Investing in P2P lending: What do you need to know about P2P lending?

P2P lending has become a popular and attractive asset class in recent years. This is hardly surprising, given that it offers high returns, good liquidity, and ease of use.

More and more investors are therefore opting for this type of investment and using P2P lending as a source of passive income or to build up their assets. But is all that glitters really gold? Drawing on my many years of experience in the field of personal loans, I would like to answer this question in detail today.

We take a look at the typical advantages and disadvantages of P2P lending and also highlight the special role played by the providers who handle the brokerage. This gives you all the tools you need to decide for yourself whether this lucrative – but risky – asset class is right for you!

In brief

- P2P lending is lending that is not granted by a bank. Several private investors come together to finance the loans.

- Borrowers and lenders meet on P2P platforms, which handle payment transactions and provide security.

- Credit defaults and other risks make personal loans risky. However, high returns make them worthwhile if you follow a few basic rules.

- Thanks to regular payments, P2P lending is suitable as passive income.

What exactly is P2P lending?

In order to take out lending from traditional banks, collateral must be provided, a credit check must be passed, and numerous documents must be completed. For many people, especially those in economically disadvantaged situations, these hurdles are difficult to overcome.

P2P lending offers an alternative here: it is not granted by banks, but by private investors. Its requirements are drastically reduced and therefore easy for borrowers to meet – in return, however, comparatively high interest rates are payable. This in turn pleases investors, because those who finance personal lending can expect high returns.

When we invest in P2P lending, we do not take on an entire loan! Several investors each contribute a small portion of the total amount. This reduces our risk: we can easily invest in dozens or hundreds of loans at the same time! Even if one of them defaults, the damage is limited.

Hint:

Every lending carries a risk of default. Therefore, spread your investment across as many lending as possible to minimise the risk.

History: How P2P lending came about

Today, we can easily invest large sums in personal loans or use P2P lending as passive income. However, the industry’s beginnings were much smaller and less spectacular: the first platform specifically designed to bring together loan seekers and investors was launched in 2005.

Initial successes were achieved, but P2P lending received little attention at first. That changed with the financial crisis of 2008! Not only did it become almost impossible to obtain lending from banks during this period, but large financial institutions went bankrupt and consumer confidence in the financial world was permanently shattered.

P2P lending was a natural solution to these problems, as it completely bypassed the traditional banking sector. No wonder the financial crisis was a golden opportunity for this fledgling industry!

Numerous P2P companies were founded or conceived at this time, such as today’s heavyweight Bondora. Other providers were able to dramatically increase their loan amounts and profits. Compared to the enormous losses and damage caused by the financial crisis, personal loans could only compensate for a negligible portion; however, they had passed their baptism of fire.

The following years saw steady growth: both the number of borrowers applying for loans and the number of investors continued to rise. The young industry showed remarkable resilience and consistently outperformed other financial products in subsequent economic crises.

This much profit is achievable

Personal loans come with a serious risk, but in return they also offer high returns. Despite occasional defaults, this means that in most cases – assuming a sufficient investment period – a hefty profit remains!

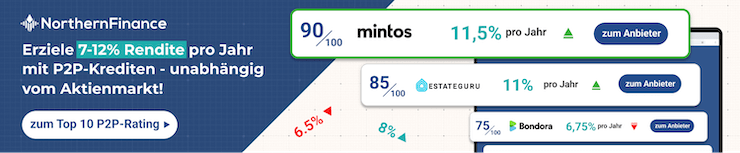

But how much can you expect to earn when investing in personal loans? Depending on the platform you choose, the term, the type of lending and the risk, P2P lending can generate returns of up to 15% per annum or more. However, a more realistic long-term figure is around 12% per annum.

If the return falls into the single-digit percentage range, it quickly becomes unprofitable, in my opinion! For returns of 5, 6 or even 8 per cent, one could easily use other financial vehicles that also carry a lower risk.

Since consumer loans in particular often have short terms of only 4 or 6 weeks, strong compound interest effects can also be achieved: interest already earned is reinvested and in turn generates interest. The short intervals between two payments favour this effect and ensure accelerated wealth accumulation.

Provider Bondora takes this concept to the extreme with its ‘Go & Grow’ programme: here, interest is paid out daily, ensuring faster growth of your own portfolio.

Advantages and disadvantages of P2P lending

When we invest in P2P lending, we are using an investment product with its own unique advantages and disadvantages! Private loans can hardly be compared to stocks, ETFs and the like, and do not always follow economic developments.

Let’s take a closer look at these characteristics:

These benefits await you

- Easy access to loans for borrowers

- High returns

- Good liquidity

- Diversification possible

From the borrower’s point of view, P2P lending is a real blessing! In the past, anyone who did not have access to banks or was unable to obtain money from them due to a lack of collateral was left high and dry.

Personal loans give millions of people access to financial resources to make purchases or tide them over difficult periods. The relatively high interest rates are less significant than they might appear at first glance due to the mostly short terms.

P2P lending is therefore often used to purchase consumer goods, so that borrowers do not have to wait for their next pay cheque (so-called ‘payday loans’). People who need to refinance their debts or urgently need money also often resort to private loans.

Investing in P2P lending is also advantageous for investors. They offer very attractive returns and often excel when other financial products perform poorly! For example, personal loans have shown in past crises that they are hardly affected by adverse circumstances.

At the same time, short-term consumer loans in particular offer high liquidity: we often get our investment back, including interest, after just 30 days! This makes it possible to use P2P lending as passive income, as it generates regular cash flow.

The numerous providers, different countries and varying credit ratings also offer good opportunities for diversification. Even less risky P2P lending, for example in the real estate sector, is available.

