Building passive income with P2P lending – how it works

For investors, building a passive income is becoming an increasingly attractive goal. P2P lending is seen as one way of doing this. This way, the low-interest phase can be avoided in traditional investments, where it is almost impossible to generate a return. But what exactly is P2P lending and how can it be used to generate a passive income?

In brief:

- P2P lending is the practice of lending money to other individuals without the involvement of a bank.

- This is a risky asset class that offers the potential for high returns.

- If you pay attention to certain aspects, you can build a passive income through P2P lending.

- High returns and short durations make P2P lending particularly attractive for building a passive income stream.

What are peer-to-peer lending services?

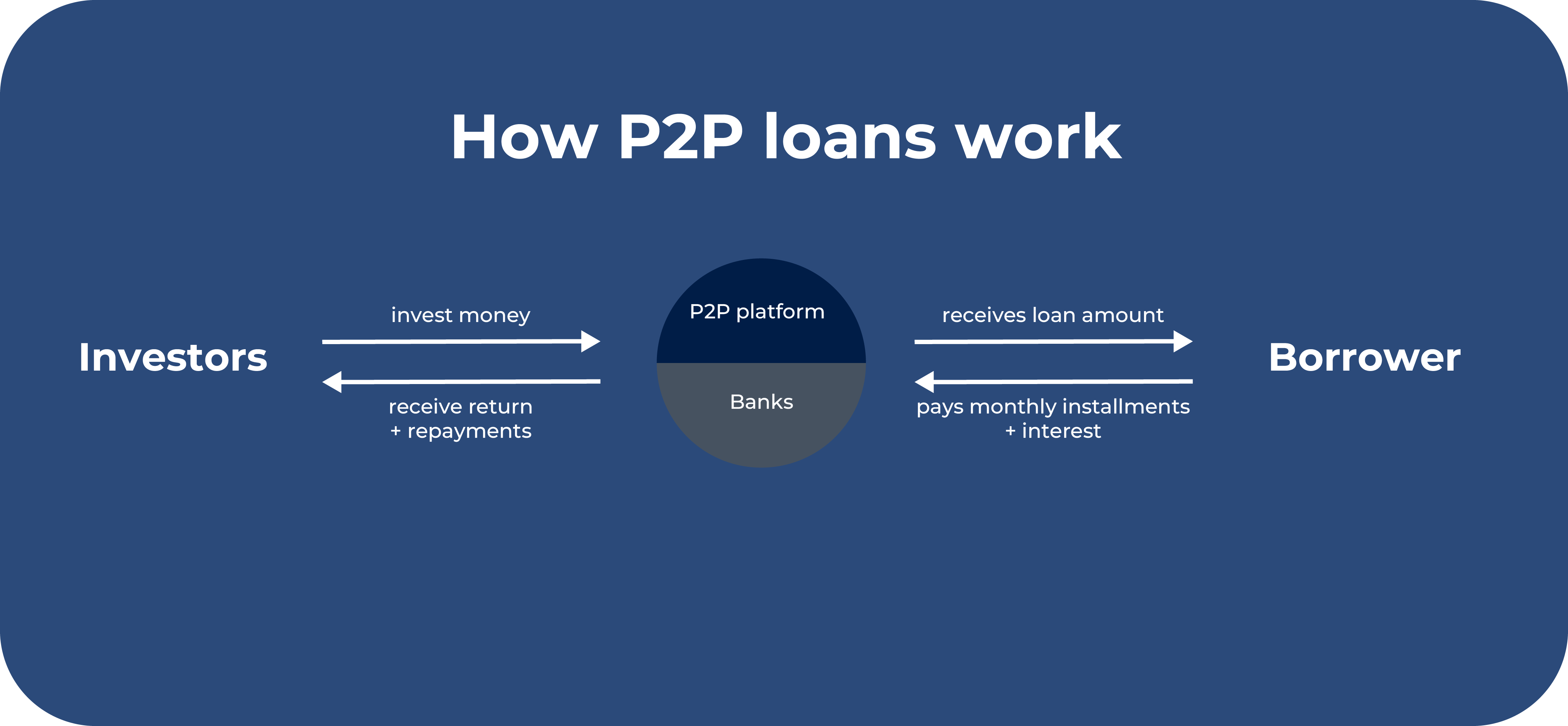

Peer is English and means something like ‘equal’. With P2P lending is done from one person to another. While banks often lend to private investors, P2P lending does not require a bank because another private individual is stepping in. This is why such loans are also called personal loans.

Worth knowing:

P2P lending is the practice of granting loans via a P2P platform. These are websites that act as intermediaries between lenders and borrowers, thereby eliminating the need for a bank. The borrower sets up an account on a P2P platform and submits their search to the lending marketplace.

Investors who are also registered on the platform are free to decide the volume from which and for which lending they want to use their assets. Over time, there was diversification in the P2P marketplaces. For example, there are classic providers and others that specialise in the commercial sector.

It is important to note that interest rates for peer-to-peer lending are generally higher than for bank lending. Interest rates of 10 per cent or more are normal. This investment stands out due to its high potential returns, especially in times of low interest rates.

What is crowdfunding?

P2P lending also falls under the category of crowdlending and is a sub-form of crowdfunding. Crowdfunding is a way of financing start-ups, products, projects and many other things. A large number of people provide financial support to enable a particular project to be realised.

