Scalable Capital vs. Trade Republic: The big comparison

When people talk about neobrokers, these two names are always mentioned first: Scalable Capital and Trade Republic are the best-known examples of affordable, simple brokers for everyone. This naturally raises the question: ‘Which is better, Scalable Capital or Trade Republic?’ We have the answers!

In brief:

- A comparison of Scalable Capital and Trade Republic reveals many similarities, for example in terms of the range of shares and ETFs on offer and the prices charged.

- Both providers offer excellent terms and conditions and a good range of products.

- Both providers are fully-fledged banks, but they use their licences in quite different ways.

- Trade Republic offers you a full-featured current account including a card, which you can use to make transfers or pay in shops.

- Scalable Capital, on the other hand, provides you with lending (using your securities account as collateral) and automated investments.

Scalable Capital vs. Trade Republic at a glance

Are you already active on the stock market, trading shares and always on the lookout for the best ETFs? Then you’re probably familiar with Scalable Capital and Trader Republic. No wonder, as they are the two best-known neobrokers on the German-speaking market!

Scalable Capital and Trade Republic have significant differences, but also many similarities. These include:

- Very favourable terms: With regular banks, you have to dig deep into your pockets to trade on the stock market. With neobrokers such as Scalable Capital and Trade Republic, however, trading is very inexpensive and in some cases even free!

- Ease of use: All neobrokers are characterised by their ease of use, so even complete beginners can quickly trade their first shares and ETFs for beginners.

- Exciting additional offers: My broker comparison shows that the competition for Scalable Capital and Trade Republic is very strong. Every neobroker therefore tries to win customers with attractive additional offers.

- Disadvantages: Unfortunately, the disadvantages of these providers are also very similar. These include a limited selection of shares and ETFs, poor customer service and a shaky infrastructure.

By the way: If the low-cost neobrokers don’t appeal to you, but you don’t want to spend a fortune at your high street bank, online brokers could be a good compromise. Providers such as Freedom24 are slightly more expensive, but offer a much wider selection, professional tools and excellent service!

You may also be interested in: Slightly more expensive, but with over a million securities – my Freedom24 experience

The similarities are clear, but before we look at the differences, let’s take a closer look at the two providers:

Trade Republic

The German provider Trader Republic is considered the most successful neobroker in Europe. Over 10 million people in 18 countries trust the Berlin-based company to trade on the stock markets at low cost. The reason for this great success is its particularly simple business model:

- Trade Republic offers you access to several thousand shares, ETFs and many derivatives such as warrants

- You pay one euro for each transaction, nothing else. There are no costs for custody account management or other services

- Everything works via the simple, easy-to-use app

In 2024, TR received a full banking licence from the German Financial Supervisory Authority (BaFin). This means that the broker can now also offer banking services. You can also set up a free current account with your securities account and use it to make transfers, card payments and more.

Of course, not everything is perfect: Extreme growth with over 100,000 new customers per month repeatedly pushes the company’s infrastructure to its limits. Unfortunately, delays and outages (for example, during the stock market crash in spring 2025) occur time and again.

Customer service is also considered inadequate and is a constant source of frustration. I have summarised my personal experiences in the article on my Trade Republic review.

Scalable Capital

Scalable Capital is a successful German neobroker and Trade Republic’s classic competitor. The Munich-based company has been active since 2014. During this time, it has gained ‘only’ one million customers, who have invested an impressive €20 billion (significantly more than is invested per person at Trade Republic!).

- Trading shares, ETFs and other securities costs 99 pence here. The selection is solid and includes several thousand securities

- In addition, a flat-rate trading fee is offered: for €4.99 per month, trading costs are waived and you receive several other benefits

- You can take out a loan with Scalable Capital, using your securities account as collateral. This makes it possible, for example, to invest even more effectively

Originally, Scalable Capital focused heavily on its ‘Robo Advisor’, an automated investment designed specifically to make investing easier for beginners. However, customers showed little interest, which was certainly also due to the modest results of the offer.

