Avoiding ETF risks: Tips for safe investing in 2025

ETFs (exchange-traded funds) are considered one of the most popular forms of investment. They are flexible, transparent and offer you the opportunity to invest in a broadly diversified manner. But how safe are ETFs really? And what risks do you need to be aware of in order to avoid losses?

In this article, you will learn about the risks associated with ETFs and how to protect yourself against them. With the right strategies, you can secure your portfolio and build a lucrative financial future.

In brief:

- ETFs are considered relatively safe compared to other assets due to their diversification, transparency and special asset structure.

- However, market risks, exchange rate risks and cluster risks are the main dangers.

- Long-term investments and broadly diversified funds reduce potential risks.

- Synthetic funds carry counterparty risk but are protected by EU regulations.

- Thematic ETFs offer opportunities for high returns, but also involve higher risks.

Why are ETFs considered safe?

ETFs are often seen as a safe investment option because they combine several mechanisms and features that significantly reduce risk for investors.

The historical development of ETFs is very attractive

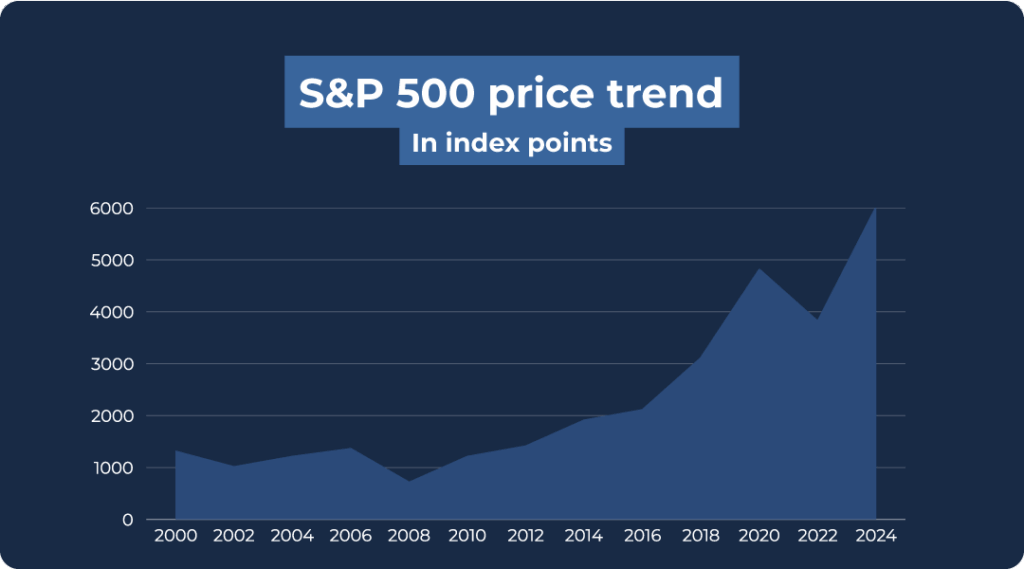

Over the past 20 years, the S&P 500 has achieved an average annual return of 7.6%. This represents an impressive total return of 329% over the entire period. These results are based on long-term market observations that include both periods of growth and difficult times such as economic crises. They therefore provide a realistic basis for assessing long-term return opportunities.

Let’s imagine you invested €10,000 in the S&P 500 in January 2014. After ten years, your assets would have grown to an impressive €26,040. That corresponds to a total return of 160.4% on your original investment.

Even if you had started later, you could have benefited from significant gains: with an investment of €10,000 in January 2019, your capital would have grown to €19,000 after five years. That is an increase of 90%.

The S&P 500 is also showing its strength in the short term. In 2023, the index achieved a return of 24.7%. An investment of €10,000 would have increased to €12,470 within that year. These figures illustrate the potential of the S&P 500 to generate attractive returns for both long-term and short-term strategies.

Index funds score points thanks to their diversification

One key factor is the broad diversification that ETFs offer by their very nature. With a single ETF, you can invest in hundreds or thousands of companies worldwide.

This diversification significantly reduces risk, as the success of your investment does not depend on the performance of a single company or a specific industry.

