Investing for doctors: building capital with ETFs and P2P

As a doctor, you bear responsibility for others on a daily basis, but your own financial future falls by the wayside. While you invest years in studying, further training and setting up your practice, there is often little time left for actually building up your assets.

Yet this is precisely the key to generating additional income in old age, supporting your children or simply enjoying more freedom in your everyday life. In this article, I will show you how you can develop a realistic investment strategy with minimal effort.

In brief:

- As a doctor, you have little time and often start investing late, so you need investments with solid returns and minimal effort.

- ETFs are a stable foundation that is well suited for long-term capital accumulation with good growth.

- P2P lending provides regular interest payments, regardless of stock market movements.

- Cryptocurrencies are suitable as a small addition for additional potential.

- Automation enables you to invest efficiently even alongside a busy working life.

Why is the topic of investing so important for doctors?

Many medical professionals start their careers late. Between studying, residency and further training, ten years can quickly pass by, while their peers have long since started building their wealth. Added to this are high training costs and often a long period of time before the investment in one’s own career pays off financially.

As a result, you will have an above-average income, but less time to capitalise on it in the long term. If you continue to put off investing, you will lose valuable returns every year.

Doctors in particular are affected by additional factors that make long-term investing even more important:

- Irregular or fluctuating income: In many practices, income depends heavily on how many patients you treat and whether they are on the National Health Service or private patients. Building up stable assets can cushion such fluctuations and create a predictable income in the long term.

- Little time for finances: Those who work long hours every day in a practice or clinic have little energy left in the evening to deal with markets, interest rates or taxes. Automated investments allow your money to work for you even when you are on duty.

- Ongoing costs and investments in your career: Medical equipment, practice premises, training and staff are expensive. A stable capital base gives you the leeway to cover such expenses without having to resort to loans or emergency reserves.

With a robust investment strategy, you can structure your income so that it grows without requiring daily attention. Interest and regular returns ensure that you build up additional income in the long term. Ideally, this could even amount to several thousand pounds per month in retirement!

Investing money for doctors: How much you can achieve

The earlier you start, the more your capital will benefit from the so-called compound interest effect, i.e. interest on your interest. If you invest regularly at a solid rate of return, this will create an increasingly strong growth effect over time, even with moderate amounts. This brings you the following advantages:

- Better financial security after retirement, regardless of state pension or practice sale.

- More freedom to reduce working hours, support your family or simply live a more relaxed financial life.

- Build wealth that will benefit not only you, but also your family in the long term.

The higher the return and the longer the investment period, the greater the effect. In practice, this means that your capital grows faster with each passing month, because interest is paid not only on your deposits, but also on the returns that have already been generated.

You can see how much this pays off in the long run in this example, based on a conservative 8% annual return:

| Monthly amount | 5 years | 10 years | 20 years | 25 years | 30 years |

| 250 € | 18.369 € | 45.736 € | 147.255 € | 237.757 € | 372.590 € |

| 500 € | 36.738 € | 91.473 € | 294.510 € | 475.513 € | 745.179 € |

| 1000 € | 73.477 € | 182.946 € | 589.021 € | 951.027 € | 1.490.360 € |

Over the course of an entire career, this can easily add up to between €750,000 and over €1 million. Regular financial investment for doctors literally pays off!

If you only withdraw 5% per year during retirement, this will generate around €40,000 to €50,000 in additional income annually, without touching your original investment amount!

Which asset classes are particularly suitable for doctors?

If you start your career late, you need to pay more attention to returns and efficiency when building up your assets. After all, your investments should make up for lost time. However, there is no room for excessive risk.

Investments for doctors should grow steadily, fluctuate little and have a low to medium risk profile. Ideally, they should also be largely automated, as you often don’t have the time to deal with stock market news on a daily basis.

These two types of investment are therefore ideal, as they complement each other perfectly:

- ETFs (Exchange Traded Funds): These track entire markets, allowing your capital to grow in line with the global economy over the long term.

