Investing in ETFs – building wealth in 2025

Do you have a long-term financial goal that you want to achieve and are looking for the right way to do so? ETFs could be an attractive option for you if you are looking for a high-yield investment with comparatively high security! In this article, we will look at how you can invest in an ETF, what aspects you should consider and how this asset class works.

In brief:

- We will show you how an ETF works so that you can get an overview.

- You will learn about the advantages and disadvantages of investing in ETFs so that you can better assess whether they could be right for you.

- You should observe these specific rules if you want to avoid mistakes and reduce risks when making your selection.

- You should pay attention to these subjective criteria when selecting a specific security. Use them to tailor your investment to your personal strategy.

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

0 % without

Points

0 % without

Points

Points

Points

Points

Points

Investing in ETFs – What are ETFs?

ETF is an abbreviation that stands for ‘exchange-traded fund’. These are index funds that are traded on the stock exchange. But what exactly is a fund? Think of a fund as a kind of pot into which many different investors pay money. This money is then invested in a specific asset class.

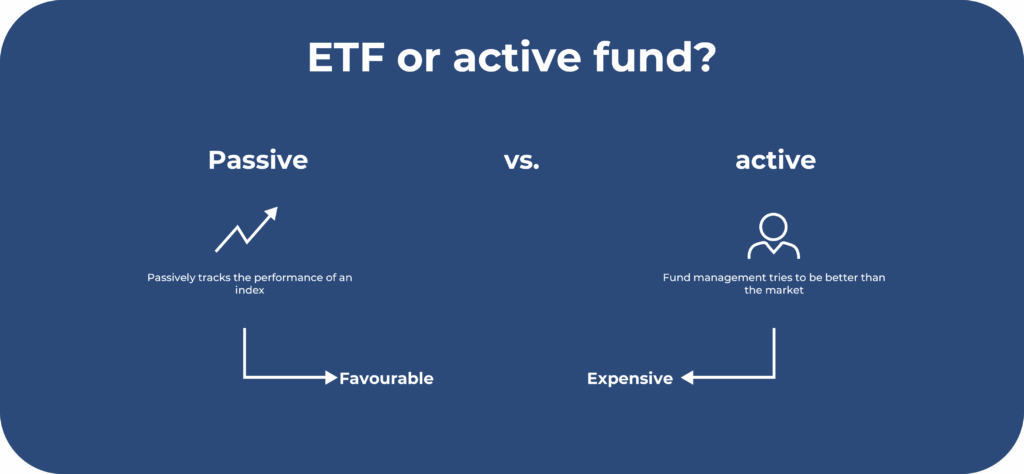

There are passive and active funds:

- Active funds are managed by a fund manager.

- Its goal is to achieve a so-called excess return.

- This means that he wants to achieve a higher return than the market.

- He is responsible for the composition of the fund.

- In reality, it is very rare for a fund manager to achieve excess returns over the long term.

Passive funds, such as ETFs, do not require a fund manager. They are based on indices. An example of an index is the DAX. If an ETF is based on the DAX, investors can invest in 40 different companies using a single security.

This has another advantage: passive funds have lower costs than active funds. When you pay fees for an active fund, you also have to pay the fund manager. Passive funds are based on an index and therefore do not require a fund manager, which is why their fees are lower.

With an ETF, you can invest in different asset classes such as bonds, stocks or commodities. In the following, we mainly refer to ETFs that invest in stocks and form a suitable basis for wealth accumulation.

Advantages of ETFs

ETFs are a transparent asset class. Fact sheets provide you with the most important information about each security. This includes, for example, its composition. The document helps you understand how heavily different countries and sectors are weighted and whether there are any potential cluster risks.

How safe are ETFs? One of the biggest advantages of ETFs is the opportunity to spread risk or diversify:

- When you invest in a single share, you are taking a big risk.

- If development is worse than expected, you could incur heavy losses.

- An ETF for beginners should be broadly diversified and invest in a large number of companies.

- Individual losses can thus be offset by other companies.

There is another aspect that ensures that ETFs are highly secure. ETFs are legally classified as special assets. A bank must keep the invested money separate from its own assets. In concrete terms, this means that your money is protected in the event of a bank insolvency.

In addition to diversification, attractive return opportunities are another key advantage of ETFs:

- Conventional asset classes such as building society savings accounts and savings accounts hardly generate any interest anymore.

- High inflation rates cannot be offset in this way.

- Stocks are among the highest-yielding financial investments.

- ETFs can combine attractive returns with comparatively high security.

Exchange-traded funds are also a beginner-friendly asset class. They are easy to understand once you have grasped the basics. What’s more, you can start investing with small contributions. You don’t need a large amount of capital to invest in ETFs.

As mentioned at the beginning, ETFs are associated with low costs compared to active funds:

- This ensures high cost efficiency.

