Industrial ETFs: lucrative returns or pre-programmed losses?

Investing in manufacturing companies is an obvious choice for many investors. Thanks to industrial ETFs, it is particularly easy to get started with reduced risk. However, although industry plays such an important role in our economy, the successes have recently failed to materialise!

Internal and external influences have caused problems for manufacturing companies. Can investors still generate profits with an ETF from the industry? Or are the ‘golden years’ over? I have analysed it in detail! I also present the most important industrial ETFs and some lesser-known but still interesting alternatives.

In brief:

- The industry sector includes some of the largest and most important companies in the world

- The past few months have been difficult and future developments remain uncertain

- High importance for our economy and society nevertheless makes industrial ETFs attractive

- Related areas, such as robotics and automation, often offer even more attractive returns

The industry is indispensable

Industrial companies process raw materials into usable products. They are therefore a fundamental pillar of our society. Without such companies, our current standard of living would be unthinkable!

From simple objects such as our furniture and food to highly complex objects such as cars, smartphones and aeroplanes: their production falls under the umbrella term of industry. It is therefore not surprising that industry is one of the largest and most important sectors of our economy. The largest and most valuable companies in the world belong to this sector!

There is no standardised definition of exactly which production companies are classified as industrial. While in many regions, for example, the automotive industry or the construction industry are regarded as separate fields, in Germany they are usually simply counted as part of the industrial sector.

If we take the somewhat broader definition, industry is the economic sector with the highest turnover. If, on the other hand, the automotive industry, ‘luxury goods’ and other sectors are regarded as independent sectors, industry is only beaten by the financial sector.

Economic outlook

Due to their great importance for our society, industrial companies are generally a safe investment. However, this does not mean that shares or industrial ETFs are always profitable!

Manufacturing companies were hit hard by the Covid pandemic. Although the recovery was surprisingly quick, the general conditions remain critical.

A collapsing supply chain, shortages of raw materials and events such as Russia’s attack on Ukraine continue to weigh on the economy. Most experts also agree that we are heading for a recession that could last for several months.

Industrial companies manufacture a wide range of products. Some of them will continue to be in demand even in difficult economic times. However, there are also so-called ‘non-consumer staples’, sales of which are likely to decline significantly.

The performance of industrial ETFs clearly shows that we have not yet overcome the lean period that has lasted for several months. Nevertheless, ETFs from the industrial sector are very popular with investors: hardly any other sector has such a high probability of making handsome profits again in the future!

Only the exact timing quickly becomes a problem: it is difficult to estimate at what point in the economic development we are currently at and whether the ideal time for an investment (lowest price) has already been reached or will only come in the next few months.

How an industrial ETF works

Whether ETF Industry, ETF Renewable Energies, ETF Global Economy or one of the many other products: The composition of such exchange-traded funds is always determined on the basis of fixed rules. They each follow an index.

In the case of industrial ETFs, for example, this could be the ‘World Industrials’ index from MSCI. This is a list of listed industrial companies in industrialised nations.

If an ETF is based on this index, the investors’ capital is used to buy shares in the companies included. The distribution, i.e. the percentage of assets invested in an individual company, is also fixed.

An ETF can also be based on a different index and be limited to a single nation, for example. Other specifications or restrictions are also possible, which can result in an even more specialised offering. However, as the selection always follows fixed rules, exchange traded funds are very predictable and clear.

An industry ETF is regularly adjusted. Shares that no longer meet the criteria are automatically removed, while new ones may be added. The allocation (what percentage is allocated to a company or nation) is also updated if it has been defined in the ETF’s rules.

Advantages and disadvantages of an industrial ETF

Investments in the industrial sector are part of numerous investment strategies. An ETF from the industrial sector offers numerous advantages! This is because several shares of companies are grouped together.

We can acquire shares in such an industry ETF and are thus invested in all the companies it contains. Due to the broad diversification, we are significantly less affected by any price slumps in individual shares.

At the same time, however, we can also benefit less from particularly favourable developments in individual stocks, as we have only invested a small portion of our capital in each case. We therefore invest in the entire industry through industrial ETFs; the focus is on the sector, not on individual companies.

This can be problematic in the case of ETFs from the industrial sector: Here it is doubtful whether there will be any lucrative growth in the coming months. It is more likely that the entire sector will suffer from the coming recession.

If you invest in an industrial ETF today, you may initially record considerable losses before you start to make gains again. However, the opposite scenario is also possible! We invest broadly in the entire industry and are therefore dependent on its success.

As such ETFs for industry or other fields simply replicate an existing index, they do not require highly paid managers to select the shares. As a result, such exchange-traded funds can be offered at significantly lower prices than traditional funds. This is one of the reasons why this form of investment has developed so rapidly in recent years!

The best ETFs for the industrial sector

If you want to invest in the industry through ETFs, you are faced with a wide range of possible products. There is not only a product for every region; we can also differentiate based on company size, focus (growth, dividends…) and many other factors.

