ETF investment strategy: 6 proven approaches for your financial success

Investing without a strategy is like driving without a destination. You might arrive somewhere, but whether it is your desired destination remains uncertain. ETFs offer many advantages, such as low costs, transparency and broad diversification. However, without a well-thought-out ETF investment strategy, your financial success will be left to chance.

In this article, I will introduce you to six proven ETF investment strategies that are suitable for different needs and risk profiles. Whether you are a beginner or an experienced investor, you will find valuable tips here to help you grow your assets in the long term.

In brief:

- An ETF investment strategy offers you clear structures and planning security.

- Buy-and-hold is the simplest strategy, especially for beginners.

- With the momentum strategy, you can profit from strong price movements.

- Strategies such as the core-satellite strategy combine stability and growth opportunities.

- Diversification and regular rebalancing are crucial for long-term success.

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

0 % without

Points

0 % without

Points

Points

Points

Points

Points

How do you find the right ETF investment strategy for you?

The right investment strategy depends on your goals and your investment type. First, consider whether you want to secure capital or build wealth. ETFs are ideal for the latter.

Another key factor is how much you can invest and how long you can do without the money: long-term investments (at least 5 to 10 years) are suitable for ETFs, while instant access or fixed-term deposits make more sense for short-term goals.

Your risk tolerance also plays a role: a high proportion of stocks (70 to 100%) offers higher returns in the long term, while a mix of stocks and bonds (30 to 50%) is more stable.

Finally, you should decide whether you want to invest actively and make your own decisions or whether you prefer a passive approach, for example with ETFs and savings plans. By considering these factors, you will find an ETF investment strategy that suits you, whether you are conservative or growth-oriented.

How many ETFs make sense for your portfolio?

Your ETF portfolio can be simple or diverse. If you don’t want to spend much time managing it, a combination of a broadly diversified global ETF and a secure bank deposit, such as a call deposit or fixed-term deposit, is a good option. This solution is particularly suitable for a long-term, uncomplicated investment strategy.

If you want more control over the distribution of your investments and the risk/return ratio, you can build your portfolio from several ETFs.

It is advisable to keep the number manageable: two to three ETFs for stocks, supplemented by bonds or commodities, are usually sufficient. A portfolio with a maximum of five to six ETFs generally covers all the important asset classes and remains easy to manage.

1. Buy-and-hold strategy: The classic approach for long-term success

The buy-and-hold strategy is one of the best-known and simplest approaches to wealth accumulation. The basic idea is simple: you buy ETFs that you hold for years or decades, regardless of how the market performs in the short term. The aim is to benefit from long-term market performance and take full advantage of the compound interest effect.

Advantages of the buy-and-hold strategy

- Simplicity: You don’t have to constantly worry about market movements.

- Cost efficiency: Fewer transactions mean lower fees.

- Compound interest effect: Profits are automatically reinvested and generate exponential growth.

- Emotional defence: You avoid impulsive decisions in turbulent markets.

Implementation of the buy-and-hold strategy

- Choose a broadly diversified ETF such as the MSCI World (WKN A0RPWH) or FTSE All-World (WKN A1JX52). These ETFs cover global markets and minimise risk.

- Start an ETF savings plan: Invest a fixed amount regularly, e.g. €100 per month. This takes advantage of the cost averaging effect, which allows you to benefit from fluctuating prices.

- Stay disciplined: even in times of crisis, you should not change your investment strategy. Markets usually recover in the long term.

