ETFs for beginners: The ultimate guide to successful investing

Want to invest in ETFs but don’t know where to start? Don’t worry, you’re not alone. Many investors face the same challenge. ETFs offer a simple and cost-effective way to participate in the stock market. This comprehensive guide will teach you everything you need to know about ETFs as a beginner so you can make your first investment decisions.

In brief:

- ETFs are exchange-traded funds that track an index.

- Broadly diversified global ETFs are particularly suitable for beginners.

- The average return on the S&P 500 between 2003 and 2023 was 10.20%.

- Long-term investing (5 to 10 years) reduces risk

- Diversification and cost control are the keys to success

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

0 % without

Points

0 % without

Points

Points

Points

Points

Points

Introduction to the world of ETFs for beginners

ETF stands for Exchange Traded Fund. Unlike actively managed funds, an ETF does not attempt to beat the market. Instead, it simply tracks a specific index, such as the DAX or the MSCI World.

Think of an ETF as a basket filled with lots of different stocks. When you buy a share in this ETF, you automatically invest in all the companies it contains. ETFs were first created in the 1970s, when investors were looking for cheaper and more transparent investment options.

Since then, the ETF market has developed rapidly. Today, there are thousands of ETFs worldwide covering a wide variety of indices, sectors and asset classes.

One key advantage of ETFs is their transparency. You know exactly which securities you are investing in at all times. The composition of the ETF is published daily, and you can track its price in real time.

This contrasts with many actively managed funds, where the exact positions are often disclosed only after a delay.

Summary: How does an ETF work?

- An ETF tracks a specific index.

- He buys the securities included in the index.

- The weighting corresponds to that of the index.

- The ETF automatically adjusts to changes in the index.

- Investors can trade ETF shares like stocks on the stock exchange.

Why invest in ETFs as a beginner?

Why are ETFs particularly suitable for beginners? The answer lies in their simple approach and long-term return potential.

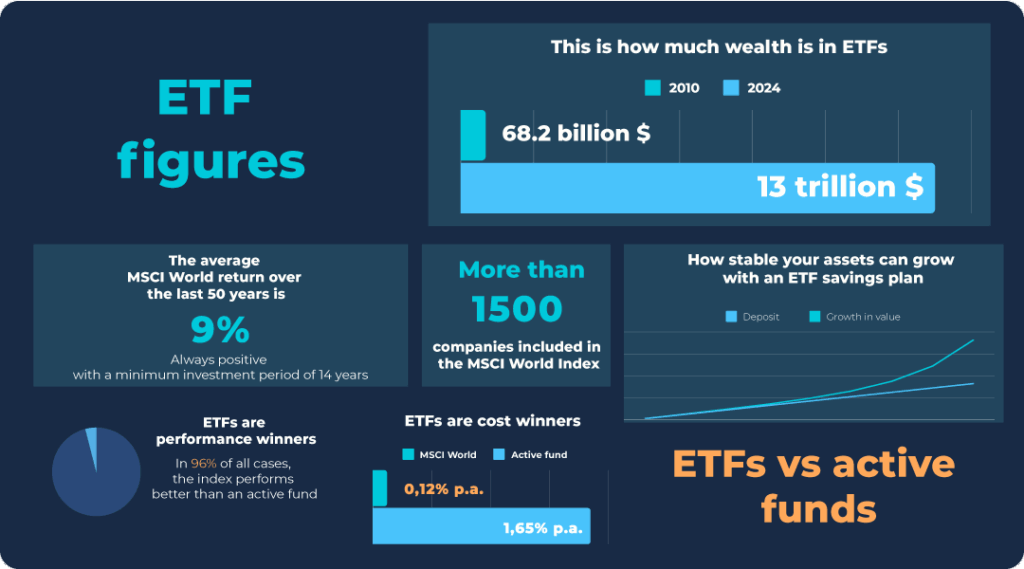

Historical data shows that ETFs that track major indices such as the MSCI World or S&P 500 have been able to generate attractive returns over the long term. For example, the average annual return of the S&P 500 between 2003 and 2023 was 10.2%.

The following table shows how differently the performance of different ETF focuses can develop. While the first index fund concentrates on a large part of the world, the second focuses solely on Europe.

| ETF | ISIN | 5-year return | p.a. (5 years) | 10-year return | p.a. (10 years) |

| iShares Core MSCI World UCITS ETF USD (Acc) | IE00B4L5Y983 | 87,55% | 13,40% | 210,56% | 12,00% |

| iShares STOXX Europe 600 UCITS ETF (DE) | DE0002635307 | 39,70% | 6,90% | 116,70% | 8,10% |

Note:

Past performance is no guarantee of future results.

