Buying ETs for beginners – trading simply explained

ETFs have become one of the most popular investment products for young people in recent years – but financial professionals are also buying these funds in droves. If you want to trade ETFs and earn substantial profits, we are here to help. In this guide, we explain all the steps in a simple and clear manner so that you can get started in just a few minutes.

In brief:

- ETFs are packages of several stocks that are automatically compiled.

- To trade them, you need a securities account with a broker. You can set this up in just a few minutes from home.

- There are thousands of ETFs. We will introduce you to some of the classics and guide you step by step through the purchase process.

- We will also show you some basic concepts related to this topic that may help you in the future.

What are ETFs and why should I trade them?

It is common knowledge that you can earn a lot of money on the stock market. However, financial transactions were long considered complicated and only suitable for people with a lot of capital. Fortunately, this has changed in recent years: today, anyone can trade stocks and ETFs with even the smallest amounts and thus lay the foundation for a large fortune!

Trading ETFs is particularly popular. Exchange-traded funds have a number of special features:

- These are packages ranging from several dozen to thousands of stocks. When you invest money in an ETF, you acquire shares in all of the companies it contains.

- You benefit from price growth: if the prices of the stocks included in the fund rise, the value of your fund also increases and you can sell it for a higher price. Conversely, if prices fall, the ETF also loses value.

- You have a wealth of funds at your disposal with which you can invest in different areas (e.g. ETFs for renewable energies, financial sector ETFs, ETFs for consumer staples, etc.). Different regions and company sizes are also available.

- Offers that include multiple stocks are usually quite expensive. This can be seen, for example, in a comparison of ETFs and funds. But not with ETFs! The running costs here are extremely low.

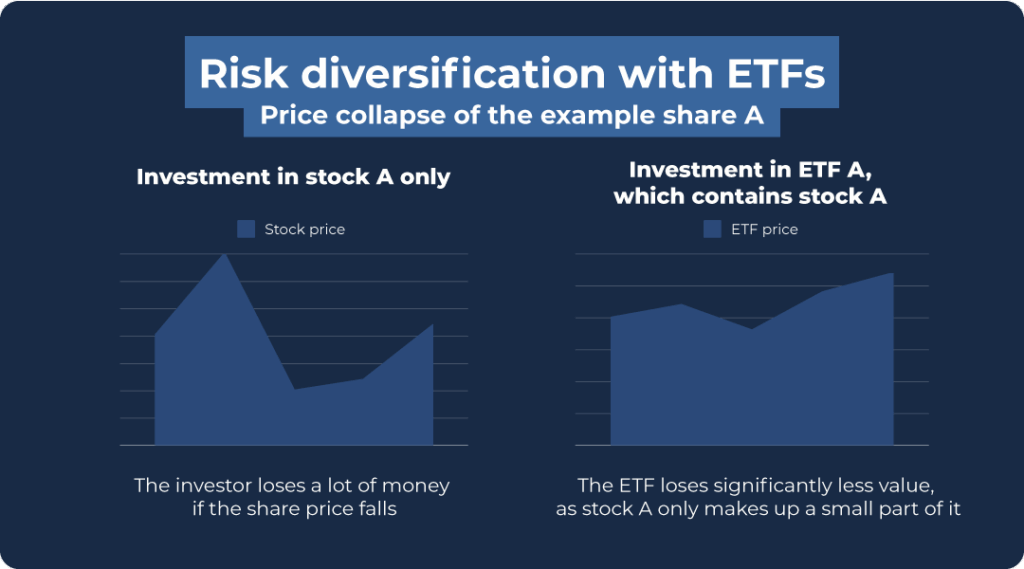

One of the most important advantages of popular investment products is their “natural diversification”: you should generally not put all your money into a single stock. The company could experience bad times or even go bankrupt. In this case, your money would be lost or at least worth less!

With an ETF, however, you buy shares in many companies at the same time. If one of them does not perform well, the damage is minimal: the stock in question only accounts for a small portion of the overall package and can only drag down the result slightly.

Although it is theoretically possible to lose the entire value of an ETF, this is extremely unlikely. However, price losses can occur! If you sell a fund when it has lost value, you will make a loss. In such cases, it is advisable to wait for prices to rise again.

