ETF costs in detail: How to reduce fees and increase returns

Have you heard of ETFs and are wondering how you can use them to invest your money wisely? Then you’ve come to the right place! ETFs, or exchange-traded funds, offer you a cost-effective way to diversify your portfolio.

Imagine ETFs as a packaged bundle of stocks on the financial market. With a single product, you buy a variety of securities, usually at a lower cost than with traditional funds.

However, there are different terms and costs associated with ETFs that you should be aware of in order to make informed decisions.

We will walk you through step by step how ETF costs are structured, what lies behind the total expense ratio and what other fees you may incur. This will help you find the ETF that not only fits your investment strategy, but also your budget.

In brief:

- ETFs bundle securities in a cost-efficient manner, but various fees such as TER, transaction costs and spreads apply. These costs can affect your return.

- The TER is the most important indicator of the ongoing costs of an ETF and includes management, licence and custodian bank fees. It is deducted from the fund assets on an annual basis.

- In addition to the TER, there are costs such as spreads and transaction costs. These arise from trading or adjustments to the ETF portfolio and are often not directly visible.

- Physical ETFs purchase actual securities, while synthetic ETFs work with derivatives. Both have different costs. Thematic ETFs are usually more expensive than traditional index ETFs.

- Choose ETFs with low TERs, minimise trading activity and use brokers that offer savings plans. Free savings plans can be advantageous, but check the terms and conditions carefully.

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

0 % without

Points

0 % without

Points

Points

Points

Points

Points

The basics of ETF cost structure

An ETF is like a ready-made strategy that gives you access to a broadly diversified portfolio without having to select each individual security yourself.

You benefit from a clear structure and efficient implementation. However, as with any professional service, there are fees involved, which you should take into account when making your decision.

What makes ETFs more cost-effective than actively managed funds?

ETFs allow you to build a broadly diversified portfolio efficiently and cost-effectively. As they generally passively track an index, extensive market analysis and constant adjustments are largely unnecessary. This keeps fees manageable and allows you to benefit from a clear, transparent structure.

Actively managed funds, on the other hand, are based on an individual approach in which opportunities and risks are continuously assessed. This often involves higher costs and more complex decisions, especially if the manager makes incorrect forecasts.

ETFs offer the following advantages:

- Lower administrative costs: No fund manager who has to make decisions all the time.

- Lower ETF order fees: Fewer reallocations mean lower fees.

- Clarity and transparency: You know exactly what to expect, with no hidden costs.

Good to know:

With an ETF, you are choosing a clear and proven path: efficient, inexpensive and simple.

What types of ETF fees are there?

When investing in ETFs, you should be aware of the various ETF fees that can affect your returns. They often seem insignificant, but can have a significant impact over time.

- Ongoing charges (TER): These fees cover the management of the ETF and are charged annually.

- Transaction costs: These arise when the ETF buys or sells securities, for example when the portfolio is adjusted.

- Spread costs: The difference between the purchase price and sale price of an ETF that arises during trading.

- Tracking difference: The actual deviation between the return of the ETF and that of the underlying index.

By understanding and comparing cost types, you can optimise your investment strategy and make better decisions in the long term. Even small cost advantages can add up to significant gains over the years.

Total Expense Ratio (TER): The key indicator for ETF fees

The total expense ratio (TER) represents the key cost factor associated with ETFs. It gives you a clear indication of how much you will have to pay each year for the management of your ETF.

The TER is like the base price of your ETF package. It indicates how much you pay annually for the management of your ETF.

TER ETF:

Always pay attention to the total expense ratio. This figure shows you how high the annual management costs of the ETF are. A low TER for an ETF can help you minimise fees and thus maximise your long-term returns.

How is the TER calculated and what does it include?

The TER is expressed as a percentage of the fund’s assets and comprises several items. Management fees, index licence fees, custodian bank fees and marketing costs are the most common components.

- Administrative charges

- Licence fees for the index

- Custodian bank fees

- Marketing expenses

An example: With a TER of 0.2%, an investment of €10,000 per year incurs €20 in fees.

In the end, it’s not just the percentage that counts, but also the amount of capital you invest. Anyone investing large sums should examine this aspect particularly carefully.

If you haven’t invested in ETFs yet but would like to find out more, take a look at the advantages and disadvantages of ETFs and compare providers such as Scalable Capital and Trade Republic to find out which broker is best for you.

