P2P loans have once again performed very well in the past year, delivering strong double-digit returns to investors. The market continues to grow and more and more P2P platforms are being added – but which providers are really worth it? We have compared the best platforms in Europe for you and present our top 10 […]

Debitum experience: 11% return and more

Debitum proves that size isn’t everything. My experiences with Debitum show: Here you can count on more than 11 percent return (after deductions of possible failures)! How this works, what advantages and problems there are and what you should pay attention to, I’ll show you in my experience report.

In brief:

- Debitum is a P2P provider from Latvia that finances business loans.

- The provider is rather unknown, but reputable, fully regulated and has been operating for a long time.

- My personal Debitum experience shows that returns of 11 per cent are easily possible!

Debitum Network Review: What’s behind it?

Investors are asking themselves the question ‘What should I invest in?’ more and more, and for more and more, the answer is: ‘P2P loans’! After all, it is a crisis-proof investment with high returns. No wonder that the market for such offers is constantly growing.

When you hear the keyword P2P, you probably think of Mintos, Bondora or EstateGuru first. However, smaller service providers receive significantly less attention – often unfairly, as my Debitum experience shows!

The company, whose name sounds like the latest crypto scam, is a small but fine P2P provider from Latvia. For more than five years, they have been successfully brokering corporate loans to private investors.

Yes, that’s right: this is where you finance. not consumer credit, real estate or agricultural machinery, but loans for companies. This makes the platform particularly exciting if you want to diversify your portfolio: you get access to an area that most investors completely ignore!

The types of companies involved depend heavily on the respective loan provider. On DN, you will find several providers that in turn offer different loans. In return for your capital, you can expect a high return of currently 11.16 per cent!

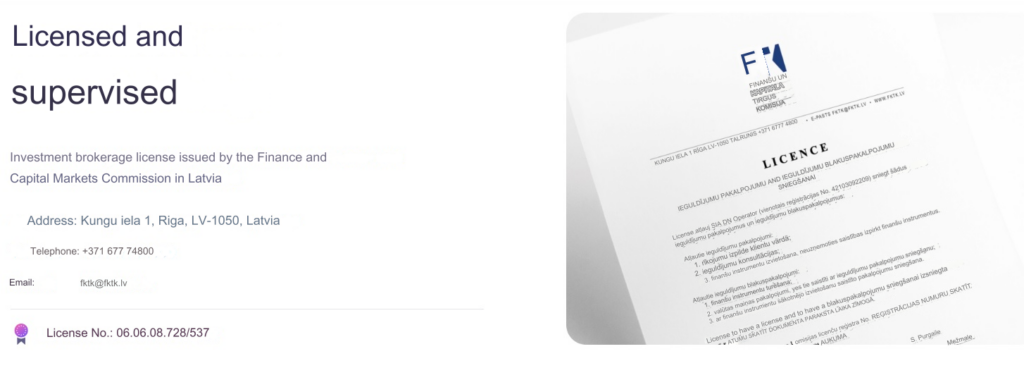

DN is regulated by the Latvian Financial Regulator. Only four providers are currently authorised to issue ‘asset-backed securities’, and the network is one of them. The regulator’s licence also provides additional protection for investors. This means that up to €20,000 of your capital is protected in the event of insolvency.

How does investing work at Debitum?

