growth of Beyond Meat and Zoom. So accurately, in fact, that it has won awards for the best forecasts from renowned media companies!

The best thing about this offer: it is completely free, available simply via the Freedom24 website! You don’t even have to register for it and you could even replicate the tips with any other broker – in practice, however, this would be difficult, as competitors often do not offer the respective securities.

Good to know:

The award-winning investment ideas are freely accessible. You can implement them with any provider from our broker comparison and are not tied to Freedom24!

Security: Is Freedom24 reputable?

The question of whether Freedom24 is reputable comes up again and again. In my experience, investors are particularly concerned about its status as a foreign broker. However, the all-clear can be given here: it is an internationally regulated and successful provider with more than 15 years of experience.

However, it is important to know that the German deposit insurance does not apply to an investment, but the European one does. Specifically, this means that your (uninvested) capital is protected up to €20,000. If Freedom24 goes bankrupt and you have a maximum of €20,000 in cash in your portfolio, you will get this amount back.

However, higher sums could potentially be lost in the event of insolvency. I therefore advise against storing large sums there – even if the very high interest rates make it extremely attractive!

Good to know:

The shares and ETFs in your portfolio are considered special assets. Even in the event of bankruptcy, your broker or its creditors cannot touch them. This means that your portfolio is protected regardless of its size, even in the event of a broker insolvency.

Overall, it can be said that Freedom24 is reputable and offers significant security mechanisms. However, it is important to know that your non-invested capital is only protected up to an amount of €20,000.

My experience with the special tax situation at Freedom24

The status as a foreign broker also has an impact on taxes: the provider does not automatically transfer the withholding tax to the tax office, as you know it from German service providers. Instead, you have to declare your winnings in your tax return.

In a broker comparison, this is both an advantage and a disadvantage for Freedom24. In my experience, you can make significantly higher profits this way. It takes several months before the tax is paid (the period until the next tax return + the time it takes for the tax office to calculate your back payment and demand payment).

During this time, you can reinvest the profits you have already made and generate additional returns. Depending on how your investments perform, this can be extremely lucrative. Or you could just put the money in a “D account” at Freedom24 and get 3.34% interest in the meantime.

However, this is particularly disadvantageous for people who have not previously had to file a tax return. For example, if you are employed and only use German brokers, you usually do not need to file a separate tax return. This changes when you switch to Freedom24. In my experience, however, most investors have to process their taxes themselves anyway or hand them over to a tax advisor – so in practice there is hardly any additional work. Of course, a tax report is available directly from the broker.

Pros and cons

As you may have gathered from the report, my experience with Freedom24 so far has been extremely positive. I’m a big fan of this relatively unknown broker! The reasons for this include:

- Huge selection of more than a million tradable assets. With around 40,000 shares and 3,500 ETFs, as well as a gigantic amount of bonds, options and other derivatives, almost no wish remains unfulfilled. In my experience, Freedom24 leaves almost all other brokers behind in the share and ETF comparison. Only CapTrader currently offers even more products.

- You have access to specialized US ETFs that you won’t find at other providers.

- Among the well-known brokers, Freedom24 has the most experience and offers access to the CIS countries (Russia, Azerbaijan, Kazakhstan, etc.).

- The two available cost models hardly differ at all and, above all, have one thing in common: they are extremely low! The base fee for a transaction can be as low as €1.20, putting it on a par with the eternal competitors Scalable Capital vs. Trade Republic.

- The web interface and app are high-quality, well-organized and work excellently. Here you can clearly see Freedom24’s experience (more than 15 years in dozens of countries!).

- As one of the few neo-brokers, Freedom24 offers high-quality support. For example, in the wake of the sanctions against Russia, the company was able to help customers exchange their ADRs (depositary receipts for foreign shares issued by US banks) for “real” securities.

- The interest on your uninvested capital is record-breaking: you get 3.34 percent for euros and up to 4.84 for US dollars!

Although my overall experience with Freedom24 has been positive, there are some drawbacks that I don’t want to keep from you:

- A €7 fee is charged for withdrawals. If you want to withdraw your capital and have it paid out to a bank account, you will be asked to pay a hefty fee: a full €7 is due each time. This can be very inconvenient for investors who are building up a passive income, for example: if they want to use their additional income every month, they will be charged the fee each time.

But no matter which strategy you follow – I find these high costs very inappropriate in any case. They significantly tarnish my Freedom24 experience.

- The tax issues could deter some investors. As a reminder, this is a foreign broker, so you are responsible for declaring your profits on your tax return. This allows you higher returns because your money stays with you longer. However, if you don’t have to file a tax return yet, this would mean additional work for you.

- The deposit protection for a foreign broker is also lower. Your non-invested capital is only protected up to 20,000 euros. This makes forms of investment such as the high-yield D account appear less attractive. However, 20,000 euros is still a considerable sum and your shares and ETFs are safe in any case.

- Freedom24 charges a whopping €250 for tickets to an annual general meeting! If you want to attend such a meeting, I strongly recommend buying shares in the company in question from a different broker and obtaining the ticket from there. By way of comparison, Trade Republic charges just €25 for an admission ticket.

- Freedom24 does not currently offer any savings plans. It is not clear why this popular investment tool is not available. However, I hope that the broker will improve this soon. Until then, Freedom24 does not come out well in the savings plan comparison.

Alternatives to Freedom24

The broker market is very extensive and Freedom24 fits in between all the chairs. With the scope of its services, it competes with the largest online brokers, while its fees can keep pace with the low-cost neo-brokers.

In my experience, Freedom24 mainly competes with two providers:

Trade Republic

Trade Republic is Germany’s most successful neo-broker – more than 2.5 million Germans have a portfolio here. This enormous success has been achieved through very favorable conditions of just one euro per transaction. At first glance, this is only around €0.20 below Freedom24’s prices.

In practice, however, fees of between €0.02 and 0.25% per share are added. At Trade Republic, on the other hand, it remains at €1 per execution. There is also an extensive range of free savings plans, while you won’t find these options at Freedom24.

Trade Republic also has a slight lead when it comes to interest rates: it offers 3.25 percent for overnight money and deposit protection of up to €100,000.

With 3.25% interest, Trade Republic has the slightly better offer.