Following a rebranding, automated investments are now offered as ‘Scalable Wealth’. Here, too, the returns are rather disappointing (compared to a simple MSCI World ETF, the S&P 500 or other standard investments), but the product is much better received: customers have invested around €4.5 billion here.

Comparison of Scalable Capital vs. Trade Republic

The best way to see the differences between Scalable Capital and Trade Republic is, of course, to compare them directly. I have therefore summarised the most important data for you:

| Category | Scalable Capital | Trade Republic |

| Fees | €0.99 per transaction €0.00 with trading flat rate (for orders over €250, otherwise €0.99) | 1.00 per transaction |

| Special features | Trading flat rate: €4.99 per monthAutomated investing with ‘Scalable Wealth’Loan secured by securities account | Full-service, free bank account |

| Savings plans | free of charge | free of charge |

| Trading centres | – European Investors Exchange -Gettex -Xetra | Lang&Schwarz Exchange |

| Stocks | > 8.000 | > 10.000 |

| ETF | > 2.700 | > 2.700 |

| Lendings | 2 | > 750 |

| Active funds | > 3.500 | No |

| Private equity funds | 2 | 2 |

| Derivatives | > 625.000 | 1.2 million |

| Cryptocurrencies | Only as ETP (32 coins) | 52 Coins |

Registration and account management

You finally want to invest money in shares and buy your first ETFs – but first you need to set up a securities account! The good news is that both providers make it very easy for you.

- Registration is straightforward via the app and takes just a few minutes. Use my links to go directly to the relevant page at Trade Republic and Scalable Capital

- At Trade Republic, you have to hold your face and an ID document up to your mobile phone camera. Various providers are available in case one of the authentication processes does not work.

- Scalable Capital is a little more flexible: here, you can choose the video option, use your electronic ID card or visit a post office in person.

- Bad news: Unfortunately, both theTrade Republic bonus and the Scalable Capital bonus are history! You can get gifts from Trade Republic when you refer friends or from Scalable Capital when you transfer an existing securities account to them.

| Trade Republic | Scalable Capital | |

| Identification for opening an account | Video identification (WebID, Fourthline or account identification) | Via Postident by video, using your identity card (eID) or in person at a post office |

| Two-factor authentication | Yes | Yes |

| Registration via the web? | No, only via the app. | No, only via the app. |

| Bonus | No sign-up bonus/Refer-a-friend bonus | No sign-up bonus Up to €2,500 when transferring an existing portfolio |

Who has the better selection?

In a comparison between Scalable Capital and Trade Republic, both providers are roughly on par in terms of product range.

At SC, you can expect:

- Just over 8,000 shares

- 2,700 ETFs

- 3,800 funds

- 32 cryptocurrencies

- 625,000 derivatives

- 3,500 active funds

Trade Republic keeps its available assets a secret, but our count revealed:

- 10,000 available shares

- 2,700 ETFs

- almost 750 bonds

- 52 cryptocurrencies

- 1.2 million derivatives

First things first: when it comes to shares or ETFs, you are in good hands with both providers. They offer all the important securities for a typical standard portfolio.

However, if you are looking for lesser-known, regional shares, you will be equally poorly served by Scalable Capital and Trade Republic. In this case, you would be better off opening a second account with a provider offering a wider range, such as Freedom24 or CapTrader.

There are major differences when it comes to bonds: if you are interested in this asset class, for example the popular 10-year US government bond, there is no way around Trade Republic.

If, on the other hand, you are interested in actively managed funds, Scalable Capital is the right choice for you.

My tip: First, decide which shares and ETFs you want to buy or acquire in a savings plan. Then check which provider offers them before deciding between Scalable Capital and Trade Republic.

Trading centres

Neobrokers such as Scalable Capital and Trade Republic are so inexpensive because they have special deals with individual trading venues: for every transaction that customers like you and me carry out there, the brokers receive a bonus payment from the respective stock exchange.