For newcomers, this means an opportunity to benefit from the growth of the global economy.

- Easy to get started: One of the main reasons is that it’s easy to get started. You don’t have to select individual stocks or spend a lot of time analysing companies. Instead, you invest in an entire market or industry with a single purchase.

- Broad diversification: This is another key advantage, as your risk is spread across many different companies. If one company performs poorly or even goes bankrupt, this will only have a minor impact on your overall investment. This diversification is an important principle of successful investing and is virtually automatic with ETFs.

Here’s an example to illustrate this: instead of laboriously selecting and buying 100 different stocks, you simply invest in an MSCI World ETF. With just one purchase, you are invested in over 1,600 companies worldwide. This not only saves time, but also significantly reduces risk.

- Low costs: Since ETFs are passively managed and simply track an index, they incur significantly lower management fees than actively managed funds.

These cost savings have a positive long-term impact on your returns. While actively managed funds often have annual fees of 1.5% or more, the costs for many ETFs are less than 0.5% per year.

- High flexibility: You can buy and sell at any time while the stock market is open. There are no minimum investment periods or complicated redemption processes like with some traditional investment funds.

Invest in ETFs as a beginner in 3 steps

The exact procedure for your first investment in index funds is explained below.

1. Open your securities account: The starting point for ETF beginners

A securities account is the cornerstone of your journey into the world of investing. It works like a digital safe where you can securely store and manage your ETFs, stocks and other securities. Without a securities account, you cannot invest in ETFs. It is, so to speak, your ticket to the financial world.

A securities account not only allows you to buy and sell securities, but also provides you with an overview of your investments, their performance and any dividend payments. It is your personal financial cockpit from which you can control all your investment decisions.

Our top tip for beginners: Freedom24 offers a combination of attractive terms and a user-friendly platform. Particularly noteworthy are:

- Regular attractive new customer bonuses that make your start in the world of investment even sweeter.

- A very clear and easy-to-navigate platform that even absolute beginners can understand. A low minimum deposit that makes it easy to get started.

- Extensive educational resources to help you deepen your knowledge of ETFs and investing.

2. Selecting the ideal ETF strategy for beginners

Before investing in ETFs, it is important that you are clear about your personal ETF investment strategy. Ask yourself the following questions:

- How long would you like to invest? The investment horizon is crucial when choosing your ETFs. Broadly diversified, global ETFs are particularly well suited to long-term goals such as retirement provision.

- How much risk can you handle? Your risk tolerance influences which type of ETFs are suitable for you. Are you prepared to accept greater fluctuations, or do you prefer more stable investments?

- What are your goals? Would you like to save for retirement, buy a house or simply grow your money? Your goals will largely determine your investment strategy.

When selecting your ETFs, you are faced with the decision between broad diversification and targeted focus:

Wide distribution

Broadly diversified ETFs are recommended for beginners and long-term investors:

- MSCI World ETF (ISIN: IE00B4L5Y983): This index tracks the performance of over 1,600 companies from 23 industrialised countries. It offers solid global diversification and is a popular core investment.

- FTSE All-World (ISIN: IE00BK5BQT80): Even more diversified than the MSCI World, this index also includes emerging markets, offering even more comprehensive global coverage.

These broadly diversified ETFs offer the advantage of lower risk through distribution across many different companies and countries. They are ideal for beginners and often form the backbone of a well-diversified portfolio.

Target markets

For more specific investment goals or to supplement your portfolio, you may also want to consider more focused ETFs:

- Technology ETFs: These focus on the booming tech sector and can offer higher returns, but also involve higher risks.

- Emerging market ETFs: Investing in emerging markets can add growth opportunities in up-and-coming economies to your portfolio.

- Sustainability ETFs: For environmentally conscious investors, there are ETFs that are compiled according to ESG criteria (environmental, social, governance).

- Industry-specific indices: If you are interested in specific sectors such as healthcare, energy or finance, there are ETFs that correspond to these sectors.

Selection criteria for your ETF

When selecting your first ETF, you should consider several important criteria. These will help you find an ETF that suits your investment goals and forms a solid basis for your portfolio.

- Broad diversification: The more companies or securities an ETF contains, the more broadly the risk is spread. A globally invested ETF such as the MSCI World or FTSE All-World offers excellent diversification across different countries and sectors.

- Low costs: Look for a low total expense ratio (TER). These annual fees reduce your return. For broadly diversified ETFs, the TER should be below 0.5%; many good ETFs even have costs of less than 0.2% per year.

- High liquidity: The ETF should be actively traded on the stock exchange. This ensures that you can buy and sell at fair prices at any time. An indicator of good liquidity is a low spread, i.e. the difference between the buy and sell price.

