10-year US government bonds: a sensible investment or an unnecessary risk?

For decades, government bonds were a safe way to achieve higher returns. Security-conscious investors in particular could rely on this safe asset class. In 1990, 10-year US government bonds achieved a yield of 9%. However, the situation has changed and investors now rarely place their trust in this tried-and-tested asset class.

In brief:

- Government bonds used to be considered a safe bet for high returns.

- In principle, government bonds function like lending for the state. Private investors lend money to the state so that it can finance itself.

- Due to the flourishing economy in the USA and the accompanying prosperity of the state, American government bonds are very popular.

Facts about the US economy

If you’ve ever wanted to invest your money in stocks, you couldn’t avoid the USA. The superpower has become an integral part of the economy. The most important companies and biggest big players are mostly based in the USA. Examples include companies such as Apple, Microsoft and Amazon.

Of course, it is not only companies that benefit from a strong economy. The state also reaps rewards. It earns its share through taxes. This, in turn, is important for the prosperity of the state and thus indirectly for government bonds.

General economic development

The US economy is the largest economy in the world. This observation can be attributed to the available natural resources, the enormous human capital, as well as the international integration of other countries and the brisk trade with them.

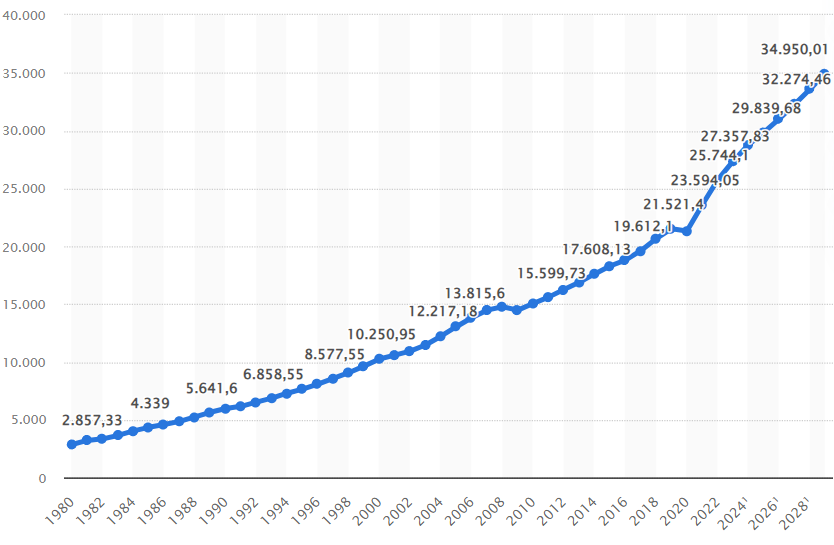

The USA accounts for approximately a quarter of global gross domestic product and thus a quarter of total world trade. But its own GDP is also growing steadily.

The graph shows the steady growth of the US economy. The forecasts for the coming years also appear to be quite positive, with continued growth expected. There are repeated predictions that the US economy will collapse or that a recession will spread. However, this does not seem to be the case.

As already mentioned, the USA owes its sustained growth primarily to its size, human capital and natural resources. Here are the most important key figures in comparison with Germany:

| USA | Germany | |

| Inhabitants | 333.3 million | 83.8 million |

| Area km² | 9.834.000 km² | 357.592 km² |

| Gross domestic product (GDP) | 23.594 | 4.082 |

| Forecast regional growth for 2024 | 2,7 % | 0,3 |

| Share of economic growth (forecast) | 15,56 % | 0,2 % |

We can therefore see that the US clearly dominates Germany. Almost no one can compete with the US economically. This is one reason why investment products such as government bonds or ETFs from the US are so popular.

Role of the state in the US economy

You have probably heard of government-sponsored investment projects, such as the Norwegian sovereign wealth fund ETF. But what about the United States? Are there similar projects there, how does the US government operate within the US economy, and how does this affect government bonds?

The American state is entirely oriented towards the concept of a free market economy. It gives the American economy a long leash, so to speak. However, this does not mean that the state does not intervene in important matters. Certain regulations, such as those concerning the formation of monopolies, remain an important part of the American economy.

The central bank also plays an important role. It determines the applicable interest rate, which in turn is directly linked to government bonds, or rather inversely proportional to them.

This means that if interest rates rise due to the current economic situation (for example, due to high inflation or an economy growing too quickly), bond prices will fall, and vice versa.

The reason: the price of a bond reflects the value of the income it provides through its interest payments. When prevailing interest rates (especially interest rates on government bonds) fall, older bonds offering higher interest rates become more valuable. Investors holding these bonds can demand a premium when selling them on the secondary market.

When prevailing interest rates rise, older bonds become less valuable because their coupon payments are now lower than those of new bonds. The price of these older bonds falls and they trade at a discount.

