What are ETFs? The ultimate ETF Guide 2025

Exchange-traded funds have taken the financial world by storm. No wonder: these share packages offer many advantages that make them ideal for private investors and hobby investors! We have compiled all the important information about ETFs – from selection and low-cost purchasing to risks, special features and tax issues – and put it together in this handy guide!

In brief:

- ETFs are packages of stocks that are automatically compiled based on predefined lists. You can buy and sell them on the stock exchange through a broker.

- You invest in all of the stocks included at the same time. This can reduce your risk. However, certain risks remain, especially if the selection is incorrect.

- ETFs have a few special features, but these are easy to understand.

- They are generally very beginner-friendly. However, with our tips and tricks, trading works even better!

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

0 % without

Points

0 % without

Points

Points

Points

Points

Points

What are ETFs? Understanding exchange-traded funds

Companies sell shares in their business, known as stocks, on the stock market. People with sufficient capital can then buy these shares. If the value of these stocks rises (for example, because the company has made high profits and is now worth more), they can then be sold again for a higher price.

The global stock market is based on this simple principle. Every day, securities worth billions of euros change hands on the stock exchanges in Frankfurt, New York and elsewhere. In addition, a huge range of related products and services has emerged. ETFs are a particularly exciting way to profit from this market.

These exchange-traded funds are packages consisting of several stocks. If you invest money in an ETF, you receive shares in all of the securities it contains. The companies included in such a product are compiled using predefined lists, known as indices.

The best-known indices are:

- S&P 500, an index of the 500 largest US stock companies

- DAX, the German stock index, consisting of the 40 largest stock companies in the Federal Republic of Germany

- MSCI World, an index comprising the 1,500 largest equity companies from 23 industrialised countries

- MSCI Emerging Markets consists of around 1,200 companies from developing countries.

There are hundreds of other lists like this and corresponding ETFs based on them. With your ETF portfolio, you could invest in an index that only contains companies from a specific industry, for example:

- Real estate ETF

- ETF of the defence industry

- ETFs for renewable energies

- Digital Security ETF

- Water ETF

- Cannabis ETF

- Technology ETF

- and much more!

Or you can opt for a specific region. Many investors prefer the 70/30 portfolio. Here, too, there are countless exchange-traded funds to choose from:

- ETFs for Asia

- ETFs for Europe

- US-ETFs

- Emerging Markets ETF

- Or even the whole world with an ACWI fund

Further selection options include company size (large, medium or small cap), whether a company operates in a socially and environmentally sustainable manner, and much more. As you can see, there is something here for every taste and every ETF investment strategy!

Why invest in ETFs: advantages and disadvantages

Exchange Traded Funds are very useful investment products with huge profit potential. Of course, they are not perfect and there are also risks and negative aspects. I have compiled the most important advantages and disadvantages for you so that you can form your own opinion!

In general, exchange-traded funds are very advantageous for investors: they combine excellent potential returns with ease of use and relatively low risk. However, there are also disadvantages!

For example, prices may fall, which could result in losses for you. This risk is particularly high if you choose the wrong product – which can happen relatively quickly given the huge selection available.

It is therefore important to understand the main advantages and disadvantages of ETFs before you start investing. This is the only way to make the most of their potential while avoiding problems. The most important pros and cons are listed here:

ETF costs

In the financial world, there is no such thing as a free lunch. There are also ETF costs that you, as an investor, have to bear. The assumption is always that a successful fund will generate such high profits that the fees are negligible.

But there is good news: ETFs are generally very inexpensive compared to other financial products. For most funds, the costs range between 0.1 and 0.6% of the investment amount per year. However, there are also some offers that charge higher fees and even exceed the 1% mark. I have explained here whether a product is still worthwhile:

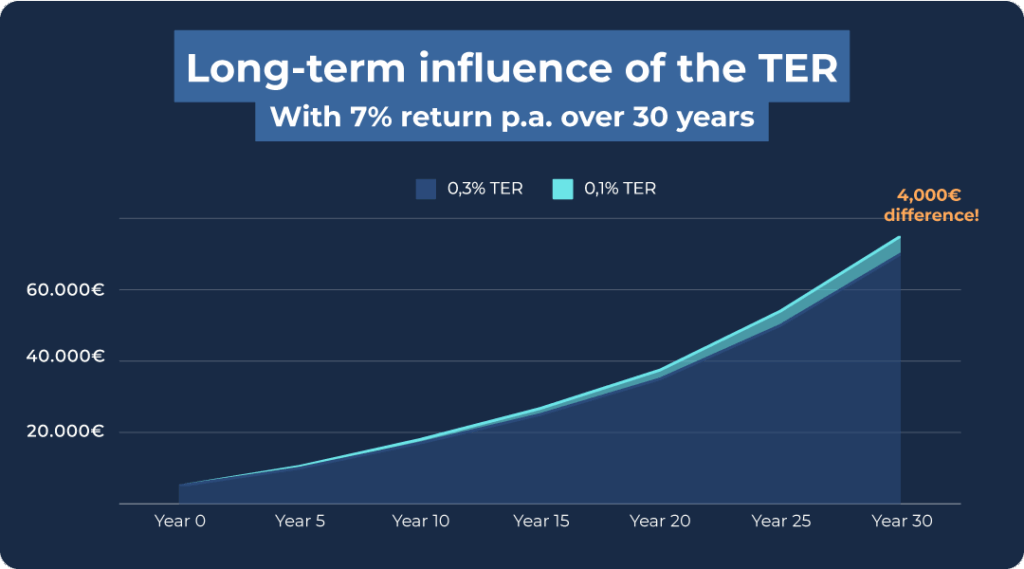

There is a helpful indicator for estimating the total costs of an exchange-traded fund: the total expense ratio.

Total Expense Ratio

An exchange-traded fund is generally very simple in structure and easy to understand – one of the main reasons for the huge success of these investment products! However, you should familiarise yourself with some key figures relating to ETFs in order to make the right choice. These include, for example, the total expense ratio or TER.

This is the total cost incurred for a fund. It is expressed as a percentage and is charged annually. For example, a TER of 0.5% means that 0.5% of your invested amount will be deducted each year to cover fees. But don’t worry: ETF fees are extremely low and are usually easily offset by the profits!

You will find the TER not only for ETFs, but also for investment funds and other financial products. The great thing about the total expense ratio is that it includes (almost) all the costs you will incur! This means you can see at a glance how much of your return will be deducted.

The TER includes the following details, among others:

- The fees charged by the issuer of a fund (the fund operator naturally wants to make a profit!)

- Licence fees that the ETF operator must pay in order to use the index as a benchmark

- Costs for the custodian where the securities are stored – comparable to a custody fee for private investors

- Administrative costs, such as documents, cooperation with supervisory authorities, etc.

Not included:

- The fees your broker charges when you want to buy or sell ETFs

- Costs incurred when stocks are bought or sold within a fund. The contents of an ETF are regularly adjusted to accurately reflect the index template. These adjustment transactions generate costs, but these are so low that they can be disregarded in practice.

- Fees for swaps using synthetic replication methods – more on this later.

Accumulating or distributing?

There are several ways to profit from ETFs. The most obvious option is to buy such a fund and then sell it at a profit later when its price has risen.

However, there is a second, lucrative option: Profit distributions! Some stocks regularly pay out a portion of their earnings to investors. This dividend can be a nice source of additional income. Even if the distributing stock is included in an ETF, such a payment is still made.

An exchange-traded fund can handle these dividend payments in two ways:

- The ETF can retain the profit distributions and use them to buy new stocks. This increases the value of the entire fund. As an investor, you benefit from stronger price increases and a compound interest effect. This form is referred to as “accumulating” or “reinvesting”.

- The ETF can distribute dividends to investors. In this case, all persons who have invested in the ETF receive a payout. This is referred to as a distributing ETF. Since you deduct the profits in this form, your total return may be slightly reduced.

Accumulating ETFs are much more common, but a large number of ETFs are now also available in distributing form. Although this choice has little impact on your overall return, it is extremely important for your strategic orientation.