Due to their special advantages, ETFs are ideal if you want to build up assets over a longer period of time. You benefit from the fact that the economy always improves in the long term. Temporary crises and crashes can leave you unfazed, because such losses will be offset sooner or later.

Step-by-step guide: How to trade ETFs

Trading your first ETF is now child’s play. You don’t even have to leave your home! All you need is:

- A smartphone with a camera, internet connection and the ability to receive text messages

- An email address

- A passport or identity card

- A current account

- Some providers also require proof of address. A utility bill or bank statement is sufficient for this purpose.

Once you have these things, you can open an account with a broker. This special type of account is the hub for trading stocks, ETFs and more. Only here can you buy and sell exchange-traded products.

There is a wide range of brokers to choose from, and each service provider has a slightly different offering and cost model. For beginners, an account with Scalable Capital or Trade Republic is very suitable. I have also had good reviews with Finanzen.net Zero. However, my favourite broker at the moment is Freedom24, so I will show you how to register with this provider below.

1. Create account

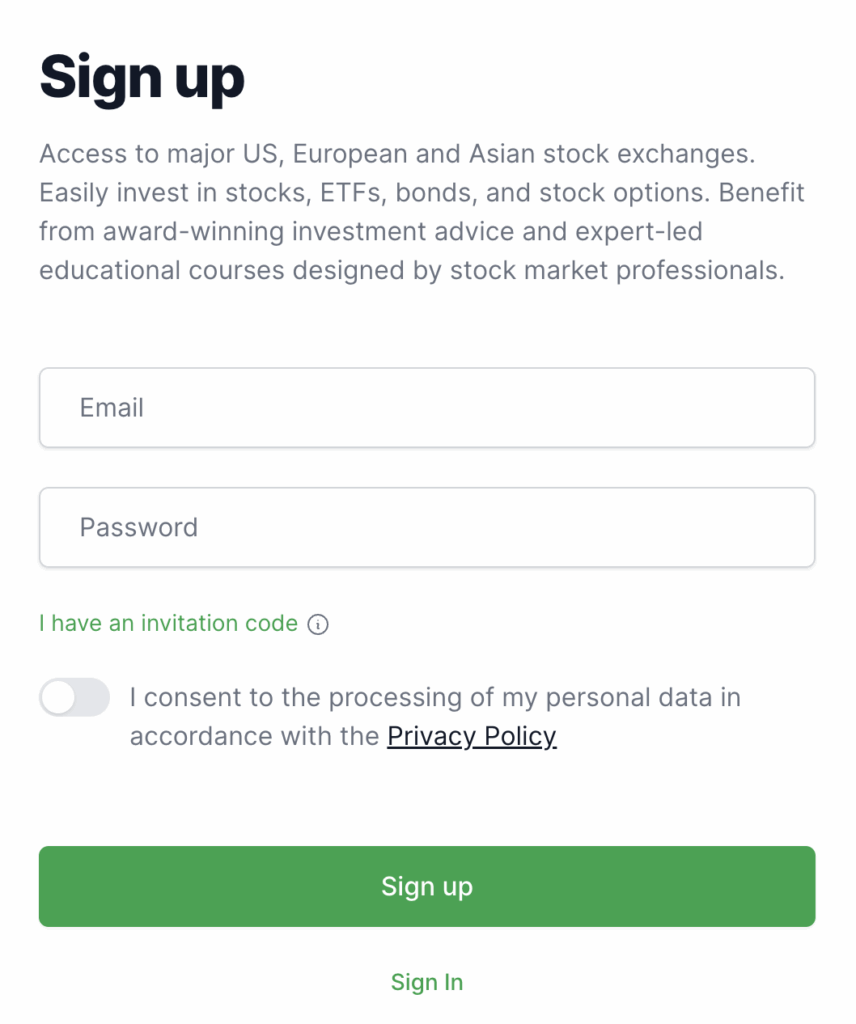

Creating an account with Freedom24 takes just a few minutes. The other brokers don’t take much longer either, as every provider wants to attract new customers and therefore makes it as easy as possible for you!

The first step is always to register. Just click on my link to go straight to the right page, where you can even grab an attractive Freedom24 bonus!

On the page, you must first enter an email address and your desired password.

Let’s get started with your email address and desired password.

You will receive a confirmation email from Freedom24, in which you simply need to click on the link. The same process applies to the phone number: the broker will send you a code, which you must enter in the registration form.

