Scalable Capital vs. Trade Republic: Who has the better offers?

The brokerage market is highly competitive, but two providers lead the rankings. We explore the question: ‘Which is better, Scalable Capital or Trade Republic?’ To do so, we examine their offerings, costs, additional features and more. And, of course, we also address the disadvantages and issues that have made headlines in recent weeks.

In brief:

- In the Scalable Capital vs. Trade Republic comparison, the two most popular German brokers go head to head.

- Both providers offer excellent terms and conditions and a good range of products.

- There are minor differences in the products offered, trading venues, order types and more.

- Trade Republic has been a fully-fledged bank since 2024 and is expanding its product range.

- Scalable Capital focuses on active trading and has a few extras to offer in this area.

Scalable Capital vs. Trade Republic at a glance

Are you already active on the stock market, trading stocks and always on the lookout for the best ETFs? Then you’re probably familiar with Scalable Capital and Trader Republic. But even if you’re just starting to build your wealth, you’ve probably heard of these two heavyweights. After all, they are two of the most successful brokers on the European market!

Without a broker, you have no access to the stock exchanges, and without stock exchanges, your only option for high returns is P2P lending. In their search for the best service providers, almost all investors sooner or later have to choose between Scalable Capital and Trade Republic – their offers are simply too attractive to ignore.

Both providers belong to the category of ‘neobrokers’. These service providers are characterised by:

- The most favourable terms and conditions, which are significantly lower than the prices offered by regular banks. Many services, such as savings plans, are even completely free of charge.

- Particularly easy access via practical apps, which also make trading stocks and ETFs possible for beginners.

- Restrictions on the product range and trading venues. The most important securities are available, but exotic stocks and the like are nowhere to be found.

- Cutbacks in customer support and general service, as providers need to make savings in order to keep costs low.

Online brokers such as Freedom24 offer a possible alternative to these service providers. Although you pay a little more (from £1.20 per transaction), you get access to over a million securities, professional financial tools such as options and significantly better customer service.

You may also be interested in: Slightly more expensive, but with a huge selection – my experience with Freedom24

There are many similarities between Scalable Capital and Trade Republic, but also some dramatic differences. First, let me briefly introduce the two providers:

Trade Republic

No other company embodies the triumph of neobrokers better than Trade Republic. From one of the first providers to attract customers with favourable terms and conditions and a purely online offering, it has developed into one of the most successful brokers in Europe!

More than 5.3 million Germans and over 8 million customers worldwide have a securities account here. The Berlin-based company therefore describes itself as the largest broker on the European market. This has been made possible by its ease of use and low costs: a fee of just one euro is charged for all transactions. This has been made possible by its ease of use and low costs: a fee of just one euro is charged for all transactions.

In 2024, it was granted a full banking licence by BaFin and has been offering banking services such as current accounts ever since. At the same time, however, this was also the year when the first cracks began to appear: extreme growth (more than 100,000 new customers per month!) regularly overwhelmed both customer service and the technical platform.

Numerous dissatisfied users have vented their frustration. However, this does not seem to have dampened its success, and the signs continue to point towards growth. For more details about this giant broker, I recommend taking a look at my article on Trade Republic experiences.

Scalable Capital

Size alone isn’t everything! It’s nice if a broker has a lot of customers, but that doesn’t really benefit you as a user. So it doesn’t matter that Scalable Capital ‘only’ has a million customers. The Munich-based company manages around €20 billion in capital, which means that although Scalable Capital has fewer customers than Trade Republic, those customers invest larger sums.

Here, too, the business model consists of easy access to the stock exchanges coupled with the lowest possible costs. For £0.99, you can trade stocks, ETFs, derivatives and more and store them in your free securities account. However, one major difference to many of its competitors is the ‘PRIME+’ flat-rate trading fee.

For €4.99 per month, you won’t pay any trading fees on transactions of €250 or more. You’ll also get better analysis tools and slightly lower costs for crypto trading. All in all, it’s a very good deal for anyone who regularly invests large amounts or trades actively.

