Mintos vs. Bondora: The big comparison 2025

Mintos or Bondora: a direct comparison of the two largest P2P platforms! Here you can find out when and for whom which provider is suitable, what risks and opportunities there are, and what you should consider when investing!

In brief:

- The two largest P2P platforms, Mintos and Bondora, offer very different advantages for investors.

- You get significantly higher interest rates with Mintos, but with Bondora your money is available at any time.

- There are also significant differences in terms of safety and product range.

- It may be worthwhile to combine both providers and reap the maximum benefits.

Mintos vs. Bondora: An overview of the P2P platforms

Bondora and Mintos are providers of P2P lending. Investors like you and me can lend money to private individuals via such platforms. In return, we receive high interest rates.

A glance at my P2P lending ranking shows that the market for personal loans has grown massively, but no one has benefited more than Mintos or Bondora. Both have massively expanded their user base, lending and profits and are now the two leading providers!

Here is an overview of the most important data:

| Bondora | Mintos | |

| Foundation | 2008 | 2014 |

| Company headquarters: | Tallinn, Estonia | Riga, Latvia |

| Management: | CEO Pärtel Tomberg (founder) | CEO Martins Sulte Martins Valters (founder) |

| Assets under management: | Over 600 million EUR | Over 800 million EUR |

| Financed credit volume: | 1.79 billion EUR | 12 billion EUR |

| Financed credits per month: | 105 million EUR | 35 million EUR |

| Regulated: | Parent company regulated, Bondora platform itself not regulated | Fully regulated |

| Annual report: | Audited annual report available; profit of 1.2 million euros | Audited annual report available; loss of 2.7 million euros |

| Investors: | 501,000 users | Over 600,000 users |

| Returns: | 6 % | 11.5 % on average |

| Bonus programmes: | €5 sign-up bonus via my link | €25 sign-up bonus via my link |

| Minimum investment amount: | 1 euro / 50 euros for credit packages | 1 € |

| Fees: | Pre-defined strategies: 0.39% p.a. Own strategy: 0.29% Smartcash: 0.19% Card deposit: 2% Currency exchange: 0.5% Secondary market (seller): 0.85% Inactivity: €4.90 per month Withdrawal fees: Variable | €1 per withdrawal |

At first glance, Mintos seems to have a clear lead with higher interest rates, more users and a larger loan portfolio.

But the reality is quite different! Both providers are pursuing completely different strategies:

Mintos at a glance

Mintos was not the first P2P company, but it is undoubtedly the most successful to date:

- You have been able to invest in personal loans via the Latvian platform since 2014.

- Significant attention from borrowers and investors led to rapid growth.

- During the COVID crisis, problems and payment delays arose.

- Since then, however, the signs point once again to growth and success.

We can confidently describe Mintos as a ‘classic P2P marketplace’. The business model is similar to Debitum or Swaper: several loan originators from different countries can be found here. These companies grant loans to private individuals or companies. They refinance their expenses via Mintos.

Mintos does not grant the loans itself, but merely serves as a digital meeting place where investors and lenders can come together. This has several advantages:

- Wide selection: The platform currently offers loans from over 30 countries. Almost all options are available in terms of term, amount and interest rates. This allows for excellent diversification!

- Sufficient lending: You will always find enough loans for an investment, allowing you to optimise your returns. With smaller platforms, on the other hand, your capital often lies unused while you wait for a suitable offer. This reduces your interest income!

The company has not rested on its laurels as market leader: it has added new products to its range, including bonds, real estate investments and a money market fund. You can find out more about these offers in my Mintos review.

Bondora at a glance

Bondora has been active since 2008, making it one of the oldest P2P providers around. What has it achieved in that time? It has become the second largest platform!

Originally, the concept was very similar to Mintos: investors could select various personal loans, invest and earn impressive interest rates. I also had a positive experience with Bondora early on.

But everything changed in 2018. The Estonian platform launched ‘Go & Grow’, a revolutionary P2P concept:

- Investors no longer have to select loans and wait for repayment.

- Instead, they make the money available directly to Bondora.

- The company grants the loans itself and collects the profits.

- Investors receive a fixed interest rate of 6.0% (originally: 6.75%) per annum.

- The money can be withdrawn at any time and will be in your account within seconds!

Go & Grow was a huge success. After just a short time, 90% of Bondora investors were investing in this option. In 2023, the logical step was taken and all other offers were discontinued.

Interest rates have since fallen to 6.0%, but the high level of flexibility remains unchanged to this day. Investors value Bondora as an alternative to traditional instant access savings accounts or as a way to build passive income through P2P lending.