For example, one of the best MSCI World ETFs (ISIN: IE00B4L5Y983) holds shares in over 1,500 companies from 23 different industrialised countries. Even if one region or sector is weak, gains in other areas can offset losses.

Investors value transparency

Another reason for the security of index funds is their transparency. ETF providers must regularly disclose the composition of their funds to the public.

As an investor, you can therefore see at any time which companies and sectors are included in an ETF and how they are weighted. This transparency enables you to make informed decisions and better assess risks.

Compared to actively managed funds, where the exact investment strategies often remain unclear, index-linked funds offer a decisive advantage for calculating your potential ETF returns.

ETFs are low-cost

A third point is that index funds are cost-efficient. ETF costs (total expense ratio, TER) typically range between 0.05% and 0.8% per year.

This is significantly cheaper than actively managed funds, which often charge fees of 1% to 2%. These low costs help ensure that your returns are not reduced by high management fees. These savings make a significant difference, especially for long-term investments.

ETFs are protected in the event of your broker’s insolvency.

Index-linked funds are also protected by their status as special assets. This means that the assets in your ETF portfolio are kept separate from the provider’s assets.

Even if the ETF provider becomes insolvent, your invested money remains secure and will not be used to settle debts. This legal provision offers you additional security.

Invest from as little as €1 per month

Another advantage of index funds is their accessibility. Even with small amounts, you can invest in many stocks at the same time through a monthly ETF savings plan.

This makes index funds ideal for small investors who do not have a large amount of start-up capital. Simply choose an ETF for beginners and build a broadly diversified portfolio. This allows you to implement your individual ETF investment strategy over the long term with just a few pounds and build up attractive assets.

What are the risks associated with ETFs?

Despite all these advantages, you should not underestimate the risks associated with ETFs. Market risks, exchange rate risks and cluster risks with certain types of ETFs can affect your returns. However, with careful selection and a long-term investment horizon, you can minimise these risks.

| Advantages of ETFs | Disadvantages of ETFs |

| Historical development of ETFs | Market risks due to fluctuations |

| Low costs | Exchange rate risk for foreign indices |

| High flexibility | Cluster risk with thematic ETFs |

| Transparency of investments | Potential monopoly formation by a few providers |

| Broad diversification | Counterparty risk in synthetic replication |

A solid understanding of the potential risks helps you make smarter decisions and secure your portfolio in the long term.

Below, we highlight the most important risks associated with index-linked funds and provide valuable tips on how you can minimise them.

General market risks

Market risks affect all ETFs, as they are closely linked to movements on the financial markets. Economic downturns, political uncertainties or natural disasters can influence stock markets worldwide and lead to short-term or even long-lasting price slumps.

The coronavirus pandemic provides a clear example of this: in 2020, share prices fell dramatically worldwide. Many investors who sold their index funds in a panic incurred heavy losses.

However, those who remained patient and trusted in a market recovery were able to benefit in the long term. This incident shows how important a long investment horizon is in order to offset such fluctuations.

How to avoid losses due to market risks:

- Long-term investment horizon: Plan your investments for at least 10 to 15 years. This will allow you to weather short-term losses and benefit from long-term market developments.

- Broad diversification: Focus on global indices such as the MSCI World ETF to minimise risk from regional or sectoral downturns.

- Avoid panic selling: don’t let yourself be influenced by short-term price fluctuations. Stick to your investment plan.

Counterparty risk

This risk mainly affects synthetic ETFs that use swaps to replicate the performance of an index. A swap is an exchange transaction between an ETF provider and a bank.

If the bank becomes insolvent or fails to meet its obligations, this may result in losses. To protect investors, there are strict regulations in the EU: 90% of the fund’s assets must be secured by collateral.

Good to know:

If you want to avoid counterparty risk, choose physically replicating ETFs that directly purchase the securities included in the index.

Thematic ETFs and cluster risk

Thematic ETFs invest specifically in certain sectors, such as renewable energies or hydrogen. Although such index funds offer the chance of high returns, they carry the risk of insufficient diversification. If the sector or trend falls out of favour with investors, the index-linked fund may lose value.

Example: A hydrogen ETF that only invests in companies in this sector is heavily dependent on the development of hydrogen technology. If this technology fails, there is a risk of significant losses.