Sector ETFs even make it possible to enter a specific sub-sector, such as the aviation industry. Below you will find a selection of such special offers as well as the most popular ‘classics’ among industry ETFs!

1. Xtrackers MSCI World Industrials UCITS ETF 1C

| Xtrackers MSCI World Industrials UCITS ETF 1C |

| ISIN IE00BM67HV82 |

| Size: 343 million euros |

| Total expense ratio (TER): 0.25 % p.a. |

| Start: 14 March 2016 |

| Distribution: Accumulating |

The Xtrackers MSCI World Industrials UCITS ETF is a classic industrial ETF: it invests in industrial companies from the industrialised nations, but has a strong focus on the United States.

Just under half of all shares included come from the USA, while second-placed Japan accounts for only 13 per cent. With this focus, the industrial ETF represents a considerable clustering risk and should only be included in an otherwise well-diversified portfolio.

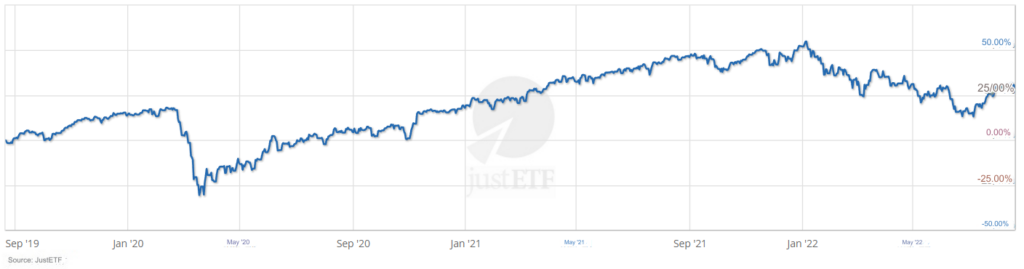

Its performance has been solid in the past; even in the Covid crisis year 2020, the result remained in positive territory. Investors who have already been invested for 3 years should be pleased with a return of 40%.

2. VanEck Space Innovators UCITS ETF

| VanEck Space Innovators UCITS ETF |

| ISIN IE000YU9K6K2 |

| Size: 7 million euros |

| Total costs (TER): 0.55% p.a. |

| Start: 24 June 2022 |

| Distribution: Accumulating |

Space travel has seen considerable innovation and the entry of new players in recent years. However, these dynamic developments are by no means over yet! On the contrary: further growth is expected in the sector in the future.

The VanEck Space Innovators UCITS ETF is an industry ETF that allows investors to invest in precisely this development. It includes companies in the space industry that are also characterised by sustainability and social responsibility.

As a particularly young ETF (launch: June 2022), there is a certain basic risk. Not all exchange traded funds make it to ‘maturity’ – many are closed after a few months because they have not reached a size that is worthwhile for the operator.

However, with a volume of EUR 7 million after just a few weeks, the Space Innovators UCITS is already doing well. There is considerable demand from investors, which could well continue.

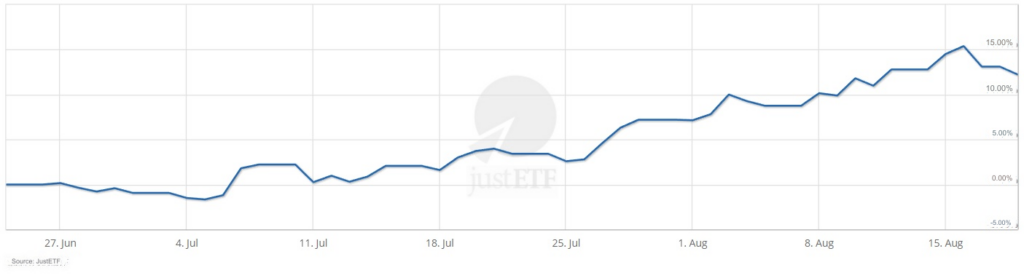

The performance so far has also been impressive: Anyone who invested in this industrial ETF a month ago can already look forward to a price gain of 12% today!

However, in view of the comparatively high costs of 0.55% per year, such results are also necessary. For investors who are willing to take risks, this ETF could nevertheless represent a good opportunity to enter the space sector.

3. SPDR MSCI Europe Industrials UCITS ETF

| SPDR MSCI Europe Industrials UCITS ETF |

| ISIN IE00BKWQ0J47 |

| Size: 291 million euros |

| Total expense ratio (TER): 0.18 % p.a. |

| Start: 5 December 2014 |

| Distribution: Accumulating |

With the SPDR MSCI Europe Industrials UCITS, investors can make targeted investments in industrial companies from Europe. An acceptable volume of 290 million euros meets very favourable costs of just 0.18 per cent per year.

The results of recent years have also been generally pleasing. The significant slump of almost 20 per cent during the coronavirus crisis was clearly an exception; those who invested in this industry ETF over the long term were able to take home gains of more than 30 per cent per year in some cases!

