My Ventus Energy review: up to 24 % interest

No P2P platform is currently growing faster than Ventus Energy! You can earn 17% interest plus up to 6% cashback bonuses here. With this offer, the company has already financed over 43 million euros in just one year! I have invested more than 11,700 euros and will tell you about my Ventus Energy review and the possible risks.

In brief:

- Ventus Energy is an energy company from the Baltic region that finances its growth strategy through P2P investments.

- With your money, you support the purchase of power plants, solar systems, etc., and in return you receive 17% interest per annum!

- Disadvantages: The minimum deposit is a hefty €1,000 + there is a risk if the strategy does not work out.

- I invested €11,700 and have had very good reviews with Ventus Energy so far.

What is Ventus Energy? What is Ventus Energy?

A glance at my P2P lending comparison shows that most platforms are structured in a very similar way. But one provider stands out from the crowd: Ventus Energy takes a fundamentally different approach – so different that it is no longer 100% a classic P2P lending investment.

Instead, you invest directly in a young, successful company on a growth trajectory. Ventus Energy operates power plants for electricity and heat production, solar plants and other projects in the energy sector.

So there is no P2P platform acting as an intermediary here; instead, your money goes directly to the project operator. In return, you receive extremely high interest rates of currently 17%, which can be increased to up to 24% through bonus promotions. Of course, even the best investment is not without risk!

- The high interest rates are possible because the company invests in the highly lucrative energy sector. Power plants, solar installations, battery storage facilities and the like can generate very high profits when in operation.

- The company purchases older systems and optimises them, but will also continue to build new systems in the future.

- They are considered “green energy” in Europe and are subsidised accordingly by the EU, which accounts for a large part of the expected profits.

- Investors like you and me provide interim financing (mezzanine lending) until larger investors come on board at a much less dramatic interest rate.

The concept is difficult to compare with traditional personal loan platforms from my P2P lending ranking. Instead, it is more similar to offerings such as Fintown, which I have also already reported on in my article ‘Fintown reviews’. abe.

| Foundation | August 2024 |

| Company headquarters: | Riga, Latvia |

| Management: | CEO Henrijs Jansons |

| Assets under management: | Over EUR 76 million |

| Financed credit volume: | Over EUR 4 million (10/2025) |

| Regulated: | Financial platform not regulated, energy projects are regulated |

| Annual report: | Company has not yet completed a financial year |

| Investors: | Über 3.600 private Anleger, sowie Banken |

| Returns: | 17 % + 1 % Cashback über meinen Link + 5 % Cashback bis Ende Oktober |

| Buy-back guarantee: | Yes, after 90 days, hedged with company shares. Earlier project exit possible after an average of 6 months |

| Minimum investment amount: | 1.000 EUR |

| Auto-Invest: | No |

| Secondary market: | No |

| Tax certificate: | No |

| Bonus programmes: | Temporary additional interest of 5 % + 1 % bonus for 60 days if you register via my link |

The team behind Ventus Energy

With a company like Ventus Energy, we have to take a particularly close look at the management team – after all, their experience and skills will determine the company’s future success! A look at the people involved reveals that this is a kind of ‘all-star team’ in the Baltic P2P scene.

- CEO Henrijs Jansons is likely to be familiar to industry insiders from his work at Debitum. He led the provider of corporate loans back to success after a long dry spell, thereby demonstrating his talent.

You can find out more about the current status of the platform in my report on Debitum review. Spoiler: It is a very attractive provider, which recently even took first place in my P2P lending ranking!

- Tom Abele supported him with his marketing skills and also made the switch to Ventus Energy.

- The Chief Development Officer is Janis Timma, who previously worked for Crowdestor. Although this P2P platform has a poor reputation, the projects initiated by Timma earned investors over 19% interest per annum. Payouts and repayments were always made on time, which was an absolute exception for Crowdestor!

- This is hardly surprising: all investments were made in the energy sector, an area in which Janis Timma has a great deal of experience and expertise, not least as the owner of a biomass power plant!

All in all, Ventus Energy has assembled a top-class team, which I personally believe is fully capable of successfully managing such an ambitious project.

How the business model works

Ventus Energy does not work like Mintos or other P2P marketplaces where you make your money available to other people or companies. Instead, it is the provider itself that operates the projects and in which you invest directly.

The business model is also different.

You don’t earn money from the interest and fees you charge borrowers. Quite the contrary: Ventus Energy has to pay interest to investors like you and me, as well as to the banks involved, and generate this capital through its operating business.

