What to invest in? The best investment opportunities for 2025

Rising energy prices, inflation, the war in Ukraine, rising interest rates: the increasingly complex economic situation is causing many private households to question their own financial plans. The best way to build up your own assets and secure your future is to invest your money. But what should you invest in? In this article, you will learn the important basics and the options available to you!

In brief:

- The magic triangle of investing can help you identify your investor type and set your priorities.

- Follow these basic rules to avoid mistakes when investing and secure your assets.

- ETFs or P2P lending can help you build long-term wealth and secure your family’s financial future.

Investing: What you need to know

Investing your own money is something that concerns all of us. But if you want to invest, you should first acquire sufficient knowledge to avoid risks. Below, we outline the basics of investing and what you should bear in mind.

Design your personal investment strategy: the magic triangle of investing

Before you start investing, it is advisable to find out what type of investor you are and where your priorities lie. Depending on the aspects that are most important to you when investing, different assets may be suitable for you.

The magic triangle of investing, a kind of model that describes the three most important goals of investing, is helpful here. It consists of security, liquidity and profitability. Every investor attaches more or less importance to a particular goal.

The security factor describes whether the investment in question has a high or low risk. No investment is completely secure, but there are relatively secure investment options such as instant access savings accounts or fixed-term deposits.

Liquidity refers to how readily available your assets are. Your investment is liquid if you can easily access the money you have invested. A building society savings agreement, for example, is not liquid because a specific period has been agreed in advance, which prevents you from accessing your assets.

Profits and returns that you can achieve with an investment are summarised under the term profitability. This point is often linked to a long investment horizon. With comparatively risky investments offering high potential returns, such as a water ETF, you can increase your security in this way.

Attention!

No investment can fulfil all three objectives. If you want a crisis-proof investment with a high level of security and invest exclusively in instant access accounts, you will hardly be able to achieve any returns.

Here are the 5 most important tips for investing

Investors invest in very different ways. However, there are some tips to keep in mind that apply to every investor and will help you build your own wealth over the long term to achieve your goals.

- Develop a strategy: The magic triangle of investing can help you identify your own priorities. But you need more information to develop an investment strategy. Ask yourself the following questions, for example: What do I want to invest my money in? How long can I do without it? What investments am I considering?

- Build up an emergency fund: This is a financial cushion for difficult times. Unforeseen situations can arise in which you need a large sum of money. Perhaps your car needs to be repaired or a few electrical appliances suddenly break down. Set aside an emergency fund of 2 to 3 net salaries in advance in a liquid investment such as a call account.

- Ask critical questions: In the digital age, you will come across lots of apparent insider tips on investing. If you want to learn more about investing, make sure that your sources are trustworthy. Do they take a critical approach to investing? Do they mention the advantages and disadvantages and suggest alternatives?

- Stay calm: One of the biggest mistakes that can have serious consequences is acting emotionally when investing. This includes, for example, rushing into panic selling when prices fall. Take your time and draw up a detailed financial plan. In difficult times, you will know that you have thought of everything and can calmly continue to follow your plan.

- Select a broker: Look for a reputable bank or broker. The provider should be well established and reliable. This way, you can be sure that orders will be executed quickly and reliably, for example.

5 more tips for building your own wealth in the long term

- Be realistic: don’t be tempted by promises of huge returns. As you saw in the magic triangle of investing, risk and return are linked. There are different ways to reduce the risk of your portfolio. Nevertheless, you should be aware that a very high-yield investment can never offer the same level of security.

- Only invest what you can afford: As a general rule, you should only invest money that you can currently do without. For example, you should only start investing at a later stage if you still have debts to pay off.

- Diversification: One of the most important rules of investing is to spread your risk. Never put all your money into one investment. Invest in different companies, asset classes, countries and sectors. This way, any losses can be offset by gains from other investments.

- Risk management: Different strategies such as sufficient diversification or a stop-loss order can minimise risks. Before you decide on an investment, find out what risks exist and how you can reduce them.

