Spread and fees: Trade Republic’s hidden costs

At first glance, Trade Republic fees amount to just one euro per trade, and savings plans are even completely free of charge. Such low prices make many investors suspicious: Are there hidden costs at Trade Republic, or does the popular broker charge fees elsewhere?

We take a close look at the neobroker’s business model and show you where Trade Republic charges fees and hidden expenses.

In brief:

- Trade Republic is a German neobroker where you can trade stocks, ETFs, bonds and derivatives for very low fees.

- The provider is financed by reimbursements from the trading venue and the order fee of one euro.

- There are no hidden costs at Trade Republic – all fees are clearly communicated.

The broker Trade Republic hardly needs any introduction. After all, more than 2.5 million Germans already have a securities account with this popular provider! The company was founded in Berlin in 2015 and has been offering trading in stocks, ETFs and derivatives since 2017.

From the outset, the core of the business model was to offer the lowest possible prices: at the time, one euro per transaction was a challenge to the traditional banks where investors had previously handled their investments. This played a key role in shaping the trend towards low-cost and effective wealth accumulation in Germany. The main target group was young investors, some of whom invested very small amounts.

In order to offer such favourable terms, a number of special measures had to be taken. For example, the provider only managed the custody accounts, outsourcing the actual transaction processing to its partners. These include:

- Deutsche Bank AG

- J.P. Morgan SE

- Solarisbank SE

- Citibank Europe plc.

The Lang&Schwarz exchange is the only trading venue offered, with which a lucrative deal has been concluded.

The focus has always been on the app, as the aim was to appeal to younger people in particular and get them excited about the financial market. The smartphone app is easy to use, fast and accessible from anywhere. Trade Republic is therefore often the first port of call for beginners looking to invest.

The offering has grown steadily since then and now includes the most important stocks and other assets that a typical investor needs. Today, TR gives you access to:

- Approximately 8,500 stocks, mostly from Europe and North America

- Around 2,200 ETFs. Most of these are equity ETFs, but bond ETFs, commodity ETFs and real estate ETFs are also available. Of course, you will also find my 10 best ETFs among them.

- All ETFs and approximately 2,500 stocks are also available as savings plans. Trade Republic is waiving the one euro fee, so you can start building your wealth for free!

- There are currently 52 cryptocurrencies. This is only a tiny fraction of the entire market, but still more than many competitors offer. Secure storage is provided for you; however, sending or receiving is not possible.

- Approximately 380,000 derivatives such as warrants and knock-out certificates are also available. The product catalogue includes providers such as HSBC, Société Générale, UBS and Vontobel.

- At Trade Republic, you receive interest on your uninvested capital at a rate of 3.25% per annum. This allows you to use your securities account effectively as a call money account. The interest rate is always based on the current base rate.

The broker is supervised by the German Financial Supervisory Authority (BaFin) and has recently even been granted a full banking licence. Its offering now includes a free current account and a corresponding cash card. To promote these new features, Trade Republic is offering a bonus on transactions, which can be very worthwhile for customers.

You can find more information about the advantages and disadvantages of the neobroker in my article on my Trade Republic review.

Trade Republic’s fees are significantly lower than those charged by banks and other online brokers. This price advantage has enabled the company to become one of the most popular providers in Germany in just a few years!

However, the favourable terms also raise the question of how the company finances itself and whether there are any hidden costs. To investigate this question, let’s first take a look at the official price list.

