How can I save money every month? 5 different approaches for 2025

Would you like to secure your and your family’s financial future or finally get out of debt? Then you’ve probably asked yourself: how can I save money every month? We’ll show you five ways you can save money without stress or sacrifice!

In brief:

- Everyone would like to save money. However, many people fear the sacrifices that this entails.

- Saving money and growing your wealth is all the rage – but many people recommend high-risk investments. The simplest investments are often the most profitable.

- With the right savings and investment strategy, you can earn up to 15% return – you just need to know how.

That’s why it’s important to save

Humanity has always saved money. In the past, this meant stashing bundles of cash under the mattress, but today we have to be much more creative. Most people see saving as working towards a goal. For example, a trip to the Maldives with your girlfriend or your children’s future education.

However, saving can also be seen as a long-term and ongoing endeavour. For example, to build up an emergency fund. Unforeseen events such as damage to your home due to storms or major repairs to your car can always happen.

Germans are among the leaders in international savings comparisons. Around 11% of their disposable income is what the average German household saves.

The goal you set for yourself is ultimately important for your investment strategy. This means deciding which asset classes to invest in, over what period of time, and how much to save. Long-term investments that support your long-term plans are recommended. Building up an emergency fund at the same time is also extremely advisable in order to be prepared for any eventualities.

The effect of inflation

Rising inflation means that your money is actively losing value. Rising prices in various sectors mean that you are losing purchasing power. In other words, you cannot buy the same amount of goods today with the same €1,000 as you could a few months ago.

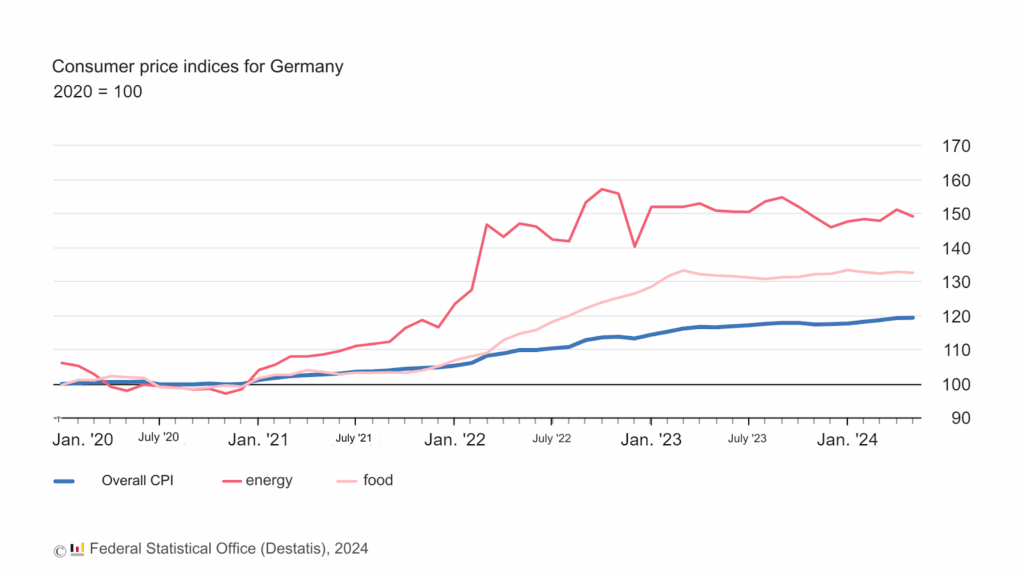

Here you can see a graph from the Federal Statistical Office. It shows how prices have changed in three different areas (total consumer price index, energy and food). According to a press release, inflation stood at +2.4% in May 2024.

How to achieve your financial goals

To beat inflation and achieve your financial goals at the same time, the right strategy is essential. In the following article, we assume a long-term investment strategy.

However, before you start investing, you should make a detailed plan:

- Where are you?

What is your starting point? Do you have some start-up capital that you can invest? You should also consider your current income. How much can you invest? As a rough guide, you should save 10–20% of your disposable income.

- Do you have any specific expenses to anticipate?

Where are you in life right now? Are you planning to buy a house or have a child? Or perhaps you are considering a change of job? You should definitely factor these predictable changes in your income into your considerations.

- Where would you like to go?

Set yourself clear and fully defined goals. Be it a sum of X by a certain date. Based on these self-imposed goals, it will be much easier for you to make a decision when choosing the right strategy.

Good to know:

The information regarding your monthly savings rate is, of course, only a guideline. You are free to decide how much you would like to set aside each month. Always remember that saving should not plunge you into financial crisis, but rather protect you from it.

Save money like the pros: the 50-30-20 rule

Before you start growing your money, you should know how to save it. To achieve their financial goals, professionals use the 50-30-20 rule. This involves allocating your monthly income according to a specific pattern:

- You use 50% for basic needs.

- 30% for wishes and personal needs

- 20% for savings or debt repayment

Applied to the practical case, the whole thing could look like this:

The average income in Germany is €1,473 net. If we apply the 50-30-20 rule to this amount, we get the following breakdown:

- €736 is spent on necessities (50% of income)

- €441 is available for discretionary spending (30% of net income)

- €294 saved (20% of net income)

If the majority of EU citizens followed the 50-30-20 rule, monthly savings in Europe would average around €300 per person, which amounts to approximately €3,500 per year. This could be used for an emergency fund, debt repayment or savings goals.