- P2P lending: Here, you lend your money directly to private individuals or companies via specific platforms. In return, you receive regular interest payments, usually on a monthly basis, regardless of stock market fluctuations.

Together, ETFs and P2P lendings offer the best of both worlds: on the one hand, you get good returns for long-term capital accumulation, even if the stock markets fluctuate from time to time. On the other hand, ongoing interest income provides stability and additional income, regardless of movements on the stock market.

ETFs as your gateway to the global economy

These asset classes represent entire markets or indices, such as the MSCI World or S&P 500. You purchase shares in these funds, allowing you to benefit directly from the growth of many companies simultaneously. The fund handles administration, dividends and rebalancing, so you do not need to concern yourself with individual securities.

Example:

Over the last 20 years, the S&P 500 has achieved an average return of 9.06% per annum (source:https://www.investopedia.com/ask/answers/042415/what-average-annual-return-sp-500.asp). This explains why this type of investment is so attractive in the long term. Investing in global economic growth literally pays off!

What makes them particularly useful as an investment for doctors:

- Stable core of your portfolio: they fluctuate, but less than individual shares. This forms the ideal basis for sustainable growth.

- Minimal time investment: You can choose between an ETF savings plan or a one-off investment. Once set up, an ETF savings plan runs automatically. You don’t have to check charts every day.

- Broad diversification with little effort: your capital is spread across many countries, sectors and companies. This reduces risk in the event that individual companies lose value.

How ETFs bring me a 9% return

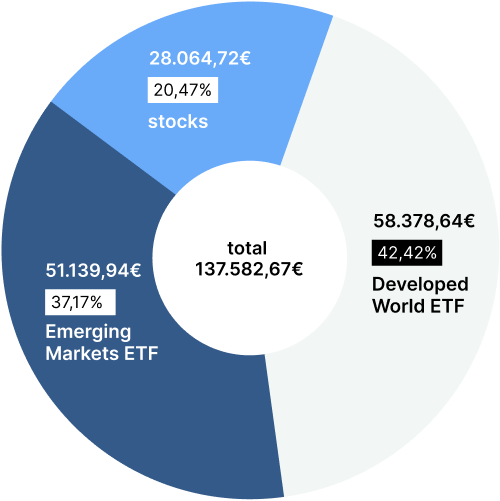

I rely on a mix of approximately 37% industrialised country ETFs and 42% emerging market ETFs. This allows me to combine stability from Western countries with the potential for above-average

To get started, it might look something like this:

- Select two global funds (e.g. World + Emerging Markets).

- Set up a savings plan (monthly, automated).

- Check the ratio in your portfolio regularly, e.g. once a year. If necessary, bring it back to the target weighting.

This type of portfolio makes it easy to systematically build up your assets. You spread your capital globally, get solid returns and have little effort in managing it. The perfect basis for efficient investing!

P2P lendings: Regular income regardless of the stock market

P2P means that you invest directly in loans to private individuals or companies. This is done through specialised providers such as Bondora or Mintos. These platforms take care of lending, credit checks and repayments, and you receive the interest in return.

Because there is no bank involved, you keep all the earnings. Currently,

This is how the principle works:

- Borrowers submit applications, e.g. for car repairs, investments or short-term liquidity.

- The platform checks creditworthiness and risk profile and decides whether and on what terms the loan will be granted.

- Your money is invested together with other investors, either as many small loan shares or in specific loans that you can select according to various criteria, depending on the platform.

- Borrowers make monthly repayments, including interest, which you receive on a pro rata basis.

- The platform takes care of everything else, such as billing, monitoring and, if necessary, reminder processes.

Why this is particularly exciting as an investment for doctors:

- Frequent returns: Most platforms pay interest or repayments monthly or even daily. This is perfect if you are looking for regular additional income.

- Independent of the stock market: even if shares fall, your credit investments continue to yield interest.

- Minimal effort thanks to automation: systems such as Go & Grow at Bondora or Auto-Invest at Mintos take care of selecting individual loans for you.