The second step is to confirm your phone number.

You will then be asked to provide a range of personal information, such as your name and address. This information will then be verified as part of an authentication process. This is because the broker needs to ensure that you are who you say you are!

But today, this can also be done in a matter of seconds via a video call. You can also rely on Freedom24 for help with every step: if something doesn’t work or you’re unsure about anything, you can contact customer service at any time.

2. Top up account

Once you have submitted all the documents and information, your broker will review them. This process can take several hours or even days! For example, opening a securities account with Trade Republic can take a little longer, as the provider has recently accepted an extremely high number of new customers.

Sooner or later, however, you will receive the green light. Now you can fund your new account and buy your first ETF. This can be done by transferring money from your current account. At Freedom24, you will find all the relevant information under the ‘Transactions’ tab in your account area.

The account area at Freedom24 is very clearly laid out. You can make deposits under the ‘Transactions’ tab.

Once you have transferred the amount from your current account to your securities account, you will need to wait a little longer. The transfer can take anywhere from a few seconds to several days.

3. Select ETF

While you wait for your money to arrive, you can start thinking about which ETF to choose. I will explain the most important points to consider below. If you don’t want to go into too much detail, it is advisable to buy a broadly diversified ETF.

Products based on the MSCI World were among the best ETFs for beginners and the most widely used offerings overall. They are so popular that I even wrote a separate article on the topic of the ‘Best MSCI World ETF’!

Many brokers are in no rush to trade. Providers such as Freedom24 and Trade Republic offer interest rates! You can earn attractive returns on your uninvested capital and use the service providers like a call money account.

4. Trading ETFs

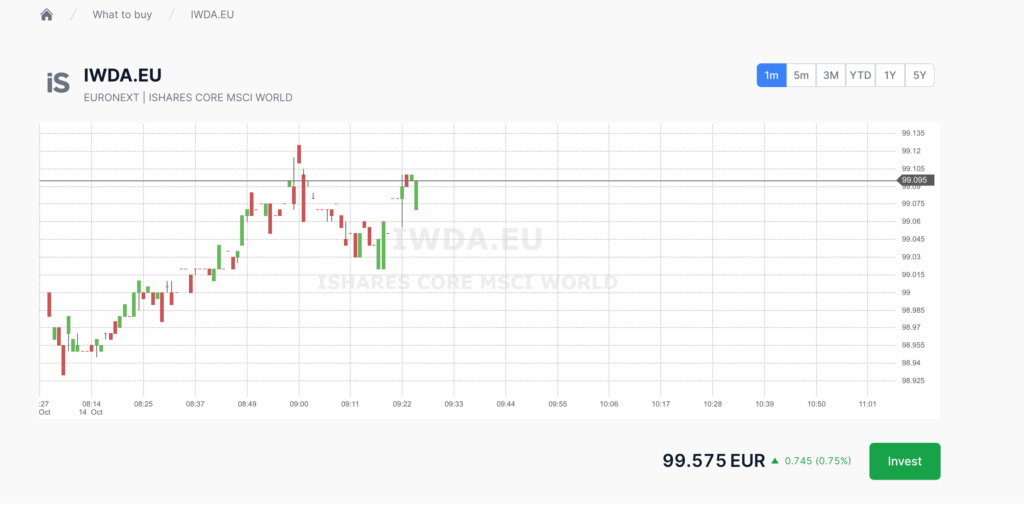

Once your money has arrived and you have decided on a fund, it’s time to take action. The easiest way is to find your desired ETF using your broker’s search function. Here you will find an ‘Invest’ button.

Freedom24 shows you the price history and offers you a button at the bottom right to complete your purchase.

You generally have two options for trading an ETF:

- One-time purchase. This is a simple standard transaction. You buy shares in an ETF for an amount you specify, with no frills. You can sell ETFs again later in the same way.

- Savings plan. Some brokers offer savings plans. These are recurring purchases that are executed at fixed intervals. For example, you could automatically invest €50 in an MSCI World ETF on the first day of every month.

Both forms of trading ETFs have their own advantages and disadvantages. In general, it can be said that:

- A one-time purchase makes sense if you want to invest a larger amount of money. Even if you believe that a fund has just reached its lowest price, direct trading can be worthwhile.

