Lendermarket review: 16.6% interest | €1,500 invested

Lendermarket is a well-known platform that has had a bad reputation among investors for a long time. But now, with new management, improved transparency and interest rates of up to 18%, the P2P provider wants to win back investors. Will that be enough? I’ll show you what you can expect from Lendermarket based on my personal experience!

In brief:

- Lendermarket is a well-known P2P provider that has long achieved dubious results. However, it has now managed to turn things around: up to 18% returns, improved regulation and very good repayment statistics await.

- The platform is backed by the profitable Creditstar Group, which is also enjoying great success with Monefit.

- Those who can do without their capital for a longer period of time will receive an excellent return here. Of course, there is also a fundamental risk.

- I have only invested €1,500 so far, but based on my positive experience, I will increase this amount to €5,000.

My Lendermarket review: Is the P2P platform worth it?

P2P lending is one of the last areas where you can still get attractive interest rates. In my P2P lending comparison, I introduce you to attractive platforms, but there are also some black sheep!

Lendermarket was a negative example for a long time, but has made a real turnaround in recent years! Today, it delivers high returns of up to 18% for investors and operates transparently and reliably. In addition, the company has recently become a certified ‘Crowdfunding Service Provider’ under EU law!

Lendermarket was founded in 2016 by one of the largest credit brokers, the Creditstar Group. The group is a well-known player in the P2P world:

- P2P investors have already had good reviews with Creditstar Group on platforms such as Mintos.

- Monefit operates another very popular P2P service, but with a different focus (slightly lower interest rates, but excellent liquidity).

- The Creditstar Group is extremely profitable and generated a profit of €8.1 million last year.

- The excellent figures give us investors additional security, as Lendermarket benefits from these good results.

For some time now, loans from other companies have also been available on Lendermarket. The platform has thus developed into a genuine marketplace! This is another important advantage, as it reduces dependence on a single loan broker.

Here is an overview of the most important data:

| Foundation | 2016, active since 2019 |

| Company headquarters: | Dublin, Irland |

| Management: | CEO Carles Federico |

| Financed credit volume: | 403 million EUR |

| Regulated: | Fully regulated platform |

| Annual report: | Audited annual report available |

| Investors: | Over 20,000 users |

| Returns: | Up to 18% on P2P lending; average: 15.60 |

| Buy-back guarantee: | Available |

| Minimum investment amount: | 10 EUR |

| Auto-Invest: | Yes |

| Secondary market: | No |

| Tax certificate: | Yes |

| Bonus programmes: | 1% bonus interest in the first 90 days with my registration link |

Who runs Lendermarket?

Carles Federico heads up the company. He brings extensive experience in the fintech sector to the table and has enjoyed success at companies such as Creditstar Group in Spain.

Many P2P platforms are run like family businesses. In many cases, the founders are also the managing directors. This has advantages: they know their company inside out, have gained experience from the outset and have ensured its success to date with their vision.

Typical examples are Indemo and Bondora, both of which are run by their founders. Federico, on the other hand, only joined Lendermarket in 2023. However, I see this as a major advantage: the company had to make a 180° turn to become competitive again – and what better way to do that than with new leadership?

How does the Lendermarket business model work?

Lendermarket uses the same proven business model as dozens of other platforms. If you already have experience with P2P lending, there will be no surprises for you here:

- Credit brokers such as the Creditstar Group grant loans to private individuals and companies. In return, they receive very high interest rates from the borrowers.

- The initiators want to refinance the necessary capital as quickly as possible in order to continue growing. They therefore make the loans available for investment to private investors on platforms such as Lendermarket.

- Several investors each invest a small amount per loan. In return, they receive a large portion of the interest.

- The credit brokers and Lendermarket also take a small portion of the payments.

All in all, it’s a clear win-win (actually, a win-win-win-win) situation! Borrowers receive money quickly and easily, and we investors, the loan brokers and Lendermarket, make a profit.

This concept works very well for everyone involved – provided that everything is properly regulated and transparent. You can find an overview of attractive platforms that meet these requirements in my P2P lending ranking.

How does registration work?

Are you interested in earning up to 18% interest on your capital? Then it’s time to register with Lendermarket! As is usual with P2P platforms, the process is quick and straightforward.

