ETF replication methods: A comprehensive overview for private investors

As a private investor, you face the challenge of structuring your portfolio in the best possible way. Exchange-traded funds (ETFs) have established themselves as a popular investment instrument for this purpose.

But not all ETFs are the same! A key difference lies in the replication method.

In this article, you will learn everything you need to know about ETF replication methods, their advantages and disadvantages, and their impact on your investments.

In brief:

- There are three main types of ETF replication: full physical replication, optimised sampling and synthetic replication.

- The choice of replication method affects the costs, performance, tracking error and risks of an ETF.

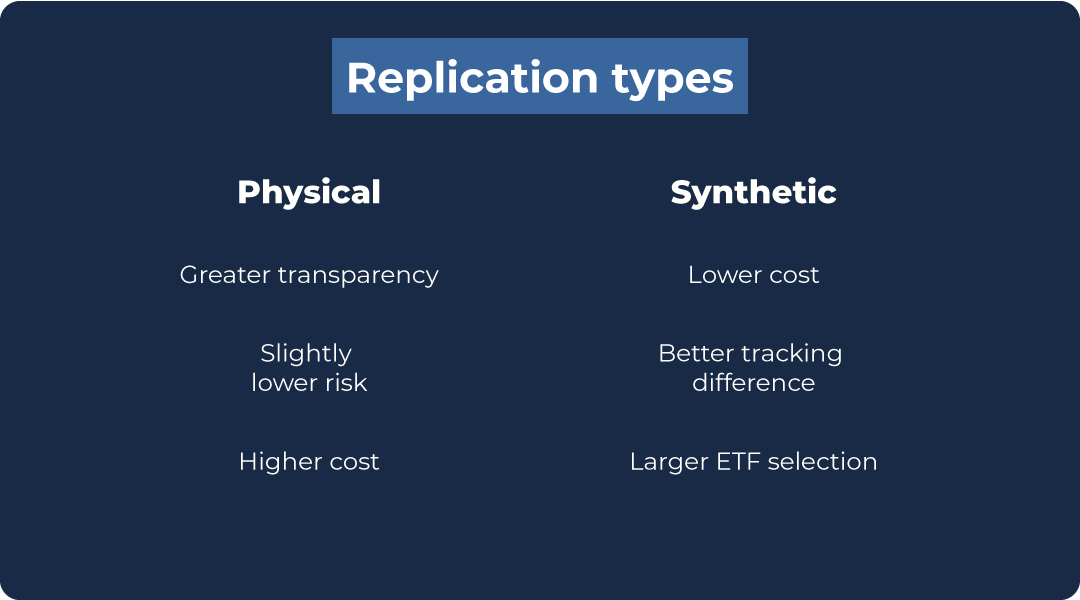

- Physically replicated ETFs are currently more popular with many investors due to their transparency and simplicity.

- The optimal replication method depends heavily on the index to be replicated and the specific market conditions.

- According to a study, accumulating index funds had a very low tracking error of only 0.11%. Distributing funds were at 0.33%.

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

0 % without

Points

0 % without

Points

Points

Points

Points

Points

What does ETF replication mean?

ETF replication refers to the way in which an ETF attempts to replicate the performance of a specific index as closely as possible. There are three main methods by which an index fund replicates:

- Physical replication

- Optimised sampling (a form of physical replication)

- Synthetic replication

Each of these methods has its own characteristics that affect costs, index accuracy and potential risks.

Physical replication: The direct method

In physical replication, the ETF actually purchases the securities of the underlying index. This is the most intuitive method and the one that is easiest for many investors to understand.

Complete physical replication

In full physical replication, also known as ‘ETF replication’, the fund purchases all securities in the index in exactly the same weightings.

Advantages:

- High transparency: You know exactly which securities the ETF holds.

- Low tracking difference: The deviation from the index is usually minimal.

- No counterparty risk: Since the index fund owns the actual securities, there is no risk from third parties.

The counterparty risk associated with ETFs is the risk that a business partner of the ETF provider becomes insolvent. Conservative investors may consider index funds without counterparty risk to be the best ETFs for them.

Disadvantages:

- Higher costs for complex indices: Transaction costs may increase for indices with many components.

- Possible liquidity problems: In illiquid markets, it may be difficult to buy or sell all index components.

Optimised sampling

Optimised sampling, also known as ‘physically optimised ETF’, is a variant of physical replication. Here, the index fund only purchases a representative selection of the index components.

The physically optimised ETF method, i.e. optimised sampling, offers a number of specific advantages, but also has some disadvantages:

Advantages:

- Cost efficiency: Transaction costs can be reduced by purchasing fewer securities.

- Improved liquidity: This can improve tradability, particularly for large or illiquid indices.