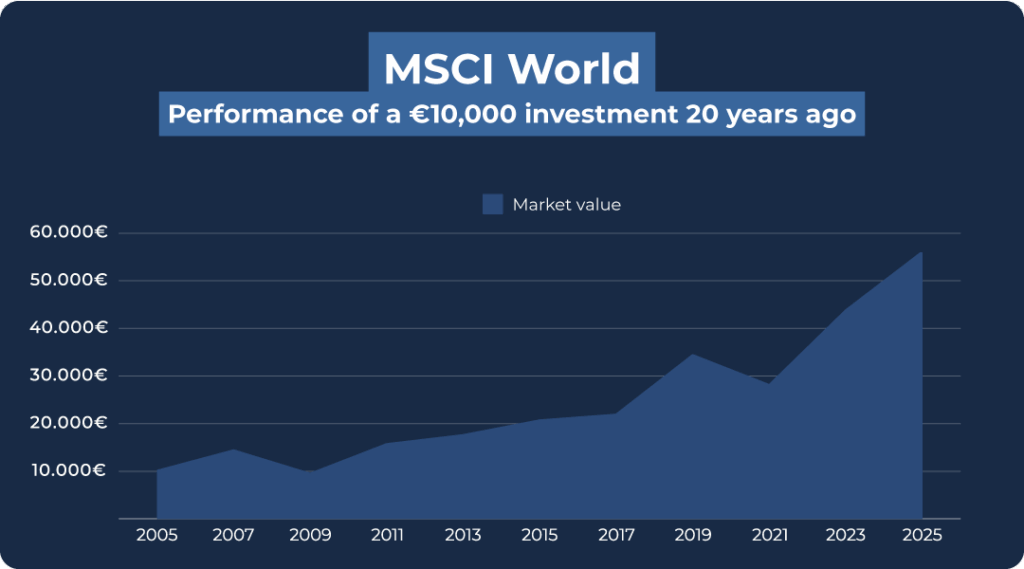

If you had invested €10,000 in an MSCI World ETF 20 years ago and reinvested the dividends, your investment would now be worth around €56,044. This corresponds to an increase in value of around 460%. This calculation is based on an average annual return of around 9%, which takes into account the compound interest effect of reinvesting dividends.

Important:

Did you know that you can also use capital-forming benefits for ETFs? Be sure to read our blog post on this topic.

2. Core-satellite strategy: stability meets return opportunities

The core-satellite strategy is one of the most flexible and secure ETF investment strategies. It combines the advantages of a stable, broadly diversified portfolio with the growth opportunities of specialised, high-yield investments. This model divides your portfolio into two clearly defined areas:

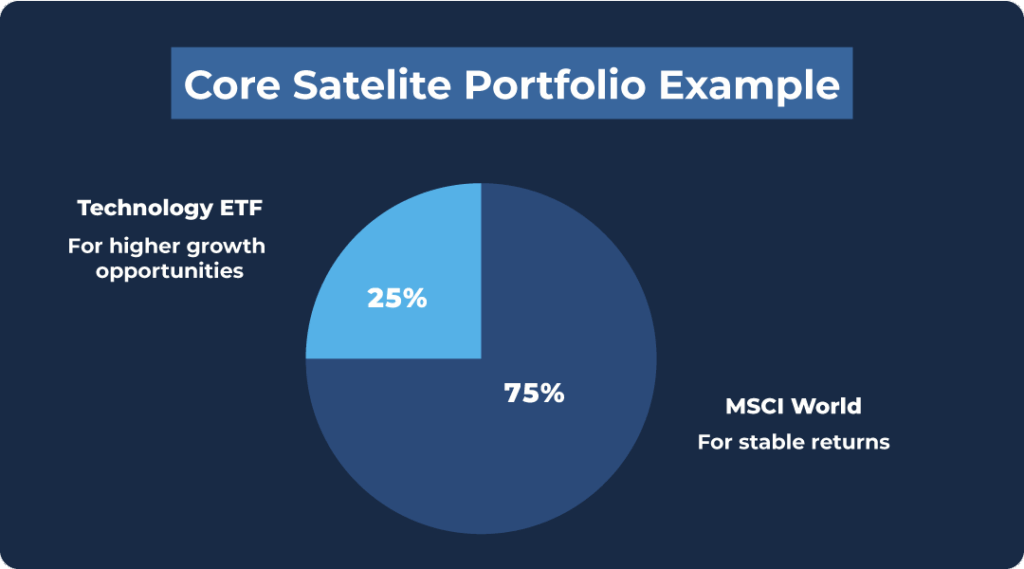

- Core: Stability and security The core forms the solid foundation of your portfolio, accounting for 70 to 80 per cent of its value. It consists of broadly diversified ETFs such as the MSCI World, which ensure long-term stability through diversification and cushion market fluctuations.