Disadvantages of P2P lending

- Default risk

- Possible insolvency of credit brokers

- Possible insolvency of platforms

P2P lending is certainly not a perfect investment product; it does carry some risks, foremost among them the danger of default. After all, borrowers are usually rejected by established banks for good reason! Often, their collateral and payment history do not look particularly promising.

The various providers of P2P lending deal with this problem in very different ways. While some platforms offer so-called buy-back guarantees to compensate for defaults, other companies leave the loss to the investor.

Good to know:

A buy-back guarantee protects you from loan defaults. Here, the platform undertakes to settle a borrower’s debts if they are no longer able to pay.

As investors, we have no choice but to trust the assessment of the P2P platform, as it evaluates the creditworthiness of borrowers. However, reviews in this still young industry are limited, which means that mistakes are made time and again.

The young age of P2P lending also leads to further uncertainties: what happens in the event of serious crises, who is liable and when, and whether investors can rely on the guarantees provided by lenders in cases of doubt remain unclear.

Although total defaults by loan originators are extremely rare, they have occurred in the past and left investors with significant losses. Anyone who uses P2P lending as a source of passive income or invests a large portion of their assets in it is taking a considerable risk.

The insolvency of a P2P platform is another nightmare scenario that can threaten us when we invest in P2P lending. Although this has not yet happened and the individual providers have security mechanisms in place, such a failure is possible. Since most of the companies are based abroad, it is questionable what chances investors would have of receiving compensation in the event of an emergency.

How are P2P lending arrangements made?

Since P2P lending involves several investors coming together to finance a loan, the organisation is not entirely straightforward. Providers of personal loans offer online platforms for this purpose, where open loans can be found and our capital invested in them.

There are two different approaches here: Providers such as EstateGuru, Kviku and Bondora are lending intermediaries, i.e. they grant loans directly to borrowers. We therefore invest directly in such loans on their websites.

However, there are also marketplaces such as Mintos, where dozens of loan originators offer their loans for investment. The platforms act solely as intermediaries between investors and lending companies.

Regardless of which option we choose, if we want to invest in P2P lending, our journey always begins with registering with one of the many providers. Once our account has been activated, the next step is to top it up with money from our bank account, which we can then invest in specific loans.

However, P2P companies such as Bondora, Mintos and EstateGuru do not just provide a marketplace for such lending; they also check the creditworthiness of individuals applying for a loan (or have this checked by third parties).

With this information, investors can then assess whether the risk associated with P2P lending is worthwhile or, in relation to the interest rate, too high. Credit checks are therefore a very important part of such investments and are essential for the security of our capital.

Once we have found a P2P lending with the right balance of risk and return, we can invest the desired amount in it. Depending on the type of contract, we will then receive regular interest payments or, at the end of the term, a one-off repayment of the amount plus interest.

In most cases, these repayments go smoothly; however, there are also regular payment defaults when borrowers are unable to pay their instalments or pay them on time. This is where P2P platforms come into play!

When we invest in P2P lending, we do not have to collect outstanding payments ourselves – the respective provider commissions debt collection agencies to recover the money. This often allows us to salvage a considerable amount of capital, further reducing our risk.

Digital investing

Personal loans are a very new and therefore modern financial product. It is therefore hardly surprising that we invest exclusively in P2P lending online. The individual providers often stand out with interesting apps and useful additional features.

Almost all platforms offer an auto-invest feature. This feature allows us to automatically invest in personal loans that meet our criteria.

To do this, we can set factors such as term, interest rate, lending type and more in an online portal. The amount to be invested in a single P2P lending can also be determined here.

Once P2P lending has been repaid, the entire sum (including interest earned) can be reinvested. Since we do not have to take care of the selection and investment ourselves, the auto-invest function can make things much easier for us.

Many platforms already make it easier for us to file our tax returns! Automated tax reports allow us to obtain the necessary documents to satisfy our tax office with just a few clicks. This is because personal loans count as investment income and must be taxed accordingly.

Good to know:

Profits from P2P lending are classified as investment income. They must be declared on your tax return. If the applicable allowance is exceeded, capital gains tax, solidarity surcharge and church tax are payable.

Who are personal loans suitable for?

There is no such thing as a ‘perfect financial product’ that will make every investor rich. It is always important to consider your own goals and possibilities and develop a suitable strategy. However, investing in P2P lending can be a sensible part of such an approach!

Due to their high returns, personal loans are ideal for building wealth. However, they always involve a basic level of risk. Therefore, they should only make up a small part of our portfolio.

Even if we want to use P2P lending as passive income, we should not overdo it: sufficient diversification of our assets is also necessary here! If we have further investments in other areas, our assets are much better protected. In these cases, P2P lending is a sensible addition that promises high profits. If you want to know which provider is best for you, read the P2P lending ranking now.

Conclusion: P2P lending is right for you if…

Personal loans are an exciting investment that promises high returns, but is not entirely without risk. Due to their special structure, P2P lending has proven to be a good choice in the past: personal loans performed particularly well when the economy and the ‘traditional financial sector’ were in crisis.

The P2P market has already gone through a few minor crises. There have also been defaults by loan originators, resulting in heavy losses for many investors. However, those who ensured sufficient diversification were able to make profits despite occasional slumps.

Therefore, it can be said that P2P lending can be a sensible option for generating passive income or building wealth. However, it is important to ensure that our capital is spread across different platforms and lending types.

At the same time, we should not invest too much money in individual lending, but instead spread our investments across as many loans as possible. If a default occurs, our losses will thus be limited.

If we have only invested a small portion of our assets in P2P lending, our risk is further reduced. In a well-diversified portfolio, P2P lending is a lucrative way to generate high returns!