- For active funds, you can expect fees of between 1.5 and 2 per cent.

- ETFs, on the other hand, charge significantly lower ongoing costs.

- A global ETF, for example, often costs around 0.2 percent.

- Thematic ETFs can be more expensive. However, they are generally less suitable for beginners.

Good to know:

A concrete example is the MSCI World Index. ETFs that track this index invest in the 1,600 largest companies in industrialised countries. This is a highly diversified global ETF that is suitable for beginners. It invests in various companies, sectors and countries, thereby reducing the risk in your portfolio.

Disadvantages of ETFs

In addition to the advantages mentioned above, there are also a few disadvantages that should be taken into account. ETFs are traded on the stock exchange and are therefore subject to price fluctuations. Depending on the economic situation, these fluctuations can be considerable. As an investor, you should be able to remain calm in such situations if you are interested in ETFs.

Furthermore, ETFs are not suitable for everyone:

- If you are looking for a short-term asset class, you should probably avoid investing in exchange-traded funds.

- It is a long-term asset class.

- With a long investment horizon, price fluctuations can be balanced out.

- In addition, you can maximise the compound interest effect in this way.

The advantage of high diversification does not apply to all ETFs. Theme ETFs invest in specific areas. These are often innovations that could play a greater role in the future.

However, this means that they are not very diversified and usually invest in only a few stocks, all of which come from the same sector. They are more suitable for advanced investors who have already built up a diversified global ETF portfolio and want to increase their returns.

Which ETFs should you invest in?

In this section, we will look at some aspects you should consider when deciding on a specific ETF. There are general rules and some subjective aspects that depend on your priorities.

Please note these basic principles

You should pay attention to the age of your ETF. A security that has only recently been launched has not yet had time to establish itself on the market. It may be that this security is not yet liquid. If ETFs fail to establish themselves, there is a risk that the funds will be closed again.

- In such a case, the bank will contact you so that you can transfer your money.

- However, this involves a lot of effort, which you can avoid from the outset.

- Therefore, only invest in ETFs that are at least five years old.

The fund volume is also related to this aspect. In the case of securities with a low fund volume, it is still unclear whether this ETF will be profitable for the provider in the long term. If it performs worse than expected, the fund may be closed. Therefore, make sure that your fund has a fund volume of at least 100 million euros. A high fund volume can also increase liquidity.

If you want to invest your money wisely, you should always consider the costs. An ETF savings plan comparison could be helpful. ETFs incur regular costs, known as the TER or total expense ratio. Providers charge this fee to cover marketing, licensing and administration costs.

- Although ETFs are low-cost securities, you should still pay attention to the following

- If you opt for an ETF with higher costs, you could reduce your returns in the long term.

- In addition to the TER, you should also consider transaction costs.

- These may arise when buying or selling shares.

- You should also find a bank or broker that does not charge custody account fees so that you do not incur any additional costs.

