Loanch review: 14.5% interest | €1,000 invested

Every year, new P2P platforms are launched that allow you to invest in the Baltic States or Eastern Europe. Loanch offers a profitable alternative: personal lending from Asia with interest rates of up to 14.5%!

I was able to try out the new player on the P2P market for myself and have already invested €1,000. In this review, I’ll show you who is behind the new platform, what opportunities and risks there are, and what you should pay attention to when investing.

In brief:

- Loanch is a fairly young P2P provider that allows you to invest in personal lending in Indonesia and Malaysia and earn up to 14.5% interest.

- The company was founded by Nik Sinikis, who has extensive experience in the world of technology and finance.

- The platform is currently experiencing strong growth, probably thanks to the attractive interest rates and good guarantees offered.

- I see excellent opportunities in the interesting Asian market. Of course, there are also some risks.

What exactly is the P2P Loanch platform?

A look at my comparison of P2P loans shows that many platforms offer attractive interest rates for your money. In this way you finance loans to individuals or businesses. These almost always come from Baltic countries, Eastern Europe and sometimes from countries like Spain or, in the case of Maclear, even Switzerland.

A new player has recently appeared with Loanch that is opening up a hitherto often overlooked market-Southeast Asia! Loans from Indonesia and Malaysia are currently available for investment. Both nations have large populations (Indonesia is home to over 280 million people) and strong economic growth.

- Strong growth is accompanied by strong demand for quick and easy loans.

- Credit intermediaries such as Ammana and Tambadana grant precisely this type of loan.

- To enable further growth, these companies are also refinancing their loans through the Loanch platform.

- Private investors like you and me can invest there and make money available for loans.

- In return, we receive most of the interest: currently up to 14.5% per year!

Ideal conditions for Loanch:

The company was founded back in 2022, but it took time to develop the platform. In 2024, it finally managed to open its digital doors and welcome its first investors.

Since then, there has been extraordinary growth: recently, the total amount of loans financed doubled in just four months!

Here are the most important facts about Loanch:

| Foundation | 2022 |

| Company headquarters: | Budapest, Hungary |

| Management: | CEO Nik Sinikis (founder) |

| Volume of credit financed: | 18 million euros |

| Regulated: | Unregulated platform, lenders are regulated |

| Annual report: | No annual report is available for Loanch; annual reports are available for credit intermediaries. |

| Investors: | Approximately 10,000 users |

| Yield: | Up to 14.5% on P2P loans |

| Money-back guarantee: | Available, effective after 30 days |

| Minimum investment amount: | 10 EUR |

| Automatic investment: | Yes |

| The secondary market: | No |

| Tax certificate: | Yes |

| Bonus programmes: | 1% extra return by registering via my link |

Management

Loanch was conceived and founded by Nik Sinikis. The Latvian engineer has a degree in Corporate Finance and extensive experience in the economic and financial sector. In addition, he has been an active P2P investor for many years.

Sinikis is not only the CEO, but also holds the majority of the company’s shares. He therefore has a personal interest in Loanch’s success. This is a positive sign for us as investors!

Another strategic partner is the Fingular group, which intends to acquire the platform in the coming months. Its manager, Maxim Chernushchenko, is well known in the P2P world, as his credit company Cashwagon suffered heavy losses on the Mintos P2P market.

Chernushchenko’s reputation has been severely damaged, but his achievements with Fingular speak for themselves: he has extensive experience in the personal lending sector.

Is it still worth using Mintos? More information in my review on Mintos!

The rest of the Loanch team consists of approximately 20 employees. The management team includes the following key members:

- Antons Lukjanenko: Human resources expert with extensive experience in the technology and finance sectors, gained through his work with large technology groups. He is responsible for investor relations.

- Arta Anaite: Certified anti-money laundering specialist, she has previously worked for renowned companies such as PayPal and Western Union. Among other things, she is responsible for the Know Your Customer process, ensuring that Loanch meets all legal requirements.

Loanch business model

The business model of the P2P platform is easy to explain:

- Credit intermediaries, currently only Ammana and Tambadana, grant loans to private individuals. The latter pay very high interest rates.