- Satellites: dynamism and growth Satellites account for 20 to 30% of the portfolio and focus on high-yield areas such as technology and emerging markets. They offer you the opportunity to benefit from specific growth opportunities and achieve higher returns.

The aim is to create a solid foundation while achieving higher returns in dynamic markets.

Advantages of the core-satellite strategy

- Flexibility: You can adapt your portfolio to current market opportunities.

- Stability: The core ensures security, even if individual satellites incur losses.

- Diversification: You minimise risk by investing in different asset classes and sectors.

- Customisation: Satellites can be tailored to your personal interests.

Implementation in practice

- Invest 70 to 80% in the core: use ETFs such as the MSCI World or the FTSE All-World for the stable part of your portfolio.

- Add 20 to 30% satellites: Invest in high-growth ETFs, e.g. technology, healthcare or emerging markets.

- Rebalancing: Review your portfolio annually and restore the original allocation if necessary.

For example, your portfolio consists of 75% MSCI World and 25% technology ETF. After a strong year, the technology share grows to 35%. Rebalancing allows profits to be realised and the surplus to be reinvested in the core.

This investment strategy is ideal for investors who value security but still want to benefit from growth opportunities.

3. Momentum strategy: profit from trends

The momentum strategy exploits the idea that existing market trends often continue rather than ending abruptly. You invest specifically in ETFs that have outperformed the market in recent months and participate in their price momentum.

This investment strategy is based on the assumption that the momentum of successful ETFs will continue in the near future before the trend weakens.

Advantages of the momentum strategy

- Attractive returns: The momentum strategy enables you to profit from strong price movements and generate targeted gains during periods of high market volatility.

- Clear signals: With the help of technical indicators such as moving averages, the RSI value or breakout levels, you can plan entry and exit points precisely. This reduces uncertainty and creates a clear basis for decision-making.

- Active approach: This ETF investment strategy is particularly suitable for investors who actively follow market movements and want to respond specifically to short-term trends. You are always invested in dynamic markets, which gives you the opportunity to react flexibly to changes.

- Focus on growth stocks: By focusing on strong trends, you can identify ETFs with high growth potential and invest specifically in high-growth sectors such as technology or sustainability.

Implementation in practice

- Choose momentum ETFs: Invest in funds such as the iShares MSCI World Momentum (WKN A12ATF), which specifically bundle companies with strong price growth. Such ETFs focus on stocks that are already in an upward trend, thereby maximising return opportunities.

- Use technical indicators: Analyse the moving average, the RSI (Relative Strength Index) value or breakout levels to find the optimal entry point. These indicators help you distinguish stable trends from short-term fluctuations.

- Set stop-loss orders: Limit potential losses by setting an automatic selling limit if the price falls below a certain level. This protects your capital and ensures that you are not caught off guard by an abrupt trend reversal.

- Monitor regularly: The momentum strategy requires you to continuously observe market movements in order to react to new signals in good time or close existing positions as soon as the trend weakens.

- Diversify within the momentum strategy as well: use ETFs from different sectors or regions to minimise risk and benefit from several market trends at the same time.

The momentum strategy requires discipline and time. You need to analyse market movements regularly and act quickly. In addition, trends can reverse before you profit.

For example, you buy into the MSCI World Momentum ETF when it breaks through the 200-day line. Within six months, you could achieve an ETF return of 15%. When the price falls below the line, you sell to realise the profit.

4. Dividend strategy: stability and passive income

The dividend strategy focuses on companies that pay regular dividends. These companies generate stable income and distribute part of their profits to shareholders.

ETFs that pursue this ETF investment strategy invest in such companies, often referred to as dividend aristocrats. These are companies that have been paying dividends for at least 25 years and are steadily increasing them.

The special thing about the dividend strategy is that it does not only target price gains. You also benefit from regular distributions, which can be used as income or reinvested.

Advantages of the dividend strategy

- Predictable income: Dividends provide a stable and regular source of income, regardless of daily fluctuations on the stock market. This consistency is particularly attractive if you want to build up passive income.

- Crisis-proof: Dividend stocks often show smaller price losses in uncertain times, as companies with stable dividend payments are financially sound. They offer a kind of buffer in volatile markets.