Comparison of Scalable Capital vs. Trade Republic

Since both brokers are similar in many respects but differ greatly in other areas, we need to take a closer look at them. We have divided the providers’ services into different categories and compared them:

| Category |  |  |

| Fees | 0.99 per transaction | 1.00 per transaction |

| special features | Trading flat rate: – €4.99 per month, – free trading for order volumes of €250 or more | Full-service, free bank account |

| savings plans | free of charge | free of charge |

| trading centres | – European Investors Exchange -Gettex -Xetra | Lang&Schwarz Exchange |

| stocks | > 8.000 | > 9.000 |

| ETF | > 2.700 | > 2.700 |

| lendings | 1 | > 500 |

| Active funds | > 3.800 | No |

| derivatives | > 375.000 | > 380.000 |

| cryptocurrencies | Only as ETP (17 coins) | 52 Coins |

Registration and account management

You want to finally invest money in stocks and buy your first ETFs – but first you need to set up a securities account! The good news is that both providers make it very easy for you. Once you have entered your personal information into the app interface, you will be asked to verify your identity.

- With Trade Republic, you have to hold your face and an ID document up to your mobile phone camera. Various providers are available if one of the authentication processes does not work.

- Scalable Capital is a little more flexible: here, you can choose the video option, use your electronic ID card or visit a post office in person.

You can set up two-factor authentication with both service providers to better protect your account from unauthorised access. But now for the bad news: neither Trade Republic bonuses and Scalable Capital bonuses are now history! If you register for the first time via the app (registration via browser is not possible), you will not receive any extras at this time.

This is, of course, a shame, as in the past it was usually possible to receive attractive gifts. On the other hand, it is understandable: both providers have grown significantly and now serve millions of users. Acquiring new customers has therefore taken a back seat and is no longer financed by sign-up bonuses.

|  | |

| Identification for opening an account | Video identification (WebID, Fourthline or account identification) | Via Postident by video, using your identity card (eID) or in person at a post office |

| two-factor authentication | Yes | Yes |

| Registration via the web? | No, only via the app. | No, only via the app. |

Who has the better range?

In a comparison between Scalable Capital and Trade Republic, both providers are roughly on par in terms of product range.

At SC, you can expect:

- Just over 8,000 shares

- 2.700 ETFs

- 3.800 funds

- 17 cryptocurrencies

- 375.000 Derivates

Trade Republic keeps its available assets under wraps, but our calculations show that:

- 9,000 shares available

- 2.700 ETFs

- More than 500 bonds

- 50 cryptocurrencies

- 380.000 Derivates

Both competitors offer an interesting range of products, but with different focuses. If you are interested in bonds, such as the popular 10-year US government bond, there is no way around TR. In a comparison between Scalable Capital and Trade Republic, Scalable clearly comes up short with only one bond.

However, Trade Republic performs poorly in terms of funds – they are completely absent from its offering. SC, on the other hand, offers around 3,800 different options and is therefore the better choice if you are planning such an investment.

There are hardly any differences between stocks and ETFs. However, it should be noted that you can trade fractions at Trade Republic – at Scalable, this is only possible as part of savings plans. Such ‘fractional shares’ allow you to purchase parts of very expensive stocks.

Our tip:

First, decide which stocks and ETFs you want to buy or acquire through a savings plan. Then check which providers offer them before deciding between Scalable Capital and Trade Republic.

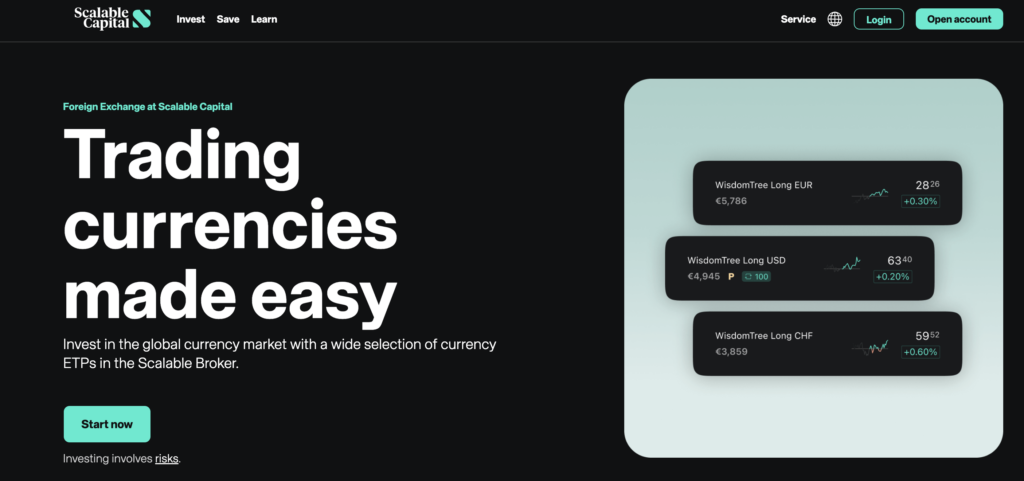

Forex trading with Scalable Capital or Trade Republic?