- Physical replication: With this method, the index is replicated by actually purchasing the securities. This is often easier to understand and more transparent for beginners than synthetic replication, which uses derivatives.

- Fund volume: A high fund volume (several hundred million euros) indicates an established ETF and reduces the risk of fund closure.

- Distributing or accumulating: Distributing ETFs pay dividends directly to you, while accumulating ETFs automatically reinvest them. Accumulating ETFs are often advantageous for long-term wealth accumulation, as you do not have to worry about reinvestment.

3. Buying ETFs: Your investment options

When investing in ETFs, you basically have two main strategies at your disposal: one-off investments and regular savings. Both approaches have their specific advantages and disadvantages, which you should weigh up depending on your financial situation and investment goals.

One-time investment: Invest large sums effectively

A one-time investment is particularly suitable if you have a large sum of money that you want to invest for the long term. This could be the case, for example, if you have received an inheritance or a severance payment. With this strategy, you invest the entire amount in ETFs at once.

Advantages of a one-time investment:

- Immediate and full market participation

- Opportunity to benefit directly from a potential upward trend

- Lower transaction costs, as purchases are made only once

Disadvantages of a one-off investment:

- Higher risk of entering at an unfavourable time

- Psychological challenges posed by short-term market fluctuations

Regular saving: Continuous wealth accumulation

With regular saving, often in the form of an ETF savings plan, you continuously invest smaller amounts at fixed intervals, typically on a monthly basis. This strategy is particularly suitable for investors with and is a popular approach for long-term wealth accumulation.

Advantages of a regular ETF savings plan:

- Using the cost average effect to smooth out price fluctuations

- Lower psychological barrier to entry

- Flexibility in adjusting the savings rate

Disadvantages of regular saving:

- Possibly higher transaction costs due to more frequent purchases

- Slower build-up of investment volume

Rebalancing: Why and how often?

Over time, the original weighting of your portfolio may shift due to different price developments of the individual investments.

Rebalancing is the process of returning your portfolio to its original asset allocation.

Why rebalancing is important:

- Achieve your desired risk structure

- Forces you to be disciplined and ‘buy low and sell high’

- Helps avoid emotional decisions

A common recommendation is to review your portfolio 1-2 times a year. There is a specific reason to rebalance if the actual weighting deviates by more than 5% from your target allocation.

Example: Your target allocation is 70% stocks and 30% bonds. After a strong year for stocks, the actual distribution is 76% stocks and 24% bonds. In this case, you would sell some of your stocks and buy bonds to return to the 70/30 portfolio.

Good to know:

Please note that rebalancing may involve transaction costs. When using ETF savings plans, you can often rebalance at low cost by simply adjusting the savings rates for the individual ETFs accordingly.

Guidance: Which types of ETFs are particularly popular for beginners?

| ETF type | Advantages | Disadvantages | Example ETF | ISIN |

| Global stock ETF | Broad diversification, good risk/return ratio | No overweighting of growth markets | iShares MSCI World UCITS ETF | IE00B4L5Y983 |

| emerging market ETF | High growth opportunities | Higher risk, greater fluctuations | Xtrackers MSCI Emerging Markets UCITS ETF | IE00BTJRMP35 |

| Government bond ETF | Low risk, stable returns | Low returns | iShares Core Euro Government Bond UCITS ETF | IE00B4WXJJ64 |

| Corporate bond ETF | Higher returns than government bonds | Higher risk of default | Vanguard USD Corporate Bond UCITS ETF | IE00BZ163K21 |

| Sector ETF | Opportunities for above-average returns | Higher risk due to lower diversification | iShares S&P 500 Information Technology Sector UCITS ETF | IE00B3WJKG14 |

The 5 most popular investments for ETF beginners

For beginners in the ETF sector, it could be straightforward and lucrative to start with solid and broadly diversified investments. The 5 best ETFs that could be of interest to beginners are presented below.

1. iShares Core MSCI World UCITS ETF (ISIN: IE00B4L5Y983)

This ETF tracks the MSCI World Index and provides access to over 1,600 companies from 23 developed countries. With a total expense ratio (TER) of just 0.20%, it is extremely cost-effective and ideal for long-term investments.

Advantages:

- Broad global diversification across developed markets

- High liquidity and low tracking error

- Accumulating, i.e. income is automatically reinvested

The iShares Core MSCI World UCITS ETF is an ideal building block for a core portfolio. It offers a solid foundation for investors who want to benefit from the performance of the global economy without focusing on individual regions or sectors.

