Low-risk investments: increase security in your portfolio

Perhaps you are familiar with the following feeling: during an economic crisis, your own portfolio is often subject to significant fluctuations. While your portfolio may be in the black during normal times, it can briefly dip into the red during an economic crisis. Some investors can become emotional as a result and find it more difficult to remain calm. In such situations, a security component in your portfolio could help. In this article, you will learn what low-risk investments are and how you can increase security.

In brief:

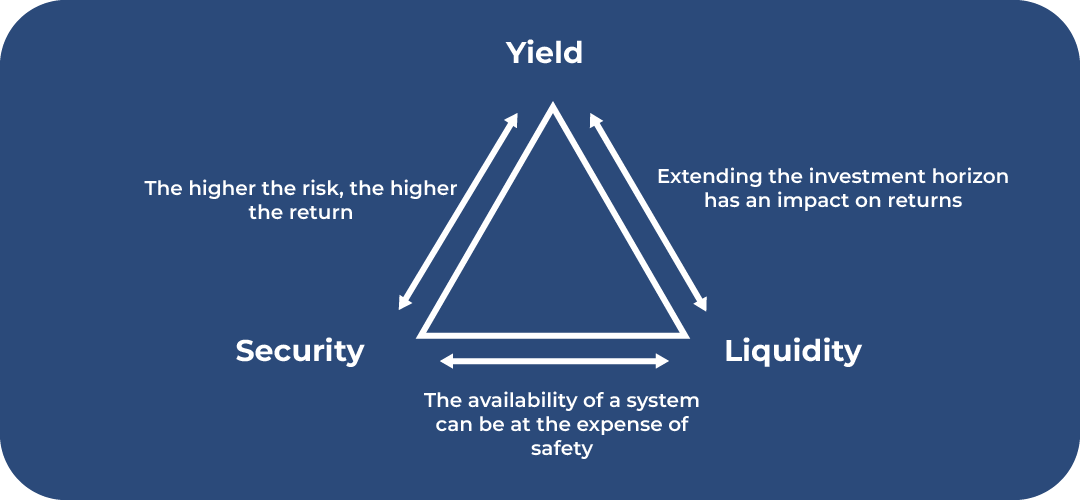

- The magic triangle of investing tells you more about the objectives of an asset class.

- Low-risk investments such as call money or precious metals such as gold and silver are suitable as a safety net.

- Safe asset classes help you balance your portfolio and reduce the overall risk of your portfolio.

- High-yield asset classes such as ETFs and P2P are suitable for the return component and offer attractive return opportunities.

- By following these tips, you can ensure greater security for your financial investments.

What you should consider when it comes to portfolio security

Investors differ in character and have different risk appetites. Perhaps you are one of those investors who are afraid of losing your hard-earned money. Or maybe you are one of those investors who focus on achieving high returns.

In order to put together your own individual portfolio tailored to your needs, you should be clear about your priorities and goals as an investor. With this knowledge, you will be better able to assess how large certain parts of your portfolio should be. The so-called magic triangle of investing can help you by explaining the goals and differences between various types of investments in a clear and concise manner.

The magic triangle of investment

Liquidity or availability describe how quickly you can access your investment if you need the money. For example, building society savings agreements are tied to specific terms and you cannot use the money immediately if you need it. The situation is different with a call money account: you have access to these assets at any time.

A second goal of investing is profitability, or the profits you can earn from your investment. The amount of time you have available is important for this goal. If you invest for a sufficiently long period of time and start early, it will be much easier to build up wealth in the long term and achieve financial freedom.

The final aspect is the security of a financial investment. Security describes the level of risk involved in making losses with this investment and losing money. Every form of investment carries a certain amount of risk, but this varies greatly from one investment to another. If you opt for a very low-risk financial investment, you will have to forego greater profitability and liquidity.

Good to know

The magic triangle of investing consists of three components: liquidity, profitability and security. These describe the different goals and differences that an investment offers. No investment can fulfil all three goals equally; the focus is always on one or two aspects.

Why too much security is a risk for your portfolio

Let’s assume you invest all your assets in very safe investments such as a call money account. In this case, you would have maximised your security, there would be no price losses and you would not experience any fluctuations. However, you would also not generate any returns with a portfolio.

Attention!

It is perfectly reasonable to consider security when building your portfolio. However, as you will have seen from the magic triangle of investing, it is impossible to achieve all three goals at the same time. No investment can offer you security, profitability and liquidity all at once.

What’s more, the money wouldn’t be working for you, as is the case with high-yield asset classes. High-yield investments are usually planned for the long term and benefit from compound interest. This shows how important it is to build a balanced portfolio – with the help of security and return components.

