Best low-risk investments for 2025: increase returns

The coronavirus pandemic, the war in Ukraine, high inflation – the last few years have been turbulent and are also affecting the economic situation in Western Europe. Investors are also feeling the impact of such transnational crises in their portfolios. Perhaps you have also noticed the sometimes significant fluctuations in the market and are therefore looking for comparatively safe investments. In this article, you will learn which is the best risk-free investment and how you can achieve a decent return with it!

In brief:

- Time deposits and call money are very safe investments and are a good way to store your emergency fund.

- Even very safe investments are subject to inflation – your money will lose value over time and your purchasing power will decrease.

- Diversification allows you to make high-yield investments more secure.

- With P2P lending and ETFs, you have the opportunity for sufficient diversification and attractive potential returns.

How can I reduce the risk in my own portfolio?

The coronavirus pandemic has shown that crises can have a significant impact on the Western European economy and on investments. Prices can fall sharply for a short period of time and your own portfolio may be in the red. In such uncertain times, investors are more concerned with issues such as portfolio security.

Assess your own risk appetite – build a strategy

Before deciding on specific investments, it is advisable to find out what type of risk taker you are. Not every asset class is equally suitable for every investor. People have different characters and deal with risks in different ways.

Perhaps you can remain calm and rational in economically uncertain times. Some people don’t get emotional when they see their portfolio in the red during an economic crisis and can simply wait it out. If you are one of those people, you can more easily deal with high volatility and therefore tend to invest in riskier assets.

However, you may be the kind of person with an increased need for security and are afraid of a total loss of your investments. Even people with an increased need for security can invest and don’t have to consider only crisis-proof investments! In such a case, you can do more research to get a better understanding of your investment.

Attention!

A good portfolio consists of a safety component and a return component. If you are a risk-averse person, you could, for example, increase your safety component compared to high-risk individuals. You could also start by investing smaller amounts to get to know the assets.

Regardless of your risk appetite, it is recommended that you develop a strategy for your finances. A solid strategy will help you to pursue your goals and stay calm in difficult times. After all, you have worked out a detailed plan and anticipated fluctuations.

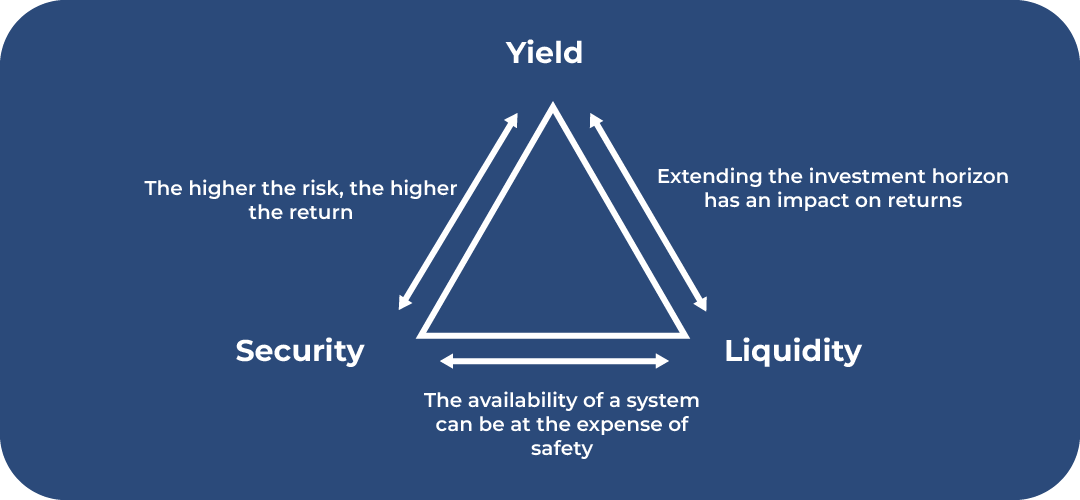

The magic triangle of investment

The magic triangle of investing can help you understand the relationship between risk and return for each asset class. Investors have three broad investment goals: profitability, security and liquidity. Each investment differs in the respective characteristics of these three goals.

The profitability of an asset class indicates the possible return, i.e. the profits that you can make. These include, for example, dividend payments, distributions or interest. These profits can also be reinvested to benefit from compound interest. An example of such an asset class would be a high-yield ETF.