- Long-term returns: Reinvested dividends amplify the compound interest effect, as they flow directly back into the ETF and thus generate additional income. Over the years, this can significantly increase the overall return.

- Emotional stability: Regular distributions act as psychological support and give you security in difficult market phases. You see returns even when prices fall temporarily.

Implementation in practice

- Select suitable ETFs: Invest in dividend ETFs such as iShares DivDAX (WKN 263527), SPDR S&P Global Dividend (WKN A1T8GD) or Vanguard FTSE All-World High Dividend Yield (WKN A1T8FV). These funds bundle companies that pay high and stable dividends.

- Reinvest dividends: With accumulating ETFs, distributions are automatically reinvested, which leads to higher returns in the long term. Alternatively, you can use distributing ETFs to have the dividends paid out to you.

- Diversify: Choose ETFs that cover different regions and sectors to spread your risk.

Comparison table: Dividend ETFs at a glance

| ETF | Dividend yield | Costs (TER) | Region |

| iShares DivDAX | 3,5 % | 0,31 % | Germany |

| SPDR S&P Global Dividend | 4,2 % | 0,40 % | Global |

| Vanguard FTSE All-World HDY | 3,8 % | 0,22 % | Global |

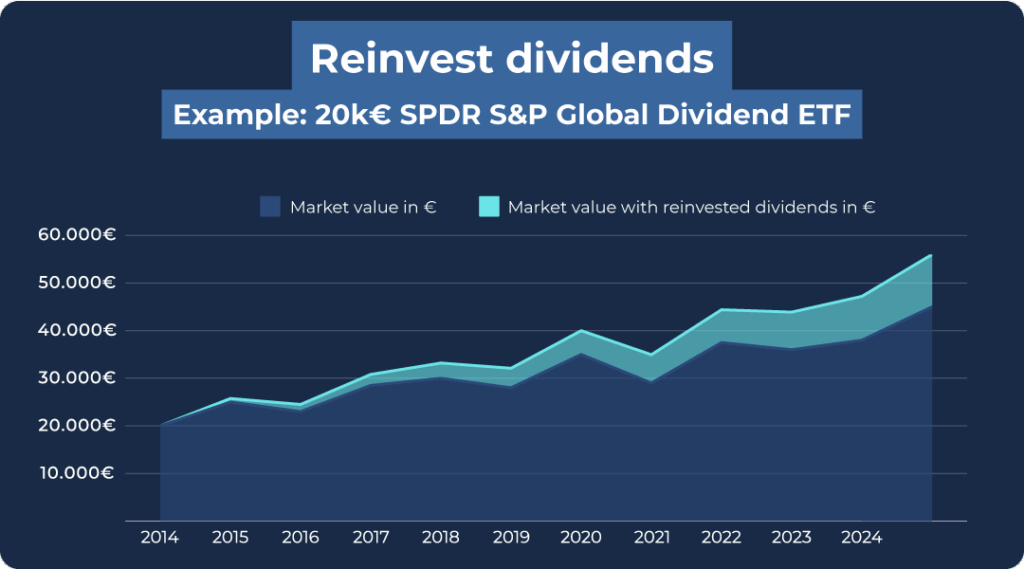

Imagine investing €20,000 in the SPDR S&P Global Dividend ETF, which offers you an average dividend yield of 4.2%. Each year, you receive €840 in distributions, which you consistently reinvest.

After 10 years, you will have accumulated an additional €10,179 solely through dividends and their reinvestment. And that’s without paying in any more money.

Without reinvesting the dividends, you would have earned ‘only’ €8,400 in dividends over the 10 years.

This example shows you how the compound interest effect through dividends can significantly increase your return while your initial capital continues to work for you.

Important:

There is even the possibility of receiving monthly dividends through ETFs.

5. Value strategy: Investing in undervalued companies

The value strategy aims to find undervalued stocks. These companies are trading at a price below their intrinsic value. The concept was made famous by legendary investors such as Warren Buffett and is considered one of the most successful approaches to long-term investment.

Value ETFs invest in such companies and offer you the opportunity to profit from future price growth when the market recognises their true value.