However, the German broker cannot keep up when it comes to the range of products: its offering of just under 8,000 shares and only one available trading venue only draws a weary smile from Freedom24. Especially for US stocks and ETFs and shares from Asia, there is hardly any way around Freedom.

My tip:

Use both providers! Since there is no account maintenance fee, you will not be at a disadvantage if you open a securities account with both brokers. For example, you can execute your savings plans with Trade Republic and process international shares and ETFs through Freedom24.

CapTrader

A similar concept is pursued by CapTrader, a German company that is also legally considered a foreign broker. My CapTrader experience shows, above all, a huge selection of international securities at extremely favorable conditions.

Here you can trade over 1.3 million securities and derivatives for prices starting at €2.00 for stock trades, €1 for futures, €2 for ETFs, €3.75 for Forex and much more. I find these adjusted fees to be very fair.

In my opinion, both Freedom24 and CapTrader are ideal candidates for a second portfolio. However, if you want to earn interest on your capital, CapTrader is not for you: you won’t find a call money offer or similar interest products here.

Community experiences with Freedom24

My personal experience with Freedom24 has been very good, but the community is rather skeptical – the offer seems too good to be true. In addition to comments that confirm the excellent quality, there are many follow-up questions and requests for confirmation.

Is the interest rate really 3.34%? Can I also use the 4.84% for US dollars? Is the exchange rate really good? Are my shares and ETFs really in the special fund? I have received hundreds of questions like these.

Questions about exactly how the broker works are very common, but they can be answered quickly.

The most common concerns revolve around the foreign location of the company and the regulations by BaFin and the Cyprus financial supervisory authority. However, these can be quickly dispelled by taking a look at the terms and conditions. As long as you follow my advice and don’t store more than €20,000 in cash in your securities or instant access savings account, you’re in the clear.

What you rarely find are real complaints from practice. Those who actually use Freedom24 seem to have very little to complain about. However, criticism is – quite rightly – directed at the 7-euro withdrawal fee and the fee for deposits via credit card.

Many comments confirm that Freedom24 works as expected. Real complaints from users are extremely rare.

Conclusion: Very positive Freedom24 experience with a few minor drawbacks

Freedom24 is an internationally successful online broker that is also stirring up the German market with its mix of a wide selection, low prices and good customer service. With more than a million tradable shares, ETFs, derivatives and more, as well as 15 available trading venues, it offers a gigantic range of products.

In particular, access to US securities and products from Asia and the former Soviet states offers extensive opportunities. As one of the few brokers in Germany, ETFs from the United States are also included in the program.

Thanks to high interest rates, it is also conceivable to use it as a call money account: you currently receive 3.34% per year for your euros and 4.84% for US dollars. If you are interested, you can even switch between the two currencies at any time for an excellent rate!

In return for the many advantages, investors have to accept minor disadvantages. For example, you have to pay a fee of a whopping €7 if you want to withdraw capital from your account. The costs of an incredible €250 to attend a general meeting are also unheard of.

Overall, however, it is a very attractive broker with a wide selection that makes many competitors in this price segment look old. It’s no wonder that my Freedom24 experience has been consistently positive so far.

FAQ – Frequently asked questions about Freedom24, its features and benefits

The scalable capital broker is stirring up the market with its unusual subscription model and innovative robo-adviser! The Munich-based company has been growing steadily for years – which is hardly surprising given that most investors have a very positive experience of scalable capital.

Reason enough to take a closer look at the neo-broker: What makes it stand out, what do you need to watch out for when investing and how do you get the most out of the subscription model? And of course, after several years of active use, I have summarised my own scalable experiences for you!

In brief:

- Scalable Capital is a German neobroker that allows investors to pay per transaction. Alternatively, there is a fee-based flat-rate subscription with various benefits.

- A ‘robo-advisor’ offers automated investments on request.

- The Scalable Capital Broker is extremely affordable when purchased by subscription and leaves its competitors behind.

- However, the offer is limited to one trading centre.

- Scalable Capital is regulated by the BaFin and deposits are protected up to

What is the story behind Scalable Capital?

Anyone who wants to invest in ETFs, shares, etc., set up a savings plan or even engage in active trading today is faced with a huge selection of possible brokers. Particularly popular are ‘neobrokers’, which combine ease of use via an app with the lowest costs.

In my experience, these providers are largely very similar, with only one really standing out: Scalable Capital. Founded in Munich in 2014, the company offers a flat-rate model that provides active investors and traders with enormous savings.

On the other hand, if you prefer to execute a savings plan in a relaxed manner or invest in an ETF, you can do without the flat rate. Instead, a price of 99 cents per trade is then due.

If you already have experience with ETFs, shares and the like, you are probably familiar with their major competitor TradeRepublic. They offer one cent more, trading for one euro per trade. The price is likely to be deliberately chosen and is another chapter in the eternal competition between Scalable Capital and TradeRepublic.

Trading in shares, ETFs and similar products is now SC’s core business. However, the company started out with a completely different offering: a ‘robo-advisor’ that uses Scalable’s experience in the financial markets to automate private investments.

Investors can indicate their preferences in terms of security. Scalable calls this ‘dynamic risk management’. The system then invests our capital and is highly likely to generate a solid return.

In recent years, however, the robo-advisor has been somewhat sidelined. It is now operated under the name ‘Scalable Wealth’, and it can be useful for absolute beginners when investing. However, in my experience, the offered return of 3.7 per cent is far too low and cannot keep up with other forms of investment.

My experiences in the following report focus accordingly on the use as a broker, the offer, cost models and co. Here, a lot has been added in recent years: Today there are shares, ETFs, bonds, funds, derivatives, foreign currencies, commodities and even cryptocurrencies – an unusually wide range for a neobroker!

The company’s good reputation also contributes to its popularity: a long company history (for the industry), supervision by the BaFin and the large investors Blackrock and Tengelmann as financiers speak for quality. The cooperation with Baader Bank, which is responsible for managing the capital, also makes a good impression.

Investors’ experiences with Scalable are correspondingly positive and the number of users is growing steadily. In view of the favourable conditions, many investors are willing to overlook the biggest shortcoming – the restriction to two trading venues.

Scalable Capital Review: history and how it works

Scalable Capital was founded in 2014 and has offered its robo-advisor to customers since 2016. This automated investment service allows us to invest capital according to personal specifications, without having to take care of the details ourselves. In 2020, customers were able to use the scalable capital broker for the first time.