Comparison of Mintos and Bondora

A direct comparison between Mintos and Bondora is difficult, as both platforms pursue very different strategies. We will therefore take a look at the most important differences and similarities from an investor’s perspective below.

1. Interest

| Mintos | Bondora | |

| Return | up to 14% | 6,0 % |

| Interest rate | Subject to credit | Daily |

The most important question is undoubtedly how much you can earn from an investment. In the case of Bondora, the answer is clear:

- You will receive interest at a rate of 6.0% per annum.

- Interest is calculated daily

With Mintos, things are a little more complicated, as there are hundreds of lending options to choose from:

- My personal review of Mintos show that 14% per year is easily achievable.

- Depending on your personal selection, this amount may also be lower.

- The provider also offers ready-made investment strategies that reduce your workload. Here too, the interest rates are usually lower.

My personal interest rate at Mintos is currently 13.72%.

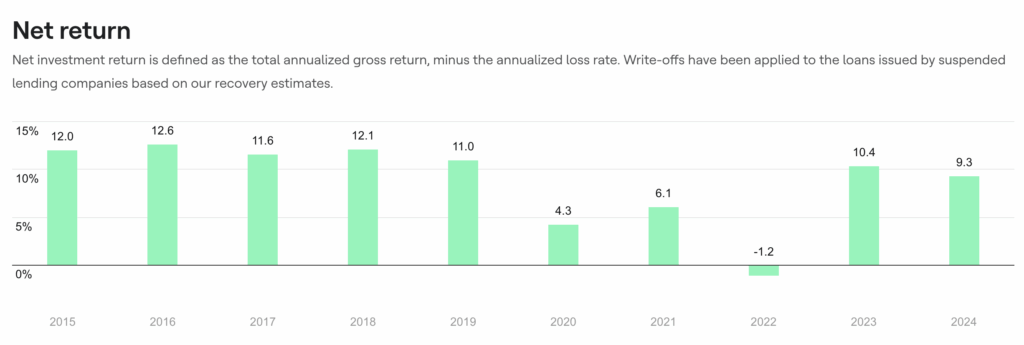

The varying interest rates, defaults and problems caused by the COVID crisis and the war in Ukraine have led to a surprising overall result: From 2020 to 2025, investors with loans on Mintos achieved an average return of only 6.0% per year!

This means that investors here are even lagging behind Bondora, where an average of 6.75% was achieved over the same period (interest rates were only reduced from 6.75% to 6.0% in 2025).

From 2023 onwards, Mintos started to pick up again and interest rates returned to around 10%.

If you are interested in these two P2P heavyweights, you should definitely keep these figures in mind!

2. Liquidity

| Mintos | Bondora | |

| Availability | After repayment or sale on the secondary market | At any time |

| Waiting time | Maximum 2 working days | A few seconds to a maximum of 2 working days |

Bondora may not offer double-digit interest rates, but it excels in terms of liquidity: you can withdraw your money at any time and have it paid out to your account within seconds.

This offer is therefore ideal for anyone who wants to set aside an emergency fund for difficult times! It is also a very good alternative to a call money account.

Mintos also offers a solid level of flexibility, but ultimately cannot compete with Bondora:

- Loans on Mintos have a pre-determined term.

- Your capital is released once the respective loan and interest have been repaid.

- There is a secondary market where you can sell your investment to other investors. A fee of 0.85% is charged for this service.

- This can result in losses, especially if you plan to exit quickly and have to offer discounts.

In a direct comparison between Mintos and Bondora, the former platform is clearly aimed at people who want to invest for the long term and with high interest rates. Bondora, on the other hand, targets investors who want to park their money temporarily or are looking for an extremely flexible investment for other reasons.

3. Risk

| Mintos | Bondora | |

| Diversification | Numerous lenders in over 30 countries | Directly through Bondora in Estonia, Finland, the Netherlands, Latvia, and Spain |

| Risk management | Risk score, buyback guarantees, but complex system | Simple structure, no third-party providers |

| Previous crisis experiences | Delayed payments and defaults that were recovered after a long waiting period | Limits for deposits and withdrawals |

| Regulation and licensing | Licensed investment company under EU law; platform regulated, credit intermediaries partially regulated | Fully regulated. Objective: to obtain a banking licence. |

| Deposit guarantee | Up to €20,000 on uninvested capital | None, planned with banking licence |

If you are looking for a risk-free investment, P2P lending is unfortunately not the right place for you: your money is always at risk here, and how much depends entirely on the platform in question!

The good news: Both Mintos and Bondora are established providers with comprehensive security mechanisms and high reserves. They have already weathered several crises well and are undoubtedly among the safest platforms in the industry!