Why is the TER not the only cost factor?

The TER provides important guidance, but it does not reflect all fees. ETF order fees may also apply if securities within the ETF are rebalanced. The tracking error shows how closely the ETF tracks its benchmark index, and tax considerations may affect your effective return.

- Transaction costs: These are additional costs and are not included in the TER.

- Tracking error: Shows the accuracy of the index replication.

- Tax impact: influencing the total cost

It is crucial to carefully consider all fee items. Even a low TER says little about how high the total costs will ultimately be. By taking a comprehensive look at all factors, you can make sustainable investment decisions.

Hidden costs of ETFs: What investors need to know

When investing, you probably pay attention to the well-known fees first, but there are other cost factors that are not immediately apparent at first. Some of these only occur occasionally, but can have a significant impact on your returns in the long term.

Transaction costs within ETFs: How do they affect performance?

Transaction costs arise when the ETF buys or sells securities. Frequent adjustments to the portfolio can reduce your returns and should therefore be kept in mind.

- Frequent index adjustments may result in higher costs.

- Large ETFs often trade at more favourable terms than smaller ones.

- The type of index plays a significant role in determining the level of transaction costs.

An ETF on a stable index such as the S&P 500 generally incurs lower transaction costs than an ETF on a more volatile emerging market index.

Spread costs: Why the difference between the buy and sell price is important

When trading ETFs, the spread, i.e. the difference between the purchase price and the sale price, can reduce your return. This effect is particularly noticeable if you buy and sell frequently.

- Liquid ETFs often have lower spreads.

- The spread varies depending on the time of day and market conditions.

- Frequent trading activities increase the impact of the spread.

A sensible approach: Buy and sell ETFs preferably at times when the underlying markets are open in order to benefit from tighter spreads.

Ultimately, hidden costs can quickly lead to lower returns. Keeping an eye on your total fees helps you make better decisions and benefit from a more efficient portfolio in the long term.

Physical vs. synthetic ETFs: What are the differences in costs?

Physical and synthetic ETFs use different strategies to achieve the same index performance.

You can benefit from this by carefully checking which option best suits your risk tolerance and cost objectives.

Differences in structure

- Physical ETFs invest directly in the individual securities of the underlying index.

- Synthetic ETFs use derivatives (e.g. swaps) to replicate the performance of an index.

- The actual composition of the fund portfolio therefore differs significantly.

Those who opt for a physical version enjoy a high degree of transparency and actually purchase the securities in the index.

Synthetic ETFs often save trading costs, but they come with counterparty risk, which should be considered when making decisions.

Impact on costs and risks

- Physical ETFs may incur higher fees for buying and selling when trading on large indices.

- Synthetic ETFs can reduce fees, but carry the risk of potential default by the swap counterparty.

- The choice between physical and synthetic replication is therefore a trade-off between cost optimisation and risk avoidance.

A thorough analysis will help you determine whether you place more value on cost advantages or lower counterparty risk.

Even minor differences in the fee structure can have a significant impact on larger investment amounts over the long term.

Tax considerations

- Physical and synthetic ETFs are taxed differently in some cases.

- Distributing and accumulating variants also influence the timing of your tax liability.

- Tax rules can vary from country to country, which requires additional planning.

Dealing with tax issues early on will save you from unpleasant surprises. If you invest across borders, you should find out exactly how much of your income will be taxed.

Thematic and factor ETFs: Why they are often more expensive

Thematic and factor-based ETFs focus on specific industries, trends or quantitative criteria. This focus enables specialised investment strategies, but may involve additional fees and higher risks.

Reasons for higher fees

- Complex analyses are necessary to identify interesting topics or factors.

- Lower trading volumes lead to fewer economies of scale and thus to higher costs per share.

- Extensive restructuring in response to market changes may result in additional transaction costs.

Careful consideration is important: you should ensure that the expected return potential justifies the higher fees. The volatility of these markets can also increase if trends lose their appeal.

Specific features of these types of ETFs

- Thematic ETFs bundle stocks that follow a common future theme (e.g. e-mobility).

- Factor ETFs sort securities according to characteristics such as value, low volatility or momentum.

- The composition may differ significantly from traditional indices and therefore offer specific opportunities and risks.