In a direct broker comparison, that’s a comparatively long company history! During this time, the company has largely managed to avoid major scandals and has built up a good reputation. Almost every test report and every Scalable Capital review from the past shows the positive experiences of users.

Recently, however, more and more negative reviews have been added. In particular, slow customer service and significant waiting times for tax reports have recently annoyed users.

Interesting:

You hardly ever hear anything negative about the app and the actual trading! The application is simple and the structure is clear considering the extensive range of offers. I have been able to gain several years of experience with the programme and have nothing to criticise here.

The business model consists of several sources of income: First, a fee of 0.75 per cent per year is charged for ‘Scalable Wealth’. According to the website, more than 20 billion euros are currently managed in this way, which corresponds to income of at least 1.5 million euros. However, the main source is likely to be the flat-rate customers and the (non-flat-rate) trades for €0.99 per execution.

Another source of income is the collaboration with the Gettex and Xetra exchanges, through which all purchases and sales are processed. Scalable receives a commission for each completed transaction. These ‘kickbacks’ are also the reason why Scalable Capital and its competitor TradeRepublic manage without hidden costs for users.

Scalable Capital costs and subscriptions

The biggest difference between Scalable and other brokers is its fee model: there are three different subscriptions to choose from, each aimed at a different type of investor.

| Depotgebühren/ Grundgebühren | order fees | crypto fees | term | |

| FREE BROKER | 0,99 € | 0,99 € | 0,99 % | Can be cancelled monthly |

| PRIME+ | €0.00 (for orders over €250) | €0.00 (for orders over €250) | 0,69 % | Can be cancelled monthly |

Additional fees for trading on Xetra: €3.99 order fees plus 0.01% trading venue fee (min. €1.50) for each transaction, regardless of the selected subscription!

FREE BROKER

The free broker model is aimed at investors who only trade rarely, only use savings plans or have no experience of the stock markets and want to execute their first trades. You benefit from free savings plans and can buy ETFs from the providers iShares, Amundi and Xtrackers free of charge, provided the order volume is over €250.

- No custody fees

- No fees for savings plans

- ‘Prime ETFs’ free of charge for order volumes of €250 or more

- 0.99 euro order fee per purchase or sale of shares via Gettex

- 3.99 € order fee via Xetra + trading centre fee of 0.01 % (at least 1.50 €)

PRIME+

With the PRIME+ model, Scalable Capital offers a trading flat rate that, in my experience, is particularly worthwhile for active traders. You pay €4.99 per month, receive all the benefits of FREE BROKERS and can also trade free of charge if the order volume exceeds €250. Furthermore, you receive interest of 2.6% per year on your non-invested capital.

- Basic fee of €4.99 per month, monthly billing/can be cancelled monthly

- All the advantages of FREE BROKER (free savings plans, premium ETFs…)

- No order fees when buying or selling via Gettex, if the order volume is over €250.

- 2.6 % p.a. interest on uninvested capital

- Better conditions for crypto trading

- Additional analysis tools, more price alerts and similar goodies

- 3.99 € order fee via Xetra plus 0.01 % trading venue fee (at least 1.50 €)

Cryptocurrencies are a special case:

You can also trade Bitcoin and other cryptocurrencies at Scalable Capital. An additional spread applies here: with FREE BROKER you pay 0.99%, with PRIME+ 0.69% on each order.

If you have not yet gained any experience with scalability or generally only trade very rarely, the ‘FREE BROKER’ is the best option for you. Here, no custody fee is charged, but each transaction with shares, derivatives and the like costs you an order fee of one euro. The offer is therefore the same as the costs of TradeRepublic, with which I have had similar experiences.

FREE BROKER is ideal for those taking their first steps; however, anyone who already has experience of Scalable and trades more frequently is likely to be more interested in PRIME+. The additional costs of around five euros per month are recouped after just five trades.

However, this requires an order volume of 250 euros each. To make the flat rate worthwhile, you would have to invest 1,250 euros per month or more – a sum that only a few investors are likely to reach! The interest rate of currently 2.6 per cent is not worth mentioning and falls into the category ‘better than nothing’.

Nevertheless, the PRIME+ model can be worthwhile: additional analysis tools such as security comparison, portfolio analysis or shopping via ‘Smart Predict’ are available here and can create real added value. Even if you regularly trade cryptocurrencies, the flat rate quickly pays for itself thanks to the 0.3% lower fees.

My tip: Take advantage of the option to change your subscription every month! This way, you can build up a new portfolio affordably with PRIME+ or invest larger sums. The following month, when there are no more trades to be made, you can switch back to the FREE model. This process can be repeated as often as you like!

Good to know:

PRIME ETFs and no-fee savings plans, even if you only use the FREE BROKER.

Offer Review: What, when and where can we act?

Whether Scalable Capital is the right broker for you depends, of course, on what kind of transactions you want to carry out. The range is extensive, but there are some restrictions. Here are the most important details:

trading centres

If you decide on the scalable capital broker, you have two different trading venues at your disposal: gettex and Xetra. If you use gettex, you not only benefit from significantly lower fees, but you can also trade for a comparatively long time on weekdays from 8:00 a.m. to 10:00 p.m.

At €3.99 in order fees + trading centre fees (0.1 per cent of the order value, but at least €1.50), Xetra is clearly the more expensive trading centre and is only available from 9:00 a.m. to 5:30 p.m. on weekdays. In general, you can also place your order outside of opening hours; however, it will not be executed until the next possible opportunity.

Gettex is the standard marketplace for this, and is also used by the majority of investors. The option to also trade on the Xetra exchange is more of a nice extra that can be useful in some rather special cases.

Attention!

For each order via Xetra, Scalable Capital charges trading venue fees of 0.01%, but at least 1.50 euros! These are independent of the selected subscription!

product range

But what is available to you at these trading centres? A whole lot! Here is an overview of the most important investment classes:

- Over 7,500 shares

- Over 2,500 ETFs

- More than 375,000 derivatives

- Currency trading via ETPs

- ETPs for commodities trading

- 14 cryptocurrencies via ETP

- Fund-based saving with more than 3,000 funds

- A single step-up bond (the offering is to be expanded in the future)

Scalable Capital’s core offering consists of around 7,500 shares and around 2,500 ETFs. This amount is not overwhelming, but it is more than enough. Especially if you want to use a share savings plan or invest in ETFs over the long term, you can easily find the best securities.