The level of security also varies greatly from investment to investment. There are different risks involved, such as currency risk or economic risk. There are different ways to reduce the risk of an investment defaulting.

Some asset classes are very quick and easy to buy and sell. Other investments are tied to specific times and are not accessible at all times. This fact is described by the liquidity of an investment. For example, you cannot terminate a home loan savings contract in every phase.

Attention!

What does this triangle have to do with your choice of investment? To answer that, you can take a close look at the three goals and ask yourself what is most important to you personally when it comes to an investment and where the focus of your assets should lie. There is no right or wrong answer; the investment must suit you and your life.

No investment can fulfil all these objectives at the same time. Safe investments are always associated with lower returns or liquidity. Therefore, it is important that you are clear about your personal risk appetite and how it relates to your investment objectives.

The most attractive investment can be both: less risk and higher returns.

A secure asset class may protect you from a total loss, but it endangers your assets in other ways: gas crisis and inflation worries for higher prices. Over long periods of time, inflation can devalue your money. As a result, you get fewer goods overall for the same money.

This shows how important it is to build up a balanced portfolio. A high-yield investment component helps you to make a profit and protects your assets from inflation. This way, you can, for example, provide for your old age or invest money for children and finance their wishes, such as a driving licence or an education.

Attention!

The safety net can reduce overall risk. In this way, fluctuations are no longer as severe and are absorbed by the safe assets. Safe assets are particularly suitable for building a financial buffer.

There are various ways to make even riskier investments safer. For example, make sure you have sufficient diversification. By spreading your investments, you can offset losses in individual areas in your portfolio. Diversification applies to:

- Different providers

- Various companies

- Countries

- Sectors

The best investments for more security in your own portfolio

Unexpected expenses can always arise: your car suddenly stops working and needs to be repaired, or you need a new washing machine. Very safe asset classes are particularly suitable for your emergency fund – a financial reserve for difficult times.

It is important that this buffer has a high liquidity, so that it can be accessed quickly should you need it. It should be easily accessible and securely invested so that you can rely on your financial strategy even in difficult situations. A useful example of such an investment is the instant access savings account.

Call money, fixed-term deposit, savings book

The instant access savings account is the classic among secure investments. It is flexible and easily accessible. In principle, it is an interest-bearing account without the commitment of fixed terms. The high liquidity ensures that you can access your money at any time should you need it.

Fixed-term deposits are very safe but less flexible. They are tied to a specific period of time. This can vary, with terms ranging from one month to ten years. You cannot access your money at any time, but must adhere to the terms.

Even the savings book carries hardly any risk. It used to be a popular asset class that offered the opportunity to make some interest. However, this is no longer the case: you cannot offset inflation with a savings book, which means that your assets will be devalued in the long term.

Government bonds for more security

Government bonds are fixed-interest securities issued by governments. An investor can lend money to a government for a certain period of time. At the end of the period, the investor gets his money back, including interest.

The security and potential returns depend heavily on the country in question. Countries are rated according to their creditworthiness. A high credit rating, such as ‘AAA’, indicates that a country is highly trustworthy and that the chance of getting your money back is high. The risk of default and the potential returns are low here.

For example, poorer credit ratings are labelled C or D. These are countries where there is a high probability of default risk and the investor cannot be sure of getting his money back with interest. Some of these bonds are highly speculative.

Attention!

Germany has a very high credit rating, which is why German bonds are considered very safe. However, they also offer no chance of a return and are therefore subject to the risk of inflation over the long term.

Investing in precious metals

Precious metals such as gold, silver and platinum are considered crisis-proof investments and are popular as an asset for the security component. Nevertheless, an investment in gold should be well considered. One advantage is that it is a limited resource, which ensures its value. In addition, gold is tax-free if you hold it for at least a year.

However, gold is associated with further expenses. Gold must be stored securely, for example in a bank vault. Storing it at home brings with it other problems. In addition, the prices for small amounts of gold are comparatively high.

You should also be aware that gold is not a risk-free investment. Depending on the economic situation, gold is also subject to strong fluctuations. However, the gold price often moves in the opposite direction to share prices, which is why gold is often used as a buffer for security in a portfolio.

Attention!