The MSCI Europe Industrial Index is led by French companies, which account for more than 20 per cent. The UK and Germany take second and third place with just under 15 per cent each.

A special feature of this industrial ETF is the limitation of the individual stocks. The weighting of the largest company in the index is limited to 35 per cent and all other companies to 20 per cent. In practice, however, this has no significance as the largest item (Siemens with 6.6 per cent) is far from this limit.

4. iShares S&P 500 Industrials Sector UCITS ETF

| iShares S&P 500 Industrials Sector UCITS ETF |

| ISIN IE00B4LN9N13 |

| Size: 220 million euros |

| Total expense ratio (TER): 0.15 % p.a. |

| Start: 20 March 2017 |

| Distribution: Accumulating |

Would you like to invest in an industrial ETF from the USA? Then the iShares S&P 500 Industrials Sector UCITS could be just right for you! Here you will find industrial companies from the United States at a favourable rate of just 0.15 % per year.

With a volume of just 220 million euros, this ETF from the industrial sector is slightly below the ideal size of at least 300 million. Nevertheless, it can be a sensible investment if you want to add US stocks in a targeted manner.

Attention!

In the USA, too, the signs are currently pointing to recession! You should therefore check the market sentiment before buying. Otherwise your investment may start with a considerable loss!

The performance of the iShares S&P 500 Industrials Sector ETF is impressive! Not only have investors been able to realise considerable gains in recent years (more than 50 % price gains in 3 years), they have also suffered fewer losses than comparable industrial ETFs, especially in times of crisis.

5. iShares STOXX Europe 600 Construction & Materials UCITS ETF

| iShares STOXX Europe 600 Construction & Materials UCITS ETF |

| ISIN IE00BMW3QX54 |

| Size: 92 million euros |

| Total costs (TER): 0.46% p.a. |

| Start: 8 July 2002 |

| Distribution: Accumulating |

The construction industry is also usually categorised as an industrial sector and offers interesting opportunities for investors. With the iShares STOXX Europe 600 Construction & Materials ETF, you can enter precisely this sector!

However, you should bear in mind that the construction industry is generally very sensitive to the economy. When the economy is booming, construction work is carried out diligently and prices rise. If growth slows down, the construction industry also suffers considerably.

The current supply bottlenecks, increased raw material and energy prices and the interest rate situation (higher interest rates mean more difficult financing for construction projects) are putting additional pressure on the construction industry.

This development can be clearly seen in the key figures for the iShares STOXX Europe 600 Construction & Materials: Here, strong results (+40% in 2019) alternate with significant slumps (already -16% in the current year 2022). Only the low volume of just 92 million euros is a warning sign for this industry ETF.

With this industrial ETF, too, it may therefore make sense to simply observe and wait for the right moment to enter. Should we actually be facing a recession lasting several months, prices will fall significantly.

Many experts therefore see such an ETF for the construction industry sector as a medium-term investment. As soon as the cost of raw materials falls, considerable gains could be possible here.

6. L&G ROBO Global Robotics and Automation UCITS ETF

| iShares S&P 500 Industrials Sector UCITS ETF |

| ISIN IE00BMW3QX54 |

| Size: 897 million euros |

| Total costs (TER): 0.8 % p.a. |

| Start: 27 October 2014 |

| Distribution: Accumulating |

It is certainly debatable whether the L&G ROBO Global Robotics and Automation ETF is an industrial ETF or rather belongs to the connected sectors. However, there is no question that it is a very attractive product!

L&G ROBO is one of the few ETFs from the industrial sector to have generated juicy gains of over 30 per cent even in the crisis year 2020. Although investors have suffered losses, especially in recent months, the automation and robotics sector has shown stable price gains over the long term.

With a volume of 900 million euros, this industrial ETF is one of the very large financial products. Unfortunately, the costs are also high: an impressive 0.8 % per year is due here!

Conclusion: Long-term opportunities

Industry is home to the largest companies in the world. The chance that these giants will one day disappear completely into insignificance is almost zero. Nevertheless, industrial ETFs and individual shares from the sector are no guarantee of profit!

With an ETF from the industrial sector, we invest in all or part of the industry, depending on the product. This means we are linked to their success. And it is precisely this success that could pose a problem: The signs in Europe and the USA are currently pointing to recession!

In difficult times, the industry also suffers, as many of its products (cars, luxury items, buildings…) are less in demand. Consumers prefer to wait until the economic situation improves before making optional purchases.

However, the coming lean period could be ideal for investors to enter a very lucrative sector at a low price. Industrial ETFs should therefore currently be on the watch list!

Those who have capital ready now may soon be able to get in at a very favourable price. ETFs from the industrial sector are very likely to benefit from a subsequent upturn!

Alternatively, an even more specialised investment may also be an option. In addition to general industry ETFs, there are also a number of sub-sectors, such as aerospace, which are often much less affected by crises.