However, those looking for exotic securities or wanting to execute complex strategies might well reach the limits of the range. In my experience, CapTrader or a similar broker with a huge range but also higher costs is then a conceivable addition.

Derivatives allow you to cut a fine figure. A wide range of certificates and warrants are available, enabling many different strategies. Active traders can achieve excellent results by combining derivatives with the low-priced trading flat rate!

When it comes to cryptos, commodities and foreign currencies (FOREX), Scalable has special advantages and disadvantages. You don’t trade the respective currencies or commodities directly, but rather via ETPs. These ‘Exchange Traded Products’ basically work like ETFs, but contain only a single asset – namely the respective cryptocurrency, gold, silver or whatever you want to trade.

When you buy units in an ETP, you own exactly that: a unit in an ETP. However, you do not own the respective asset! The cryptocurrency, commodity, etc. does not belong to you. Therefore, you cannot transfer Bitcoin purchased via ETP to your private wallet, for example – you do not own the Bitcoin, only an Exchange Traded Product!

For many investors, this is a disadvantage. At the same time, however, investing becomes easier and more predictable: ETPs are investment products that are monitored by financial regulators and must meet certain standards. You can trade them with a reputable broker like Scalable Capital, which has many years of experience in dealing with these products.

Risk and respectability of Scalable Capital

When we entrust a company with our hard-earned money, we want to be sure that it is in good hands. It doesn’t matter whether it’s buying shares, ETF savings plans and the like, or using the robo-adviser from Scalable Capital.

In terms of security, the Munich-based company is very well positioned: it is subject to the regulations of the German Federal Financial Supervisory Authority (BaFin), which, despite a few slip-ups (Wirecard), enjoys a good international reputation. In any case, Germany as a location offers investors a major security advantage.

Another advantage is the fact that the depot is managed by Baader Bank. Even in the event of the insolvency of Scalable Capital or Baader Bank, our securities cannot be touched by the companies! Our (uninvested) capital is also protected up to €100,000 by the deposit insurance of the German Banks’ Compensation Scheme.

The background structures are also very appealing: numerous well-known international investors have helped to build Scalable Capital and continue to be involved. These include Blackrock, HV Capital, Tencent and Tengelmann Ventures. This prominent support is a testament to the quality of the company.

What has gone badly for Scalable Capital in the past is data protection: in 2020, hackers were able to steal the data of at least 23,000 customers. Among other things, they were able to gain insight into sensitive information.

The assets of those affected, as well as passwords, were not affected, so at least no financial damage was done. The company’s handling of the incident (communication, transparency) was also positive. Nevertheless, the incident remains negatively in the memory of investors and damages the reputation of Scalable Capital.

Scalable Capital Taxes

Investors also benefit from the fact that Scalable Capital is a German company in terms of taxation: capital gains tax is automatically paid to the tax office.

For the majority of investors, the Scalable Capital taxes are thus already settled and a separate report to the tax office is no longer necessary. However, exemption orders or non-assessment certificates can also be stored with just a few clicks, if required.

If you need a tax certificate for your tax office despite the simple Scalable Capital taxes, that’s not a problem either: Baader Bank, where the portfolio is held, is responsible for this. They will issue you with a clear tax certificate.

Scalable’s practical experience: this is how you invest

1. Registration and verification

Your investment in Scalable Capital starts as soon as you sign up. Click on the banner to get additional [Hier Bonus einfügen]

First, you need to enter your email address. After a few seconds, you will receive a confirmation email from Scalable Capital. Next, you can select the subscription plan; since you probably don’t have any experience with Scalable yet, I recommend that you start with the FREE BROKER first. However, if you already have a plan and want to get off to a flying start, one of the paid models may be worthwhile.

Now you just need to enter your personal details, such as your name, address, nationality, date of birth and mobile phone number. You will also need to set up a password. The request for your bank account details is a little unusual. But don’t worry: this is just for your first deposit (you can set the amount as you wish), which will be debited via SEPA direct debit.

This process is used to verify your account. If you set up a share or ETF savings plan at a later date, the amount will also be debited from this current account. This is very convenient, as it means you don’t have to worry about having sufficient funds in your Scalable Capital account!

Finally, you have to go through a verification process, as Scalable Capital needs to verify your identity. This is done using a video identification procedure in which you hold your ID up to the camera and follow the instructions. For me, this process took just a few seconds, which contributed to my positive experience with Scalable.

Alternatively, you can also use the POSTIDENT procedure. To do this, you have to go to a post office with your ID document. This is, of course, more time-consuming and takes longer, but it can be a good option if you cannot or do not want to use Video-Ident.

2. Deposit and invest

After your customer account has been created, you need to deposit capital. If you have already deposited enough to verify your account, you can skip this step now or save it for later.

You can find the appropriate button in your app or via browser by clicking on ‘Payments’ in the customer area. Here you have two options: direct debit or active transfer. I recommend the latter option, as it saves you a lot of time – and as we all know, time is money! Nevertheless, it can take up to 2 business days for your capital to be available.

You can also find the IBAN of your personal account in your customer area. Transfers received there are immediately credited to your securities account and are available for investment.

Buying securities, ETFs and savings plans is also very simple: just enter the name of the desired product in the search bar. Of course, the ISIN number will also get you there.

Once you have found the stock you are interested in, some key data and prices are displayed. This information is very rudimentary! You will only find the really important data if you follow the link to the product data sheet. I strongly recommend studying it before every purchase, as this is the only way to be sure that you are buying the right security.

Attention!

Scalable Capital provides only a little information about the individual shares and ETFs in its app. You should therefore always follow the external link and check the key data of the security to avoid confusion and bad buys!

The purchase is – surprise! – started with a click on ‘Buy’. The button ‘Set up savings plan’, on the other hand, allows you to do just that. With a regular savings plan, you can automatically build up your wealth at fixed intervals.

3. Sale and payment

Selling is just as easy: select, open and sell the security from your portfolio. The money is available immediately and can be used for a new investment. Of course, a payout is also possible.

To do this, simply open your customer area (where you have already made the deposit). With just a few clicks and at no cost, your capital can be withdrawn from Scalable. The speed is also very good; however, in some cases it may take up to two business days.