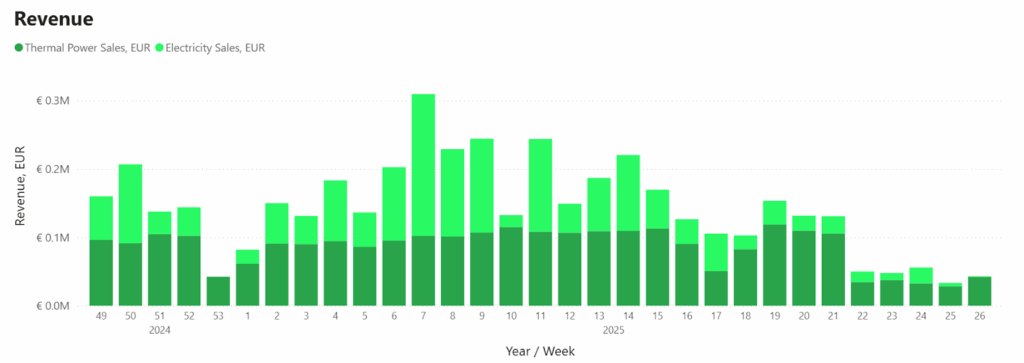

- The power stations and solar installations generate high revenues through their daily operation.

- The best result to date was in February 2025, with over €300,000 in just one week!

- So here you are investing in an energy company that is already making money and has valuable experience in this sector. This is not a theoretical concept!

- Another important source of income is subsidies: the European Union subsidises renewable energy production with large sums of money, from which Ventus Energy also benefits.

But if Ventus Energy already successfully operates power plants and solar facilities and receives subsidies, why are they offering investors high interest rates? The answer is simple: they want to grow and build and purchase additional facilities in order to develop a large and successful energy portfolio.

- The necessary capital will come in the long term from banks and other large investors, who will receive market interest rates in return.

- However, it may take a very long time to convince these investors and for the money to actually reach Ventus Energy.

- In the meantime, private investors like you and me are stepping in. We are much quicker to lend money.

- Through our crowd-sourcing, we are financing the projects in the meantime, allowing Ventus’ portfolio to grow more quickly.

Investments with Ventus Energy

The projects available at Ventus Energy are usually offered in phases, so you can invest your money at any time and never have to wait too long for the first interest payments to arrive.

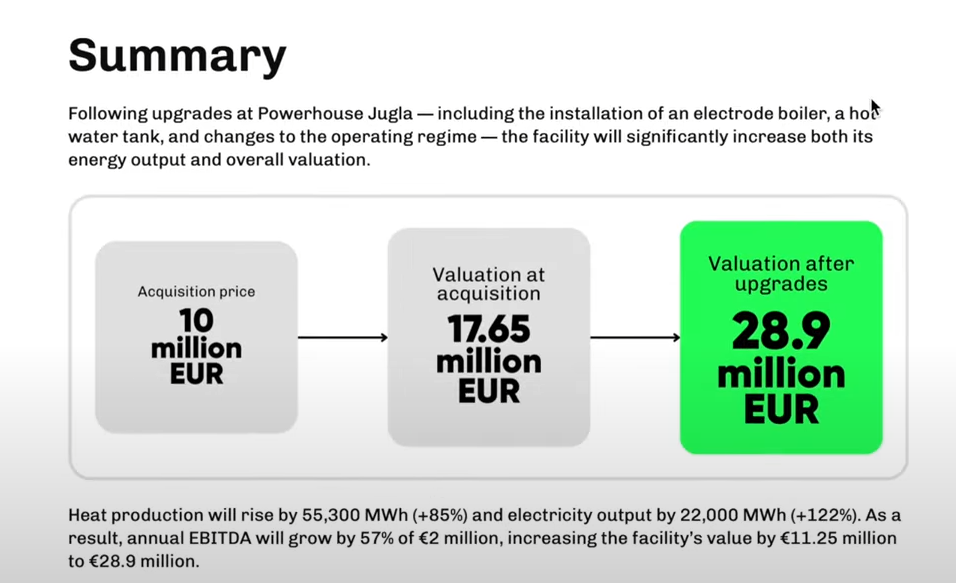

In addition to acquisitions and the construction of new plants, there are also optimisation projects designed to improve existing plants. You will receive comprehensive information about each project. The selection of data shows that Ventus Energy has a wealth of experience in the energy sector and knows exactly what it is doing.

- The interest rate for all projects is generally 17%.

- This value increases to an incredible 24% per annum thanks to my sign-up bonus and regular cashback promotions!

- Since we make the money available directly to Ventus Energy for all projects, the selection is hardly relevant.

Ultimately, however, we are always investing in the company itself; which project we choose is secondary. If Ventus Energy’s ambitious strategy does not work out, our capital will be lost – regardless of which power plant or other project we have invested in!

One major disadvantage: you must have at least €1,000 available to invest in Ventus Energy. The high minimum amount is intended to ensure that only committed investors with sufficient capital get involved. For this reason, you will not find typical P2P lending features such as an auto-invest function.

Good to know:

There is the option of early exit. You can sell your investment at the earliest three months after joining – provided that another investor is interested!