It is advisable to invest only a small portion of your capital in thematic ETFs. The majority of your portfolio should be invested in broadly diversified index funds.

Exchange rate risk

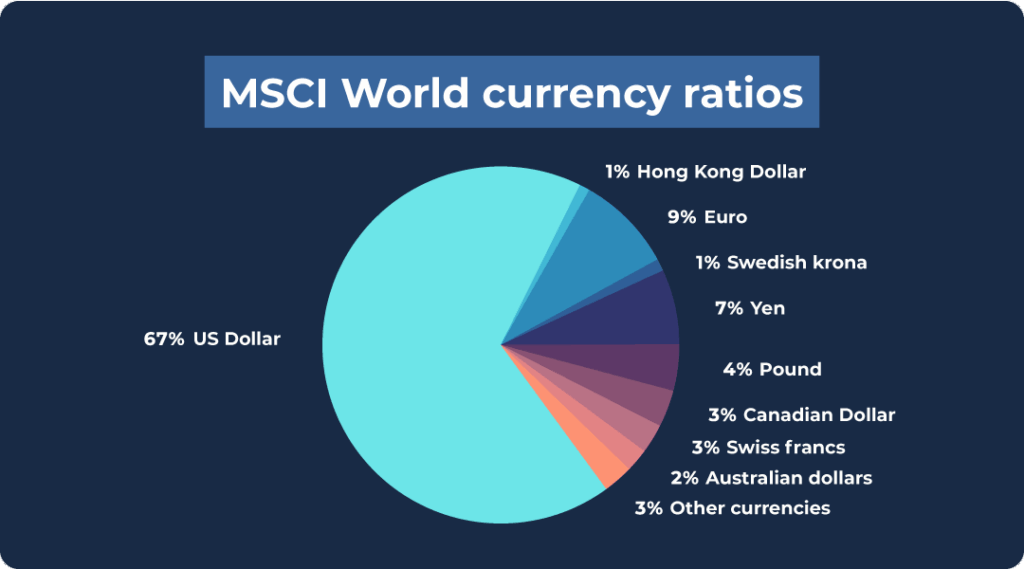

ETFs denominated in foreign currencies such as US dollars or British pounds are subject to exchange rate fluctuations. If the euro appreciates against a foreign currency, this may reduce the return on your ETF. At the same time, however, currency fluctuations can also have a positive effect.

For example, you invest in an ETF with a high proportion of US dollars. If the index fund rises but the US dollar loses value against your home currency at the same time, this can still lead to losses.

Good to know:

Choose ETFs with currency hedging if you want to avoid exchange rate risks.