- Mintos: Offers high diversification through investments in over 30 countries and with dozens of lenders. In addition, there are usually buyback guarantees for defaulted loans. Mintos is a regulated investment firm, so uninvested capital is protected by deposit insurance up to €20,000.

- Bondora: Manages its own loan portfolio, so you have no influence on the diversification of investments. The company protects investors with reserves of at least 15%. This ensures sufficient liquidity even in the event of multiple defaults during crises.

Here, too, it is difficult to compare Mintos and Bondora, as both platforms pursue such different concepts! Bondora grants its loans itself and protects investors through reserves that are intended to ensure normal operations in times of crisis. This is particularly easy for us and requires no active involvement.

Mintos acts as an intermediary for loans from other companies, so the risks are less likely to affect the platform itself. Good diversification further minimises risks. However, greater caution is required here in any case! Ideally, you should carefully review each investment beforehand.

4. Crisis resilience

| Mintos | Bondora | |

| Impact of the crisis | Significant problems, several lenders defaulted | Short-term payment suspension, longer restrictions |

| Returns in times of crisis | Interest rates were significantly lower | Interest income was paid out in full |

| Reaction time | Slow recovery, uncertainty among investors | Rapid normalisation after just a few weeks |

| Measures thereafter | Introduction of risk scores and stricter admission criteria | No changes necessary, model remained stable |

What good are all security mechanisms if they don’t work in an emergency? The COVID crisis in 2020 was the most serious test yet for P2P providers! Both Mintos and Bondora survived this phase, but in very different ways:

Mintos:

- Fell into a genuine crisis. Lenders defaulted and a large portion of the loan portfolio fell into arrears.

- Even today, five years later, I am still waiting for some repayments.

- The recovery of defaulted loans is generally working well, but waiting times are considerable.

- Extensive measures, such as the introduction of a risk score, were subsequently implemented.

Bondora:

- Immediately took measures and limited the number of withdrawals and deposits that an investor could make per month.

- Once the initial shock had subsided, the restrictions were lifted bit by bit.

- Throughout the crisis, the promised interest payments were made in full and there were no defaults.

- Since this difficult phase had been overcome so well, no further changes were necessary afterwards.

Both companies thus experienced a baptism of fire. Bondora weathered it much better, which is undoubtedly also related to its unique business model.

Mintos, on the other hand, was severely affected. Payment defaults became more frequent, returns plummeted and numerous investors turned away. The platform subsequently introduced a series of innovations designed to prevent such damage in the future. It seems that lessons have been learned from the last crisis.

5. Fees

| Mintos | Bondora | |

| Payoff | Free of charge | 1 € |

| Fees | Free up to max. 0.39% p.a., depending on the strategy selected | No additional fees |

Both Mintos and Bondora try to keep the costs for investors as low as possible. Their main source of income is the very high interest rates that borrowers have to pay!

Mintos uses the following structure for this purpose:

- Manual loan selection: If you select all your investments on the platform yourself, you do not have to pay any fees.

- Auto-Invest: With the Auto-Invest feature, you can let Mintos automatically invest your money according to your preferences. A fee of 0.29% per year applies.

- Core Loans: These are pre-designed strategies, two of which are currently available (“High Yield” and “Conservative”). You pay 0.39% per year to use them.

- Additional costs: Additional fees apply for the ‘Smart Cash’ service (0.19% per year), card deposits (2% of the deposit amount), currency exchange (0.5%) and sales on the secondary market (0.85%).

The additional fees charged by Mintos can seem intimidating, but in practice they are easy to avoid.

So, fees are charged at various points, but the amounts are very reasonable. What’s more, you can use Mintos completely free of charge if you select your investments yourself.

With Bondora, on the other hand, things are much simpler: a fee of €1 is charged for each withdrawal, but there are no other fees! In the comparison between Mintos and Bondora, the latter platform once again stands out for its simplicity.

6. Extras, innovations and user-friendliness

When it comes to its product range, Mintos really makes an impression! The platform offers:

- P2P lending from over 30 countries with different terms, minimum amounts and interest rates in the areas of mortgages, consumer, agricultural, business, car and pawn loans.

- You can invest in traditional personal loans or use loan-backed securities (packages of at least 6 loans).

- Two ready-made P2P strategies, a freely adjustable auto-invest function and the option to select loans completely independently.

- Investments in a money market fund.

- Bonds issued by a real estate company, through which we can benefit from rental income.

- Three unique corporate bonds.

This naturally results in a somewhat more complex website, which has to accommodate all of the functions. Bondora is quite different, as it only offers one product and two central functions: depositing and withdrawing money. Three unique corporate bonds.