Disadvantages:

- Potentially higher tracking difference: The deviation from the index may be greater than with full replication.

- Lower transparency: The exact composition of the ETF portfolio may differ from the index.

Synthetic replication: an alternative method?

Synthetic replication is an advanced method of ETF replication that differs significantly from physical replication.

With this method, the ETF uses derivatives, in particular swaps, to replicate the performance of the underlying index.

How synthetic replication works

A synthetic ETF enters into a swap agreement with a counterparty, typically a bank. The counterparty undertakes to deliver the exact return of the index to the index fund.

In return, it receives the return on a basket of securities held by the ETF. This basket does not necessarily have to correspond to the index components.

Synthetic ETFs, often referred to as swap-based ETFs, deserve closer examination as they offer both opportunities and risks.

How it works in detail

- The ETF collects investor funds.

- These funds are used to purchase a basket of securities that does not necessarily correspond to the target index.

- The index fund enters into a swap agreement with a bank.

- The bank undertakes to deliver the return of the target index.

- In return, the bank receives the return on the basket of securities.

Risk management for synthetic ETFs

In order to minimise counterparty risk, many providers of synthetic ETFs employ various safety mechanisms:

- Collateralisation: The swap partner deposits collateral that can be used in the event of default.

- Daily reset: The swap is reset daily to limit risk.

- Multiple swap partners: Some ETFs spread the risk across multiple counterparties.

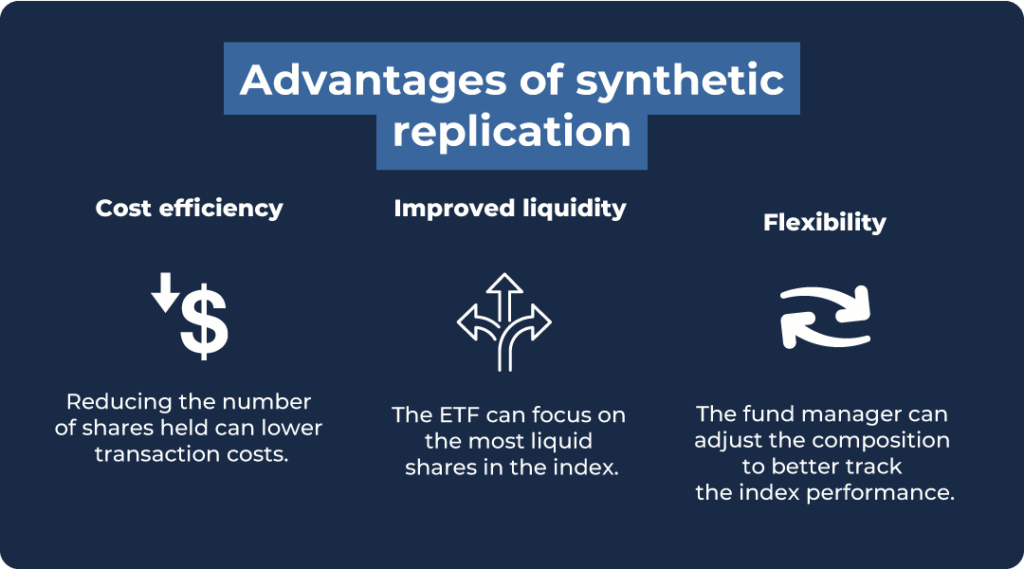

Advantages:

- Very accurate index replication: Often lower tracking difference than physical index funds.

- Access to difficult markets: Enables investment in markets that would otherwise be difficult to access.

- Potentially lower costs: This method can be more cost-effective for complex indices.

Disadvantages:

- Counterparty risk: The ETF is dependent on the solvency of the swap counterparty.

- Complexity: The structure may be more difficult for many investors to understand.

- Regulatory concerns: Some countries have stricter regulations for synthetic ETFs.

ETF replication meaning:

This refers to the method used by an ETF (Exchange Traded Fund) to replicate its underlying index.

Comparative analysis of ETF replication methods

To help you decide between the various ETF replication methods, let’s take a look at them in direct comparison:

| Method | Advantages | Disadvantages | Best use |

| Complete physical replication | – High transparency – Low counterparty risk – Accurate index replication | – Can be expensive for large indices – Potentially higher tracking difference in illiquid markets | Simple, liquid indices (e.g. DAX) |

| Optimised sampling | – More cost-efficient for large indices – Better tradability | – Slight deviations from the index possible – Less transparent than full replication | Large or partially illiquid indices (e.g. MSCI World) |

| Synthetic replication | – Very accurate index replication – Good for hard-to-access markets – Often more cost-effective for complex indices | – Counterparty risk – More complex structure – Potentially stricter regulation | Complex or exotic indices (e.g. commodity indices) |

Performance comparison of replication methods

Let’s take a quick look at how well different types of ETFs perform.