Issuer risk

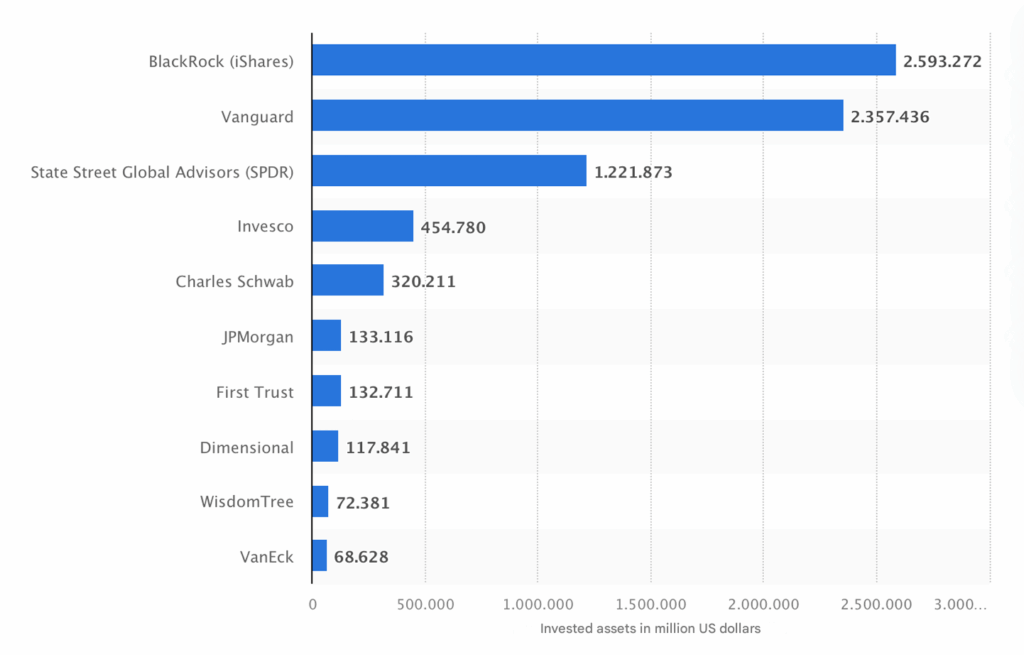

The ETF market is dominated by a few large providers such as BlackRock and Vanguard. In the long term, this concentration could lead to these companies gaining market power and costs rising for investors. This could be because issuers exploit their dominant market position to your disadvantage.

There is also a risk that smaller providers in financial difficulties will close their index-linked funds. Ideally, you should opt for index funds from established providers and regularly check their financial stability.

Practical recommendations: How to invest safely in ETFs

With the right strategy, you can minimise ETF risks and secure your assets in the long term. The following tips will help you invest safely and successfully in ETFs.

- Invest for the long term: Plan your ETF investments with a time horizon of at least 10–15 years. This will allow you to offset short-term losses caused by market fluctuations and benefit from long-term growth in value.

- Broad diversification: Invest in globally diversified ETFs such as the MSCI World. With an index fund like this, you automatically invest in hundreds of companies from different countries and sectors, which significantly reduces your risk.

- Prefer physical ETFs: Choose index-linked funds that directly purchase the securities in the index to avoid counterparty risk. Synthetic ETFs carry additional risk, even if they are regulated.

- Use specialised ETFs in moderation: Invest a maximum of 10-20% of your portfolio in thematic ETFs such as hydrogen or renewable energies. The majority of your capital should be invested in broadly diversified standard ETFs in order to minimise cluster risk.

- Keep an eye on costs: Choose index-linked funds with a low total expense ratio (TER), ideally below 0.5%. Low costs significantly increase your returns, especially for long-term investments.

- Manage exchange rate risks: If you invest in index funds with foreign currencies, check whether currency hedging makes sense to avoid losses due to fluctuating exchange rates.

- Use reputable providers: Choose established ETF providers such as BlackRock, Vanguard or iShares. These are financially stable and offer a wide range of index-linked funds. You should also choose an attractive platform for investing. We recommend reading the article on Trade Republic vs. Scalable Capital.

- Stay disciplined: don’t let price fluctuations tempt you into panic selling. Stick to your investment plan and focus on your long-term goals.

- Savings plans for small amounts: Use ETF savings plans to invest regularly in a broadly diversified manner, even with small amounts. You can build up long-term wealth starting from as little as €1 per month.

- Review your portfolio regularly: Check once a year whether your ETFs still meet your investment goals and rebalance your portfolio if necessary.

- Find out in advance: The ETF taxes you owe depend on whether you choose accumulating or distributing ETFs. With dividend ETFs, capital gains tax is deducted directly when the dividends are paid out. The situation is different for accumulating funds. In this case, the advance lump sum is payable annually.

Consider these criteria to build a secure, robust portfolio. This will allow you to relax and enjoy the long-term benefits of your investments.

Conclusion: ETF risks – know these dangers to protect your money

ETFs are a versatile and attractive investment vehicle that offer many advantages. Their low costs, broad diversification and high flexibility make them particularly interesting for long-term investors. Their combination of transparency and accessibility makes them equally suitable for beginners and experienced investors.

Nevertheless, you should be aware of the risks associated with ETFs. Market risks, exchange rate risks and specific risks such as counterparty risk in synthetic index funds or cluster risk in theme ETFs can affect your returns. Careful selection and strategy are crucial to avoiding losses and maximising the potential of index-linked funds.

With the right measures, such as a long-term investment horizon and the use of savings plans, you can secure your ETF portfolio and benefit from the advantages of this asset class.

Remember to make informed decisions and do your research beforehand, for example on costs or the choice between accumulating and distributing ETFs.

In conclusion, index-linked funds are an excellent way to build wealth if you understand the risks and actively manage them. With a well-thought-out strategy, nothing stands in the way of your financial success.