Trade Republic fees at a glance

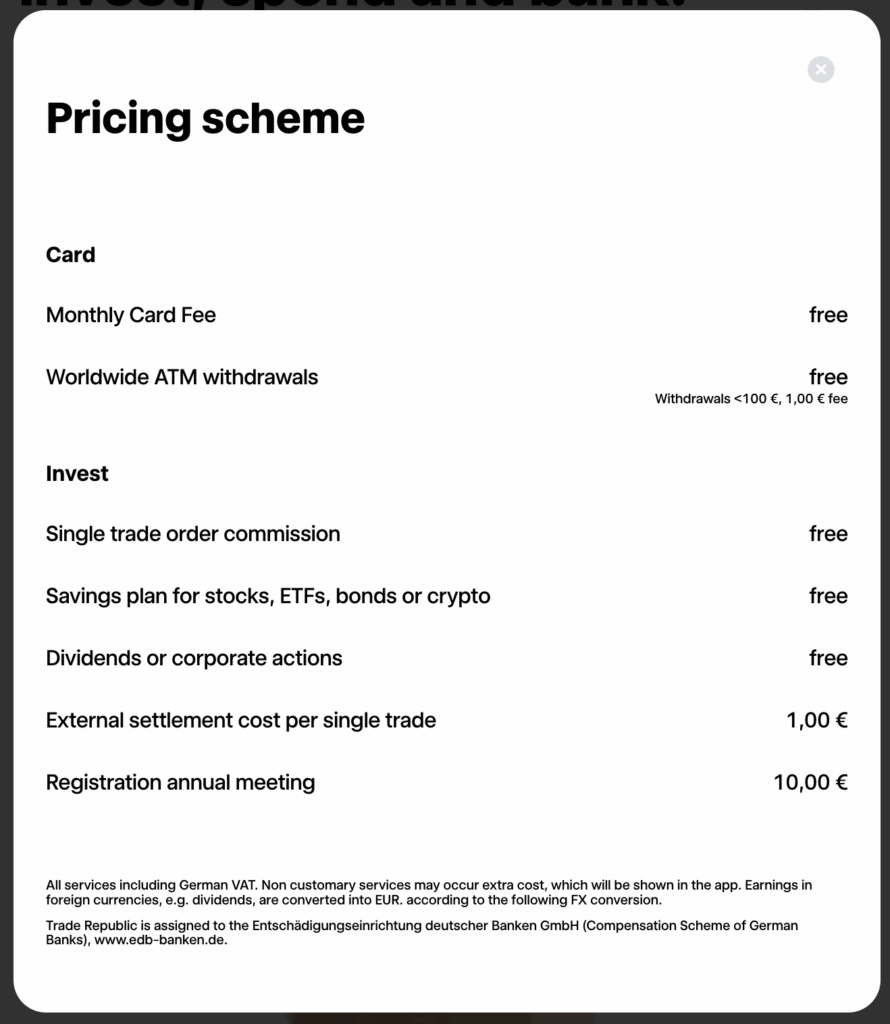

Here are the broker’s official prices:

| Order commission | free of charge |

| Flat-rate third-party fee per trade (excluding savings plans. In the event of partial executions, the flat-rate third-party fee will only be charged once per trading day) | 1,00 € |

| ETF savings plan / stock per execution (investment volume per execution: €10 to €10,000) | free of charge |

| Postal order placement (execution per order placement, change or cancellation) | 25,00 € |

| Depot management | free of charge |

| Deposit transfer charged to the deposit account | free of charge |

| Transfer to reference account | free of charge |

| Management of the clearing account | free of charge |

| Transfer order by letter (per transaction) | 25,00 € |

| Participation in capital measure (per capital measure) | free of charge |

| Processing instructions per standard instruction | 1,00 € |

| Deposit and account statement (issued quarterly) | free of charge |

| Annual tax certificate (statutory reporting) | free of charge |

| Voluntary confirmation of deposit/balance (per copy, as of the reporting date) | 25,00 € |

| Voluntary tax reporting (per income statement, tax voucher, etc.) | 25,00 € |

| Address determination (per transaction, if the customer culpably violates their notification obligation under Section 6.1 of the framework agreement for online brokerage) | based on actual expenditure |

| Processing instructions according to specific customer instructions (letter/email) | 5,00 € |

| Voluntary instructions for conversion, termination, exercise of warrants or certificates | 10,00 € |

| Trading in subscription rights of any kind per transaction (including partial rights and fractional sales) | 1,00 € |

| Reset (with video identification) | 5,00 € |

A glance at this long list reveals a clear trend: fees for everyday activities are extremely low or even completely free. Unusual and rare steps, on the other hand, are associated with quite high costs.

This means, for example, that you don’t pay a penny for custody account management, your own current account, the execution of savings plans, transfers to another account, dividend credits or the issuance of a tax certificate. Together with trading for £1 per transaction, this covers pretty much everything a regular investor needs.

If, on the other hand, you want to make transfers or place orders by letter, you will have to pay €25 each time. However, since it makes little sense to use an app-based broker for postal transactions, this is unlikely to be an issue in practice.