What you need in order to register:

- An identity card, passport or residence permit

- A valid email address

- A mobile phone number

- A smartphone with an existing Internet connection

- A bank account within the EU (not required for registration, but needed to deposit money later)

- Identification number (This is your ‘IdNr’, not your tax number. You can find it on your income tax assessment or your income tax statement in the top left corner).

- You must be at least 18 years old

- You must be a resident of an EU country.

Step-by-step instructions

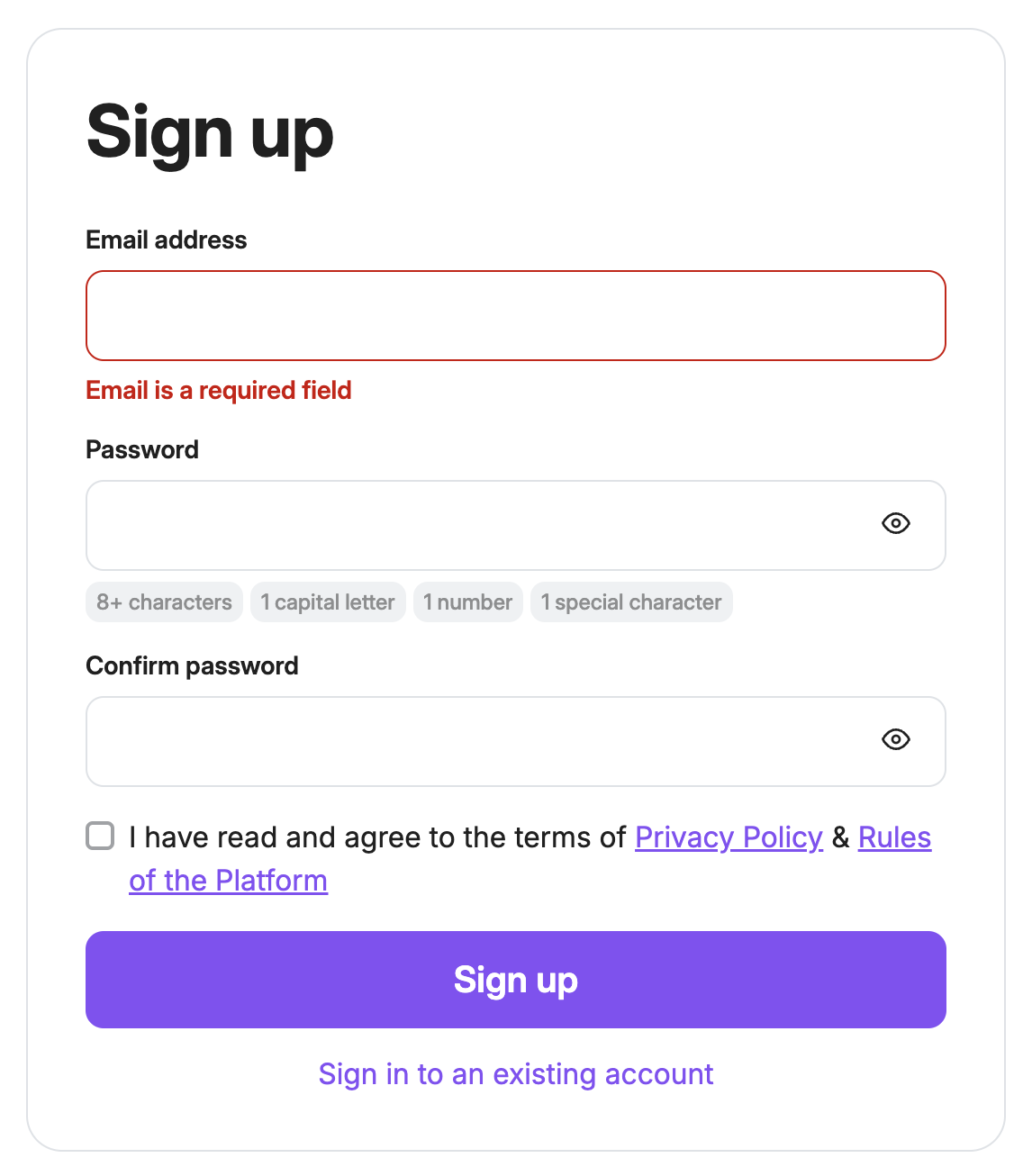

- Start by clicking on this link, which will take you straight to the registration page and secure you 1% extra interest. Begin by entering your email address and a password. You will then receive a confirmation email containing a link to click on to confirm your email address.