- Savings plans are ideal for long-term wealth accumulation: sometimes you buy at a slightly higher price, sometimes at a slightly lower price. On average, this results in a very attractive purchase price. Savings plans are also ideal for investors who don’t want any hassle. Everything is done automatically and you don’t have to worry about a thing.

5. Sell ETFs

Your desired ETF has been sitting in your portfolio for some time and has increased significantly in value. Now you want to sell it and realise your profit. Nothing could be easier! You can find all your investments in your account overview. Select the fund you want to sell.

Insert screenshot here. Account area of Freedom24, select an ETF (ideally an MSCI World or something else simple) so that you can see the button for selling.

Once you have selected the item, you will immediately see the ‘Sell’ button.

Before you finalise the sale, you should consider the following points:

- You don’t have to sell your entire investment; you can also sell just a portion of it.

- When trading ETFs, whether buying or selling, fees apply. It may therefore be advisable to trade larger amounts and avoid multiple transactions.

- Trading is only possible during trading hours. Most exchanges only offer this service on working days, but transactions are also possible at weekends via the ‘Gettex’ trading venue (available from brokers S-Broker, Smartbroker, Consorsbank and Comdirect). The exact times may vary from exchange to exchange:

| Stock exchange name | Available from which broker? | Weekdays from | Weekdays until | Weekend |

| Xetra | Among others, Freedom24, Scalabale Capital | 09:00 | 17:30 | – |

| Gettex | Smartbroker, Finanzen.net Zero, Scalable Capital | 08:00 | 22:00 | – |

| Lang&Schwarz | Trade Republic, S-Broker,ConsorsbankComdirect,Smartbroker | 07:30 | 23:00 | 7:30 a.m. to 11:00 p.m. |

| Tradegate | Comdirect,SmartbrokerS-Broker,Consorsbank | 08:00 | 22:00 | – |

Everything you need to know about trading ETFs

To select the right ETF to trade, you should understand a few basic concepts. I have compiled the most important information for you:

- Structure: An exchange-traded fund tracks an index. This is a list of stocks (or other securities) that follows predefined rules. For example, the DAX index tracks the largest German companies. If the order changes because a company gains or loses value, the index is also updated. This ensures that indices and the ETFs based on them are always up to date.

- Costs: Since the contents are compiled automatically, you can trade ETFs very cheaply. Unlike investment funds, for example, there are no highly paid managers who you have to feed with your fees! Nevertheless, you should take a look at the costs (abbreviated: TER): some ETFs cost significantly more than others.

- Size: You can trade ETFs worth billions as well as small products worth just a few million euros. If there are not enough investors, the fund operator will sooner or later close the fund. You will then get your money back, but in the meantime, prices may have fallen. Very unpleasant! A solid minimum size of 100 million euros or more has therefore proven to be a good rule of thumb when trading.

- Replication: There are several ways in which exchange-traded funds replicate the underlying index. Physical replication is particularly recommended for beginners. Here, the ETF actually buys the stocks contained in the index (full replication) or at least some of them (sampling). Synthetic replication, also known as swapping, is much more complicated. Such swap ETFs are also less secure.

- Distributing or accumulating: Some stocks pay a share of their profits to investors. If such securities are included in an ETF, the ETF can pass the money on to you (distribute it) or reinvest it (accumulate it). There is no general answer to the question of whether an ETF should be accumulating or distributing. Both forms have their advantages. Simply choose what sounds better to you – it will have little impact on your ETF return.

Please note that although trading in ETFs is considered very safe, there are also risky products! Among the thousands of funds available, there are some that are subject to extreme price fluctuations or represent very risky sectors. Therefore, always do your research before deciding on a product!

Conclusion: Trading ETFs has never been easier

Exchange Traded Funds are packages of several stocks that offer investors a simple and broadly diversified investment. No wonder ETF trading is so popular!

Trading works via a securities account with a broker, which you can set up in just a few minutes from home. I recommend Freedom24, but other providers also offer good services.

Once your account has been set up, all you need to do is deposit funds and you can start trading your first ETF. If you don’t yet have a specific plan for which fund is right for you, the classic ‘MSCI World’ is a good choice. With this fund, you invest in the most important companies from industrialised nations and benefit from their growth.

If you choose a product yourself, you should pay attention to factors such as costs, replication method and a minimum size of 100 million euros. Overall, trading ETFs is extremely easy. It only takes a few minutes to lay the foundation for your own fortune!