However, you can also leave your capital in euro form in your securities account and reinvest it at a later date. This is particularly useful in times of crisis when you are waiting for prices to reach their lowest point. Scalable Capital does not charge negative interest on non-invested capital!

Overview of the pros and cons

My experience with Scalable Capital has been very positive so far, but this is also related to the way I use the broker. I have been able to gain extensive experience with both the FREE BROKER and the PRIME+ model in the past.

Both forms are aimed at a separate target group and offer them considerable added value. For me, this results in the following advantages and disadvantages:

Advantages

- There are no fees for the Scalable Capital securities account. It is managed by the German bank Baader Bank, which also guarantees the deposit insurance up to €100,000.

- The app is very easy to use, but it also offers really professional features. In particular, the options for tracking prices and periods of time and setting price alerts are ingenious.

- Deposits and withdrawals are extremely fast (in a few minutes for real-time transfers) and easy. They are also free!

- Trading costs are extremely low when you use the PRIME BROKER.

- FREE BROKER is perfect for people who rarely trade or only buy ETFs.

- Savings plans are free and possible with a savings rate of just one euro, which makes most competitors look old.

- Scalable Capital has an excellent reputation: it is a German, regulated company with many years of experience and a good infrastructure.

- With the PRIME+ model, the premiums for crypto trading are reduced to 0.69%, which is quite favourable and quickly justifies the costs of the flat rate!

However, not everything is perfect. I see these disadvantages:

- The limited choice of trading venues is reflected in the prices of some foreign shares. More supply would be desirable here.

- At €3.90 plus trading centre fees, buying via Xetra is very expensive for a

- Trading is only free of charge in the PRIME+ model if the order value is at least €250. For smaller amounts, the €0.99 fee applies, so you have no financial advantage from the flat rate.

- The cost model is more complicated than that of the competition. This doesn’t make Scalable Capital a bad product, but you have to be able to estimate how many trades of each type you will execute.

Another point is customer service. My experiences with Scalable have been quite positive so far, but at the same time I didn’t have particularly high expectations – the service of neobrokers traditionally leaves something to be desired. Therefore, I would speak of a neutral result here.

Conclusion: a low-cost broker with its own niche

Scalable Capital is an unusual broker, as its billing model differs significantly from that of its competitors. However, the Munich-based company’s own approach has been a complete success! This is confirmed by constant customer growth, significantly more attention and a wealth of new offers and innovations.

When using the paid subscriptions, the scalable capital costs are significantly lower than the fees we pay to other providers. Even if you only execute a few trades, the flat rate has already paid off after a very short time. Even with regular crypto traders, you benefit from the subscription model very quickly!

The free ‘FREE BROKER’ model, on the other hand, is very suitable for investors with long-term goals who use savings plans. If you want to gain your first ETF experiences, invest in a share savings plan or pursue a buy-and-hold strategy, this is the right place for you.

The offering is rounded off by a highly sophisticated app and web application with great additional features that make investing easier for you (some of which are only available to PRIME+ customers). In addition, there is a very extensive offering with more than 7,500 shares, 2,500 ETFs, more than 375,000 derivatives and more. Here you leave many competitors far behind!

It’s hard to find things that go wrong at Scalable Capital. The restriction to two trading centres is a disadvantage, especially since one of them (Xetra) has significantly higher costs. Speaking of costs: a trading centre fee of €1.50 is added to each transaction via the Xetra trading centre!

Also note that the flat rate is only worthwhile if you carry out transactions with a volume of more than €250. For smaller amounts, €0.99 per transaction will continue to be charged!

Overall, Scalable Capital is one of the most attractive brokers on the German market and offers unbeatably low-priced trading with its flat-rate models. My personal experience with Scalable has been consistently positive so far. However, only you can decide whether this offer is worthwhile for you and your personal investment strategy, or whether another broker is more suitable for you.

For more insight into the broker market, you should also take a look at my other reports on Freedom24 experiences, JustTrade experiences, Trade Republic experiences and of course my broker comparison.

FAQ – Frequently asked questions about Scalable Capital Broker

Things are going haywire at TradeRepublic: thanks to a full banking licence, the company can now offer its customers their own current accounts, and the rapid growth of the company is impressive. At the same time, however, there are also problems caused by the expansion, and many customers are having negative experiences with Trade Republic for the first time.

But what is the situation really like, how good is the offer and what can you expect? Find out everything you need to know in my report ‘TradeRepublic Experience 2024’!

In brief:

- TradeRepublic is one of the most popular neo-brokers on the German-speaking market. Trading in stocks and shares is possible from €1.00.

- The company has implemented its customers’ own experiences and wishes and greatly expanded its 2024 range.

- Not everything went smoothly: technical difficulties, poor communication and an unattractive design met with little approval. However, they ultimately do not change the attractive offer.

2.5 million Germans have gained experience with TradeRepublic!

Actually, no introduction is necessary: if you invest money in shares or ETFs, you have probably already had experience with TradeRepublic. Around 2.5 million Germans and four million customers worldwide use the popular platform. According to the company itself, it is now the largest broker in Europe!

If you are not yet one of our customers or simply need a little refresher: TR is an online broker based in Berlin that has completely transformed the market for share and ETF investments with its trading app. Since 2019, it has offered users the opportunity to invest in various exchange-traded products.

In 2024, the company received a full banking licence from the German Federal Financial Supervisory Authority (BaFin). This means that the company is now a real bank and is allowed to offer current accounts, for example. However, its core business remains online securities accounts and stock market trading.

In contrast to the previously common method via a house bank, the money-multiplying process is simple, practical and extremely cost-effective: you can invest in shares and ETFs for a fee of just €1.00. In addition, you can also use riskier assets such as derivatives. However, this area of the product range receives little attention – only around two percent of customers use these offers.

The option to execute an ETF or shares through a savings plan free of charge has helped make the app extremely popular. These regular, automatic investments now form the core of many people’s wealth accumulation.

The broker can use the experience gained in more than five years of the company’s history – and the Berliners need to, because the market is highly competitive! They are always trying to poach customers from competitors with new offers and improvements. This seems to be working well, with around 100,000 new customers joining every month!