These activities involve a significant amount of work for the company. I therefore think it is entirely reasonable for Trade Republic to charge high fees in these areas in order to deter investors.

Good to know:

Trade Republic also charges a fee of €10 for attending a general meeting. Compared to other online brokers, this is a reasonable price, as competitors typically charge between €25 and €50.

Trade Republic savings plan costs

Savings plans are extremely popular tools for building wealth: instead of investing your money directly in a pile of stocks or ETFs, you buy in small increments. By spreading your investment over several weeks or months, you can achieve a significantly better average price. In addition, automatic execution simplifies long-term wealth accumulation, as you don’t have to worry about your investments yourself.

At Trade Republic, you will find ETFs for long-term savings plans as well as a wide selection of stocks. The best part: execution is completely free of charge. Even the already very low costs of €1 per transaction are waived!

However, if you want to sell your accumulated stocks or ETFs later, you will have to pay the usual fee again. I think this is fair, as it is no longer a savings plan execution. As these rules are clearly communicated, there are no hidden Trade Republic savings plan costs.

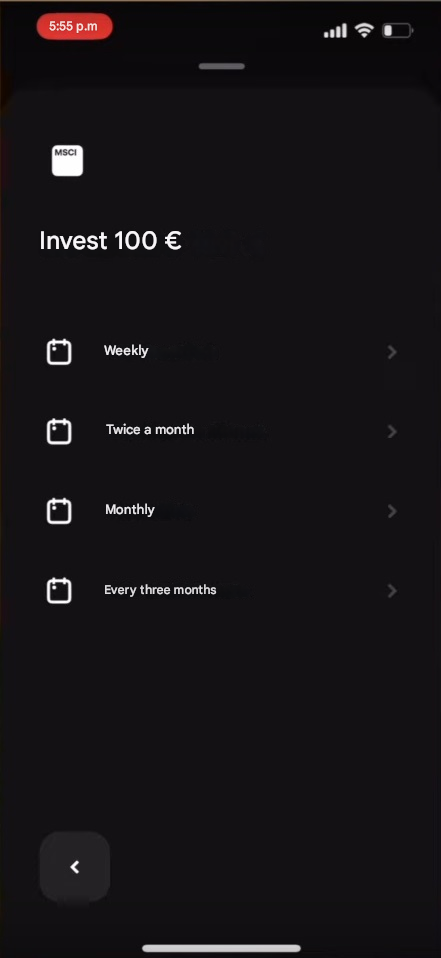

Hundreds of thousands of Germans already rely on a Trade Republic savings plan. With zero fees, this is hardly surprising. Users also benefit from a high degree of flexibility: you can choose between weekly, fortnightly, monthly or quarterly execution.

The amount is also flexible. You can start with as little as €1, and the maximum amount is €5,000. If you are planning to save larger amounts, you will need to set up several savings plans. However, as Trade Republic does not charge any savings plan fees, this should not be a problem.

Trade Republic Spread

If you have already reviewed Trade Republic, you will have noticed that small amounts are missing from some transactions. Often, these amounts are only a fraction of a percent, but sometimes they can be more. So, are there hidden costs at Trade Republic? Not quite!

This is known as the ‘spread’, which is the difference between the purchase price and the selling price of financial products. Just as a retailer buys goods cheaply and sells them at a higher price, stock exchanges also want to make a profit. If you buy a security, you have to pay a little more; if you sell it, however, you receive a slightly lower price.

The only trading venue available on Trade Republic is the Lang&Schwarz Exchange. Spreads are based on Germany’s leading stock exchange, XETRA. In practice, this means price differences of between 0.5% and 2%.

The spread at Trade Republic is not determined by the broker, but by the respective exchange. TR therefore has no influence on the price difference. In addition, the company repeatedly points out the price difference and even issues warnings when the spread is particularly high. Trade Republic can therefore hardly be accused of hidden costs!

An effective way to keep the spread as low as possible on Trade Republic is to trade during XETRA hours. Lang&Schwarz’s opening hours are significantly longer than other exchanges. However, when XETRA is closed, the price difference on L&S increases, and so do your costs. It is therefore best to execute your trades on weekdays between 9 a.m. and 5 p.m.