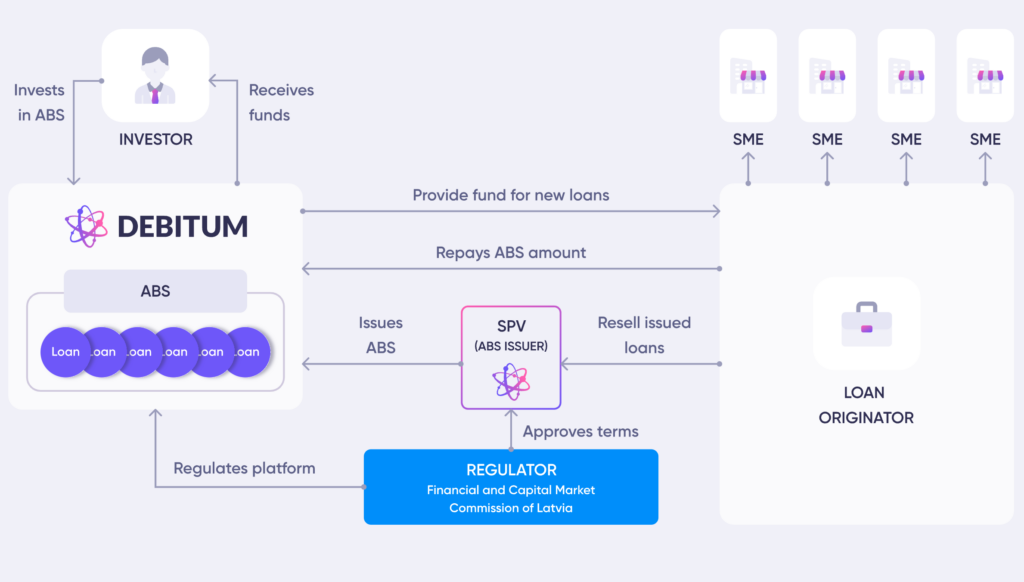

Have you already gained experience with P2P loans? Then there are a few innovations waiting for you at DN! Let’s start from the beginning: small and medium-sized companies often need loans but have difficulty getting them from a bank.

The reasons for this include the young age of the companies (banks want to see a track record and history before they hand over the money) or simply the long waiting times for ‘normal’ loans.

Alternatively, loan brokers with impressive-sounding names such as ‘Triple Dragon’ or ‘Sandbox Funding’ are available. They specialise in specific industries – Triple Dragon, for example, in the video game industry – and are very knowledgeable in this area.

If a company asks them for money, they assess the request with their expertise. If everything looks good, they issue the capital, but want to refinance it as quickly as possible (in order to continue working and issuing new loans).

This is where private investors like you and me and marketplaces like Debitum come in: on the website, you can see a variety of such loans and invest in them. However, the Latvian company first checks everything carefully to make sure that everything is above board!

Strict testing and licences

Both the credit providers and each individual credit are carefully scrutinised. Even the Latvian financial supervisory authority keeps a watchful eye on all processes.

This is because DN holds an investment broker licence from the authority. This licence is subject to considerable requirements that the company must meet. that benefit us investors. So you can be sure that every investment has been given the green light by at least three institutions!

To further reduce the risk, we combine at least five such loans into ‘asset-backed securities’. If, contrary to expectations, there are ever problems with one of them, the damage to the whole package is at least limited.

If you are interested in one of the loan bundles, you can invest your capital via the sleek web platform. If everything goes smoothly and the loans are repaid as agreed, you will receive your money and the interest, which is currently 11.16 per cent.

However, if there are problems and a borrower, for example, does not pay on time, the broker has to buy it or replace it with an equivalent loan – in this case, you also receive your stake and the promised return.

Risk and security

If you want to achieve a high return, you have to accept certain risks for your money – this also applies to P2P loans! For example, I have already reported extensively on the risk of Mintos.

The situation is similar for Debitum. However, my experience shows that the high return on P2P loans is the worth the risk, though! The company will, of course, do everything it can to protect your capital.

This starts with the selection of loan originators and loans: instead of a variety of providers and investments, you will find only a handful of loan brokers and a few asset-backed securities on DN.

The reason for this is not low demand, but the strict selection criteria of the Latvians! They only authorise a few brokers and also check every loan thoroughly – the Latvian Financial and Capital Market Commission also carries out checks.

Should a bad loan nevertheless find its way onto the platform, it’s not a problem: there is a buy-back guarantee that starts with the loan originators. If the borrowers default or delay repayment, the middlemen have to take over the payment.

So in this case, too, you will get back your invested capital and the interest. The defaulting borrowers have to pay 15% p.a. for delays, so that fresh money flows into the company’s coffers even in the event of delays.

Security mechanisms in the event of payment defaults

Should a borrower become completely insolvent, the deposited collateral is used. This includes, for example, guarantees for the borrowed capital. It is also possible to exchange the collateral for a loan of an equivalent value.

Fortunately, this has not yet been the case since I invested here. However, experience with other providers shows that this system works very well as long as the companies involved themselves have sufficient funds.

If, on the other hand, a loan broker or an entire platform goes bankrupt, things usually look bleak for us private investors. However, such problems are always apparent long in advance and give investors enough time to react accordingly. There are currently but no indications of this on Debitum.

Another advantage of the financial licence: capital that you store on the platform but have not yet invested is subject to deposit protection. Up to €20,000 is protected in this way – even in the event of insolvency.

Your investments (asset-backed securities) are not covered by this protection, but the investment broker licence provides significantly better legal protection for investors like you and me in the event of defaults.

Debitum in the test: What is the current status of the platform?

For the security of your capital, it is important that the respective P2P provider is economically sound. The biggest risk is the bankruptcy of the loan arranger or the entire platform.