Basics: This is what you get at TradeRepublic

TR is particularly suitable for people who have little or no experience of the stock markets and now want to invest their money wisely. The simple handling and low costs are of great benefit to newcomers – but advanced traders also profit, of course.

This is because the depository is generally free of charge and costs are only incurred for the actual trading. The extremely favourable conditions are possible, among other things, because Trade Republic only offers a single trading venue: you have to conduct all transactions on the Lang & Schwarz exchange.

In my experience, a single trading centre is easily sufficient for investors who primarily want to achieve long-term asset growth. However, if you are looking for more exotic stocks or want to actively trade in derivatives, leverage, margin and the like, you should also open another securities account with a different provider. Since online brokers no longer charge securities account fees, this is easy to do at no extra cost.

I have had particularly good experiences with the combination of TradeRepublic and CapTrader. But brokers like Freedom24 are also a good match.

You can then use TR for savings plans or investments in ETFs or large companies. Thanks to the favourable cost model, you can save a lot of money here! If you occasionally want to buy other, rather unknown stocks on different exchanges, CapTrader and Monefit come into play.

What you should not expect is outstanding customer service or personal attention. This is where Trade Republic and all neo-brokers have problems: they save on customer service and try to deal with problems, complaints, etc. through automated responses, chatbots and FAQs.

However, poor experiences with customer service are not limited to TradeRepublic; almost all online brokers have to deal with these problems.

Shares and ETFs

The range has grown from an original 7,500 to around 8,500 stocks at present. Added to this are 2,200 ETFs. Overall, the offering is therefore solid and, in my experience, you will find most stocks here without further ado. However, if you are looking for exotic stocks or special ETFs, there may be problems.

Of the 8,500 securities, around 2,700 are available as an equity savings plan available. It is also possible to buy fractions, which allows you to get in on expensive securities at a low cost. However, certain rights, such as attending a general meeting, are denied to you until you own at least one whole share.

Particularly interesting: among the available ETFs, around 1,500 include equities, 550 use bonds, 30 rely on commodities and another 30 on real estate. An exciting mix that offers you many strategic options! For example, if you have no experience with commodities but still want to benefit from this asset class, ETFs are a good place to start.

| ETF Type | Figures |

| equity ETFs | About 1,500 |

| bond ETFs | About 550 |

| commodity ETFs | 30 |

| property ETFs | 30 |

The available providers are also attractive! Almost all the big names, such as Vanguard, HSBC, Van Eck, Xtrackers and iShares, are represented in sufficient quantity. Many investors place less value on a wide selection of ETFs, but it can certainly bring advantages. For example, the issuers have different fee models that can help you save costs.

You can buy stocks and ETFs as a market order (immediate execution at the best available price – but may be more expensive than expected) or limit order (execution at the price you specify. If the price is not available, the execution will not take place).

With other brokers, you have significantly more choice here – there are dozens of special order forms! However, this should be enough for most private investors. Problems only arise here if you want to actively trade.

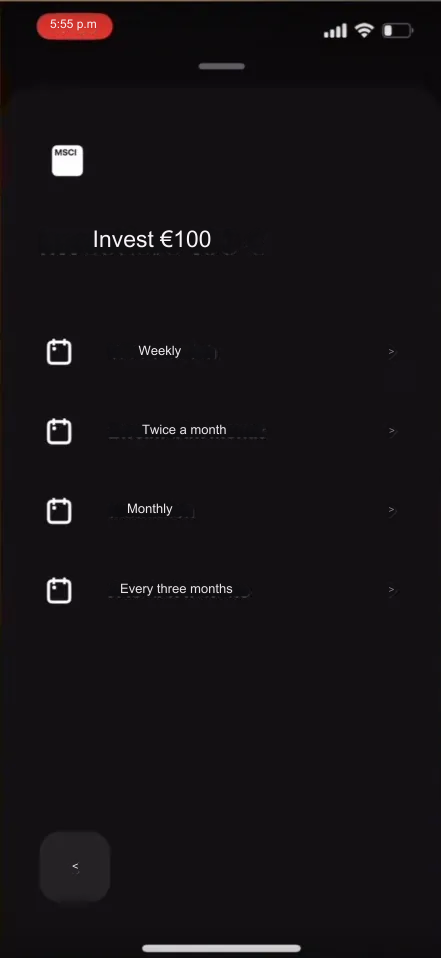

All 2,200 exchange traded funds are also available free of charge as an ETF savings plan. Even the already low fee of €1.00 is waived here! You can set the execution quite flexibly (weekly, biweekly, monthly or quarterly) and, of course, different savings rates are also available to you. You can get started with as little as €1.00 per purchase.

You can conveniently have the money for the execution debited by direct debit. Of course, TradeRepublic would prefer you to set up a current account with the company and handle your investments (and all other banking transactions) from here.

New bonds available!

Bonds are usually considered to be rather boring investments – wrongly so! In addition to the usually very safe, but also only minimally interest-bearing government bonds (for example from Germany), there are also much more exciting alternatives.

At TR, you currently have a little over 600 bonds at your disposal. This selection is not overwhelming, but it is solid. By way of comparison, over 5,000 government bonds and more than 10,000 corporate bonds are traded on the Xetra exchange in Frankfurt.

As is so often the case, TradeRepublic is ideal for gaining initial experience in a particular field. You can easily invest in bonds here and thus, for example, add an additional hedge to your portfolio. In any case, it is a nice extra that you won’t find with many other brokers.

Particularly in times of falling interest rates, you can hope for attractive price gains with this financial instrument. This is because bonds are traded on the stock exchange and have fluctuating prices. When the base rate falls, such securities with the older, higher interest rate suddenly become much more interesting – the price rises. In addition to the often measly interest rate, the prospect of capital gains is the main reason why many investors turn to this asset class.

With TradeRepublic, you can get started from as little as €1.00! A savings plan for purchases is also offered, creating a very flexible offering. This is a perfect way to gain your first experience with bonds.

But be careful: such small amounts are only possible because you are only buying fragments. So you don’t actually own the (whole) bond. If there are problems at TR and there is a threat of insolvency, this would have negative consequences. . Die Absicherung ist jedoch, dank der Erfahrungen aus der Finanzkrise 2008 und der 2024 erteilten Vollbank-Lizenz, heute generell so gut, dass eine Pleite äußerst unwahrscheinlich sein dürfte.