Therefore, traditionally, only those trading venues where brokers receive the highest bonuses are available to choose from.

- For Trade Republic, this is the Lang & Schwarz Exchange. It is open on weekdays from 7:30 a.m. to 11:00 p.m., giving you considerable flexibility to trade.

- Scalable Capital similarly uses the Gettex exchange in Munich and the EIX. Here, too, you can trade on weekdays between 7:30 a.m. and 11:00 p.m.

- In addition, Scalable also allows you to use Germany’s largest stock exchange, XETRA. However, a fee of €3.99 per transaction is charged here.

Please note! The commission model (‘Payment for Order Flow’) has been banned by the EU because customers sometimes had to accept unfavourable prices and excessive spreads. The ban will also apply in Germany from June 2026.

It is not yet clear how Scalable Capital, Trade Republic and other neobrokers will respond to this. However, higher costs for end consumers are very likely in the future.

Good to know:

XETRA’s opening hours are from 9 a.m. to 5.30 p.m., which is significantly shorter than Gettex and L&S. At first glance, the longer trading hours of the smaller exchanges appear to be a significant advantage – but in fact, it is advisable to trade during XETRA hours in order to secure better prices (lower spreads).

In the comparison between Scalable Capital and Trade Republic, SC comes out slightly ahead here. The option of trading on Germany’s largest stock exchange, if desired, offers a number of advantages. In practice, however, this is likely to be of interest only to investors who are investing very large sums.

Trade cryptocurrencies with Scalable Capital or Trade Republic

Cryptocurrencies are a particularly exciting asset class. Despite the high risk, the coins in my portfolio have also generated massive profits.

Both providers allow you to trade cryptos, but they do so in very different ways:

1. Trade Republic

After a long period during which trading and storage were only possible via external service providers, Trade Republic has finally introduced a fully-fledged wallet! You can now:

- Buy and sell 52 cryptocurrencies

- Store the currencies in your wallet free of charge

- Send and receive cryptos

- Engage in staking

- Pay directly with cryptos in shops using your TR card

The spread can be up to 2% of the order value, which is well above average. These surcharges can significantly reduce your returns, especially if you want to trade regularly!

2. Scalabale Capital

Scalable Capital relies on a completely different concept:

- You cannot trade cryptocurrencies directly, only ETPs (exchange-traded products). These allow you to profit from price changes in coins.

- Trading is simple and works in the same way as other exchange-traded products such as ETFs or shares

- In addition to trading fees, you also have to pay the running costs/total expense ratio of the ETPs

- With some coins, you can benefit from staking rewards, but these only amount to 3 to 5%. This is significantly less than you would receive from private staking with ‘real’ cryptos.

A crypto ETP offers specific advantages and disadvantages. For example, you cannot send or receive your investment to or from a wallet, as technically speaking, the coins are not held by you, but by the ETP provider. In addition, trading is only possible when the respective exchanges are open.

On the other hand, you do not have to worry about lost passwords or hacked wallets. Trading is very simple (also as a savings plan), just as you are used to with shares or ETFs, which can be another advantage.

When trading, you have to pay an additional spread of 0.99% (in addition to the usual trading fee of €0.99 or zero pounds if you use the flat rate). This amount is reduced to 0.69% for flat rate users.

However, it is important to emphasise that the competition also offers such crypto ETPs! In a comparison between Scalable Capital and Trade Republic, the former therefore has no real advantages. So if crypto trading is important to you, you should open your account with TR – or, even better, go directly to a real crypto exchange.

| Scalable Capital | Trade Republic | |

| Available cryptocurrencies | 32 | 52 |

| Own property? | No, only as an ETP | Yes, in a separate wallet |

| Send/Receive? | Not possible. | Yes |

| Costs: | With PRIME+: – No fee for trades over €250 – 0.69% mark-up on the spread Without PRIME+: – €0.99 fee per trade – 0.99% mark-up on the spread | – €1.00 per trade – 2% surcharge on the spread |

Savings plans

An ETF or stock savings plan is an ideal way to build up your assets continuously and reliably. These offers are extremely popular and are of course also available from the two major neobrokers. You have numerous settings options for automatic execution:

Scalable Capital offers execution

- Monthly,

- Every two months,

- Quarterly,

- Half-yearly,

- and annually.