Advantages of the value strategy

- Attractive prices: With the value strategy, you invest in stocks that are trading below their intrinsic value. In other words, they are essentially on ‘sale’. This minimises your risk, as you pay less for potentially profitable companies and benefit from a safety margin in case the market develops unexpectedly.

- Long-term potential: Undervalued companies often have high growth potential, as the market frequently recognises their quality only at a late stage. Once their true value is recognised, the share price rises significantly, which can bring you considerable returns.

- Proven method: The value strategy has proven itself over decades and is used by successful investors such as Warren Buffett. Studies show that value investments beat the broad index in many markets over the long term.

- Stable companies: Value ETFs often contain established companies with solid business models. These companies are less susceptible to market fluctuations and offer you additional security.

- Value-oriented growth: Unlike pure growth strategies, the value strategy focuses on substance and sustainability. This makes it particularly suitable for investors who are patient and have a long-term investment horizon.

With the value strategy, you focus on proven companies at attractive prices and benefit from their long-term increase in value. In other words, a combination of security and growth.

Implementing the value strategy in practice

- Select a value ETF: Opt for proven funds such as the iShares MSCI World Value (WKN A12ATG) or the SPDR S&P 500 Value ETF (WKN A0MYDQ). These ETFs filter undervalued companies based on key figures such as the price-earnings ratio (P/E) or the price-book ratio (P/B). Such criteria help to specifically select stocks with high growth potential and attractive valuations. This allows you to benefit from broad diversification and reduce the risk of betting on individual mispricings.

- Think long term: The value strategy is not an approach for quick profits. It often takes years for the market to recognise a company’s true value. Be prepared to hold your portfolio for at least 5 to 10 years to really benefit from this investment strategy. Patience is the key to long-term success here.

- Rebalance: Regularly check whether the companies included in the ETF still have attractive valuations. Markets change, and not all stocks remain undervalued in the long term. Annual rebalancing helps you to ensure that your portfolio is always optimally positioned and that the original investment strategy is maintained.

- Take advantage of market opportunities in a targeted manner: Make sure to make additional investments during market corrections or times of crisis, as value stocks are often particularly cheap during such phases. This can significantly increase your long-term returns.

Imagine investing €15,000 in the iShares MSCI World Value ETF. This fund contains proven companies such as Johnson & Johnson and Procter & Gamble, which are known for stable profits and attractive valuations.

After 10 years, you will achieve a remarkable increase in value with an average annual return of 8%. Your portfolio will grow to €32,383, solely through the combination of solid company values and the compound interest effect. This allows you to benefit from the strength of the value strategy in the long term.

6. 70/30 portfolio strategy: The perfect balance between risk and security

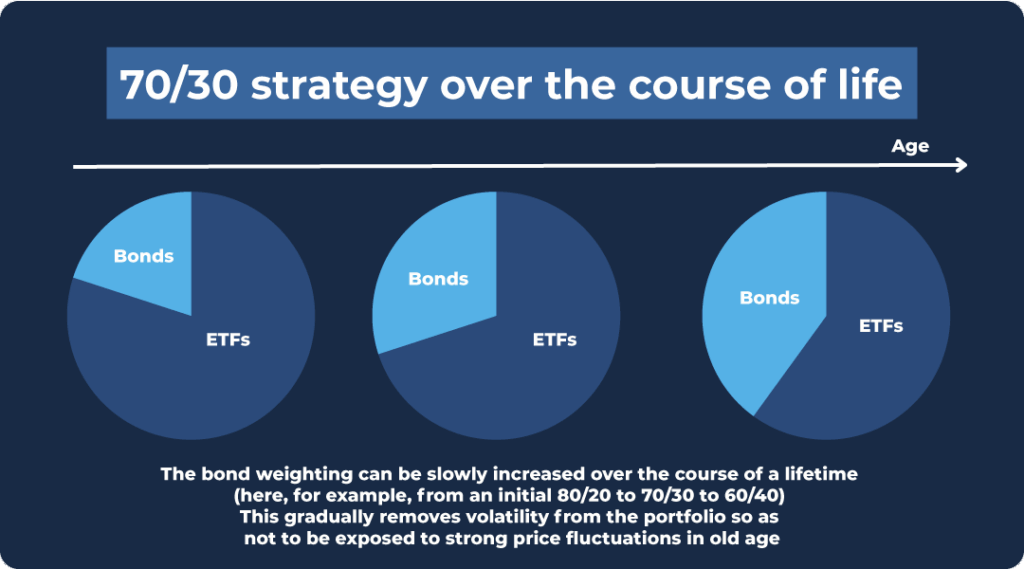

The 70/30 strategy is one of the most popular approaches for investors seeking a balanced combination of returns and stability. It combines 70% stock ETFs, which target long-term growth, with 30% bond ETFs or other safer investments that stabilise the portfolio.