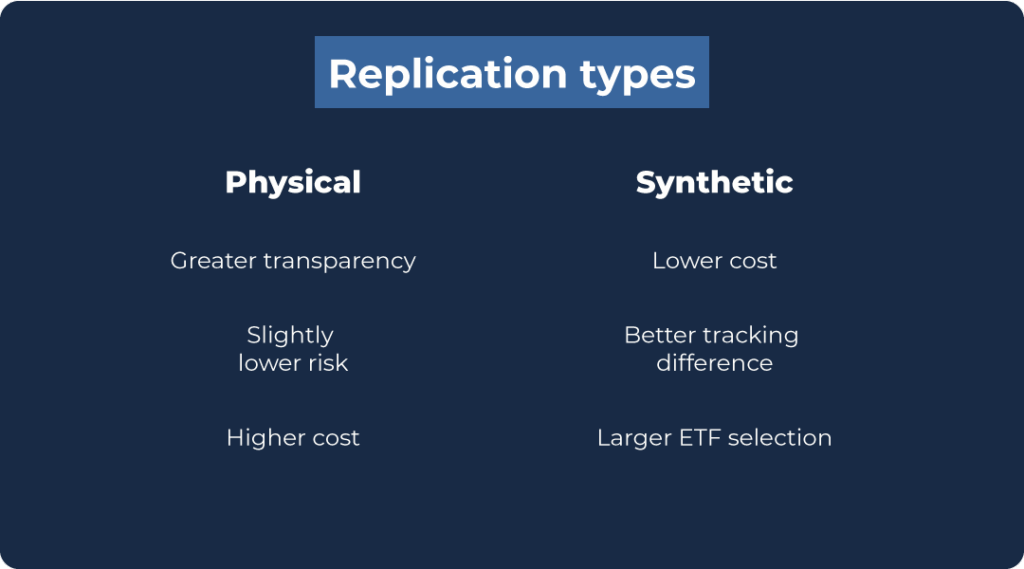

ETF replication methods

An ETF represents a series of stocks. Many funds purchase these securities with investors’ money and then hold them in a securities account. In other words, they are no different from private investors who buy stocks through their brokers – just on a larger scale and as middlemen.

This variant is referred to as “physical replication” because the index is actually replicated. This contrasts with “synthetic replication”. ETFs that use this form do not directly own the stocks, but merely have a right to them.

Synthetic ETFs work through exchanges between financial institutions. These ‘swaps’ can seem a bit confusing to outsiders, can cost money, and can even be a security risk. That’s why most investors prefer physical replication. You can find out more about the pros and cons of both types in my article on ETF replication methods.

What return can you expect?

You don’t want to put your money into a financial product just for fun – you want it to be worthwhile, of course! ETFs are no exception. The return you can expect depends entirely on your selection!

Each find forms an index. The performance of this index therefore determines how well your exchange-traded fund performs. For example, with a product based on the MSCI World Index, you could have earned an average return of 10.15% per year.

If, on the other hand, you had used an ETF based on the ‘MVIS Global Hydrogen Economy ESG’, you would have lost around 64% per year! The hydrogen stocks it contains have simply failed to perform well so far and have ruined returns for the unfortunate investors.

Your profits or losses therefore depend largely on the index selection! Costs also have a slightly smaller impact: a high TER can eat into your returns, while low fees ensure better results. You can find more details on this in my article on ETF returns.

ETF risiks

By investing in exchange-traded index funds, investors aim to profit from rising prices. Unfortunately, this can also backfire: prices can also fall!

- Economic crises, stock market crashes and other events can affect the entire economy and also reduce the value of your ETFs – fortunately, however, such downward trends are rarely long-lasting.

- Companies in a particular industry may perform poorly overall. A fund that tracks this sector will naturally be affected as well.

- Some sectors of the economy, such as finance, are characterised by particularly pronounced ups and downs. Regular price slumps are unfortunately part and parcel of ETFs in these sectors.

In general, there is a risk that the results of all exchange-traded products will not meet your expectations. However, investors accept this risk because the results can be very attractive if the investment is successful! In any case, you should be aware of this possibility. You can find out more about the risks associated with ETFs in my report on this topic:

ETF total loss

It is highly unlikely, but not entirely impossible: you can lose capital with ETFs – up to and including the total loss of your ETF investment. There are several scenarios in which such losses could occur:

- If not enough people invest in a fund, it is not worthwhile for the issuer to continue operating it. In this case, the ETF is closed, the shares are sold and you get your money back. However, if the price is down at the time of the forced sale, you will incur a loss.