You can choose from 9 different days of the month (1st, 4th, 7th, 10th, etc.).

Trade Republic has merely

- Weekly,

- Every two weeks,

- Monthly,

- or quarterly.

You can choose between execution at the beginning of the month or in the middle of the month.

So, in this regard, Scalable vs. Trade Republic offers more options. To be honest, however, these details only play a minor role in the execution. The selection is much more important!

| Scalable Capital | Trade Republic | |

| Shares eligible for savings plans | All (over 8,000) | 2,700 |

| Implementation of savings plans | weekly, every 2 weeks, monthly, every 3 months | monthly, every 2 months, every 3 months, every 6 months, annually |

| ETF savings plans | All (over 2,700) | 2.700 |

| Execution days | 1. or 16 | 1., 4., 7., 10., 16., 19., 22., 25. |

| Share savings plans | 2.650 | 8.000 |

| Minimum amount | 1 € | 1 € |

Trade Republic is at a disadvantage here, as the available savings plans are limited. For example, you can find my top 10 ETFs for savings plans here, but you will have to make compromises with some securities. Scalable Capital, on the other hand, offers savings plans for all available shares and ETFs.

Particularly appealing: all savings plans are free of charge with both providers, making continuous wealth accumulation particularly worthwhile!

Banking services

Both service providers are licensed banks, but they use these opportunities in very different ways:

- Trade Republic offers you typical banking services such as a free current account, a cash card and the option to make transfers or cashless payments

- Scalable Capital tends to use its opportunities in the background to offer new products. These include, for example, the option to take out a loan and deposit your shares as collateral.

Trade Republic offers you a current account and associated bank card. With an additional Saveback bonus, the aim is to actively encourage customers to use their account and card regularly.

Here, we can say in general terms: Trade Republic is very attractive for people who are looking for an additional bank account. You receive a bonus (currently 1%) when you pay with your cash card and can withdraw money worldwide free of charge from €100.

On the other hand, those who are not interested in an additional account may soon become annoyed by the amount of advertising in the app. Scalable Capital could be a good alternative here, as the provider primarily uses its banking licence to expand its investment range.

Scalable Capital vs. Trade Republic: Interest rates

Both brokers offer interest on uninvested capital. The exact interest rate changes regularly and is heavily dependent on the European base rate. You should therefore check the Scalable Capital and Trade Republic websites for the latest information.

| Scalable Capital | Trade Republic | |

| Current interest rate | 2% per annum | 2% per annum |

| Maximum amount | Max. €100,000, unlimited with PRIME+ flat rate | unlimited |

Compared to active investment in P2P lending, shares or ETFs, the current values are of course rather modest. As an alternative to instant access savings accounts, however, both brokers perform very well! You can safely park your nest egg here, because your money is protected up to €100,000.