This allocation allows you to benefit from the growth opportunities offered by the equity markets, while bonds reduce volatility.

The aim of the ETF investment strategy is to ensure solid risk management without sacrificing returns. It is particularly well suited to investors who want to build up long-term wealth and value security and predictability.

Advantages of the 70/30 strategy

- Stability: The bond portion acts as a buffer against market fluctuations. Especially in times of crisis, bonds can cushion losses in the equity portion and give your portfolio a certain degree of stability.

- Flexibility: The weighting can be adjusted to suit your stage of life and risk appetite. Younger investors could start with an 80/20 distribution, while older investors may prefer a more conservative ratio such as 60/40.

- Diversification: By combining different asset classes such as stocks and bonds, you minimise your overall risk and reduce your dependence on individual markets or sectors.

- Predictability: The clear structure helps you to act in a targeted manner in different market phases without calling your entire ETF investment strategy into question. You know exactly how your portfolio is structured and what role each asset class plays.

- Protection against inflation: Stocks offer long-term protection against loss of purchasing power, while bonds provide stability. This combination ensures balanced asset growth.

Implementation in practice

- Choose stock ETFs for the bulk of your portfolio: invest in broadly diversified funds such as the MSCI World, FTSE All-World or similar global indices to benefit from global market developments.

- Supplement with bond ETFs: Invest 30% of your portfolio in government bond ETFs (e.g. WKN: A0J202) or corporate bonds to create stability. Depending on your risk appetite, you can also invest in inflation-protected bonds or short-term securities.

- Adjust the weighting: Adjust the ratio of stocks to bonds to suit your age and goals. A young investor can start with 80/20, while an investor approaching retirement is more likely to opt for 40/60.

- Rebalancing: Review your portfolio at least once a year. If the weighting shifts due to price gains or losses, rebalance it by shifting profits from equities to bonds. Or vice versa.

Imagine you invest €50,000 according to the 70/30 rule. Of this, you invest €35,000 in equities and €15,000 in bond ETFs. After five years, strong growth means that equities now account for 80% of your portfolio.

To maintain your original risk profile, you sell some of your stocks and invest the profits in your bond portion. This restores the original 70/30 distribution, secures your returns and reduces potential risks in the event of future market fluctuations.

Are you wondering which broker is better suited to you? Find out everything you need to know about costs, trading offers and features of Scalable Capital vs Trade Republic in our detailed comparison to make the best decision for your ETF portfolio.

Conclusion: Find your ideal ETF investment strategy

Choosing the best ETF investment strategy is the key to successful and stable wealth accumulation. Each strategy you have learned about in this article has its own strengths and is tailored to different needs and goals.

If you are new to ETFs, the buy-and-hold strategy offers a solid and straightforward introduction. With the momentum strategy, you can focus on current market trends and take advantage of higher return opportunities.

The core-satellite strategy combines the security of a broad foundation with the potential of targeted growth investments. Dividend strategies offer you an ideal opportunity to generate passive income, while the value strategy enables long-term growth at attractive prices.

The 70/30 portfolio ultimately strikes the perfect balance between security and returns.

What all strategies have in common is the need for discipline and consistency. Long-term success depends not only on choosing the right ETFs, but also on consistently pursuing your ETF investment strategy, regularly rebalancing your portfolio and responding flexibly to changing circumstances.

Start with the ETF investment strategy that best suits your goals, risk tolerance and time horizon. Adjust it as you review your portfolio and deepen your knowledge. Remain patient and let your money work for you. This will lay the foundation for financial success and security.

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

0 % without

Points

0 % without

Points

Points

Points

Points

Points