Furthermore, gold is not considered a high-yield investment. Profits can only be made if the gold price at the time of sale is higher than at the time of purchase. Gold does not pay interest or dividends to investors and cannot compensate for inflation, which is also a risk in the long term.

Real estate as an investment

There are several options for investing in property. Some people buy houses with the intention of living in them themselves at a later date and rent them out. By renting them out, you can build up a passive income and supplement your future pension. Real estate is a tangible asset and is in demand even in difficult times.

However, if all your assets are tied up in one property, your risk diversification is not particularly high. This is where real estate funds come in. These enable investors who cannot yet afford their own property to benefit from the property market.

These funds invest in real estate projects such as shopping centres, hotels or residential properties. The properties are then rented out. Investors benefit from the rental income or the increase in value when the properties are sold, which enables attractive returns.

Reduce risks by spreading them – this way, you can still make a profit.

As mentioned earlier, the most lucrative investments offer you the chance of an attractive return with a comparatively high level of security. No investment is completely safe, but there are assets that can be diversified very well, which lowers your overall risk.

Investing in lending: P2P as an investment

P2P lending is one example of such an asset class. P2P platforms enable lending between two private individuals. Unlike conventional lendings, no bank is needed. There are no long waiting times either, when the loan approval first has to be checked.

P2P lending is a form of crowdlending, which is a subcategory of crowdfunding. The term ‘funding’ refers to all the ways of raising money on online platforms. Crowdfunding is specialised and includes lending between two private individuals.

On average, returns of over 10 per cent can be achieved through P2P lending. It is therefore a high-yield investment that is suitable for building up assets. However, these loans offer further advantages:

- Small contributions are possible: If you want to invest smaller sums or test out an investment first, this works without any problems in the P2P area. This means that investors with less income or experience can also invest.

- Diversification: Investing small amounts also allows for broad diversification. You can spread your assets across many different lending opportunities, thus protecting yourself from total loss.

- Transparency: Lending is subject to fixed conditions. The borrower is categorised according to their credit rating, which should achieve greater transparency for the lender. Based on the credit ratings, you as an investor can decide whether the investment is too risky for you or whether the potential returns are worthwhile.

- Meaningful purpose: P2P lending can be used to easily support private projects. If the meaningfulness of your investment is important to you, you might find it in private lending and support other people.

Investing in ETFs: high diversification through broad distribution

ETFs are exchange-traded index funds that specialise in different areas, such as stocks. They track a specific index, such as the S&P 500, which contains the largest 500 listed companies in America.

Good to know:

Unlike investing in individual stocks, ETFs allow you to buy a whole ‘bunch’ of stocks with just one ETF. The MSCI World, for example, is an ETF recommendation and invests in over 1500 companies worldwide. It focuses on industrialised countries and their largest companies.

In principle, investments in stocks are always riskier than investments such as time deposits or government bonds. ETFs are subject to fluctuations and are more vulnerable in economically difficult times. However, they offer attractive potential returns and various ways to reduce risk:

- Diversification across different countries: an index based on the DAX invests in the 40 largest companies in Germany. If you only invest in the DAX and a crisis occurs in Western Europe, your portfolio is subject to strong fluctuations. It is advisable to invest in many different countries in order to balance out such regional crises.

- Diversification across different sectors: thematic ETFs specialise in certain sectors, such as infrastructure or energy. It is never possible to predict with certainty which sectors will perform better or worse. Therefore, you should invest in a broad range of different sectors. One option is the MSCI World Index.

- Long investment horizon: If you want to invest in ETFs, you should have enough time: only invest money that you don’t need in the near future. You should invest your assets for at least 10 to 15 years. The longer the money is invested, the lower the risk and the higher the possible returns.

Conclusion: These are the best investments with little risk of loss.

To summarise, when it comes to security, it is important to know your personal risk appetite. The magic triangle of investing can help you to better assess your goals as an investor and to clarify your priorities.

Secure investments such as fixed-term deposits or overnight money are suitable for safely storing an emergency fund of three to six months’ salary. This serves as a financial reserve in case you suddenly need money due to private circumstances, such as buying a new electrical appliance. Unfortunately, this investment does not protect you from inflation.

Once you have built up a safety net, you can start thinking about your return. Here, too, there are ways to increase security and take fewer risks. Perhaps the most lucrative investments are ETFs and P2P lending, as long as you diversify sufficiently and understand exactly what you are investing in.