It is therefore extremely worthwhile to take a regular look at the business figures! These show a recent loss of €110,000 for the company. Based on my experience at Debitum, this amount is completely within reason and can be recouped through further growth. Level off the future quickly.

Despite its – for the P2P market – long company history of at least five years The company is still in the growth phase. Only just under 10,000 investors are currently active. So there is plenty of room for more.

It has also only been a short time since the Latvian financial supervisory authority granted its licence, and the company is still working on implementing the many requirements. There are no real templates for this – regulated P2P lending is a new concept.

Debitum seems to have implemented the authorities’ rules very well so far and is already using many of the new options. Elsewhere, they are still making improvements: for example, an auto-invest function is missing because it also has to meet the requirements of the financial supervisory authority. It should be added soon.

Overall, Debitum seems to be on the right track; as long as more users join and invest diligently, there is nothing standing in the way of a lucrative future from an economic point of view.

The new CEO, Henrijs Jansons, also sees it this way: he took over the management position in 2022 and immediately acquired a large stake in the company. A management team that has a stake in the company and thus ‘skin in the game’ is a very good sign!

While it doesn’t completely protect against shady dealings, it usually means that the person believes in the company’s success. Given the company’s positive outlook, this is easy to understand.

Debitum experience: strengths and weaknesses

Despite its longer history, the Latvian P2P marketplace has only a few users so far. However, this does not mean that an investment would not be worthwhile! A closer look at the advantages and disadvantages will help you decide whether it would be worth your while to get involved.

Let’s look at the problems first:

What are the disadvantages of Debitum?

- Average interest rates. You can expect a return between 9 and 12 per cent. That is solid, but only average in the P2P market. By way of comparison, on the stock market, you often also expect a possible profit of around 9 per cent, but here you have less risk (with a well-diversified portfolio)!

If the stock and ETF market is more interesting for you, it is worth taking a look at my broker comparison or my report ‘How safe are ETFs?’

- Small size. DN is currently still one of the very small P2P providers. Only around 10,000 investors are currently active here. Both the number of available loan originators and their loans are limited and can make good diversification difficult.

- The company’s small size also limits its revenues, which have recently resulted in a loss of €110,000. Not a disaster, but not necessarily a good sign for the long-term outlook either!

- There is no auto-invest function, so you have to select all loan packages yourself. This is not due to technical inability or anything like that, but simply to the high demands of the Latvian financial regulator! However, the feature should be available soon.

- Opaque loan originators. While the P2P marketplace itself communicates its business figures and the like in an exemplary manner, the situation is quite different for the loan brokers. It is almost impossible to find out anything about their economic situation or obtain any tangible figures. So you have to trust that DN and the Latvian financial regulator will carefully scrutinise the companies and the loans.

But of course there are also a number of advantages!

What are the advantages of Debitum?

The most important ones are:

- Regulated platform. We can’t say it often enough: the investment broker licence from the Latvian Financial Supervisory Authority is a big deal! Only a very small number of providers can boast such an honour. For us investors, it means additional security, as the authorities regulate and monitor here. We also have a better basis for reclaiming capital in the event of insolvency.

- Interesting environment. You are investing here in business loans that are not only lucrative but also comparatively safe. Companies simply repay their debts better than private consumers do, for example!

While you finance a small loan for a new Playstation from other providers, you invest in productive capital with DN. The borrowers use your capital to make a profit, so that repayment usually goes well.

It’s also interesting from a moral point of view: your money helps small and medium-sized companies to grow and make new investments. You can make a positive economic contribution. It feels much better than consumer credit, where you may be helping a private individual down the road to debt!

- Good diversification opportunities. The best way to avoid risk with your investments is to spread them out widely. If one of them fails or produces negative results, the others will compensate for the damage.

With the loan packages, you can get into dozens of loans at the same time. This makes it easy to diversify broadly with even a small fortune!

Further advantages of Debitum

- And talking of ‘small fortunes’: you can get started with as little as 10 euros per loan bundle! Since each package contains at least five (but often significantly more!) Loans, this corresponds to an incredibly low minimum amount of just 2 euros per loan! This makes them look old compared to almost all competitors in the P2P market, where 50 euros for a loan is still the norm.

- Reliable returns over a long period of time. A return of between 9 and 12 per cent is normal for personal loans; nevertheless, we must emphasise that DN has been maintaining this solid result for more than five years! Even the war in Ukraine, which caused problems in the portfolio, could not change that: investors have gone home with an average return of at least 10.9 per cent since the company was founded.