A study conducted in 2022 observed 14 ETFs over a period of 10 years. These index funds all track the Euro Stoxx 50, which is a list of the 50 largest companies in Europe.

What did the researchers discover?

- Tracking error: This is the deviation between the ETF and the index it is supposed to track. The smaller the better. Index funds that reinvest profits (accumulating ETFs) had a very small tracking error of only 0.11%. ETFs that pay out profits (distributing ETFs) were at 0.33%.

- Accuracy: All ETFs performed very well in tracking the index. This shows that modern ETFs, regardless of how they are structured, can operate very accurately.

What does this mean for you as an investor?

- If you are looking for an ETF that tracks the index very closely, you could choose an accumulating ETF.

- Don’t just focus on accuracy. Costs and long-term development are also important.

- ETFs are very accurate over long periods of time. Don’t worry about short-term fluctuations.

- It is beneficial to have various ETFs that track different indices.

- Check regularly to see if there are any new, better ETFs available.

Optimised sampling or complete replication?

The decision between an optimised sampling ETF or full replication depends on various factors:

- Index size and complexity: For very broad indices such as the MSCI World, which comprises over 1,600 stocks, optimised sampling can be more cost-efficient, whereas for more concentrated indices such as the DAX, full replication is often preferable.

- Liquidity of index components: For indices with many illiquid components, optimised sampling can improve tradability.

- Costs: Full replication can result in higher transaction costs for complex indices.

- Accuracy of index replication: Full replication generally provides a more accurate representation of the index, while optimised sampling may result in slight deviations.

Practical examples and use cases

To illustrate the effects of the various replication methods in practice, let us consider some concrete examples of different index types:

DAX ETF with full physical replication

The iShares Core DAX UCITS ETF (DE) with ISIN DE0005933931 tracks the German benchmark index DAX, comprising 40 stocks, through full physical replication.

This method is very efficient here, as the DAX contains relatively few highly liquid stocks. The ETF has a very low tracking difference, which demonstrates the high accuracy of the index replication.

With a total expense ratio (TER) of just 0.16% and a fund volume of over €6.4 billion, this ETF is a cost-effective and liquid option for investors looking to invest in the German stock market.

MSCI World ETF with optimised sampling

The Xtrackers MSCI World UCITS ETF 1C with ISIN IE00BJ0KDQ92 uses optimised sampling to track the MSCI World Index, which comprises over 1,600 stocks.

Instead of buying all stocks, the index fund holds only around 700-800 positions. Nevertheless, it achieves a low tracking difference. This shows how effective optimised sampling ETFs can be for very broad indices.

With a TER of 0.19% and a fund volume of over €17 billion, this ETF is a popular choice for global equity investments.

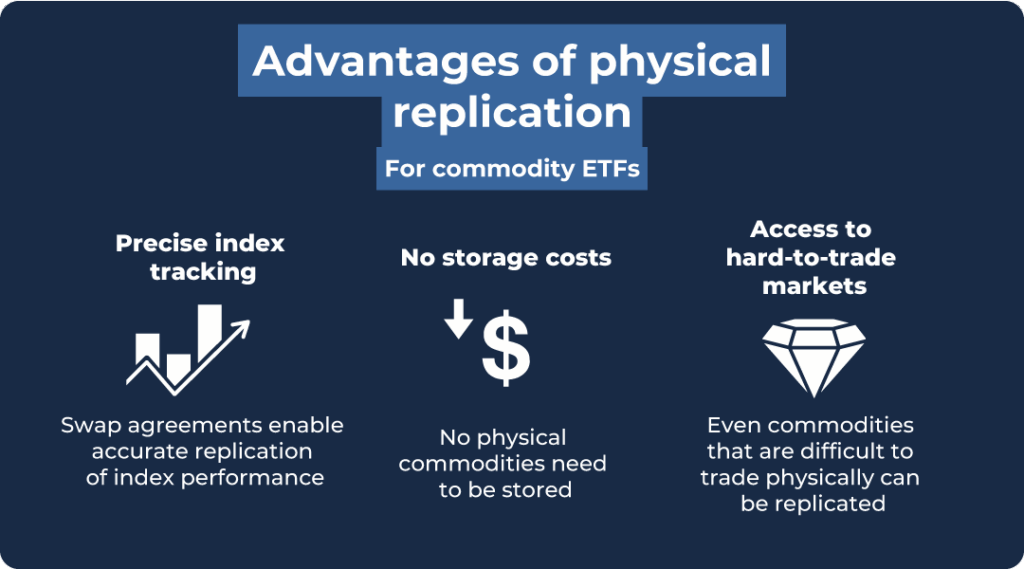

Commodity ETF with synthetic replication

The Xtrackers Bloomberg Commodity Swap UCITS ETF 1C with ISIN LU2278080713 uses synthetic replication to track the Bloomberg Commodity Index.