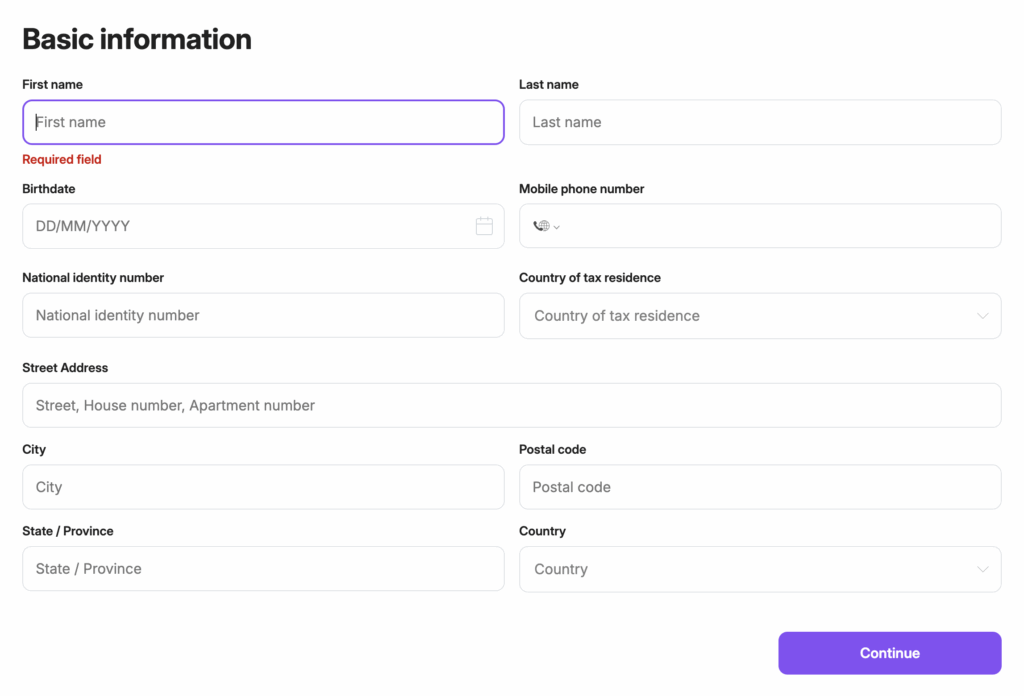

- Your account has now been created and you can log in with the password you just chose. Now it’s time to enter your personal details.

Lendermarket requires a ‘national identity number’. This is your 11-digit ‘IdNr’ (not your tax number). You can find it at the top left of your income tax assessment or your income tax card. If you have misplaced it, you can obtain it again using this form.

- Next, you need to confirm your identity. If you are using a computer, you will now need to switch to your smartphone. Lendermarket will provide you with a QR code or SMS service for this purpose. The registration process will briefly switch to English at this point, but is still easy to complete.

Lendermarket uses the well-known provider Veriff for identification. To do this, you need to take a photo of your ID document and make a selfie video. The exact process always varies slightly (sometimes you just have to move your head, sometimes read something aloud, etc.), but in my experience, it only takes a few seconds.

The entire identification process is automatic; you do not need to speak to a service representative.

- Now you can complete the registration process by answering a few questions about yourself. You will then be taken to the overview page and can start investing!

Deposit money, invest and withdraw profits

Once your Lendermarket account has been created, you can deposit money directly and start investing. You have two options: deposit via bank transfer or by credit or debit card.

In my experience, the second option is extremely rare on P2P platforms! When you deposit by card, the money is immediately available in your Lendermarket account.

No matter which option you choose, deposits are always free of charge.

Good to know:

The minimum investment per loan is €10. It therefore makes no sense to deposit smaller amounts.