Scalable Capital advertises that it enables Forex trading. This type of foreign currency trading is extremely popular with traders because it offers:

- Highest liquidity and therefore low spreads

- Round-the-clock trading, as the Forex markets are always open

- Attractive returns (but also high risk!), as trading involves leverage

The problem with this offer is that these are only currency ETPs, not ‘real’ currency pairs as is customary in Forex trading! These ‘exchange-traded products’ are comparable to ETFs, but only contain a single product – in this case, a currency such as the euro, dollar, Swiss franc, yen and others.

ETPs are an exciting asset class, and currency ETPs can offer easy access to the currency market for beginners. However, they do not allow ‘real Forex trading’!

Advertising them as such is almost tantamount to misleading customers. What’s more, the products are also available from almost all brokers, including competitor Trade Republic, and are therefore not a unique selling point.

Trading centres

Trade Republic offers only one trading venue, the Lang & Schwarz Exchange. It is open on working days from 7:30 a.m. to 11:00 p.m. German time. Scalable Capital uses the Gettex exchange in Munich in a similar way. Both providers receive a hefty commission for your transactions – this is the only way they can offer such favourable trading conditions.

However, this commission model is under threat: the EU has banned the concept! The changes will come into force in Germany in June 2026. It is still completely unclear how Scalable Capital and Trade Republic will finance themselves then.

Scalable also offers

At €3.99 per transaction, trades on XETRA are significantly more expensive. However, if there is a better spread (the difference between the selling and buying price of an asset) and a large amount is involved, it may still be worthwhile.

Good to know:

XETRA’s opening hours are from 9 a.m. to 5.30 p.m., which is significantly shorter than Gettex and L&S. At first glance, the longer trading hours of the smaller exchanges appear to be an important advantage, but in fact, it is advisable to trade during XETRA hours in order to secure better prices (lower spreads).

In the Scalable Capital vs. Trade Republic comparison, SC comes out slightly ahead. The option of trading on Germany’s largest stock exchange if desired offers a number of advantages. In practice, however, this is likely to be of interest only to investors who are investing very large amounts.

Trade cryptocurrencies with Scalable Capital or Trade Republic

Cryptocurrencies are a particularly exciting but also risky asset class that enjoys enormous popularity. It goes without saying that the two most important neobrokers are also involved here and offer Bitcoin and Co.! Compared to Scalable Capital, Trade Republic has the edge here, as it gives you access to no fewer than 52 different coins. However, with a low minimum investment (the purchase price of an asset) and a large amount, this can still be worthwhile.

Considering the thousands of cryptocurrencies available, this is not outstanding, but it is a nice offering. After all, the broker does not want to replace a real crypto exchange.

However, you should bear the following in mind:

- If you purchase coins from Trade Republic, they will be stored for you by BitGo Europe GmbG. You do not have the option of storing them yourself.

- The actual trading is handled by B2C2, a crypto exchange based in the United Kingdom.

- You cannot send or receive your digital currencies.

- Staking, lending and other lucrative applications are also impossible.

So there are significant disadvantages that you have to accept, especially in terms of security. In return, however, you benefit from extremely easy access without any special effort. The costs are also within the normal range: in addition to the usual one euro per transaction, there is a spread surcharge of 1 to 2%.

In comparison, Scalable Capital relies on a completely different concept:

- You cannot trade cryptocurrencies directly, only ETPs (Exchange Traded Products). These allow you to profit from price changes in the coins.

- Trading is simple and works just like other exchange-traded products such as ETFs or stocks.

- With some coins, you can benefit from staking rewards, but these only amount to 3 to 5%. This is significantly less than you would receive from private staking with ‘real’ cryptos.

- A crypto ETP can offer a security advantage, as you do not own any coins at all – they cannot therefore be stolen by hackers.

- You can also use ETPs as a savings plan.

When trading, you must pay an additional spread of 0.99% (in addition to the standard trading fee of 0.99 or zero euros if you are using the flat rate). This amount is reduced to 0.69% for flat rate users.