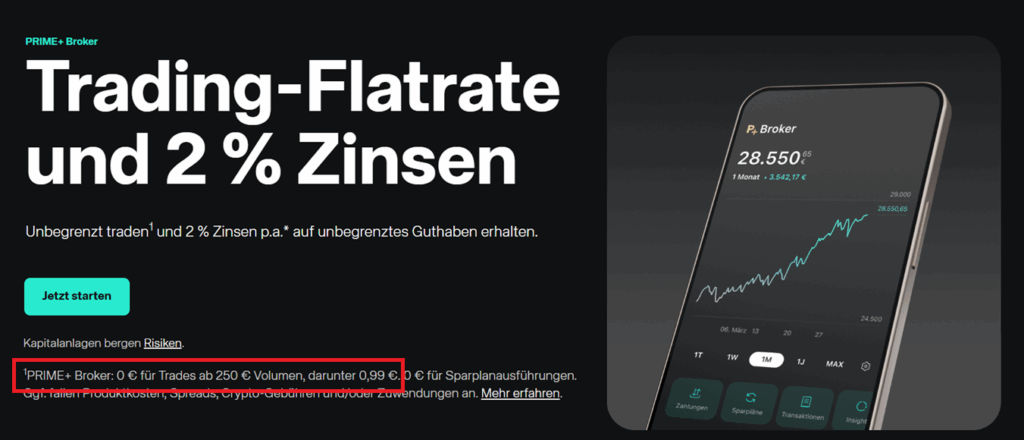

Scalable Capital Unique selling point: Trading flat rate

For a fair comparison between Scalable Capital and Trade Republic, the trading flat rate must be mentioned: With Scalable, you can trade for free for a fee of just under €5 per month.

- If you buy and sell three shares, ETFs or other assets per month, you benefit from the ‘PRIME+’ flat rate

- You get access to additional analysis tools and can, for example, compare stock key figures or set up change alerts.

- The flat rate also comes with improved spreads for crypto trading (0.3% less mark-ups) and lending (you pay 1% less interest).

This is therefore a very attractive offer for active traders! There is just one slight drawback: the very small print in the footnotes states that free trading only applies to orders of €250 or more. If you trade smaller amounts on the stock exchange, you will still have to pay €0.99.

For many investors, this should not be a problem, because anyone who pays €4.99 per month for their broker is usually serious about trading. However, if you want to trade frequently with small amounts, the flat rate is not an advantage.

Further offers

Scalable Capital is a master at selling ETPs as standalone products. For example, its homepage boldly promotes forex trading and trading in commodities and cryptocurrencies.

In reality, however, these are only ETPs: they function like the more familiar ETFs, but always contain only a single product. This could be Bitcoin, crude oil or a euro-dollar currency pair, for example.

With these offers, you can actually profit from the respective markets to a limited extent. However, this cannot be compared to real forex trading, which is possible with Freedom24, for example.

So don’t be fooled by the marketing: specialised brokers and exchanges are still necessary for real commodity, currency or crypto trading. Scalable Capital and Trade Republic remain neobrokers for simple, limited access to the exchanges.

Good to know:

Other providers, including Trade Republic, also offer a wide range of ETPs. The products on Scalable Capital’s homepage are therefore by no means unique, and the somewhat misleading marketing leaves a bad taste in the mouth.

Disadvantages and problems: Scalable Capital and Trade Republic in comparison

Although both providers have made investing easier and cheaper for private individuals, not everything is perfect: Scalable Capital and Trade Republic are plagued by problems that must also be mentioned here:

- The infrastructure of both providers regularly reaches its limits: During the ‘customs crash’ in spring 2025, for example, the apps were overloaded. Customers were unable to act in time and lost considerable amounts of money. Numerous lawsuits are still being heard in German courts as a result.

- Further outages are also not uncommon: For example, Scalable Capital experienced problems during a large-scale deposit transfer (customer deposits were moved from Baader Bank to Scalable). In some cases, users were unable to trade individual securities for days.

- Trade Republic also actively intervened in trading at least once: during the GameStop rally in February 2021, the broker suspended trading in the stock for several hours. This also led to numerous lawsuits and an investigation by BaFin due to the illegal intervention.

- Slow dividend crediting: Investors often have to wait a long time for their dividends to be credited at Trade Republic. In 2023 and 2024, the waiting time reached its peak: investors had to wait weeks for their profit distributions to be credited. BaFin also investigated this case due to massive complaints.

All cases were complicated by the poor customer service of both providers: it is generally difficult to obtain information or resolve problems in a timely manner. When they have questions, customers must first navigate FAQ pages and incompetent chatbots before they can finally contact customer service.