- Cost comparison: The fees for different financial investments can vary greatly. Even within the same asset class, there can be significant variations. Comparing brokers can help you find favourable terms and conditions so that your returns are not reduced.

Build up your fortune with these financial investments

There are now numerous options for investing in different assets. They all have different advantages and disadvantages and are suitable for different risk types and investors. But what should you invest in? We present a few investments for you.

1. Stocks

Stocks are high-yield investments, which means they come with risks. You buy individual shares in a company in the form of a security. The goal is to find undervalued companies and profit from their positive performance.

This can quickly become very time-consuming. Because investments are made in individual companies, investors have to do a lot of research. Investors try to find the best companies from a large pool. In addition, investors need detailed knowledge of analysis and key figures.

One positive aspect of stocks is the compound interest effect. Profits can be reinvested directly to generate further returns. In the long term, stocks are an excellent way to build wealth.

Earning money with stocks can offset inflation. The inflation rate is currently relatively high. This means that there is a general rise in prices. Households can buy fewer products or services for the same amount of money, which means that their money is worth less and less.

Market timing can play an important role here. This refers to the point in time at which you buy or sell stocks. As you can see, there are numerous aspects to consider and a lot to learn when buying individual stocks. But is there an easier way to benefit from stocks and their comparatively high return opportunities?

2. ETF

You may be wondering where to invest in order to balance risk and return. ETFs, or exchange-traded funds, offer an alternative to buying individual stocks. Some of the disadvantages mentioned above can be offset with this asset. ETFs are linked to an index fund and attempt to track it as closely as possible.

With just one ETF, you can invest in hundreds of companies, which is known as diversification or risk spreading. Potential losses from individual companies can be offset by the returns from other companies. It is an investment strategy designed to reduce the risk of your portfolio.

Good to know:

ETFs on the MSCI World are particularly popular. This is a very broadly diversified global index. With an exchange-traded fund on the MSCI World, you can invest in over 1,600 companies and track the global economy over the long term.

The long-term investment horizon is important for this asset. This must be taken into account in order to reduce potential risks and benefit from compound interest. A minimum term of approximately 15 years applies, whereby the following principle applies: the longer the investment horizon, the better.

Compared to individual stocks, significantly less research is required, as the composition of the ETF is already determined by the index. In addition, there is no need for a fund manager who has to be paid. This makes ETFs a relatively inexpensive form of investment with low ongoing fees.