- Through Loanch, we can provide the money needed for these loans, enabling Ammana and Tambadana to refinance themselves.

- The largest portion of the interest paid goes to us, the investors. Credit brokers also benefit from this arrangement.

- Loanch also receives a small percentage of this interest on each loan financed.

The fact that this concept works very well is proven by other providers who have been successfully applying it for years. In my ranking of P2P lending, for example, you will find numerous platforms that generate millions in revenue this way!

How registration with bonuses works

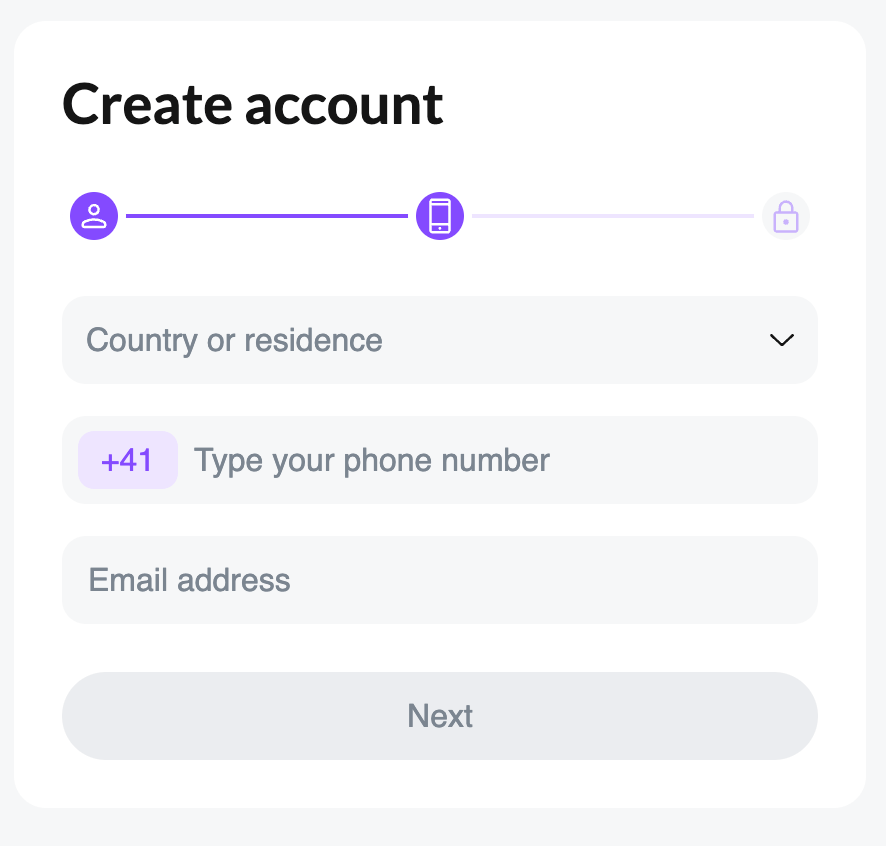

Would you like to try Loanch and earn up to 14.5% per year? Nothing could be easier! The registration process is very simple and only takes a few minutes!

To do this, you will need:

- An identity card, passport or residence permit

- A valid email address

- A mobile phone number

- A smartphone with an active Internet connection

- A bank account (not required for registration, but for depositing money at a later date)