It’s the perfect second source of income! With

1. Easy to get started: Invest effortlessly and earn interest daily with Bondora

Bondora offers an extremely simple P2P product with Go & Grow. You deposit money, the platform automatically distributes it across many small loans, and you receive daily interest, currently 6% per annum.

Advantages:

- Extremely simple: you don’t need to select loans or invest manually, everything runs automatically.

- Daily availability: You can withdraw your money at any time, usually within one working day.

- Passive income: Interest is credited daily. I think this type of regular income is great!

What you should know:

- Although Bondora is one of the most established P2P providers, this does not make it risk-free. Even if defaults are cushioned by provisions, it remains an investment in loans.

Despite residual risk, Bondora has been on the market for over 17 years and now has 500,000 investors. To date, a total of €1.7 billion has been invested and around €159 million in returns has been paid out. This definitely speaks for a stable platform!

2. Stay flexible: actively select and achieve high returns with Mintos

Mintos is one of the largest P2P platforms in Europe. Here, you invest in loan portfolios from various originators (e.g. leasing or consumer loans from different countries). The platform offers auto-invest, buyback guarantees and broad risk diversification.

Advantages:

- Attractive returns: Depending on your risk profile, returns of 6% to 15% per annum are possible.

- Buyback guarantee: Many lenders offer buybacks for overdue payments, which increases security.

- Automation as needed: You can either configure Auto-Invest according to your criteria or invest manually if you wish.

- Strong diversification: Your capital is spread across many borrowers and regions, which reduces risk.

What you should know:

- In the past, there have been defaults by lenders, which delayed repayments or made them only partially possible.

- Mintos is a bit more complex to use. You should take your time to familiarise yourself with it or start with small amounts.

Portfolio proposal for financial investments for doctors

My portfolio shows how a well-thought-out mix of different asset classes not only builds wealth in the long term, but also secures monthly income. You can adopt it directly or adapt it to your own needs; the logic behind it remains the same:

- maximum return with acceptable risk,

- regular returns for greater flexibility,

- Systems that can be almost completely automated.

For you, an allocation could look like this, with more focus on stable returns and less risk:

| Investment | Share in the portfolio | Goal |

| ETFs | 60 % | Long-term fundamental growth |

| P2P lendings | 35 % | Regular cash flow |

| Cryptos | 5 % | Yield drivers in the portfolio |

Why this combination makes sense as an investment for doctors:

- ETFs cover your basics. You benefit from global economic growth in the long term, with manageable risk and moderate fluctuations in between.

- P2P brings cash flow. Regular interest payments provide liquidity and help stabilise your income without you having to actively trade.

- Cryptocurrencies are quite volatile, but they can significantly increase the overall return on your portfolio.

You can specifically incorporate these products:

- ETFs: My portfolio contains a mix of developed market and emerging market ETFs, such as Vanguard FTSE Developed World and iShares Core MSCI World, as well as Vanguard FTSE Emerging Markets / iShares Core Emerging Markets. This combination allows you to invest in stable developed markets while benefiting from growth opportunities in emerging markets.

- P2P lending: For solid returns with manageable risk, you can invest in Bondora Go & Grow or Mintos, for example. Both providers are easy to use, well established in the market and make automated investing easy for you. This saves time and generates returns!

- Cryptocurrencies: As a small addition to your portfolio, cryptocurrencies can significantly boost your return profile. Binance is well suited for buying and holding these assets, especially if you are investing for the medium to long term and do not need a day trading platform.

My conclusion: high-interest financial investments instead of overnight money

Despite your busy daily routine, the best way for doctors to invest their money is with a well-thought-out portfolio. Especially if you have little time but a stable income, it is important that your capital works for you.

With ETFs, P2P loans and a small portion of cryptocurrency, you can build a stable foundation for the long term. You benefit from global growth, secure regular interest income and don’t have to check daily prices.

Automation takes a lot of the work off your hands and automatically reduces your risk through diversification. You don’t have to be perfect, but the sooner you start, the faster you can grow your money and take advantage of the snowball effect!