My Lendermarket review: features, interest rates and fees

I’ll be honest: due to Lendermarket’s turbulent history, I only signed up a few months ago. However, with over 10 years of experience in P2P lending and a portfolio of over €400,000, I am still able to assess how good or bad the platform is!

Here are the key points:

- The entire payment process, interest credit, etc. runs smoothly and without surprises. Thanks to free card payments, deposits are even significantly faster than most competitors!

- Interest rates are very high, reaching up to 18% for individual projects. On average, investors achieve 15.60% per annum here. Such high returns naturally come with a corresponding level of risk, which I will discuss in more detail later.

- Most loans come from the Creditstar Group. However, there are also several other loan originators, different countries and the option to invest in both private and corporate lending. This allows for good diversification at Lendermarket.

- The website is clearly laid out and works excellently. A good English translation is also available. This shows that Lendermarket already has several years of experience in the market!

- The offer is backed by the highly profitable Creditstar Group, which already operates Monefit, a very good platform for investments with high liquidity. These reviews and the company’s strong financial position give me personally a good feeling about the future.

- As is standard practice for high-quality P2P platforms, no fees are charged to investors.

Lendermarket return: How I earn 16.69% interest

I have only been with Lendermarket for a short time, but thanks to the positive expierience, I have already increased my investment to over €1,500. By the end of the year, I will increase this amount to at least €5,000. I am currently achieving a return of 16.69% interest per year!

I invested as follows:

- I have mainly selected loans manually. However, I have also set up the auto-invest function, as I do not want to select all projects myself in future.

- By selecting the loans manually, I was able to achieve broad diversification: for example, I am invested in loans from Sweden, the Czech Republic, Spain and Finland.

When it comes to returns, it is important to note that high values, such as my average of 16.69% or the maximum possible 18%, can only be achieved with a correspondingly long commitment. Some high-interest loans run for several years!

If you only want to tie up your capital for a short period, this is of course also possible: numerous offers run for only 30 days or less. In my experience, however, the maximum interest rate for such projects is 10 to 12%.

How is interest on arrears calculated?

A special feature of Lendermarket is the default interest you receive in the event of late payment. If a borrower is unable to repay their loan on time, you will have to wait a little longer for your money. However, you will be well rewarded for this waiting period:

- The lending period can be extended up to six times the original term. In the worst case, a 30-day loan can therefore run for up to 180 days!

- Your interest will of course continue to be charged for the entire term. The only real disadvantage is therefore the extended waiting period.

- Unfortunately, you have no influence over whether a loan is extended or not.

- If a loan is not repaid on time but is not extended, you will not be left empty-handed: the credit brokers will charge the borrower a late payment fee, which will go directly to you. At Creditstar Group, for example, this fee is a hefty 17.25% per year! So every day of delay is worth your while!

Due to the possibility of loan terms being extended, Lendermarket is not suitable for investors who need quick access to their money. For such cases, liquid platforms such as Bondora or Bondora alternatives such as Monefit are better options.

How the Auto Invest feature works

Selecting all loans yourself quickly becomes tedious – especially with larger accounts! What’s more, with the manual method, your capital is constantly lying around unused, reducing your overall return.

The Auto Invest feature is therefore a useful alternative, as it allows you to build up a truly passive income and take full advantage of compound interest.

This is how it works at Lendermarket:

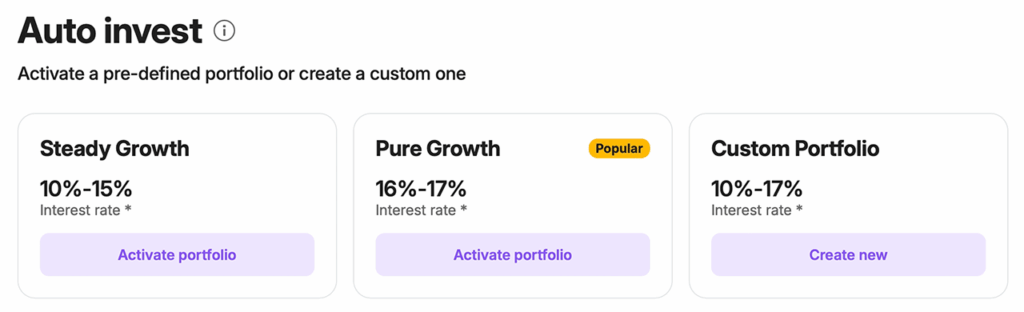

- You can choose between two pre-built portfolios (‘Steady Growth’ and ‘Pure Growth’) or a custom investment.