Detailed instructions + guaranteed bonus

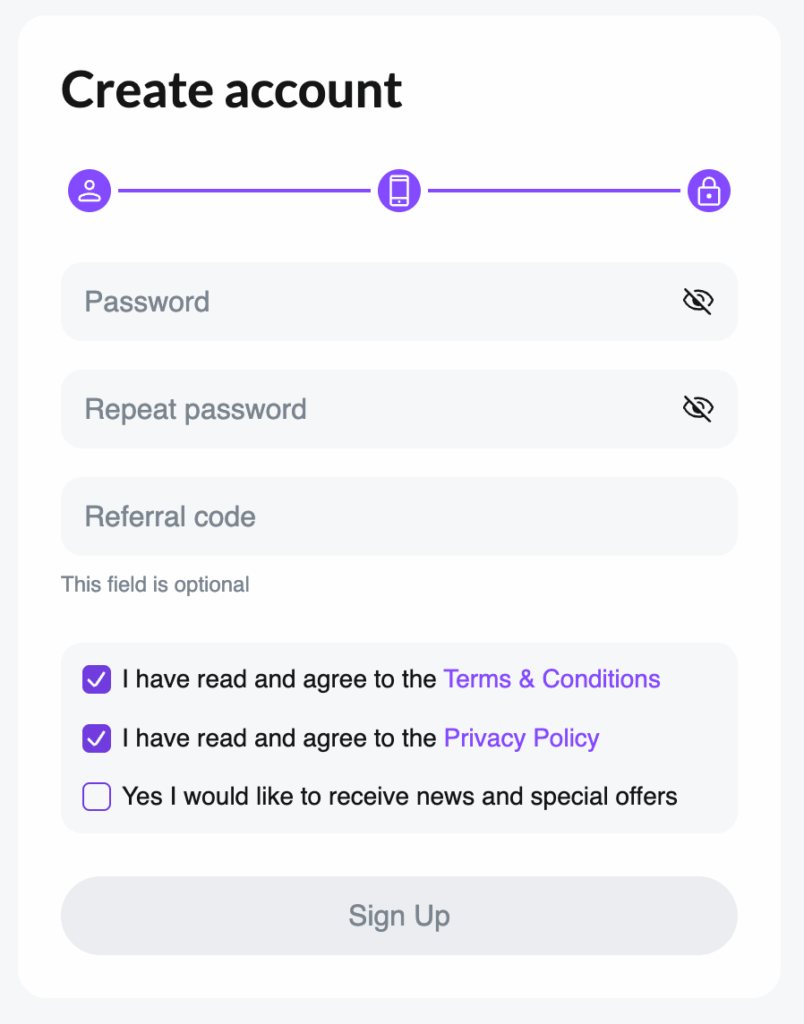

Start by clicking on my registration link. This will give you 1% extra interest for the first 90 days, an opportunity not to be missed!

- Then click on ‘Register’. In the next window, enter your first name and surname (please note: these must match the information on your identity document!).

- Now enter your country, phone number and email address. You will need to confirm these later, so make sure you enter a real phone number and email address.

Good to know:

If you have selected English as your language you will be able to see the countries. You can switch to another language in another step.

- In the third step, you still need to create a password:

- Verify your email address: You will find an email from Loanch in your inbox. Click on the confirmation link. You will be redirected to the verification page.

- Now you need to confirm your identity. If you have experience with other P2P platforms, you know how this works: for legal reasons, Loanch must ensure that you are who you say you are.

The P2P platform relies on the well-known provider Veriff. You can verify your identity using your smartphone (if you started the registration process on a computer, you will receive a QR code).

In my experience, this happens automatically, without the need to contact customer service.

After a few seconds, this process will be complete and your account will be activated. You will now be welcomed by the clear Loanch dashboard:

Deposit money, invest and withdraw profits

You can deposit money below under ‘Top up’ in the menu on the left. In my experience, a bank transfer only takes two working days. Once you have received the money, you can start investing right away.

This can be done either by manually selecting the credits or automatically using the ‘Autoinvest’ function. The minimum amount is €10 per credit in both cases.

If you wish to withdraw your money again at a later date, simply click on ‘Withdrawals’. Again, you will need to wait approximately two working days for the money to be credited to your account.

So far, my experience with Loanch has been positive: everything works perfectly and the website is clear and intuitive.

My experience with Loanch: how it works, fees and returns

I have only been active on Loanch for a few weeks, but thanks to my visit and interview with Tambadana, a credit broker, I have already been able to gain some interesting information.

Loanch does not charge any fees to investors. That’s great, but if you already have experience in the P2P sector, you know that this is the norm.

With the exception of Estateguru, none of the well-known P2P providers require anything from investors. This is one of the reasons why I reduced my capital there and invested it more in Fintown. To learn more, read my review of Fintown.

In terms of fees, Loanch is therefore able to compete with other platforms. Interest rates are also very attractive: depending on the project, they are 13.6% or 14.5% per annum!