Register with Ventus Energy + get a bonus!

Have I piqued your interest and would you like to participate in one of the most exciting financial projects of recent years? Then you should register immediately via my link and secure an additional bonus!

First, you must enter your name, email address and telephone number, and create a password.

Now it’s time for the usual verification via identity card or passport. Ventus Energy must carry out this step in order to comply with the requirements of the European Money Laundering Act.

The provider for authentication is ‘veriff’ and, according to my review, the entire process takes only a few seconds. You do NOT have to make a video call with a service representative; everything works automatically.

How to receive your bonus

There are currently two exciting bonuses available at Ventus Energy:

You will receive 1% cashback when you register via my link! One percent of the money you invest here will be refunded to you immediately in cash. You can then withdraw this amount or invest it again, for example.

However, this bonus is only valid for the first 60 days after registration! To make the most of it, you should invest a larger amount at the beginning.

As an added bonus, you will receive an additional 5% cashback! This bonus promotion is not available all the time, but it does appear every few weeks.

For every investment you make during this period, you will receive a total of 6% of your money back into your account immediately.

For both bonuses, all you have to do is top up your account after registering and make an investment. You can see your refund immediately afterwards in your dashboard and use it as you wish.

Good to know:

If you have a particularly large amount of capital at your disposal, a loyalty bonus also awaits you: for investments over €100,000, you can earn 2% additional interest. However, due to the high sum involved, this is likely to be worthwhile for very few people.

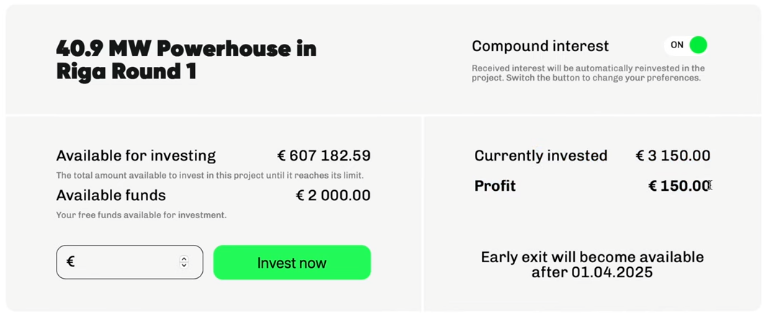

My Ventus Energy review: How I earn 19.8% interest on my €11,700 investment

Based on my review of the platform so far and my personal contact with the management team, I am convinced of Ventus Energy. That is why I have invested a total of €11,700. Thanks to the very attractive interest rates and cashback bonuses, I have already earned €1,700.

With a total of €11,700, Ventus Energy is therefore an important component of my portfolio.

Ventus Energy works with very high cashback bonuses that pay off immediately. However, if you invest in a project for several years, your return gradually decreases and settles at around 17%.

One of my first reviews of Ventus Energy was an investment in the project ‘Powerhouse Daugavpils’. Here you can see how I immediately received €150 as a cashback bonus for my €3,000 investment:

You receive your interest from Ventus Energy daily. You can choose between automatic reinvestment or accumulation for later payout.

Good to know:

You can reinvest your earned interest or have it paid out. The withdrawal process takes approximately one working day.

Tax on your winnings

The tax situation looks quite simple. If you have already gained experience with P2P companies such as Ventus Energy, you probably know that Latvia levies a withholding tax of 15 %. This is withheld immediately and can be offset against your final withholding tax in Germany.

However, this process creates additional work and is unpopular with all investors who have already had to deal with a review of it.

- Ventus Energy makes it easy for us: although the company operates in Latvia, its tax domicile remains in Estonia. And the tax situation is much better here!

- This is because Estonia does not levy any withholding tax, so you can pay tax on your profits in the United Kingdom as normal. This makes the whole process much easier.

- Companies can also open an account with Ventus Energy and receive the same high interest rates. In this case, the tax situation is naturally different.

A tax certificate is available in your account area with just a few clicks. All you have to do is select the desired period and you will receive the appropriate report.

You simply declare the profit shown there in your tax return. In Germany, you use line 19 of Appendix KAP for this purpose. If in doubt, however, you should definitely contact a tax advisor.

Incidentally, this feature was not yet available when I wrote my first report on my reviews with Ventus Energy a year ago. So you see: things are happening here! The company is constantly improving its offering.

Ventus Energy Risk: Is my money safe here?

I won’t lie to you: Ventus Energy is a risky platform! The company is still young, and even though the management has a lot of experience in the industry, the future prospects are uncertain.

- The entire project is also extremely dependent on the energy market. Since February 2025, the Baltic states have no longer been connected to the Russian energy grid. Instead, further connections to Europe are now being established. Energy prices are likely to remain high in the foreseeable future.