In addition to the TER and possible licence fees, other aspects such as liquidity and the approach to index replication must also be taken into account. This will help you determine whether a more expensive specialised ETF is really a better fit for your portfolio.

Cost-benefit analysis

- Specialised strategies often promise additional returns, but do not guarantee them.

- Higher fees and potentially lower tradability may reduce yield advantages.

- A clear prioritisation between return opportunities, costs and risks helps in the decision-making process.

Anyone investing in a more expensive theme fund should be guided by a long-term perspective. Short-term trends may be tempting, but sustainable returns usually require a convincing strategy and patience.

Calculating ETF costs: How to determine your actual expenses

Calculating the actual costs can dispel the illusion of having a cheap product that ultimately loses its appeal due to hidden fees. An exact breakdown helps you to realistically estimate the total cost.

Step-by-step instructions

- Determine TER: This percentage shows how high the ongoing fees are each year.

- Calculate costs based on the investment amount: For €10,000 and a TER of 0.2%, the annual expense is €20.

- Take transaction costs into account: around 0.1% per year is realistic. For €10,000, this amounts to an additional €10.

- Take the spread into account: When buying and selling, 0.1% may be payable, which means a one-off total of €20 for €10,000.

Such a combination of ongoing and one-off fees adds up over the years. Even a few tenths of a percentage point difference in the TER or spread can have a significant impact on the final result.

Sample calculation and interpretation

- For €10,000: €20 TER costs per year, around €10 transaction costs, plus a one-off fee of €20 for buying and selling.

- In the long term, all cost components have an impact and reduce your net return.

- The cost-return ratio should also be monitored so as not to rely solely on a low TER.

It makes sense to regularly review your actual costs, especially if your investment amount increases or if you add new ETFs to your portfolio.

Tools and resources

- ETF databases: Platforms such as justETF provide comprehensive information on costs and returns.

- Broker calculator: Many online providers offer calculators that allow you to compare different ETFs directly.

- Fact sheets: The official documents provided by fund providers list all fees and risk warnings in detail.

A combination of databases, comparison calculators and official documents can be used to create a good overall picture. This will enable you to better assess which ETF meets your criteria for a cost-effective investment.

Strategies for minimising ETF costs

If you want to optimise your portfolio, you should not only keep an eye on the known fees, but also consider various approaches to reducing costs. A few simple measures can already save you a lot of money.

How can investors effectively reduce ETF fees?

- Select ETFs with low TERs: A comparative look at several similarly structured funds can help you find a particularly favourable candidate.

- Consider fund size: Larger ETFs benefit from economies of scale, which leads to lower ongoing costs.

- Prefer simple indices: Complex strategies often generate higher administration and licence costs.

- Keep trading to a minimum: Every transaction incurs additional fees and spreads, which reduce returns in the long term.

- Take advantage of savings plan discounts: Some brokers offer more favourable or even free terms for regular deposits.

Carefully considering these points before making a selection will help you avoid unnecessary expenses. Taking the time to compare the fees charged by different products will give you a significant advantage in the long run.

Free ETF savings plans: opportunity or marketing ploy?

Free ETF savings plans sound appealing because there are no order fees and you can save regularly without much effort. At the same time, however, there are some restrictions to bear in mind.

- Advantages: No purchase fees, which is attractive for monthly or quarterly savings plans.

- Disadvantages: Often, only selected ETFs are available, which may incur higher spreads.

- Important: Even with free savings plans, there are ongoing costs (TER) and other fees that are included in the return calculation.

If you are interested in a free savings plan, you should take a look at the overall package. Even if no order costs are charged, other items may be above average.

If you haven’t invested in index funds yet but would like to find out more, learn about the best ETF for your goals. You may also be interested in the best MSCI World ETF for broad diversification.

Also pay attention to the ETF yield to see how different ETFs can affect your portfolio in the long term.