Government bonds – explanation and significance

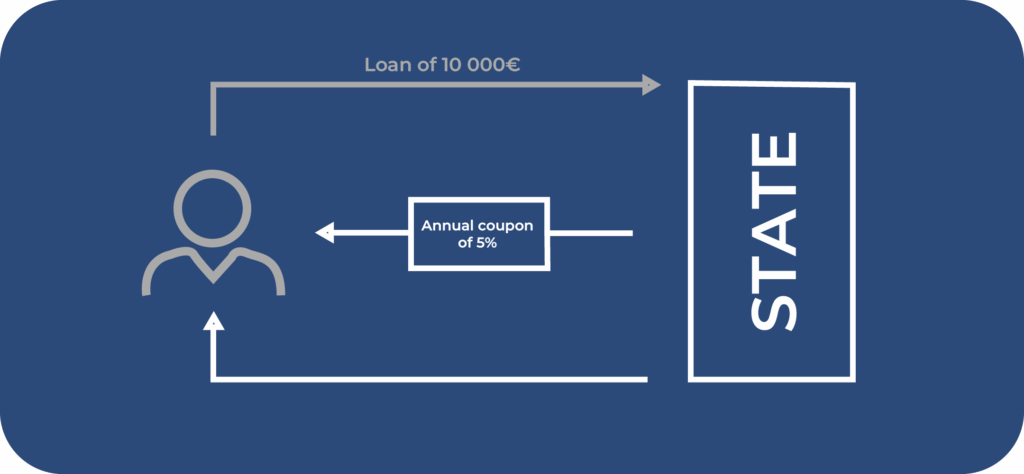

Government bonds – also known as sovereign bonds or government securities – are fixed-income securities issued by governments. Governments borrow money from investors in order to finance themselves. Anyone who buys a government bond is therefore lending the respective country. Issuers can be any country in the world.

To this end, the states define the financial volume they require. This volume (in dollars) is divided into a large number of bonds, each with a specific individual value. As an investor, you can now buy as many bonds as you like – until the target volume is reached.

At the end of the fixed term of the “lending”, you have the right to reclaim your money – with a fixed interest rate.

Example:

You invest €10,000 in a government bond with a term of 10 years and an interest rate of 2%. From now on, you will receive 2% interest every year. At the end of the term, i.e. after 10 years, you will get your invested money back. You will therefore receive a total of €12,000, which amounts to a profit of €2,000.

Unlike ETFs, however, you cannot take advantage of the compound interest effect here. This is because you only receive interest payments on the principal amount borrowed.

Impact of demand on returns

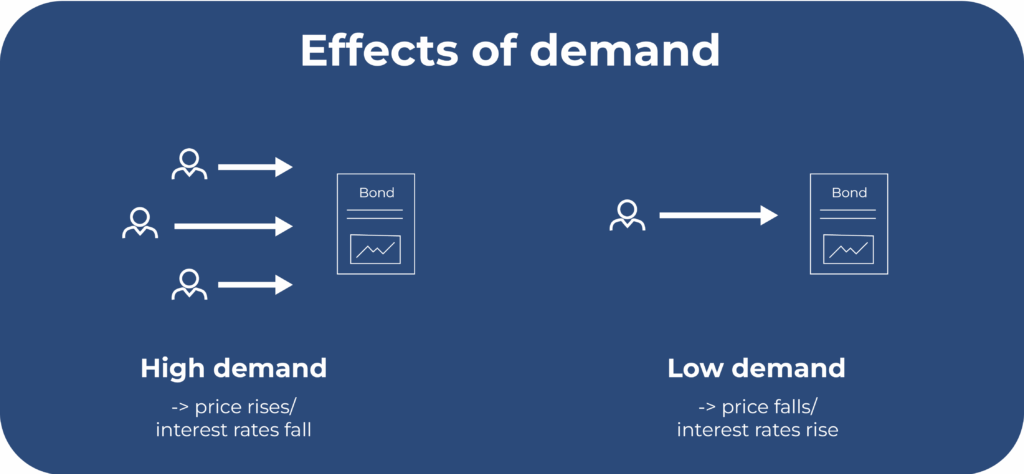

Increased demand for an asset class normally means an increase in value and therefore a reason for you as an investor to rejoice. With government bonds, however, the situation is somewhat different. Increased demand also leads to an increase in price here. This weakens the yield on the respective government bond.

To clarify: bonds are always issued at a price of 100% (the so-called ‘nominal value’) and then traded on the stock exchange. There, they are subject to price fluctuations. Therefore, the yield on a government bond is variable.

Let me explain with two simple examples:

Example 1: Demand increases:

When demand increases, our price rises to 103%. This means that a buyer now has to pay 3% more than the bond is actually worth.

This can be explained by the fact that the nominal value of the bond is only 100%, which is the amount that is repaid. If the investor buys at the stated price of 103%, they pay €103, but ultimately only receive €100 back, resulting in a loss of €3.