- A total loss may occur if all of the companies included go bankrupt at the same time. However, even with an ETF containing only a few stocks, the risk of such an event is extremely low: even during the worst crises, there has never been such a mass bankruptcy!

- If you invest in related products such as ETNs (exchange-traded notes), ETCs (exchange-traded commodities) or ETDs (exchange-traded derivatives), total losses are possible. From a legal perspective, these investment classes represent a promissory note issued by the issuer. If the issuer goes bankrupt, your money is lost!

Due to the broad diversification of most ETFs, they are considered particularly safe investments. However, you should be aware of the underlying risk! You can find all the important information here:

From practice: How you can use ETFs

Have exchange-traded index funds piqued your interest and are you looking to invest as well? Nothing could be simpler! Here you will find the most important instructions, tips and tricks to get started or optimise your existing financial strategy.

ETF trading

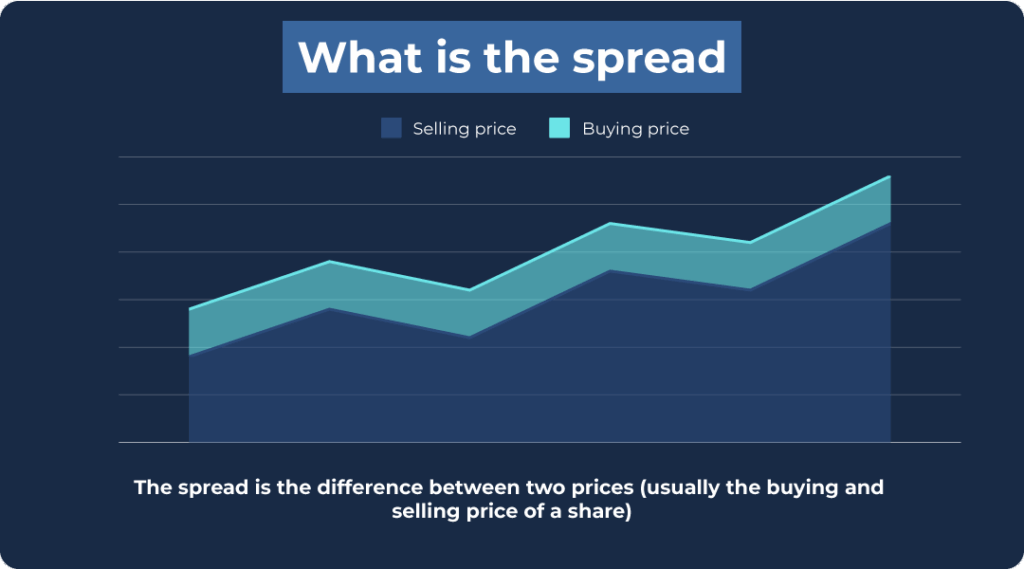

To benefit from exchange-traded index funds, you first need to buy them and, in the case of savings products, sell them again later. This process is actually quite simple. However, if you want to get the most out of your investments, there are a few things you should keep in mind:

- The purchase is now completely free of charge via your broker, but almost all providers charge fees for selling. You should therefore think carefully about such transactions and always compare prices.

- The timing of the sale is crucial for all exchange-traded products! If your funds are currently deep in the red, you should ideally not sell them and instead wait for the price to recover. In practice, however, this is often easier said than done.

- Taxes are payable on profits from sales and dividends received. However, you can reduce this burden by making use of allowances and clever staggering.

You can find more tips on how to maximise your profits and keep costs and taxes low here:

Buy ETFs

Everything starts with the purchase. Only those who invest can benefit from the funds! There are numerous tricks for keeping the purchase price low and avoiding fees, either partially or even completely.

The cheaper you buy, the better your return will be when you sell again one day! I have compiled the best tips and everything you need to consider when investing here for you:

Sell ETFs

Distributing funds provide you with regular cash. All other products only generate a profit when you sell them! A lot can go wrong and affect your return: taxes, fees or simply the wrong timing.