So it’s a deal with pros and cons: you can profit from bonds with the smallest amounts and don’t have to invest 1,000 euros or more first, you can use savings plans and save fees. In return, you have a slightly smaller selection and are not the actual owner of the bond.

Trade Republic Call Money: Interest on your capital

As early as 2023, TradeRepublic caused a stir with an exciting measure: as one of the first neo-brokers, it paid interest on uninvested capital. A proud 3.75% p.a. has since been paid on unused money! This amount is limited to €50,000 and, at the time, offered a very attractive return.

The problem is that the key interest rate and the financial environment have changed. 3.75 per cent is no longer really worth mentioning. On the other hand, it certainly doesn’t hurt to get extra interest on your unneeded capital.

My personal experience shows that there are always phases when you have some cash lying around in your account. For example, you may have money set aside for a purchase but you’re waiting for the ideal time to make the purchase. In such cases, an interest rate of 3.75 per cent is, of course, very attractive!

To start earning interest, you first have to activate the feature. Your money then goes to one of the partner banks, such as Solarisbank or Citigroup.

Since Citigroup is based in Ireland, the Irish deposit guarantee scheme applies to this interest offer. In the event of a bank bankruptcy, you can get 90 per cent of your capital back here, up to a maximum of €20,000 – significantly less than the German deposit guarantee of €100,000! The experiences during the banking crisis of 2008 have shown that, while such an insolvency is not likely, it is still possible.

Fortunately, this special regulation only applies to the interest rate offer. All other services are based in Germany, monitored by BaFin and protected by the German deposit insurance. It should also be noted that TradeRepublic reserves the right to lower, suspend or even charge negative interest rates at any time.

Since TradeRepublic recently obtained a full banking licence, it can be assumed that it will process the interest offers itself in the future. The problems with the Irish hedge and the manual registration would then probably no longer apply. Until then, you are handing over your money and should be aware of the risks.

If you don’t want to register your money for the 3.75 per cent, you will still receive a small amount of interest: 2 per cent is currently paid automatically on your non-invested capital. Again, this interest rate is hardly worth mentioning, but if you don’t have anything better to do with the amount anyway, you are welcome to take it.

You want to know who the best neobroker is? Our comparison of Scalable Capital vs TradeRepublic will tell you!

Problems and bad reviews at TradeRepublic

Let’s move on to what is probably the most interesting part at the moment: the problems of TradeRepublic. Since spring 2024, a series of difficulties began that have apparently not yet been overcome. There is not necessarily one specific cause, but rather many problems in different areas that add up. The rating on portals like TrustPilot has suffered extremely since then.

For months, we have been inundated with a flood of bad reviews. The reasons for this are:

- Customers report difficulties in transferring money and sometimes have to wait months for the capital to arrive somewhere.

- Dividend payments that used to be credited to securities accounts within hours now take several days.

- A securities account transfer (transferring shares or ETFs from one securities account to another) can take several months.

- Problems and uncertainties in crypto trading, as the company recently wanted to exclude three altcoins from trading within 24 hours, but then offered them again.

All these points would be bearable if it weren’t for the one central problem: TradeRepublic has terrible customer service! Contact is only possible via email – with astronomical response times. If you do get a reply, it usually contains only text modules that can also be found in the FAQ section.

This ultimately raises the question: how reputable is TradeRepublic? And would I really want to trust a bank that doesn’t offer accessible customer service with my money? Based on the current assessment, it can be said that many users tend to answer these questions with ‘no’.

To make matters worse, the company’s communications are characterised by an almost impertinent tone, which is reflected in the way the company deals with customers. For example, the company generally uses standard phrases to explain problems or points out that it has done nothing illegal (as happened with the delayed dividend payment). There is no sign of any admission of guilt or promise of improvement.

Those who have been using TradeRepublic for a while are probably not surprised: as early as 2021, the company decided to disable the purchase of shares during the GameStop short squeeze, angering many users. At the time, BaFin received over 4,000 complaints against TradeRepublic.

Even with the problems that persist today, there were again thousands of reports to the supervisory authority. The authority is finally reacting and has ordered an investigation of the company. In response to the abuses, fines could be imposed. However, it is more likely that the company will be forced to stop taking on new customers. a popular measure of the BaFin when a provider has grown too fast and cannot get its problems under control.

This is how I invest with TradeRepublic

I myself have been actively investing in TR for many years – in fact, I have been involved almost from the very beginning! Since then, my portfolio has grown steadily through further deposits and the profits and dividends I have earned. Today, it is worth more than 15,000 euros.

My use of it is fairly standard: I use the app to buy stocks and ETFs with a medium to long holding period. I do this through direct purchases via limit orders and through savings plans. So you could call me a typical standard user who is engaged in quite boring but successful wealth accumulation.

During my years with TR, I have had nothing but positive experiences. I have never had to deal with error messages, an unavailable app or any other problems. All transactions went as promised and even depositing and withdrawing money is easy and surprisingly fast.

Since I haven’t had any problems so far, I haven’t had to deal with the infamous customer service either. I think it’s important not to get your hopes up here: TradeRepublic is a broker that offers low-cost access to stock markets. However, if problems arise, you are largely on your own. and I have to accept very long waiting times before problems are solved.

Conclusion of my TradeRepublic experience: a low-cost broker with problems

TradeRepublic has been known for years as one of the top neo-brokers in the DACH region! TR is ideal especially for investors with little experience and those who only want to engage in long-term asset accumulation with savings plans.

The product catalogue is good with 8,500 shares, 2,200 ETFs, 600 bonds and numerous derivatives. Other providers can often offer more here, but usually fail due to the costs: with TradeRepublic, you only pay one euro for the trade! Without surcharges, special conditions or other hidden costs. In our opinion and experience, this is one of the most attractive offers on the German market.

ETF savings plans are completely free of charge, enabling you to build up your assets. In addition, you receive two per cent interest on unused capital. You can even increase this amount to 3.75 per cent if you entrust the money to the partner banks – however, a limit of €50,000 then applies.

The actually great offer suffers from numerous difficulties that have arisen since 2024: delayed or missing deposits and withdrawals, uncertainties in crypto trading, late dividend payments… These problems are exacerbated by poor customer service and have caused thousands of bad reviews.

But despite these problems, the offering remains attractive. For inexperienced investors, there is hardly a better option than TradeRepublic.