Since the direct purchase and storage of raw materials would be impractical, the swap-based structure enables the index to be accurately replicated.

With a TER of 0.19%, this index fund offers a cost-effective way to invest in a broadly diversified commodity index.

Good to know:

These examples show how the choice of replication method depends on the type of underlying index and how each method can offer advantages in certain situations.

Current trends and developments

The world of ETF replication is constantly evolving. Some current trends include:

Hybrid models

More and more ETF providers are experimenting with hybrid models that combine elements of different replication methods.

For example, an index fund could mainly replicate physically, but use swaps for market segments that are difficult to access. This flexibility can improve efficiency and the cost structure.

Improved sampling techniques

Advances in data analysis and artificial intelligence are enabling increasingly precise sampling methods. ETF providers use complex algorithms to identify optimal subsets of securities that can track the index even more accurately.

Increased transparency for synthetic ETFs

In response to concerns about counterparty risk, many providers of synthetic ETFs now offer greater transparency. Some publish daily information about the composition of the basket of securities and the swap counterparties.

ESG integration

The growing importance of environmental, social and governance (ESG) criteria is also influencing ETF replication. Index fund providers are developing new methods to integrate ESG factors into their replication strategies without compromising index tracking.

These developments demonstrate that the ETF industry is continuously working to improve its offering in order to provide investors with more efficient and transparent products.

Are you familiar with dividend ETFs?

Dividend ETFs, which focus on companies with high payout ratios, are a popular type. ETFs are particularly attractive as retirement investments for investors who are interested in regular income and want to generate passive income. Alternatively, you can build up this income through an ETF pension insurance policy.

Tax aspects of ETF replication

The choice of replication method may also have tax implications, particularly with regard to the treatment of dividends:

- Physically replicating ETFs: Dividends are collected directly and can be passed on to investors in the case of distributing ETFs.

- Synthetic ETFs: Dividends are treated via the swap. This may result in different tax treatment in some countries.

Despite this standardisation, there are a few things investors should keep in mind:

- Distributing vs. accumulating ETFs: Regardless of the replication method, the choice between distributing and accumulating index funds can have tax implications. With distributing ETFs, dividends are paid directly to investors and are immediately taxable. With accumulating index funds, the income is reinvested, which can lead to a tax deferral effect.

- Withholding tax: With physically replicating ETFs that invest in foreign stocks, withholding tax may be levied. Depending on the double taxation agreement, this may be partially or fully creditable. With synthetic index funds, withholding tax is often taken into account in the swap agreement.

- Partial exemption: ETFs that hold a certain percentage of equities benefit from a partial exemption on income. This applies to both physically replicating and synthetic index funds, provided they meet the relevant criteria.

- Tax optimisation: Some providers use the replication method for tax optimisation. For example, synthetic ETFs can in some cases offer tax advantages when replicating dividend strategies.

It is important to note that tax regulations are subject to change and the tax treatment of ETFs may vary from country to country.

As an investor, you should therefore regularly check the current tax regulations or consult a tax advisor.

Ultimately, tax considerations should be factored into the investment decision, but they should not be the sole deciding factor. The overall performance, risk profile and suitability for the individual investment strategy should be the main criteria when selecting an ETF.

Conclusion: Which ETF replication methods will you invest in in 2025?

Choosing the right ETF replication method is an important aspect of selecting an index fund. Each method has its advantages and disadvantages, which vary depending on the type of index, market conditions and individual investor objectives.

Physical replication, whether full or optimised sampling, offers high transparency and minimises counterparty risk. It is often the best choice for simple, liquid indices or for investors who value direct ownership of the index components.

Synthetic replication can offer advantages for complex or difficult-to-access indices, but it does involve a certain counterparty risk. It is particularly useful for commodity or currency indices.

The decision between optimised sampling and full replication often depends on the size and liquidity of the index. For very broad indices such as the MSCI World, optimised sampling can be more cost-efficient, while full replication is often preferable for concentrated indices.

As an investor, when selecting an ETF, you should not only pay attention to the replication method, but also consider other factors such as the total expense ratio (TER), the tracking difference and the trading volume.

A thorough comparison of different index funds that track the same index can help you find the product that best suits your needs.

Ultimately, there is no ‘best’ replication method for all situations. The optimal choice depends on your individual investment objectives, risk tolerance and the specific index you wish to invest in.

With knowledge of the various methods and their characteristics, you are now better equipped to make informed decisions for your ETF portfolio.