- Buyback guarantee. The concept of the buyback guarantee is ideal for investors: should the borrower fail to meet their obligations, the P2P provider (in this case: the loan originator) steps in, buys the debt and pays you. This only works as long as the service provider is financially sound; nevertheless, it is a great mechanism that has proven itself time and again in the past!

- No cash drag. Cash drag is a huge problem in the P2P sector: if there are not enough suitable loans available, investors’ money can only be invested in loans very slowly. This can result in a huge drop in returns! Cash drag is a problem for almost all providers; however, DN offers a sufficient number of business loans, which are often very high in volume (sometimes half a million euros or more). This means that you can quickly find a suitable investment, so your money is not left lying around uselessly.

- Deposit protection. You probably know about the protection of your cash assets from your broker. Non-invested assets are protected by the Latvian Financial Supervisory Authority’s security systems up to €20,000, even if the service provider goes bankrupt. Hopefully, in practice, you have invested your capital in a profitable way so that this should not happen – but it is still a useful bonus!

My Debitum experiences in practice

I personally tested the platform for several months with a capital of €1,200. There were no problems or other surprises – everything went exactly as I would have expected.

Unlike most competitors, you have to select all investments yourself here. An auto-invest function is not currently available, but it is coming soon. However, since the product catalogue consists of loan packages that already offer good diversification, this is not such a big problem.

The due diligence, i.e. the careful examination of an investment, is also massively reduced. Since you are investing in a bundle of loans, it makes little sense to thoroughly check each individual loan.

Instead, I analyse the structure of the overall package and trust in the control mechanisms and supervision of the loan provider, DN and the Latvian Financial Supervisory Authority.

So far, this has always worked well – the platform has an excellent track record of more than five years, which even the war in Ukraine could not affect! You won’t find large-scale failures here, as other service providers have experienced during the Corona pandemic, for example.

I have invested in these packages.

I currently have six loan bundles in which I have invested my money. Two of them contain the minimum of five loans, while the largest package contains an impressive 43! In total, I invested in 97 loans in this way – and with ‘only’ 1,200 euros!

| Name | Number of loans included |

| Evergreen | 22 |

| Flexidea Polen | 43 |

| Sandbox | 5 |

| Sandbox | 5 |

| Triple Dragon UK | 5 |

| Evergreen | 17 |

Of course, your investment can look quite different, because the selection is more than big enough. In my experience, new loans are added regularly. This is particularly important because it is the only way to avoid cash drag, i.e. capital lying around uselessly!

If I divide my invested money by the number of loans, I have invested an average of 12.37 euros per loan. This is a very low amount that shows a high degree of diversification and would hardly be possible with other service providers.

You may also be interested in: How do personal loans actually compare? My report ‘the 10 best investments’ shows it!

Debitum experience: a lucrative P2P provider in an interesting niche

Business loans are an exciting area for P2P lending. They offer a good return and comparatively strong collateral, as companies are highly likely to repay their debts.

Debitum has experience in this area, having been offering such loans for more than five years! Small and medium-sized companies approach credit brokers, who in turn forward the applications to DN and the Latvian Financial Supervisory Authority.

If everything looks good, you can then find the projects summarised in practical packages on the website. Here you can get started with as little as 10 euros per bundle (at least 5 loans)! This also allows investors with little capital to diversify very effectively.

My return is currently over 11 per cent, which is a good result. Other P2P providers offer higher rates, but they are often less reputable. You won’t have a problem here: the network has an investment broker licence from the Latvian financial regulator!

An accolade that comes with many advantages (and a few minor disadvantages): The authorities keep a watchful eye on all transactions in the credit business, which offers us investors additional security. Even in the event of insolvency, we thus have a better chance of getting our money back.

In addition, there is a deposit guarantee for non-invested capital and significantly better transparency than is the case with many competitors. However, due to the high requirements, there is currently no auto-invest function; so you always have to select the loan packages by hand.

Overall, the network makes a very good impression. Solid returns, an exciting business area and the security of official licensing are very attractive to me. My previous Debitum experiences were correspondingly positive.

I will continue to invest money here and look forward to future developments!

Aleks Bleck is the face of Northern Finance and was already a shareholder, lender and ETF investor at the age of 18. His focus is on P2P loans and passive ETFs. Aleks founded Northern Finance in 2017 while studying business administration in Lu00fcneburg.

He built up the YouTube channel alongside his main job in investment and corporate banking before finally focusing full-time on Northern Finance.

Things are going haywire at TradeRepublic: thanks to a full banking licence, the company can now offer its customers their own current accounts, and the rapid growth of the company is impressive. At the same time, however, there are also problems caused by the expansion, and many customers are having negative experiences with Trade Republic […]