Since 2024, it has had a full banking licence from BaFin and has since started offering current accounts and debit cards. However, it is up to you to decide whether you want to trust a bank that is unavailable when you need it.

Based on my experience, I can say that TradeRepublic is an extremely affordable broker with a solid offering. For savings plans and investments in well-known securities, TR continues to be a good first port of call.

FAQ – Frequently asked questions about Trade Republic experiences

Are you interested in investing in real estate but don’t know how? You may also be looking for high-yield investments with an average return of 10 to 14 per cent. In this article, I’ll share my Fintown review, what you should consider, and the pros and cons!

In brief:

- Are you looking for a high-yield investment? With real estate projects through Fintown, you can achieve returns of between 10 and 14 per cent.

- Various real estate projects in Prague are supported: properties that are currently under construction or apartments that are rented online for short periods of time.

- We show you the pros and cons and everything you need to know about the provider.

Fintown Test – P2P lending

The provider Fintown

Fintown is one of these P2P platforms. What makes it different from the rest is that it specialises in real estate. It works with the Vihorev Group and offers loans from this company.

The Vihorev Group has been developing real estate in the Prague area since 2014. In addition, they themselves have a 20 per cent stake in each of the loans offered on Fintown. This is particularly important for investors to know, as it shows that there is a great interest in ensuring that the projects are successfully implemented and the loans repaid.

There are two different ways to invest in real estate. On the one hand, you can invest in development projects that are currently under construction. Here you can expect returns of 10 to 14 per cent. These funds are used to buy equipment for the properties.

On the following screenshot, you can see the current projects and some important data about them. You can see that the terms are relatively short and what the interest rates are.

If you would like to learn more about the projects, you can find significantly more information by clicking on ‘Show details’, the button in the bottom right corner.

On the other hand, you can invest in real estate that is already rented out. You can look up the individual projects on the Fintown website, by the way. In the screenshot below, you can see what this might look like, for example.

I am particularly interested in the properties that have already been let. After construction is complete, the development projects also become real estate projects that are regularly let. For me personally, the system works in a similar way to Gow & Grow.

You can view photos of the properties and get information about them, such as the rent and size. What I particularly like are the detailed descriptions, which give you a good overview of the projects. You also have access to detailed documents, which ensures transparency.

My Fintown Portfolio – the FLEXI model in the Fintown test

At this point, I would like to show you a specific example. In the so-called FLEXI project, money is collected from investors, which can generate 8 percent interest. The attractive thing about this investment is the low minimum amount: you can invest as little as 1 euro!

These are mainly short-term loans, which can also be interesting for investors. In this example, you must have been invested in the project for at least 30 days. Interest payments are calculated daily and distributed monthly. After the 30 days have expired, you can withdraw your money at any time. The short maturities are particularly attractive for some investors.

You can see an example project in the screenshot below. The wealth of information provided offers you transparency, for example, you can see how much money has already been invested. In this specific example, over €160,000 has already been collected.

Fintown opens these projects as and when required. This also means that you have to be quick if you are interested in a specific project. The ‘Min. term’ shows you the minimum time you have to invest in the corresponding project.

In contrast to Go & Grow, I believe that investors are more secure here because it is not just a portfolio of consumer loans. Instead, actual, physically existing properties serve as collateral. The 8 per cent interest rate, calculated daily, makes the whole project quite attractive.

The property is already being used and rented out to interested parties on real estate websites such as Booking.com, as you can see in the screenshot below. This is a project in which not one tenant pays for years, but a house with several individual apartments that are rented out weekly.

Of course, renting out via platforms requires management, which can increase costs. In the end, however, there is still a significantly higher return for us investors, which is due to the short-term rentals. These are an advantage because more money can be charged than for a long-term rental apartment.

The valuations of rented flats are particularly important in this context:

- This example currently has a rating of 8.9/10 stars based on over 2,000 ratings.

- Surely you also know the situation when you are looking for a rental apartment for your next holiday and you read the reviews carefully before deciding on an apartment.

- Therefore, whether or not you would rent such a flat yourself is an important criterion. Take enough time to look at the project closely and get an overview.

Personally, I think it’s very good that a lot of information is provided and that every investor gets the opportunity to view the properties. This makes the project very exciting for investors, as everyone can easily understand exactly what they are investing in.

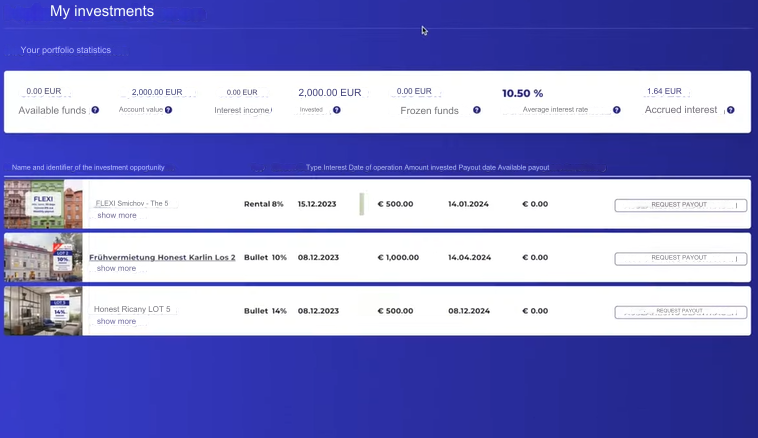

I also find the project exciting, especially the FLEXI model, and have invested in it myself. I would like to briefly show you my portfolio with the provider here. As you can see, I have invested a total of 2,000 euros.

I only received 1.86 euros in interest. On the far right, you will find the so-called ‘accrued interest’ in the amount of 25.21 euros. I am already entitled to this, but, as is usual with real estate projects, it will be distributed at the end of the term.

I have diversified into three different projects, as can be seen below. So far, I have invested €500 in the FLEXI project, but I would like to increase this further. The project involves refinancing the owners’ equity, which is subordinate to the senior loan.

This means that this loan is riskier than the senior loan. It is therefore important that the project is also profitable. To this end, values can be checked.

The average occupancy rate of the apartments and the average daily rental income, for example, can be used here. The annual rental income and net values are also given. In the specific example, an occupancy rate of 91.44 per cent is given here.

My Fintown experiences about security