Good to know: High-security investments such as instant access accounts or savings accounts do not generate any returns. Inflation even reduces the purchasing power of your money. In the long term, you can lose money this way, as you can buy less and less for the same amount.

How to increase security in your portfolio

There are various ways to increase the security of your portfolio. Here, we show you the best risk-free investments, as well as other ways to prioritise security: If you follow a few basic rules when investing, you can achieve returns while still improving security.

Precious metals as a safe investment – silver, platinum and gold

A gold investment is known as a very safe investment. They often move in the opposite direction to stocks, rising when stocks fall during an economic crisis and falling when stocks rise. This makes precious metals a popular investment in difficult economic times.

In addition to the typical risks associated with price fluctuations, there is also currency risk. Precious metals are traded in US dollars. Nevertheless, gold, platinum and silver are considered safe investments and normally quickly recover their price level after a slump.

Good to know:

Precious metals are not a 100% low-risk investment. They are also subject to fluctuations and can experience sharp, short-term price drops. In such cases, you should wait and remain calm before selling your shares.

Fixed-term deposits and instant-access savings accounts – invest your money safely

Call money and fixed-term deposits are recession-proof investments. They are usually a central component of any investment portfolio. You can use them to store your emergency fund. Before you start investing, you should build up some kind of financial reserve for difficult times. Normally, your emergency fund should amount to 3 to 6 months’ net salary.

The reason for the high level of security is deposit protection. This is a government guarantee of up to €100,000. If your bank becomes insolvent, you know that your assets are protected. However, the interest rates are very low and hardly worth mentioning. These investments also cannot offset the rate of inflation.

It is advisable to regularly review the terms and conditions of your bank and other banks. If you find a better offer, you could benefit from switching banks on a regular basis. Online comparisons on the Internet are helpful for this, as they help you find the best offer.

Increase security and returns – where should you invest your money?

To increase the security of your portfolio, you don’t just need to invest in crisis-proof assets. If you take the following tips into account when investing, you can generate returns while still improving the security of your assets.

- Long investment horizon: Investing over as long a period as possible is an excellent way to offset fluctuations. In the long term, you can benefit from compound interest and let your money work for you. This can compensate for unfavourable entry points, such as periods when prices are high. To this end, it is advisable to develop a long-term strategy and stick to it.

- Diversification: A particularly good tip for increasing the security of your portfolio is to spread your investments widely. This protects against losses. Divide your money among several different types of investment and focus on different goals, such as the three goals of the magic triangle of investing. Potential losses on individual investments can be offset by the performance of the remaining investments. You should also invest in different countries and sectors.

- Financial reserves: The emergency fund mentioned above is important for protecting your investments. If you are not prepared for an emergency, you may find yourself in a situation where you need money for everyday expenses. It would be detrimental to your long-term investment if you had to dip into this money and it was no longer working for you. This could result in a reduction in your return.

- Pay off debt: This point is related to the previous one. Before you start investing, you should make sure that all your debts are paid off and that you can focus on your portfolio.

- Asset planning: To develop a suitable strategy for your investments, you should consider your entire assets. It does not make sense to only keep track of individual investments. It is a good idea to keep a household budget book. This will allow you to better assess your overall risk and see whether it matches your personal risk profile.

Financial investments for your return component

By focusing on safe investments, you can be sure that you will not suffer any losses, but you will not be able to make any gains and may even lose purchasing power due to inflation. This shows how important it is to have a balanced portfolio.

Attention!

If you build up a safety net with investments such as call money or precious metals, you can reduce fluctuations during difficult economic times. On the other hand, high-yield investments such as ETFs and P2P can ensure that your money works for you and that you can build up your wealth in the long term.

ETFs – Improved security and returns

ETFs are also known as exchange-traded funds. They are traded on the stock exchange and are a passive form of investment. They replicate specific indices, thereby achieving the average return of the respective index.

Investors pay into a joint investment pool. Depending on the strategy, these assets are invested in different types of investments:

Funds are divided into actively and passively managed funds. Active fund management is characterised by a fund manager attempting to make targeted investment decisions in order to increase returns. ETFs are a passive type of investment, which is why they are comparatively affordable. Fees range between 0.1 and 0.8 percent.

ETFs offer several advantages:

- Transparent and easy to understand

- Diversification protects your assets and reduces risk

- ETFs are legally considered special assets.

- Low costs thanks to passive asset class

- attractive potential returns

Investing using ETF strategies allows you to remain more liquid than with traditional investment funds, for example. Because ETFs are traded on the stock exchange, they are easy to sell during normal trading hours. Nevertheless, ETFs are generally a type of investment with a long-term investment horizon.