However, it is important to emphasise that competitors also offer such crypto ETPs! In a comparison between Scalable Capital and Trade Republic, the former therefore has no real advantages. So if crypto trading is important to you, you should open your account with TR – or, even better, go directly to a real crypto exchange.

|  | |

| Available cryptocurrencies | 17 | 52 |

| Own property? | No, only as an ETP | Yes, in a separate wallet |

| Send/Receive? | Not possible. | Not possible. |

| Costs: | With PRIME+: – No fee for trades over €250 – 0.69% mark-up on the spread Without PRIME+: – €0.99 fee per trade – 0.99% mark-up on the spread | – €1.00 per trade – 2% surcharge on the spread |

Savings plans

An ETF or stock savings plan is an ideal way to build up your assets continuously and reliably. These offers are extremely popular and are of course also available from the two major neobrokers. You have numerous settings options for automatic execution:

Scalable Capital offers execution

- Monthly,

- Every two months,

- Quarterly,

- Half-yearly,

- and annually.

You can choose from 9 different days of the month (1st, 4th, 7th, 10th, etc.).

Trade Republic has merely

- Weekly,

- Every two weeks,

- Monthly,

- or quarterly.

You can choose between execution at the beginning of the month or in the middle of the month.

So Scalable has more options than Trade Republic in this regard. To be honest, however, these details only play a minor role in execution. The selection is much more important! Trade Republic falls short here with 2,650 stocks eligible for savings plans, while its competitor SC offers an impressive 8,000!

When it comes to ETF savings plans, the competitors are neck and neck with around 2,700 products each. Here you will find the most important products, such as my top 10 ETFs for savings plans.

Particularly appealing: all savings plans are free of fees! This means that execution is free of charge for you, even if you opt for Scalable and do not sign up for a PRIME+ flat rate. The minimum savings amount for both brokers is just £1. And what’s even better: all savings plans are free of fees! This means that execution is free of charge for you, even if you opt for Scalable and do not sign up for a PRIME+ flat rate.

|  | |

| Implementation of savings plans | weekly, every 2 weeks, monthly, every 3 months | monthly, every 2 months, every 3 months, every 6 months, annually |

| execution days | 1. or 16. | 1., 4., 7., 10., 16., 19., 22., 25. |

| ETF savings plans | 2.700 | 2.700 |

| share savings plans | 2.650 | 8.000 |

| minimum amount | 1 € | 1 € |

Order types, bank card and other extras

When trading on the stock exchange, there are dozens of order types you can use to execute a transaction. Most neobrokers offer only a bare minimum of these – some even only offer the basic form, known as a ‘market order’.

Not at Scalable! Here you can choose from limit orders, stop orders, stop-limit orders, stop-loss orders, take-profit orders and, of course, standard market orders. These order types offer you a wide range of strategic options, allowing you to hedge against price drops or take profits, for example.

Trade Republic, on the other hand, only offers limit, stop and market orders. This is sufficient for simple investments, but more would be desirable. In the Scalable Capital vs. Trade Republic comparison, you are therefore at a slight disadvantage here.