The impact of ETF costs on long-term returns

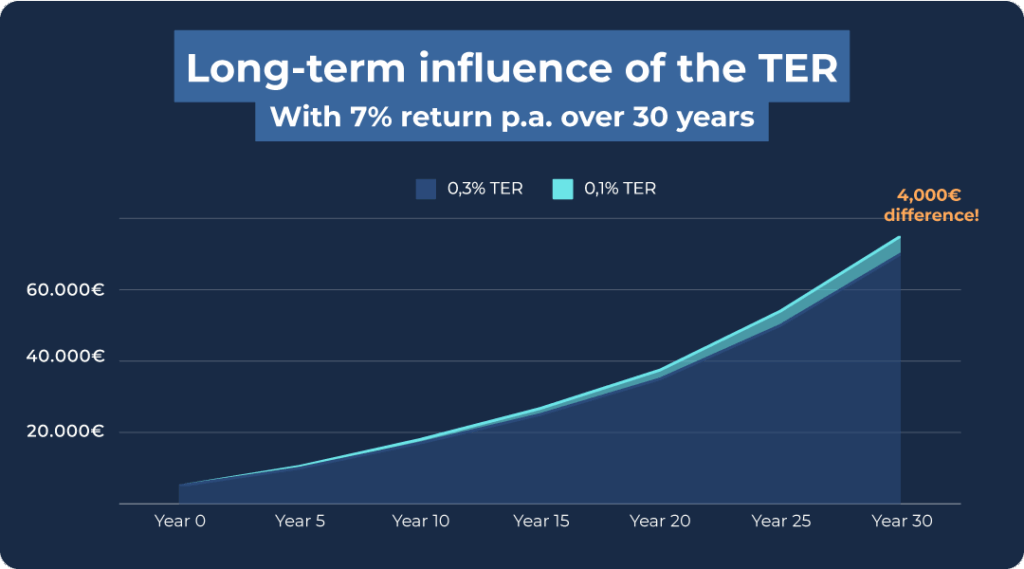

At first glance, fees usually seem to have only a marginal impact, but over decades they can have a significant effect. Even small differences in the cost ratio can add up to significant amounts.

Why even small cost differences can have a big impact

An example illustrates this. Assuming an annual return of 7% and an investment amount of €10,000, if there are two ETFs to choose from, the difference in fees can amount to several thousand euros in the final sum.

- ETF A (0.1% TER): After 30 years, the investment reaches €74,016.

- ETF B (0.3% TER): Over the same period, capital rose to €69,973.

TER ETF calculation example with spread: cost comparison over 30 years

Even ETFs with similar investment focuses can have cost differences that seem insignificant at first glance but can have a significant impact in the long term. Let’s look at three products based on an example index:

| ETF | TER | Tracking Difference | Gross return | Effective return | Final value after 30 years |

| ETF X | 0,20% | -0,30% | 7,00% | 6,50% | 66.143,66 € |

| ETF Y | 0,30% | -0,25% | 7,00% | 6,45% | 65.218,37 € |

| ETF Z | 0,40% | -0,35% | 7,00% | 6,25% | 61.640,79 € |

With an annual gross return of 7% and an investment amount of €10,000, the final values shown above are achieved after 30 years.

Although the differences in costs appear small at first glance, the difference between ETF X and ETF Z adds up to a considerable €4,502.96.

This illustrates how even small deviations in TER and tracking difference can lead to significant differences in investment performance over longer periods of time.

It should be noted that this calculation is simplified and does not take into account other factors such as transaction costs, spreads or regular savings rates. In practice, these aspects could further increase the differences between ETFs, especially in the case of regular deposits or rebalancing measures.

This example highlights the importance of considering not only the TER but also the tracking difference when selecting ETFs in order to achieve the best possible investment results over the long term.

Good to know:

A long-term investment strategy is crucial to minimising the costs of ETF investments. The less you trade, the lower the transaction costs.

Conclusion: ETF costs in detail – trade now with minimal fees

Choosing the right ETF and understanding its cost structure are crucial to the long-term success of your investment strategy.

The most important cost factors, such as the TER, transaction costs and spread costs, can have a significant impact on your return. It is therefore essential to analyse these costs carefully and select ETFs with low fees and good liquidity values.

ETFs offer many advantages, especially for long-term investors who want to benefit from broad diversification and low management costs. Careful selection of ETFs based on ETF costs, trading costs and liquidity can help avoid unnecessary expenses and maximise returns.

By adopting a long-term investment strategy and minimising trading activities, you can keep transaction costs low. You should also consider tax aspects, as accumulating ETFs often offer better tax treatment.

By understanding the different types of ETF fees and focusing on cost-efficient ETFs, you can achieve your investment goals and benefit from the advantages of a well-structured portfolio in the long term.