3. P2P

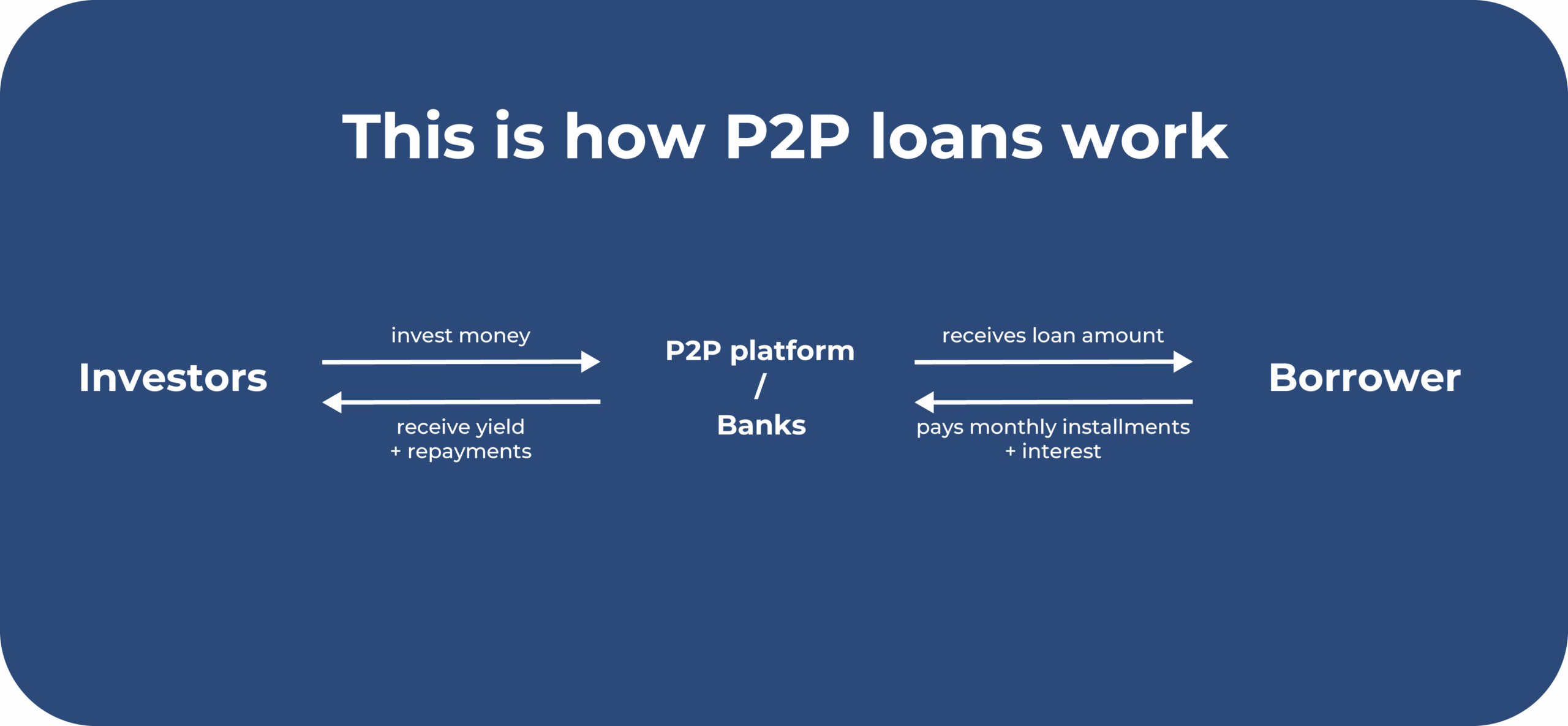

P2P lending involves loans between two private individuals. The transaction is carried out via a P2P platform. This is a relatively new form of investment that does not require a bank.

If you want to invest in P2P lending, you can benefit from high potential returns. However, these opportunities also come with risks. Possible risks include the following:

- Loan defaults: If the borrower is unable to repay the loan including interest, a loan default may occur. The platforms try to remedy this situation by assigning borrowers credit ratings based on their risk, which should provide you, the lender, with greater transparency.

- No deposit protection: ETFs are subject to deposit protection. If your bank becomes insolvent, 100,000 euros of your assets are protected, as invested money is kept separately, which provides additional security. There is no deposit protection for P2P lending.

It is also advisable to develop a strategy and remain patient. Get to know investing by investing in short-term loans. Once you are confident in the asset, you can use tools that invest automatically according to your individual preferences.

Good to know:

Despite the potential risks, P2P lending can be a promising option if you understand the basics of investing. As with any investment, make sure you diversify your portfolio. To do this, invest in loans with different credit ratings and consider different platforms.

Conclusion: Inflation protection and wealth accumulation through financial investment

Investing money can help you build long-term wealth, secure your family’s financial future and generate returns. When investing for beginners, it is important that you acquire sufficient knowledge and understand the basics of investing.

These basic rules include, for example, diversifying your investments, thinking critically and developing your own strategy. An emergency fund can help you in unforeseen situations that require a financial cushion. Stay calm and realistic, and ensure you have a suitable risk management strategy in place.

But what should you invest in to suit you as an investor? Get to know yourself as an investor and your financial goals. This knowledge can help you decide on a type of investment.

If you want to build up an emergency fund, investing in a call money account is a good option. If, on the other hand, you have long-term goals, such as providing for your family, P2P lending or ETFs may be worth considering. Learn more about the best investment or the 10 best investments here!