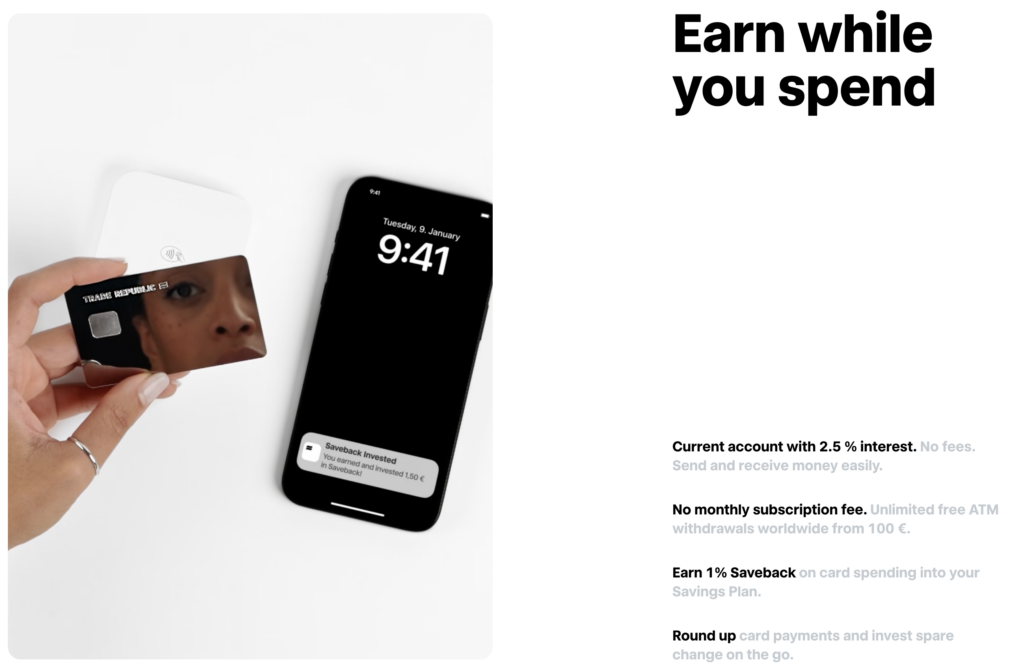

To this end, TR has been a fully-fledged bank licensed by BaFin since 2024. The new account and accompanying debit card are being promoted very aggressively. The standard plastic card costs five euros, while the stylish metal card costs 50 euros. You can use it to pay or withdraw money at all points of sale and ATMs that accept Visa cards.

Withdrawals of more than £100 are even free – worldwide! You also receive a bonus called ‘Saveback’: one percent of your spending, up to a maximum of €15 per month, is invested in a savings plan of your choice. However, this requires that you deposit at least £50 per month into a savings plan yourself.

An attractive Trade Republic bonus that is particularly worthwhile for investors who already have a savings plan!

Scalable Capital, on the other hand, focuses solely on investments. With ‘Scalable Wealth’, it offers an automated portfolio that intelligently adapts to market conditions. To do this, you select a predefined strategy and your monthly deposit rate.

The intelligent investment advisor then selects suitable investments for you and creates your portfolio. Wealth management was the company’s core business for a long time – even before brokerage services were added! This service remains very popular today, as this comprehensive package means you don’t have to do any work yourself.

A direct comparison between Scalable Capital and Trade Republic is therefore hardly possible in the ‘Extras’ category. The two brokers focus on very different offerings. Here, you have to decide for yourself what offers you greater added value.

Scalable Capital vs. Trade Republic Interest rates

Speaking of attractive offers: both brokers pay you interest on your uninvested money at a rate of currently 2.75% per annum. Scalable Capital has limits on the maximum amount, while Trade Republic does not:

| Scalable Capital Free Broker | Scalable Capital PRIME+ | Trade Republic |

| Max. 50.000 € | Max. 500.000 € | unlimited |

In practice, these limits are likely to be of little significance. After all, the interest rate is certainly nice in the current interest rate environment, but it’s not earth-shattering. You can make significantly more out of your money by opting for a call money account, investing in P2P lending or buying stocks and ETFs.

However, if you already have capital in your securities account (for example, because you are waiting for a favourable moment to make a purchase), the interest rates are very attractive in any case.

Theoretically, TR therefore has a slight advantage here, but this is unlikely to play any practical role.

Disadvantages and problems with Scalable Capital vs. Trade Republic

The comparison between Trade Republic and Scalable Capital is particularly interesting because both providers are young companies that are growing rapidly and constantly adding new, innovative features to their products. However, it seems that Trade Republic in particular may have grown a little too quickly recently… the last few months have been full of reports of problems!

- The Munich-based company recently received a full banking licence from the ECB. This step demonstrates its seriousness and opens up many new opportunities.

- These new opportunities also bring significantly higher demands and expectations for brokers. It was precisely these expectations that were recently disappointed when dividends did not reach customers’ accounts quickly enough. Normally, TR only needs a few hours to credit the profit distribution.

- A waiting time of over a week annoyed some customers. The company’s handling of this problem was not exactly ideal. The response was something along the lines of: ‘Relax, legally we’re allowed to do this.’ Not the kind of crisis management you expect from a bank!

- Want to complain about these issues or need help? Good luck! Customer service is not available by phone, and emails are answered sporadically and with long wait times. A new chat feature is supposed to help, but it only connects you to a chatbot that repeats the FAQ page.

- This has led to so many complaints that the financial supervisory authority BaFin has launched an investigation and may impose penalties or sanctions.

- There have also been recent difficulties with cryptocurrencies, as it was not possible to merge three altcoins quickly enough for technical reasons.

Given the enormous growth of recent years, the problems are partly understandable. However, the company’s poor communication is inexcusable.

This is also evident when searching for information: it was extremely difficult to research the data for this article, as the company does not provide clear information, for example on its product range. This lack of transparency is completely unacceptable for a broker that wants to be a fully-fledged bank!

However, not everything is running smoothly at Scalable Capital either.

- Customers are complaining en masse about the app crashing and orders not being executed – and always at the peak of the trading day, when it is particularly important that everything works properly!