Example 2: Demand falls:

Demand is logically lower for certain bonds. This also causes the stock price to fall. If we assume the same scenario, i.e. a price fluctuation of 3%, we end up with 97% instead of 103% because the price is falling.

If you now purchase a bond for €100, you would ultimately realise a profit of 3% (after the entire term), excluding the additional interest paid.

What you should pay attention to:

Please note that the respective profits or losses do not only become realisable after the specified period has expired, as in the examples above. You can sell your bonds before the end of the term. This allows you to improve your entry value.

You should also bear in mind that the higher the demand and the lower the interest rate, the more difficult it will be to generate a return on government bonds.

Advantages and disadvantages of government bonds

To give you an overview of the various advantages and disadvantages of government bonds as an investment, we have created a table for you:

| Advantages | Disadvantages |

| Security and stability: Government bonds are issued by the state, making them one of the safest forms of investment. Government bonds, treasury bills and government debentures are guaranteed by the Spanish state, which minimises the risk of default. | Low returns: One of the main disadvantages of government bonds is that they generally offer lower returns compared to other forms of investment, such as stocks or ETFs. The biggest problem is that the returns offered may not be sufficient to offset inflation. |

| Fixed return: Investments in government bonds offer consistent and predictable income. Interest is paid regularly, allowing investors to plan their finances with greater certainty. | Interest rate risk: We have already explained in detail the link between interest rates and government bonds. This means that this asset class is logically dependent on interest rates and therefore also on the discretion of central banks. |

| Diversifying your portfolio: You should be aware that you should have a broadly diversified portfolio comprising several asset classes. Government bonds can also help to diversify your portfolio to a certain extent. | Liquidity: Although government bonds are generally liquid, certain types of instruments, such as long-term government bonds, cannot be sold quickly without incurring losses. This can be a disadvantage for you as an investor if you need to access your money quickly. |

| Access: Unlike fixed-term deposit accounts, for example, you can access your investment at any time and sell it. |

Investing in US government bonds – does it make sense or is it a no-go?

So, are government bonds the best investment right now? Although we don’t want to dampen your enthusiasm, we have to disappoint you. Let’s take a look at the current yield and your potential profits.

At first glance, the graph looks promising. There has been a clear increase in returns over the last four years, from 0.65% to 4.54%. Unfortunately, this means that the fixed return is below the current inflation rate, which appears unpredictable at present and may even rise further.

Your primary goal as an investor should be to beat the return. Otherwise, you will see your money lose value.

Government bonds have always been considered a safe investment for your portfolio. Fixed returns, price-independent payouts (as long as you stick to the fixed term and do not sell early) and the government as a trustworthy partner are arguments in favour of a safe investment. However, the reality is different, and you should only invest in government bonds if they have a really good credit rating.

An alternative to government bonds that are still suitable for the security component of your portfolio are instant access and fixed-term deposit accounts. These offer slightly higher returns under favourable conditions and also provide a high degree of security thanks to EU-protected deposit insurance of up to €100,000.

Meaningful alternatives to government bonds

Of course, you can invest not only in individual government bonds, but also in shares of a bond fund. This fund then invests in a variety of bonds.

And as is often the case, in addition to actively managed funds, there are also passively managed funds, i.e. ETFs. However, unlike usual, these do not track the common stock indices, but rather so-called bond indices.

In other words, an index that invests in several bonds at the same time. This allows you to diversify your investment and also earn the average ETF return of 8% per year!

To save you having to compare ETFs, we’ll introduce you to a popular index: the MSCI World. This index consists of the world’s most successful companies. The top positions are held by companies such as NVIDIA, Microsoft and Apple. The MSCI World is considered a stable ETF with good returns.

If you still want to invest in bonds, ETFs are also a good option here. Take a look at the iShares USD Treasury Bond 7-10yr UCTIS ETF (Acc) for this purpose.

Important core data:

- Issuer: BlackRock Asset Management – ETF

- Date of publication: 20 February 2019

- Distribution type: Accumulating

- TER: 0,07 %

- Replication type: Physical

- Fund size: 14,409,867,102.65

How to buy government bond ETFs

To purchase your government bond ETF, you need a securities account with a suitable broker. We have compared the three best neobrokers for you:

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

Points

0 % without

Points

0 % without

Points

Points

Points

Points

Points

Which of the three brokers you ultimately choose depends on your preferences. Personally, I prefer Freedom24 because this broker offers me the widest selection of trading venues at very low costs.

Conclusion: US government bonds are still profitable – with an adjusted investment strategy

The economic world power of the USA is one of the strongest and most reliable partners you can have when it comes to your investment transactions. However, traditional government bonds have fallen somewhat out of fashion. Low yields and a strong dependence on interest rates make this asset class appear anything but worthwhile.

However, you can beat the lower returns by adopting a tailored investment strategy, namely by investing in government bond ETFs. ETFs also allow you to invest in US government bonds for 10 years. Would you like to learn more about investing? Find out everything you need to know about the snowball effect and read our comprehensive review of savings plans!