How exactly does the regulation work?

The 50-30-20 rule simplifies budget planning by dividing your net income into the spending categories of basic needs, wants, and savings or debt reduction.

Spend 50% of your money on basic necessities.

Simply put, basic needs are expenses you cannot avoid – costs for all the necessary things you absolutely need to live. When categorising your basic needs, you should be completely honest with yourself – which expenses do you really need, and which are more related to your lifestyle?

Basic needs include:

- Rent

- Electricity and gas bills

- Insurance policies

- Staple food

Spend 30% of your money on things you want

If 50% of your net income is used to cover your basic needs, you can use 30% of your net income to cover your wants and personal needs. Wants refer to expenses that are not essential to life – things you want to spend money on even though you could live without them.

The exciting thing about the 50-30-20 rule is that you don’t necessarily have to practise self-denial. You should definitely treat yourself every now and then and not always think about saving. After all, the strategy is supposed to work in the long term.

Examples of wishes are:

- Shopping tours

- Gym

- Dining out

- Entertainment subscriptions

Set aside 20% of your money for savings.

If you spend 50% of your monthly income on basic needs and 30% on wants, you can use the remaining 20% to achieve your savings goals or pay off outstanding debts.

Even if minimum repayments are classified as basic needs, all additional repayments reduce your existing debt and future interest, so they are considered savings. The next section explains how to invest and save the 20% correctly.

How to invest 20% of your income wisely

You have already been given a sophisticated strategy for how you should save. The question now remains as to how exactly you should save 20% of your income. Instead of simply leaving the amount in your account each month, there are many other options available.

Your first goal should be to build up an emergency fund. This can help you in difficult times or in the event of unforeseen circumstances. An emergency fund is basically money that is readily available and that you can spend without feeling the pinch. It is generally recommended that your emergency fund should amount to two to three months’ salary.

The best way to build up your own emergency fund is with instant access savings accounts. These give you access to your money at any time and allow you to park it there. Once you have built up your emergency fund, however, you should not stop saving and investing. From this point onwards, the best asset classes for your 20% are ETF savings plans and P2P loans.

Invest in ETFs for high returns

ETFs are the asset class of young people. They are the counterpart to actively managed funds. No fund manager invests in this asset class. Instead, the ETF tracks a specific index generated by a computer.

Would you like to learn more about ETFs and understand this asset class? Read our article ETFs for beginners and find out everything you need to know.

An ETF savings plan involves investing in various stocks (in fractions). ETFs track exchange-traded index funds. These reflect the performance of an index such as the DAX or the MSCI World Index.

The popularity of ETFs can be attributed primarily to their high returns of 8% per annum on average, combined with comparatively low costs.

P2P lending

A modern option that is becoming increasingly popular is P2P lending. This basically refers to private lending. You can arrange this via special platforms.

By lending privately, you can achieve excellent returns. On average, these are between 10 and 15 per cent, which is even higher than ETFs.

| Advantages | Disadvantages |

| Investments in lending are also possible for private individuals. | Existing default risk if the borrower cannot pay – diversification helps here. |

| You can expect high returns! The average interest rates on lending are between 10 and 15%. | Incorrect assessment of the creditworthiness of some borrowers by P2P marketplaces, as some of them do not have sufficient review. |

| Independent of bank lending, fast and efficient P2P marketplaces also function. |

Your task now is to choose the right type of investment for your savings goal. Current accounts and fixed-term deposit accounts are particularly suitable for building up an emergency fund.

However, the best options for long-term savings are ETF savings plans and P2P lending. These are characterised by their high returns and low costs.

Exclusive checklist: What you need to consider when saving and investing

To ensure you know exactly what to do, we have provided a short checklist here, which will tell you exactly how to proceed from now on!

- Point 1: Start saving:

To start saving properly, you should first get an overview of your running costs. It is best to draw up a comparison of your income and your expenditure.

- Point 2: Applying the 50-30-20 rule:

Once you know exactly what your running costs are, you can start planning and applying the 50-30-20 rule. To do this, you can divide your money between different accounts using standing orders, for example. Once you have started this strategy, you can take care of your investments.

- Point 3: Defining your investment strategy:

To ensure you invest your 20% wisely, you should choose an appropriate investment strategy. Once you have decided on one or more specific asset classes, you can tick this item off your checklist.

- Point 4: Selection of the provider:

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

0 % without

Points

0 % without

Points

Points

Points

Points

Points

To make your investment, you need an account with a broker. You can buy and trade securities through a broker. The neo-broker with the best terms and conditions is currently Freedom24:

- Point 5: What are the costs involved?

Each broker and each ETF or P2P lending also differs in terms of its costs. So before you press the final ‘Invest’ button, find out in detail about the costs you can expect.

- Point 6: Opening your securities account

You’ve done it! Nothing stands in the way of opening your account and reaching your monthly savings goal. Congratulations!

Conclusion: Relaxed saving and investing with the 50-30-20 rule!

You should be aware that saving is important. Due to rising inflation and in order to be prepared for any eventuality, it is more worthwhile than ever to invest a certain amount each month. Two asset classes stand out in particular: ETF savings plans and P2P lending. These two options allow you to generate the best returns and increase your assets in the long term.

Would you like to learn more about investing? Read our articles on the topics of ‘snowball effect’ and ‘Scalable Capital vs. Trade Republic’ and become a trading expert!