Selling is therefore always associated with a thrill. However, you should keep your emotions in check if you want to sell your ETFs at maximum return. I have summarised the most important tips on how to keep a cool head and achieve ideal results:

ETF savings plan

When investing, you have two methods to choose from:

- You can buy funds directly, i.e. execute a single purchase order. This is referred to as a one-time purchase.

- However, there are also savings plans available. These are a kind of subscription: a purchase is automatically made for you at regular intervals.

You can set up a savings plan with most (but not all) brokers today. You can largely determine the amount per transaction, when and at what intervals the purchase should take place.

Savings plans are not only available for exchange-traded funds, but also for stocks! For example, the popular broker Trade Republic offers around 2,200 ETF savings plans and almost 3,000 stocks eligible for savings plans. The best thing about it: purchasing via a savings plan is free of charge – the broker does not charge any fees!

Regular execution has two important advantages: it helps you to work on your assets in a disciplined manner, as you only have to set up the savings plan once. Even more exciting, however, is the fact that an ETF savings plan allows you to achieve a very good average purchase price!

Find out how it works and how worthwhile this method can be here:

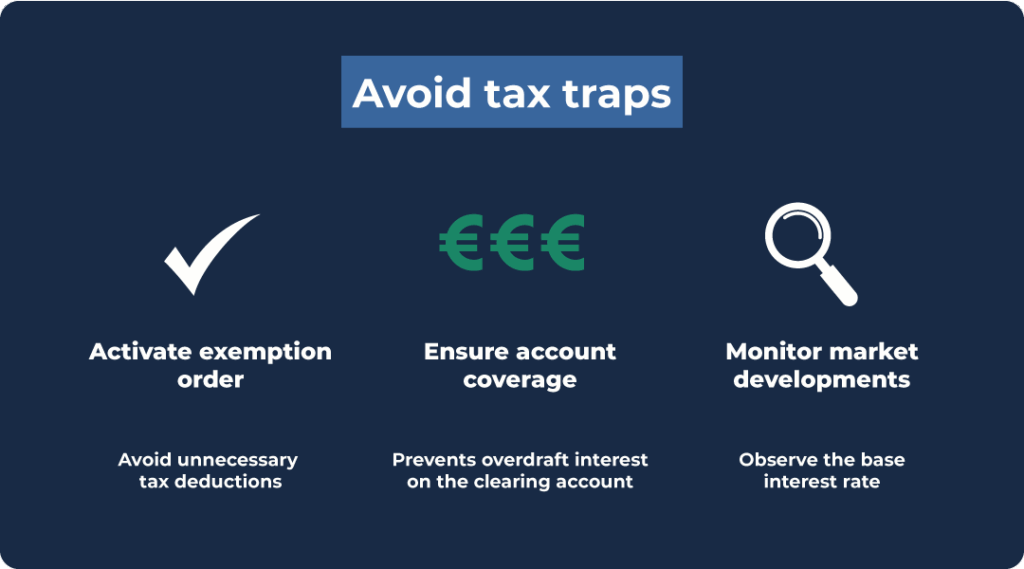

Taxes on exchange-traded funds

If you have earned income, the tax office will come knocking on your door. This also applies to profits from financial transactions. You also have to pay tax on your income from ETFs. Find out exactly how it works here.

ETF taxes

Income from ETFs – whether from distributed dividends or gains on sale – is taxable. The tax burden in Germany is as follows:

- Your winnings are subject to a 25% withholding tax. In addition, there is a solidarity surcharge, bringing the total tax burden to 26.375%.

- There is an allowance of €1,000 per person (€2,000 for married couples). All winnings up to this amount remain tax-free; anything above this amount is subject to tax.

- If your personal income tax is lower than the 26.375% flat-rate withholding tax, you can switch to the lower tax rate. This is done via a so-called ‘Günstigerprüfung’ (most favourable tax treatment check), which you can apply for as part of your tax return.

Lump sum payment

For exchange-traded funds (and other fund products), an additional tax on the advance lump sum may apply. This is a fee levied on profits.

The calculation is somewhat complicated (first, a base return is calculated, to which the current base interest rate is then applied), but your broker will do this for you. The actual amount payable is limited and currently stands at around 0.33% for a stock ETF.