- When creating a custom portfolio, you have basic options such as credit initiators, maximum term, amount and minimum return.

The minimum amount is always €10 per loan; there is no upper limit – unless you set one in Auto Invest! Once you are happy with your settings, you can check the number of available loans at the bottom right and make sure that your portfolio is working.

If you click on ‘Activate’, your Auto Invest portfolio will be created.

Risk on Lendermarket: How safe is your money?

When we invest in P2P lending, we always expose ourselves to two specific risks:

- A borrower may not be able to make their repayment and we will not get our money back.

- The credit broker or platform may no longer be able to make repayments due to financial difficulties, insolvency or criminal activity.

Like almost all other P2P providers, Lendermarket offers a buy-back guarantee: if a borrower defaults, the platform will repay the loan. Scenario 1 is therefore not a problem for us. However, scenario 2 remains relevant!

In the past, investors have had mixed experiences with Lendermarket, as repayments did not always go as planned. In 2022 in particular, investors had to wait longer for their money. Although everything was ultimately repaid and interest was paid in full for the waiting period, the platform’s reputation was severely damaged.

In addition, IT problems plagued the website and reinforced the negative impression. However, with new technology, additional loan brokers and excellent repayment statistics, the new ‘Lendermarket 2.0’ was launched a few months ago.

My experience and those of other users are overwhelmingly positive:

- Almost all loans are repaid on time. The failure rate appears to be in the single-digit percentage range.

- Non-performing loans are successfully repurchased by Lendermarket and paid out to investors.

- Overall, everything is going as expected for investors, with very short waiting times (e.g. for deposits and withdrawals) and no unpleasant surprises.

- Even the support team enjoys a good reputation and works quickly and reliably – not something you can take for granted with a larger P2P platform!

The relaunch appears to have been successful. If this trend continues, Lendermarket will certainly be able to further improve its customer numbers and profitability.

This is the situation at Lendermarket

How much risk our money is exposed to on a P2P platform depends largely on the platform’s financial success. After all, a profitable company is better able to weather crises and ensure repayment even in the event of major loan defaults!

Lendermarket presents a mixed picture here:

- The Creditstar Group behind the platform is one of the most profitable players in the P2P market: the credit broker earns more than €8 million per year!

- The other providers available on the P2P marketplace also show a positive trend. However, they cannot compete with Creditstar’s millions in revenue.

- Lendermarket still made a modest profit of €87,836 in 2023. However, in 2024, it suffered a loss of just under €300,000. Although these figures appear worrying at first glance, they are not actually critical.

- However, this loss can be quickly explained: in 2024, the company renewed its entire IT infrastructure and restructured its finances, reserves and other areas, which entailed significant financial expenditure.

- The aim was not only to revamp the platform and attract new customers, but also to obtain a licence as a ‘crowdfunding service provider’ under EU law, which was granted in December 2024.

- The company now appears to be well positioned for the future and can benefit from strong customer growth.

Advantages and disadvantages: How I rate Lendermarket

Based on my experience, the new Lendermarket 2.0 is an exciting offering that has some strong advantages and disadvantages and is likely to polarise investors:

| Advantages | Disadvantages |

| Very high interest rates of up to 18% | To get the highest interest rates, you have to tie up your capital for a very long time (sometimes several years). |

| Very broad diversification: different credit originators, countries, corporate lending, maturities, etc. | Short-term loans carry ‘only’ 10 to 12% interest. Their term can also be extended without warning. |

| There is a buy-back guarantee for defaulted loans, which works very well in practice. | As with all P2P platforms, there is a risk involved with Lendermarket. |

| The platform is very clear, offers a tax report and an auto-invest function. | There is no secondary market, so you cannot sell your investments prematurely in an emergency. |

| The platform is a regulated crowdsourcing service provider under EU law; all credit introducers are fully regulated in their respective countries. | Significant problems in the past: Many investors had negative experiences with Lendermarket prior to its relaunch. |

What alternative P2P platforms are there?