In addition, sufficient credit is always available for investment, so that your money does not remain unused. These forced breaks produce what is known as ‘cash drag’:

- If sufficient loans are not available, you cannot invest all your money.

- The uninvested portion does not earn interest.

- Your overall return decreases because only part of your capital is working for you.

- You have to wait for new credits or invest larger amounts for each credit.

- However, higher sums increase the risk of aggregation and therefore your risk.

In my experience, this cash drag does not occur with Loanch. In the future, with a larger number of investors, the situation may change. At the moment, however, you do not need to worry.

My return: how I earn 14% interest

Loanch is still a relatively new platform, and I only signed up recently. To gain some initial experience, I initially invested ‘only’ €1,000. I proceeded as follows:

- I have selected only credits from user ‘Tambadana’ from Malaysia.

- All loans have a very short duration of 30 days.

- For this, I receive interest of 13.6% per year.

- Higher interest rates (up to 14.5%) would also have been possible, but would have required a longer term.

I chose Tambadana because I have already had the opportunity to meet this lender in person. His way of working and his professionalism convinced me, so I can invest here with complete peace of mind.

In the meantime, I have already received the first repayments and interest, and I can confirm that Loanch keeps its promises!

How does Auto-Invest work?

P2P platforms with short maturities usually have an automatic investment feature, and Loanch is no exception! It would be too laborious to manually select new loans several times a month. Furthermore, you would not reinvest your money immediately, thus losing out on returns.

Loanch’s automatic investment system is structured as follows:

- You can create a custom strategy or choose from two predefined methods.

- You can choose between ‘Long’ with loans up to 182 days in duration and an interest rate of 14.5%.

- The second option, ‘Short’, provides loans with a maximum duration of 32 days and an interest rate of 13.6%.

- In addition, you can also set your own parameters and independently choose the duration, interest rate and investment amount for each loan.

As soon as a loan is repaid and the interest is distributed, your money is immediately reinvested in the next loan. How to get the most out of it! This method should be the best choice for most investors:

- Short-term consumer loans do not vary greatly. Selecting them manually would make little sense. Loanch therefore only provides you with minimal information.

- This concept is very different from P2P platforms, where you invest in individual large-value loans that you should check out first. This is the case, for example, with LANDE’s agricultural loans. More information in my review of LANDE.

- If you have invested large sums in Loanch, manual selection involves a considerable amount of time and effort. In this case, the Auto-Invest feature is truly invaluable!

Good to know:

Loanch has set a maximum amount for automatic investments. You can invest a maximum of €10,000 in this way.

Loan risk: how dangerous is the P2P platform?

Sooner or later, all investors will face cases of insolvency or delays in repayments. In the case of P2P lending, these are simply part of the game, but they are easily offset by repayment guarantees and high interest rates.

Loanch is no exception! If a borrower is unable to repay the money, this does not result in any loss for you:

- The promoters Tambadana and Ammana, through whom the loans are granted, also arrange for the recovery of the funds.

- If the refund is 30 days late, Loanch’s money-back guarantee kicks in.

- The credit broker will now have to reimburse you from his own pocket.

- You will, of course, be paid any interest accrued during the period of delay.

In normal day-to-day operations, your investment is therefore secure, because in the event of default, the credit broker is obliged to refund your money. The companies will then naturally attempt to recover the money from the debtor through debt collection measures.

However, since you have already been paid, this procedure should not concern you too much. During my personal interview with Tambadana, I learned that the default rate was initially only 12% and has since fallen to 6%. It therefore appears that this is a profitable business.

Loanch’s experience with crises: how secure is Loanch?

Let us now turn to the significantly more serious danger: a severe crisis, a prolonged recession or similar problems. During the COVID crisis, for example, many investors had to realise that even safety mechanisms have their limits.

If too many borrowers become insolvent (for example, because they have lost their jobs due to a global pandemic), even a credit intermediary such as Tambadana or Ammana is at risk.

- In this case too, the refund guarantee applies and credit intermediaries must reimburse investors after 30 days of delay.

- Due to massive defaults and payments, the financial reserves of these credit companies are rapidly being depleted.

- In the event of a promoter’s insolvency, investors could lose part of their capital or even be left completely empty-handed.