If your find pays a dividend, the advance lump sum is reduced even further. This is because the payments are deducted from the taxable amount, but in return are subject to withholding tax (after all, they are profits).

How to choose the right find

If you’ve read this far, you’re already an expert on ETFs. But one area remains a difficult task, no matter how much knowledge and experience you already have: choosing the right fund! After all, you want the product you choose to be worthwhile! Here are a few tips.

Beginners in particular are quickly overwhelmed by the huge selection of exchange-traded index funds. Thousands of products are available and just waiting for your investment! But if you take a closer look, making the right choice is surprisingly easy.

You only need to know and understand a handful of characteristics of ETFs. In just a few minutes, even beginners can learn the right tools and select lucrative investments. You can find the most important steps here:

ETF savings plan or one-off investment

Once you have found something suitable, you are faced with a choice: should you make a one-off purchase or set up a savings plan? Both options have their own advantages and disadvantages!

- Most brokers now offer savings plans free of charge, but fees apply for one-off purchases. However, there are various ways to avoid these costs.

- A savings plan offers a good average price, as you sometimes buy at a low price and sometimes at a high price.

- A one-off purchase is more like gambling: if you happen to catch a very low price, you can make a very good deal. If, on the other hand, the price was rather high, you will ruin your return.

- If you have a large amount of cash lying around, it will take some time to invest it through a savings plan. During this time, your unused capital will not generate any returns! A one-off investment may be more worthwhile in this case.

When and for whom which method is worthwhile is not an easy question to answer. You can find the right answer for your personal situation in this article:

Best ETF

A risky industry, a well-diversified global ETF, or the classic dividend aristocrats? Which ETF is ideal for you depends primarily on you and your goals.

However, there are some basic insights and facts that you should not ignore. I have compiled the most important information you need to find the top ETF here:

The special features of ETFs only become really clear when you compare them with other investment products. Below, I will introduce you to some possible alternatives and show you when each type is most suitable.

Difference between funds and ETFs

ETFs have enjoyed tremendous success in recent years. Before these products became widely available, investors had to rely primarily on investment funds. These are also packages of stocks and other assets.

Unlike exchange-traded funds, however, investment funds are managed by professional managers. They select the securities in which to invest and thus attempt to achieve a very good return. There are several problems with this approach:

- Success is by no means guaranteed, and a large number of funds achieve rather disappointing returns.

- Management incurs high costs, which you as an investor must bear.

Although they may appear to be a poor choice on paper, investment funds can be beneficial in certain situations. Find out which ones these are and when ETFs are a better option here:

ETF or Stocks

An exchange-traded fund contains numerous stocks (or other assets) – but that doesn’t mean that buying individual stocks can’t also be a good idea! If you choose shares from the right company, you can achieve very high returns and even outperform most ETFs.

At the same time, however, you are also exposing yourself to a higher risk: the stocks may perform worse than hoped for. Even a total loss is possible if the company goes bankrupt. Such a scenario is virtually unthinkable with a fund, however.

An ideal portfolio therefore consists of both asset classes. The ratio depends on how much risk you are willing to take. You can find all the details on selecting stocks or ETFs here:

ETP, ETC and ETN

Other products are often lumped together with ETFs:

- ETNs (Exchange Traded Notes) also track the performance of an index. However, they are bearer bonds issued by a bank or other financial institution.

- ETCs (Exchange Traded Commodities) contain commodities or a commodity index instead of stocks. This allows you to profit from the commodity market quite easily.

- ETDs (exchange-traded derivatives) contain futures or options and allow such derivatives to be traded on regular exchanges (not just options exchanges).

- ETP (Exchange Traded Products) is the umbrella term for financial products that track indices, cryptocurrencies, commodities and more. ETFs also fall into this category.

Please note that ETN, ETC and ETD are debt securities issued by the issuer. If, for example, the issuing financial institution becomes insolvent, your investment may be lost!

ETFs, on the other hand, are classified as special assets. Even if the issuer goes bankrupt, they remain untouched. In this case, you would get your money back. This makes exchange-traded funds significantly safer!

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

0 % without

Points

0 % without

Points

Points

Points

Points

Points