Good to know:

In some special cases, such as extremely high demand or significant price fluctuations, the premium may also rise sharply. The spread also increases rapidly when the trading volume of a security is very low (low liquidity).

If you would prefer to trade more exotic stocks, for example from Asia, North America, Oceania or South America, it may be worthwhile to open a securities account with a broker that offers access to many trading venues. Significantly more stocks are traded on the respective “parent exchanges” in the home countries of such companies. This can result in lower spreads and thus considerable savings for you!

I can recommend opening a second account with providers such as CapTrader or Freedom24. Both brokers offer trading venues around the world! As there are no account management fees, you can register without any additional costs. You can find out more about both providers in my reviews of CapTrader and Freedom24.

Trade Republic is not a charitable organisation, but a company that aims to make a profit. Given the extremely low fees, the question naturally arises as to how this works.

The main source of income is clearly the rebates from the L&S exchange. The trading platform pays a premium for each trade executed, as a kind of thank you to the broker for generating turnover for the exchange. TR can credit between €3 and a maximum of €17.60 per transaction.

The provider receives high payouts, for example, for very large order amounts or if you trade outside XETRA opening hours. Even in this case, Trade Republic cannot be accused of hidden costs.

- The refunds are clearly communicated in the terms and conditions, and

- the payments are subject to a special agreement between TR and L&S.

So it’s not like the broker is stealing your rebate! The payments only exist between the two companies; as private investors, we would have no access to this money, so we don’t lose anything.

Overall, both the broker and the trading venue are left with only a very small profit margin. Trade Republic therefore places particular importance on user activity: the more frequently an investor buys and sells, the greater the rebate. This also explains why the company has been offering savings plans completely free of charge for a long time.

Refund before expiry – will there now be additional Trade Republic fees?

The reimbursement by trading venues, known as ‘payment for order flow’, has long been the subject of criticism. Long-established and significantly more expensive banks and brokers in particular claim that this business practice disadvantages customers, who ultimately have to pay higher prices.

However, various studies by the German Financial Supervisory Authority (BaFin) and other research groups have come to the opposite conclusion: the refund is neither clearly advantageous nor does it have any major disadvantages for investors.

- For smaller order amounts, there is a price advantage for users.

- However, these advantages were lost again with higher amounts and low liquidity.

Overall, payment for order flow is neither good nor bad. However, this has not prevented the EU from banning the concept. With a grace period until 1 June 2026, all brokers and trading venues must discontinue these payments.

This hits neobrokers particularly hard, as it undermines their fundamental business model. They now have to tap into new sources of income or significantly increase their fees. It is even possible that Trade Republic will introduce hidden costs in order to remain profitable.

It is still unclear how Trade Republic’s fees will develop. However, investors can remain calm about the issue overall: if the popular neobroker does indeed charge higher prices for its services, you can transfer your securities account to another provider at any time without incurring any costs.

The popular German neobroker Trade Republic shines with extremely favourable terms and conditions: most of its services are even completely free of charge! This naturally raises the question of whether Trade Republic charges hidden costs or tries to pull the wool over our eyes in other ways. The answer to this is a resounding no!

The company is financed by a rebate it receives from Lang&Schwarz Börse. For each trade transmitted, TR receives a payment of between €3 and €17.50 from the trading venue, which we as customers do not notice. However, this remuneration is described transparently and can be viewed in the terms and conditions. Trade Republic cannot therefore be accused of hidden costs.

The spread is also not influenced by the broker. This difference between the purchase and sale price of securities is a popular way to generate additional income. However, the Berlin-based service provider is not responsible for these price differences.

In order to maximise the rebate, the provider has always tried to encourage customers to make as many transactions as possible. This also explains why Trade Republic’s savings plans are free of charge. Regular execution is very lucrative for the broker. Therefore, this fee model is unlikely to change in the foreseeable future.

However, major changes are on the horizon: the EU has banned the rebate model with a transition period until 1 June 2026. Neobrokers such as Scalable Capital and Trade Republic are particularly affected. It remains to be seen how providers will implement these changes and whether Trade Republic will introduce hidden costs, additional fees or other financing options.

You can find out more about the competition between Germany’s most popular neobrokers in my article on Scalable Capital vs. Trade Republic.