- Fluctuations in the price of electricity and district heating or a reduction in EU subsidies would also have a significant impact on the company. The consumption of wood chips and gas is enormous, and price increases for raw materials could also have a significant negative impact on profitability.

- If the project goes wrong and there is a threat of insolvency, we private investors are at an additional disadvantage: We only get our money back once the banks (main investors) have been paid out.

How likely is the worst-case scenario, namely Ventus Energy going bankrupt? In my view, the company’s chances of success are very high! The current business figures confirm this: up to €300,000 is generated per week through the sale of heat and electricity. So the business model is already working very well!

Additional security is provided by the very favourable purchase prices for the power stations, which result in a low loan-to-value ratio (debt burden on the plants).

Regulation

Ventus Energy recently became a registered investment fund. This status comes with additional transparency requirements, among other things. It will also make it easier for the company to obtain favourable bank loans in the future. This is excellent news for us as investors!

On the practical side, as an energy company, it is also monitored by numerous authorities. The market is highly regulated and not everyone can simply acquire a power plant. This creates additional security, as we know that it is a legal, operational company.

Advantages and disadvantages of Ventus Energy

Ventus Energy is a risky but also highly lucrative financial project. Its advantages and disadvantages are just as unique as its business model:

| Advantages: | Disadvantage: |

| Extremely high interest rates of up to 24% currently possible | High risk due to the challenging industry |

| Experienced team that has already successfully managed other P2P platforms and power plants and is very knowledgeable about the energy sector | The energy market is notoriously volatile (raw material costs, energy prices, political situation, etc.). Security measures such as buy-back guarantees and early exit options are promises made by the company that are likely to be quickly withdrawn in an emergency. |

| Protective mechanisms such as buy-back guarantee and the option of early exit Investment in operational business with existing facilities that are already generating profits | Very high minimum investment of €1,000 per project |

| High transparency for all projects, plans and previous figures | You invest directly in a single company and are dependent on its success. |

| The power plants and solar installations were acquired at well below their value and have a low loan-to-value ratio. | An annual report does exist, but it is not available for inspection. |

| Strong compound interest effect thanks to daily interest crediting | |

| Lucrative business area | |

| Ventus Energy is an exciting addition to an existing P2P portfolio and can serve as a Mintos alternative, for example. |

Alternatives to Ventus Energy

When looking for similar products, the European market looks rather bleak: no other provider offers a direct investment in a company on the energy market.

However, if you are interested in loans in industry and commerce in general, there are a number of options available to you. At debitum, for example, you can find business loans with interest rates of up to 15%.

This is a P2P platform that connects you with external borrowers and is therefore fundamentally different from Ventus Energy.

Another alternative is to invest in agriculture via the Lande platform. Here, you finance lending for farmers, for example to purchase seeds, cattle or farmland. Machinery, crops or animals usually serve as collateral.

You can expect around 13% here. I have described in more detail how well this works in practice in my reviews on my Lande review.

What the community says about Ventus Energy

The Northern Finance community is divided in its opinion of Ventus Energy. Some members do not want to miss out on the high interest rates and have already invested money. Considering the high minimum amount of €1,000, this is an important sign of trust in the company!

Of course, there are also many investors who shy away from the considerable risk involved. This is completely understandable, as the combination of unclear prospects and large sums of money is potentially dangerous. I would advise people with rather small portfolios in particular not to invest large sums in Ventus Energy!

Conclusion on my Ventus Energy review: High interest rates and considerable risk

Ventus Energy is probably the fastest-growing P2P company. Here, we invest in an energy company and are rewarded with very high interest rates of 17%, which can be increased to up to 24% through current bonus promotions!

The experienced management team, which previously did very good work at debitum, among others, makes no secret of the risks: In an exceptionally transparent manner, they present figures, potential and risks.

The company has taken over and improved several power plants. Here, electricity and district heating are produced, benefiting, among other things, from the high demand following Russia’s withdrawal as an energy supplier. EU subsidies also account for a large part of the profits.

In addition, there are further projects for solar power plants and energy infrastructure. With capital from banks and private investors, the company is gradually building up a comprehensive portfolio of energy projects. Initial successes are already clearly visible in the current figures.

I have therefore invested more than €11,700 and have had good reviews with Ventus Energy so far. Interest is available daily and can be automatically reinvested or accumulated and paid out. Security mechanisms such as a buy-back guarantee or early project exit are also available.

In addition, Ventus Energy has recently become a licensed investment fund and, as such, is subject to additional controls and strict requirements. Considering the minimum investment of €1,000, this is an important step that should reassure many investors.

I consider Ventus Energy to be an extremely exciting offering and probably the most lucrative provider on the P2P market. Although it cannot compete with the large user base of competitors such as Mintos or Bondora, it is clearly ahead of the pack in terms of interest rates in the P2P world!