- Complaints and requests for help often remain unanswered here too. Although a telephone service is offered (which is already a big plus compared to Trade Republic!), it is almost impossible to get through. If you do manage to get a service agent on the line, you are usually just fobbed off. Real help seems to be hard to come by here too.

There seems to be little difference between Scalable Capital and Trade Republic. However, the problems at TR are currently receiving more attention. This is likely due to its larger customer base and faster growth rates. Nevertheless, Scalable makes a slightly better impression overall.

Conclusion: The comparison – Scalable Capital vs. Trade Republic

Both brokers are ideal for casual investors and investors who want to build their wealth in a straightforward manner. Although the offers differ slightly, they cover everything you need for successful stock market trading. Both service providers also offer a very fair pricing model with low fees.

|  | |

| 1. Costs | ||

| Depot management | Free of charge | Free of charge |

| order costs | LS Exchange 1 € | gettext €0.99; XETRA €3.99 + 0.01 percent (min. €1.50) |

| order fees | 1 € | 0.99 €With PRIME+: Free for orders over 250 euros, but 4.99 euros per month |

| ETF and equity savings plans | Free of charge | Free of charge |

| cryptocurrency savings plans | 1 € + 2 percent spread surcharge | 0.99 € + 0.99 percent spread surcharge (0.69 percent with PRIME+) |

| 2. Hidden costs | ||

| Entry in the share register | 2 € | Free of charge |

| Registration for the Annual General Meeting | 25 € | 25 € |

| standard instruction | 1 € | Free of charge |

| Trading in subscription rights | 1 € | Gettex or XETRA costs |

| 3. Other | ||

| 3. Subscription model | Not available | 4.99 per month |

| Interest | 2,75 % | 2,75 % |

| order types | Market, Limit, Stop Market | Limit-Order, Stop-Order, Stop-Limit-Order, Stop-Loss, Take-Profit, Market-Order |

| Cashback | 1% cashback up to £15 per month | No cashback |

| Extras | Full-service bank account | Automatic asset management ‘Scalable Wealth’ |

It is difficult to pick a winner in the Scalable Capital vs. Trade Republic comparison, as various factors come into play here. Trade Republic leads the way in cryptocurrencies, but lags far behind ‘real crypto exchanges’. And if you want to invest in bonds, this broker is also the better choice.

In addition, the full-service bank account and Saveback programme offer an interesting extra for anyone looking to open a new bank account. However, if you are looking for more professional analysis tools and options or want to invest in funds, this is not the right place for you. But don’t worry, competitor Scalable Capital is already on hand!

Trading on the XETRA exchange and the use of multiple order types are also possible here. It is therefore safe to say that Scalable is suitable for newcomers, but also provides good support for investors with previous experience who want to get more out of their money.

In comparison between Scalable Capital and Trade Republic, my conclusion is as follows:

- Trade Republic is an affordable neobroker with a huge customer base that makes basic investments particularly easy. With its banking licence, the company is authorised to issue current accounts and cash cards. The focus here seems to be on offering the widest possible range of services for everyone, while experienced investors may find some features lacking.

- Scalable Capital is also inexpensive and offers a similar selection of stocks and ETFs. Unlike its competitor, however, it focuses on the stock market and investments. It offers more order types, numerous funds, trading on XETRA and an automatic investment concept called ‘Wealth’. This makes it easy for beginners to get started, but also satisfies advanced investors.

Which provider is best for you depends on your personal needs, goals and previous stock market experience. Subjective factors also play a role: for example, I personally find Scalable Capital’s web and app interface much more appealing. However, this is purely a matter of taste and has no impact on the services available.

Here is an overview of the most important data:

|  | |

| Shares | 8.000 | 9.000 |

| ETFs | 2.700 | 2.700 |

| loans | 500 | A bond + bond ETFs |

| trading centres | LS Exchange (7:30 a.m. – 11:00 p.m.) | Gettex (8:00 a.m. – 10:00 p.m.); XETRA (9:00 a.m. – 5:30 p.m.) |

| fragments | Yes, starting at one euro | No, only whole shares, except via savings plan |

| Derivates | 380.000 | 375.000 |

| cryptocurrencies | 52 | 17 in the form of ETPs |

| Transfer to wallet | No | No |

| crypto spread | 1-2 percent | 0.69 per cent (PRIME+); 0.99 per cent (Free Broker) |

If you need further information about the two providers, I can recommend my reports on my experiences with Scalable Capital and Trade Republic.