Mintos offers a comprehensive range of products that can be broadly divided into four asset classes.

Now, one could argue that Mintos is the more innovative platform. However, this would not do justice to the Bondora Go & Grow concept: it is a minimalist approach that was highly innovative when it was introduced and continues to work extremely well today. With its efforts to obtain a banking licence, the company can further consolidate this strategy and certainly celebrate further successes.

Who are Mintos or Bondora suitable for?

Both platforms have specific advantages and disadvantages and are aimed at a specific target group:

- Mintos: For active investors who are looking for high returns and want to manage their investments themselves. Here, it is best to select the loans yourself to ensure good results and sufficient protection.

- Bondora: For passive investors who want to park their money temporarily or are looking for the simplest possible way to build up their assets. Thanks to its extremely simple use, no active involvement or prior knowledge is required.

So there is something for every type of investor. Due to the special features of P2P companies, it is also possible to use them simultaneously! By registering with Mintos AND Bondora, you can create a flexible P2P portfolio with very good returns.

With my Mintos and Bondora sign-up link, you’ll also benefit from a double sign-up bonus!

My investments with Mintos and Bondora

I have been active with both providers for years and have extensive experience. In 2024, I reduced the amount I had invested in these platforms slightly in order to invest more in other products. However, I will reverse this process and increase my investment in Mintos and Bondora again!

My portfolio at Mintos is currently worth €5,300. Over the years, I have earned a total of €1,112 in interest!

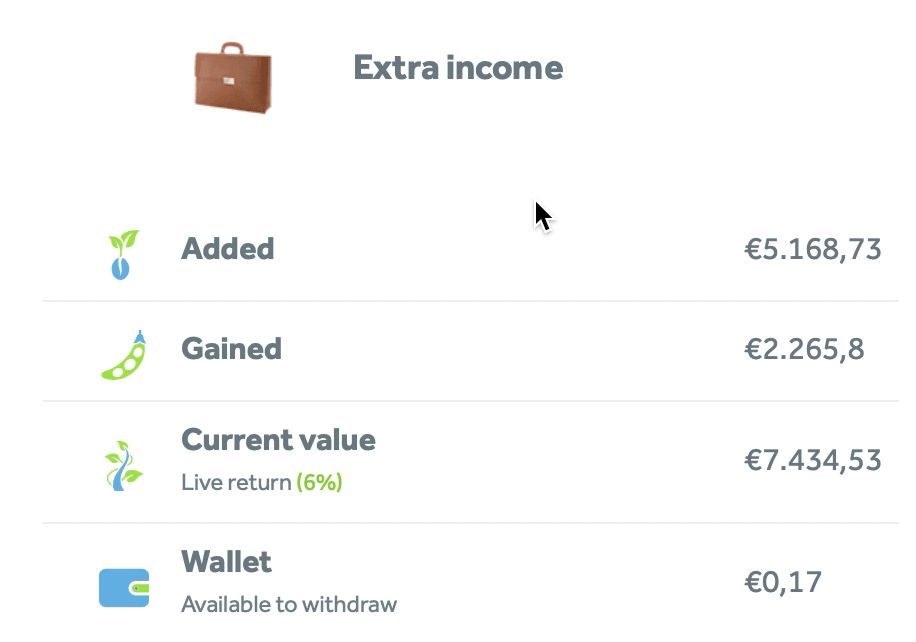

I currently have around €7,423 invested with Bondora. In the past, I repeatedly invested large sums here, but also withdrew money. This resulted in a total profit of €2,255!

My Bondora portfolio currently totals €7,423, of which €2,255 comes from previous profits.

Both platforms are therefore very lucrative. I highly recommend using them in combination!

Conclusion: Mintos vs. Bondora – two lucrative pioneers

Mintos and Bondora are the two largest and undoubtedly best-known P2P platforms. They have had a huge impact on the personal loan market and now each have around half a million investors!

However, that is where the similarities end, as both companies pursue very different strategies. Mintos brokers loans from other loan originators and can therefore offer a high degree of diversification and excellent returns of up to 11,5%.

However, this also makes them more vulnerable to potential crises, as demonstrated during the COVID crash. Investors should be a little more risk-tolerant here, take a proactive approach and select the loans themselves.

With Bondora, on the other hand, you can earn interest of 6%. What may sound relatively low at first becomes extremely attractive thanks to the high level of flexibility: here, you can withdraw your capital at any time and use the platform like a call-money account!

Investors are also impressed by the high level of security that has been demonstrated so impressively during past crises.

I have gained experience with both Bondora and Mintos over many years and can recommend both providers. The different products complement each other very well and offer great benefits for investors!