2. Vanguard FTSE All-World UCITS ETF (ISIN: IE00BK5BQT80)

The Vanguard FTSE All-World ETF invests in large and medium-sized companies from over 40 countries, including emerging markets. It offers even broader diversification than the MSCI World and has a TER of 0.22%.

Advantages:

- Most comprehensive global coverage, including emerging markets

- Available as distributing and accumulating variants

- Very large fund volume, ensuring high liquidity

This ETF is ideal for investors who want to invest truly globally and also benefit from the growth opportunities offered by emerging markets. It offers a solution for a broadly diversified equity portfolio.

3. Xtrackers MSCI World UCITS ETF (ISIN: IE00BJ0KDQ92)

With a TER of just 0.19%, this ETF offers a particularly cost-effective way to invest in the MSCI World Index. It is well suited to investors looking for a simple and effective investment.

Advantages:

- One of the cheapest MSCI World ETFs on the market

- Large fund company with many years of ETF expertise

- Physical replication for maximum transparency

The Xtrackers MSCI World UCITS ETF is an excellent choice for cost-conscious investors who do not want to compromise on the quality and reliability of a major provider.

4. iShares Core MSCI EM IMI UCITS ETF (ISIN: IE00BKM4GZ66)

This ETF focuses on emerging markets and offers access to a broad range of companies in emerging markets. With a TER of 0.18%, it could be an attractive choice for investors who want to invest specifically in the growth potential of these regions.

Advantages:

- Comprehensive coverage of emerging markets, including small caps

- Accumulating, which is advantageous for tax purposes in many cases

- Good liquidity despite focus on less developed markets

This ETF is an excellent addition to a core portfolio to increase diversification and benefit from growth opportunities in emerging markets.

5. Amundi STOXX Europe 600 UCITS ETF (ISIN: LU0908500753)

The Amundi STOXX Europe 600 UCITS ETF tracks the STOXX Europe 600 Index and provides access to the 600 largest companies in Europe. With an exceptionally low TER of just 0.07%, this ETF is particularly cost-effective.

Advantages:

- Very low costs, which increases returns in the long term

- Broad coverage of the European stock market

- High liquidity and low spread

This ETF is ideal for investors who want to invest specifically in the European market or add a strong European component to their existing portfolio.

The comparison table for the question: Which ETFs are suitable for beginners?

| ETF Name | ISIN | Index | TER | Advantages | special features |

| iShares Core MSCI World UCITS ETF | IE00B4L5Y983 | MSCI World | 0,20% | – Broad global diversification – High liquidity – Low tracking error | – Accumulating – Over 1,600 companies from 23 industrialised countries – Ideal building block for core portfolios |

| Vanguard FTSE All-World UCITS ETF | IE00BK5BQT80 | FTSE All-World | 0,22% | – Most comprehensive global coverage – Distributing and accumulating available – Very large fund volume | – Over 40 countries, including emerging markets |

| Xtrackers MSCI World UCITS ETF | IE00BJ0KDQ92 | MSCI World | 0,19% | – One of the cheapest MSCI World ETFs – Large fund company – Physical replication | – Cost-effective option for MSCI World – Suitable for cost-conscious investors |

| iShares Core MSCI EM IMI UCITS ETF | IE00BKM4GZ66 | MSCI EM IMI | 0,18% | – Comprehensive emerging market coverage – Accumulating – Good liquidity | – Focus on emerging markets – Includes small caps – Good as a portfolio addition |

| Amundi STOXX Europe 600 UCITS ETF | LU0908500753 | STOXX Europe 600 | 0,07% | – Very low costs – Broad European coverage – High liquidity and low spread | – 600 largest companies in Europe – Ideal for a European focus in your portfolio |

These ETFs offer beginners an excellent introduction to the world of index-based investments. They are characterised by broad diversification, low costs and high liquidity.

Depending on your personal investment strategy and risk tolerance, a combination of these ETFs can form a solid basis for a long-term investment portfolio.

Would you like to learn more about popular neobrokers? Discover how easy it is to open a securities account with Trade Republic or read authentic reviews about Scalable Capital. These modern providers are revolutionising access to the stock market and making ETF investments particularly attractive for beginners.

Conclusion: How do you see yourself getting started with ETFs?

ETFs offer you a simple and cost-effective way to get started in the world of investing. With a long-term strategy, regular savings and the right selection of ETFs, you can achieve solid returns and build your wealth step by step.

ETFs are a powerful tool for achieving your financial goals. Whether you want to save for retirement, build wealth or achieve financial freedom, the right ETF strategy will put you on the right track.

Be patient, keep yourself informed and let your money work for you.

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

0 % without

Points

0 % without

Points

Points

Points

Points

Points