The response then takes several days to arrive and usually contains only pre-written text blocks. This approach is consistent with the general communication structure of the companies:

- Trade Republic generally reveals very little information: It was extremely difficult to research the data for my comparison of Scalable Capital vs. Trade Republic because the company does not provide clear information. Anyone looking for a price list, for example, has to laboriously search for it in the help section of the app. Not a good impression for a licensed bank!

- Scalable Capital is more open with its data, but is not quite as precise in its marketing: numerous products are advertised so boldly that consumers should take a closer look! For example, a range of ETPs is touted as trading in commodities, cryptocurrencies or forex.

Overall, it can therefore be said that both brokers are suitable for private wealth accumulation. However, active traders, for whom every second counts, should choose other providers. In addition, you should exercise the necessary caution with all offers, as some products do not deliver what they promise.

Conclusion: No clear winner between Scalable Capital and Trade Republic

First things first: Both brokers are very well suited for private investors who want to build wealth through shares, ETFs or cryptocurrencies. Additional offerings such as bonds, actively managed funds or private equity funds round out the range.

Thanks to low fees, your profits remain yours and are not eaten up by costs. Both providers offer a solid selection of securities. If you are particularly interested in active funds, you should contact Scalable Capital. For bonds, on the other hand, you should contact Trade Republic.

However, both providers repeatedly struggle with problems: customer service at both brokers is slow and unreliable. This is particularly annoying, as it can lead to repeated outages and delays. Scalable Capital and Trade Republic are therefore rather unsuitable for active traders.

Here is an overview of the most important data:

| Trade Republic | Scalable Capital | |

| General costs | ||

| Depot management | Free of charge | Free of charge |

| Order costs | 1 € | €0.99 With PRIME+: Free for orders over €250, but €4.99 per month |

| ETF and share savings plans | Free of charge | Free of charge |

| Cryptocurrency savings plans | 1 € + 2 percent spread surcharge | 0.99 € + 0.99 percent spread surcharge (0.69 percent with PRIME+) |

| Hidden costs | ||

| Entry in the share register | 2 € | Free of charge |

| Registration for the Annual General Meeting | 25 € | 25 € |

| Standard instruction | 1 € | Free of charge |

| Trading in subscription rights | 1 € | Gettex or XETRA costs |

| Other | ||

| Subscription model | Not available | 4.99 per month |

| Interest | 2.00 per cent per annum | 2.00 per cent per annum |

| Order types | Market, Limit, Stop Market | Limit-Order, Stop-Order, Stop-Limit-Order, Stop-Loss, Take-Profit, Market-Order |

| Cashback | 1% cashback up to €15 per month | No cashback |

| Extras | Full-service bank account | Automatic asset management ‘Scalable Wealth’ |

It is difficult to pick a clear winner in the Scalable Capital vs. Trade Republic comparison. My assessment is therefore as follows:

- Both brokers are roughly equivalent if you want to invest in securities. However, if you want to use a savings plan for shares or ETFs, Scalable has the edge: all securities are available in the savings plan, whereas Trade Republic has restrictions.

- When it comes to cryptocurrencies, Trade Republic leads the way. Not only are there more coins available, but you can also store, send or receive them in a real wallet.

- If you could use another bank account, Trade Republic is the right choice. Here, you get a free current account with all the usual features in addition to your securities account.

- If, on the other hand, you want to spend as little time as possible dealing with your finances but still want to earn a return, Scalable could be the right choice for you: Scalable Wealth supports you in passive wealth accumulation.

- If you are interested in a specific investment product, such as bonds, funds or derivatives, you will have to decide for yourself which neobroker is more suitable. The differences here can be very significant!

Depending on what is important to you personally, a different winner will emerge from the Scalable Capital vs. Trade Republic comparison. If you need more information about the two providers, I can recommend the reports on my Scalable Capital review and Trade Republic review.