With its offering, Lendermarket is clearly positioned in the high-interest segment of the P2P market. Only a few platforms can offer interest rates of up to 18%. So if you’re not interested in Lendermarket, you’re left with only a handful of alternatives:

1. Ventus Energy: Up to 24% interest!

At Ventus Energy, we invest directly in energy projects such as power plants, solar plants and electricity infrastructure. In return, the company rewards us with 18% interest. Thanks to the now famous Ventus Energy bonus of 5% for new customers plus 1% cashback when you register via my link, you can earn up to 24% per year!

The disadvantage: a minimum investment of €1,000 per loan! Anyone who can spare this amount of capital and is not afraid of taking a fundamental risk will find Ventus Energy an extremely lucrative alternative to Lendermarket.

You can find all the important information in my Ventus Energy review.

2. Indemo: 25% interest through debt securities!

Indemo also deviates from the standard P2P concept in order to achieve extremely high returns of 25% on average: here, we invest in ‘discounted debt securities’. Indemo acquires defaulted real estate loans, auctions off the buildings and shares the profits with us. Individual projects can generate profits of over 40%!

The returns are not guaranteed, but in my experience they have been at least 20% and in most cases significantly higher. As with Lendermarket, you need to be prepared to commit some time, as your money is tied up for a while. However, in my opinion, this is a very attractive offer!

You can find all the details in my Indemo review.

3. Crowdedhero: 19% interest thanks to corporate lending

Crowdedhero is a small platform that allows you to invest in a limited number of companies. It is more of a crowdsourcing offering than a traditional P2P investment. Nevertheless, you receive 19% interest, although some fees may be deducted.

If a company you invested in is sold, you would even receive 25%! The offer is complex and involves some risks. Nevertheless, it could be an exciting alternative for investors looking to diversify their portfolio! Read more about this in my Crowdedhero review.

How do taxes work at Lendermarket?

A special feature of Lendermarket is that it is based in Ireland: european investors are not subject to withholding tax here! This means that you must declare your profits as normal in your tax return. You can download a tax report containing all the important information via the platform.

Then you declare your winnings in your tax return:

- Gains from capital income, such as interest, dividends or profits from share trading, are subject to withholding tax + solidarity surcharge (total 26.375%).

- Members of certain religious communities also have to pay church tax.

- There is currently an allowance of €1,000 per person per year. Tax is only levied on the amount exceeding €1,000.

- If your income tax is lower than 26.375%, you can apply for a so-called ‘Günstigerprüfung’ (favourable tax assessment). The tax office will then use your lower income tax rate instead.

Good to know:

If you have any problems or questions, you should always consult a qualified tax advisor! I am only providing an overview here and do not offer tax advice!

Conclusion: Lendermarket has made a successful turnaround!

From black sheep to one of the most attractive offers on the P2P market: Lendermarket has made the transition with its version 2.0! The platform revamped its concept last year and is now shining in new splendour. The most important points are:

- New management with a CEO who has already done an excellent job at Creditstar Group.

- New IT infrastructure that has completely eliminated technical difficulties from the past.

- Successful licensing as a ‘crowdsourcing investment company’ under EU law.

- Additional safety measures such as the creation of reserves and improved transparency in order to comply with EU requirements.

- Broader offering with multiple credit originators from different countries and with very different credit projects.

- Very high interest rates of up to 18%.

Due to the new offer, I registered with Lendermarket for the first time and have invested around €1,500 so far. My experience has been positive so far! I will therefore continue to increase my investment rapidly.

In addition to the high interest rates of up to 18%, I particularly like the broad diversification: here we can invest in different countries, consumer and corporate loans, different maturities and projects from numerous loan originators.

Bad experiences from the past do not seem to be repeating themselves with the new Lendermarket 2.0 so far. However, a certain residual risk remains – but in my opinion, it is still worth getting started due to the high interest rates.

Only investors who want to access their money quickly are out of place here. They would be better off turning to more liquid platforms such as Bondora, Monefit or Swaper.