Financing is provided via internet platforms and with a predefined minimum amount that must be reached within a certain period of time. If the required financing is not provided, the investors receive their money back.

If the project receives sufficient support in good time, the investors receive something in return. This consideration can take various forms, such as a product of the project outcome, financial participation or a behind-the-scenes insight. These different variants of crowdfunding are available:

- Crowdlending: the crowd lends the money, which is repaid later.

- Donation crowdfunding: These are pure donations, with individuals receiving no financial or material consideration.

- Crowdinvesting: Investors invest in the project and receive shares in return.

- Classic crowdfunding: supporters of the project receive a non-financial thank-you, such as a copy of the project result

The following table shows the exact differences between crowdlending and crowdfunding:

| Crowdlending | Crowdfunding |

| A single private individual engages in lending to another person | A crowd gives money for a project |

| The investor receives interest in return and has a financial added value. | Investors receive no interest or financial value added for their support. |

| The investor gets his money back. | The money will not be refunded. |

Earn money with P2P lending – these are the advantages

P2P lending is a good way to build up a passive income for a number of reasons. When you lend money, you receive interest, which you can use to build up your own return and your passive income. Below, we highlight two important points that show why P2P is an interesting investment opportunity.

High potential returns with P2P lending

The risks that an investor takes when lending money result in good opportunities for high returns in the form of interest. When comparing P2P lending with, for example, dividend distributions through share purchases, it quickly becomes apparent that returns from P2P are comparatively high.

This makes personal loans an interesting way to build up a passive income. Investors can start investing with small sums. Even with these sums, a comparatively high, regular income can be built up.

Short lending periods

Lending in this area is characterised by its short term. As a rule, the terms are 30 days and are therefore referred to as payday loans. The short terms mean that the loans are paid off monthly.

In addition to being a suitable passive source of income, the short term also has another advantage: as an investor, you do not have to tie up your money in an investment for many months or years. If your financial or personal situation changes, you can quickly and easily withdraw your money from the platform without having to wait long for it.

The risks of P2P

Attention!

There are three main risks involved in investing in P2P lending. Firstly, the platform may misjudge the borrower’s creditworthiness. The platforms in this area are still relatively young and have less experience than, for example, banks in lending.

This can lead to the risk of default being incorrectly assessed. It can also happen that borrowers do not provide truthful answers when filling out the required information, which in turn affects the credit rating. In such cases, the risk is assessed as being lower than it actually is. To minimise the number of mistakes, it is advisable to read the projects thoroughly and to critically question them, especially at the beginning.

Another category is the risk of default itself. Particularly in the case of lending that promises a very high return, it may happen that the borrower is unable to repay the loan. To reduce this risk, broad diversification is recommended. For example, investors should only put a small portion into very risky lending.

In addition to the risks already mentioned, the P2P platform may also become insolvent. The majority of platforms have integrated various security measures to protect investors. However, since the P2P sector is still relatively young, it is difficult to estimate how well these measures would work in the event of a real insolvency.

Good to know:

It is particularly uncertain how platforms in non-German areas would react in an emergency. Investing one’s own assets in different German platforms can reduce this risk.

How to avoid making mistakes with P2P lending

If you bear in mind some basic aspects of investing in P2P lending, you can reduce your risk and build up a passive income. We have put together some important tips for you below.

- Set up the automated investment function correctly: the auto invest option is the best way to generate a passive income. You can choose which loans you want to invest in and the credit ratings of those loans. This allows you to optimally customise P2P lending to your investment strategy and risk profile.

- Short terms: You can also choose the terms. Short-term loans are best suited for building a passive income because they are repaid monthly. Short-term loans make up the majority of P2P lending.

- Diversification: As with other investments, you should ensure a broad spread to reduce the overall risk. This includes the choice of lending, credit ratings and P2P platforms.

- Financial reserves: Only invest money in such risky asset classes if you could theoretically lose it without experiencing serious financial problems.

- Solvency of the borrower: Especially in the beginning, you should carefully check which lending you want to invest in and how realistic it is for the borrower to be able to repay the money, including interest.

- Creditworthiness and risk class: Pay attention to the estimated creditworthiness of each borrower. This classification gives you an overview of how realistic it is that the borrower will be able to pay.

- Costs: Remember that the platform also wants to earn money from the lending. Usually, costs amount to 1 to 2 per cent of the total loan amount.

- Buy-back guarantee: Some platforms offer a so-called buy-back guarantee: if a loan cannot be repaid, the platform guarantees to buy back the loan. This is intended to protect investors. Not every P2P platform offers this option.

Conclusion: Build up P2P passive income with these tips

P2P lending is an interesting opportunity for investors to build a passive source of income. Particularly attractive are the short terms and high potential returns. This can make the asset class profitable. However, the high potential returns are accompanied by different risks. In particular, the risk of default and the incorrect assessment of creditworthiness should be mentioned here. Insolvency of the P2P platform is also possible.

To avoid such problems, investors should scrutinise the lending and borrowers particularly critically. In particular, the creditworthiness should be checked. In addition, the risk can be reduced by sufficient diversification and the careful choice of P2P platform. Platforms that offer a so-called buyback guarantee for their investors are suitable here.