ETF recommendation: Invest in global ETFs

Global ETFs are particularly recommended. If you want to find a suitable ETF, you should ensure that it is sufficiently diversified for security reasons. Global ETFs such as the MSCI World comprise numerous companies from different industrialised countries, which gives you broad diversification and greater security.

Perhaps it is also an advantage for you that ETFs are eligible for savings plans. With this type of investment, there are often no order or custody fees. You can choose a specific amount and a time, and the investment is made automatically each month without any hassle.

Attention!

The respective return depends on the performance of the relevant ETF index. Because there are also thematic ETFs that specialise in different industries and sectors, returns vary greatly. A broadly diversified ETF that includes different countries and industries and reduces risk is recommended.

Transparency also offers an advantage for investors. If you are interested in the exact composition of your ETF in order to avoid overlaps, you can check this on the public website of the provider you have chosen.

P2P – What is the best way to invest money?

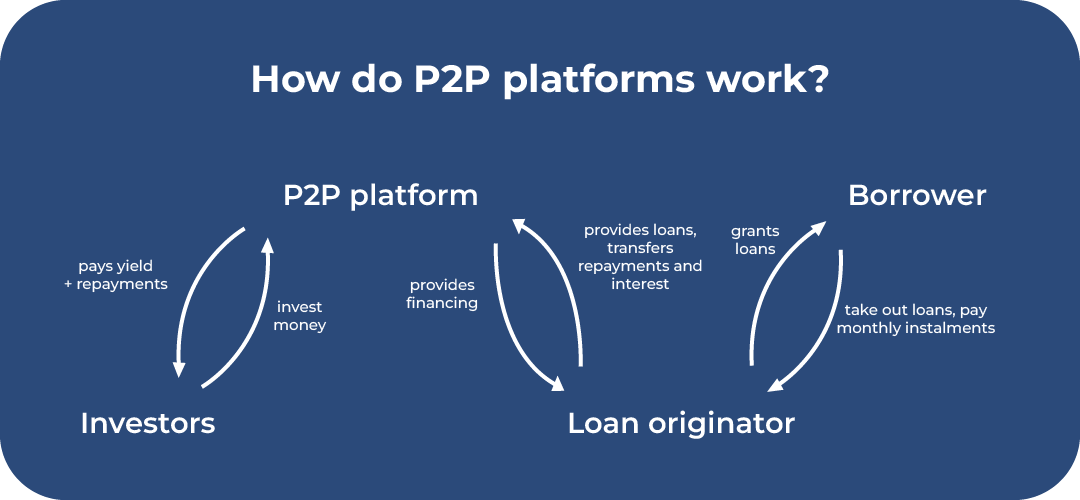

A P2P portfolio offers attractive return opportunities. These are loans granted by private individuals to other private individuals. This trade is facilitated by P2P platforms that bring lenders and borrowers together. P2P investments offer various advantages.

Investors who want to invest smaller amounts will also find what they are looking for in P2P. This allows a broad range of investors to invest. Investing smaller amounts in different types of loans also allows for sufficient diversification to increase the security of your investment.

P2P lending is worth mentioning Risks. As these are private loans, there is generally a risk of default. Unlike with banks, any private individual can apply for a loan. P2P platforms are relatively young, so it is possible that credit ratings may be incorrectly assessed.

To reduce the risks, you should invest in European loans. In addition, you can not only invest in loans with different credit ratings, but also consider different P2P platforms. This often offers the advantage that you can often benefit from a bonus.

Generate passive income with P2P? It works! Once you have thoroughly researched your investment, the process can be automated and passive. Many platforms offer tools for this purpose. You choose the size of the loans and their credit ratings yourself, and the programme carries out your wishes.

Conclusion: Combine low-risk investments with high-yield investments

The magic triangle of investing has shown that there are generally three different goals to investing: security, profitability and liquidity. No single investment can combine all three goals, which is why it is important to develop a personal investment strategy.

You can plan the security component of your portfolio using various strategies. On the one hand, you can opt for low-risk investments, and on the other hand, you should observe important basic rules when investing. These include diversification, building up an emergency fund and a long-term investment horizon.

Safe investments include precious metals such as silver, gold and platinum, or a call money account or savings account. They each have different advantages and disadvantages. Call money accounts and savings accounts are particularly advantageous due to their state deposit protection.

With the help of high-yield asset classes such as P2P or ETFs, you can balance out your low-risk investments, as these crisis-proof investments generate very little profit. This allows you to build a balanced portfolio and focus on security and returns. Find out more here.