In the past, most crises in the P2P world have been resolved acceptably. Investors generally recovered their capital, but they often had to be patient for a long time. In this case, Mintos investors faced long wait times-I still have outstanding payments too!

I assume that Loanch would also be able to overcome a crisis of this kind. Considering the attractive interest rates, I believe that this risk is acceptable. Furthermore, this risk can be minimised with one simple measure: diversification!

Spread your capital across multiple P2P platforms and you will greatly reduce the risk of incurring large losses in a crisis. In addition to Loanch, there are dozens of other P2P providers. In my ranking of P2P loans you will find the best candidates.

Pros and cons + My opinion

My experience with Loanch is mainly based on conversations with credit brokers and an analysis of financial data. Given the company’s short history, I unfortunately cannot say much about the rest of its business. The following advantages and disadvantages have emerged so far:

| Advantages | Disadvantages |

| Very high interest rates of up to 14.5% | There is no experience yet with Loanch or credit intermediaries, as the companies are still relatively new. |

| Many receivables with very short maturities, less than 30 days, ensure high liquidity. | Lack of diversification: only two credit intermediaries, two countries and one type of credit (short-term consumer credit) |

| 30-day money-back guarantee | It is unclear how effective the safety mechanisms would be in a real crisis. |

| Simple and intuitive platform with automatic investment function. | There is no secondary market |

| Competent management team with experience in the P2P sector | The platform is not regulated and no annual report is available yet. |

| An interesting market (South-East Asia) ideal for diversifying existing P2P portfolios | |

| Excellent growth opportunities for Loanch and the credit companies represented therein | |

| The data available so far (growth, insolvency rate, etc.) is very positive. |

Alternative P2P platforms

Loanch offers short-term P2P lending and is therefore in the most competitive niche of the market! As a result, it faces numerous competitors:

1. Swaper

Swaper is probably the fiercest competitor: the P2P platform also offers interest of around 14.5% and offers very short-term loans, allowing investors to exit their investment quickly. Unlike Loanch, however, it has much more experience, having been active since 2016.

In my opinion, both providers are therefore very interesting. For diversification reasons, it might be a good idea to sign up for both platforms.

2. Viainvest

Only 12% interest on consumer lendings, but excellent payment statistics: Viainvest has always been a mainstay for investors in all crises. This allows investors to turn a blind eye to slightly lower interest rates and longer loan terms.

3. Monefit Smartsaver

The provider Monefit takes the concept of highly liquid P2P lending to the extreme: there are no minimum terms or similar, and you can withdraw your money at any time! In return, you receive ‘only’ 7.25%, which is still much more than a comparable instant access savings account or similar products.

Taxation on Loanch

Profits from P2P investments are, of course, taxable. However, this often raises the question: Where do I have to pay tax? In many cases, the country in which the P2P platform is located already levies a withholding tax. You can then offset this against your flat-rate withholding tax.

With some other providers, this additional effort is not necessary and you can offset your profits directly in your country.

Fortunately, Loanch falls into the second category!

All you have to do is enter your income in your tax return.

You can see how much you have earned with Loanch in the ‘Account statement’ section on the left-hand side of your navigation bar.

If you have any questions about taxes on personal loans, please contact a specialist who is familiar with the subject of taxes.

Conclusion on my experience with Loanch: attractive interest rates and I invest

Is Loanch just another P2P provider that allows you to invest in short-term consumer loans? Not quite! The new platform based in Hungary offers microloans from Southeast Asia and is therefore ideal for diversifying your P2P portfolio. The interest rates, which currently reach up to 14.5%, are also very attractive!

As a relatively new provider, there is naturally a lack of experience, so there is a certain amount of risk involved. However, given the strong growth and high interest rates, this is acceptable to me: I have already invested €1,000 and will definitely increase this amount further.

A buyback guarantee protects you against bad debts, and an automatic reinvestment feature simplifies investing. In addition to a secondary market (which is hardly necessary given the very short duration), there is everything an investor could want.

My experiences with Loanch so far and my impression during the face-to-face meeting with credit broker Tambadana have been very positive. I believe that the new platform can become a benchmark in the P2P market and offer good opportunities to generate passive income with P2P!