Subjective aspects

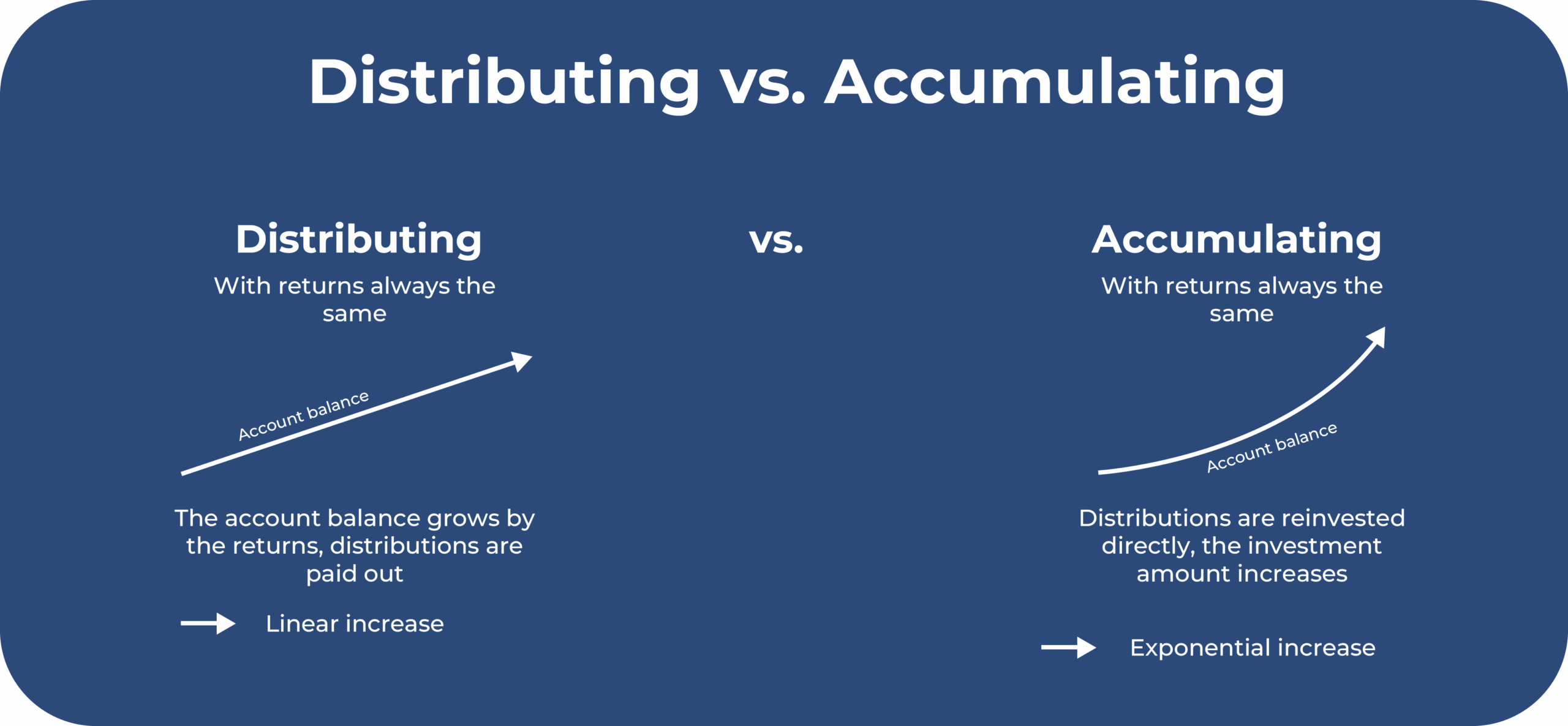

In this section, we will look at some aspects that may influence the decision to choose a specific ETF and that are related to your personal priorities. These points include, for example, the use of income. There are accumulating and distributing securities.

When companies make profits, they can pay them out to their shareholders in the form of dividends. If you make profits with your ETF, you can have them paid out at regular intervals. These are known as distributing ETFs.

This means that your winnings are credited directly to your account and you can use the money for other things. This option is suitable if you have another use for regular winnings or see the payouts as a kind of motivation for investing.

- Another option is accumulating securities.

- With this form, the profits generated are reinvested.

- The base amount in your ETF that works for you will grow larger and larger in this way.

- This option is particularly suitable for investors who want to invest for the long term, as they can take advantage of the compound interest effect.

Good to know: If you want to build up your assets over the long term, accumulating ETFs are particularly suitable. This option allows you to take advantage of the compound interest effect.

Your personal investment strategy also plays a role in your ETF evaluation. Traders deal intensively with the topic of investing, often invest in the short term and take high risks. Investors, on the other hand, want to invest for the long term with less research effort.

- Your investment strategy also includes how much you want to invest in your return and security components and how large these will be.

- The degree of diversification should also play a role here.

- If you have not yet invested, a balanced global portfolio is a good option.

- If, on the other hand, you have already invested money in broadly diversified ETFs, you may be interested in thematic ETFs to increase your returns.

Therefore, consider fundamental questions about your investment before investing in an ETF. These include questions such as ‘How much money do I need? What is my goal? When do I need the money by?’

If you already have a specific ETF in mind, the question of whether it is suitable for a savings plan arises. You may have a larger amount of capital available and want to invest the entire amount. In this case, a single investment may be worthwhile. However, you need to consider the timing of your investment, as this can reduce your return if you buy at a high price.

If, on the other hand, you want to build up a fortune over the long term with small amounts, an ETF savings plan may be more worthwhile. You don’t need a large amount of capital to do this. Another advantage is that you don’t have to worry about when to start.

You invest a fixed amount at specific times. This is done automatically, for example quarterly or monthly. This means you buy at different prices and gradually approach an average price, also known as the cost average effect.

Conclusion: Trade ETFs and build wealth in small steps

ETFs are traded on the stock exchange and are funds whose composition is based on an index. They can invest in various asset classes. They offer many advantages: high transparency, low fees, diversification, security, attractive return opportunities and a high level of beginner-friendliness.

However, there are also disadvantages. ETFs are not suitable for investors who want to invest for the short term. As an investor, you also have to expect price fluctuations, which can be significant. Thematic ETFs are not sufficiently diversified and can be risky.

They are particularly suitable for investors who want to build up long-term wealth. If you want to choose a specific ETF, you should follow some basic rules. These include the age and fund volume of the ETF to avoid the risk of closure. You should also take the costs into account.

There are also subjective criteria. You can tailor these aspects to your investment. These include the use of earnings, your investment strategy or the suitability of the investment for a savings plan. You may also be interested in “ETF Clean Energy”, “Crypto ETFs” or “ETF Depot Comparison”? Find out more here.

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

0 % without

Points

0 % without

Points

Points

Points

Points

Points