Things are going haywire at TradeRepublic: thanks to a full banking licence, the company can now offer its customers their own current accounts, and the rapid growth of the company is impressive. At the same time, however, there are also problems caused by the expansion, and many customers are having negative experiences with Trade Republic […]

The big P2P loan comparison: the top 10 best P2P platforms 2024

P2P loans have once again performed very well in the past year, delivering strong double-digit returns to investors. The market continues to grow and more and more P2P platforms are being added – but which providers are really worth it? We have compared the best platforms in Europe for you and present our top 10 list!

In brief:

- Different P2P platforms offer different advantages (high interest rates, high security, fast availability, etc.).

- Some P2P credit providers have significantly lost quality, while others have improved greatly.

- The winner is clearly at the top of our top 10 list. The clear losers are at the bottom of the list, well behind.

What are P2P loans?

P2P loans, also known as peer-to-peer loans, are a form of direct financing in which private individuals or companies borrow money directly from other private individuals. This type of lending usually takes place via online platforms that act as intermediaries, connecting borrowers with potential investors.

Unlike traditional bank loans, where banks act as intermediaries, P2P loans enable direct interaction between lenders and borrowers. This allows investors to potentially achieve higher returns, while borrowers often get access to lower interest rates than with traditional bank loans.

The way P2P loans work is relatively simple: borrowers post a request for a loan on a P2P platform, stating their financial needs and creditworthiness.

Investors can then view these requests and decide whether they want to invest in these loans. Most P2P platforms allow investors to spread their capital across several loans to diversify risk. In return for their investment, investors receive regular interest payments from the borrower.

Another advantage of P2P loans is the flexibility they offer both borrowers and investors. Borrowers can take out loans for a variety of purposes, including consumer loans, business loans, mortgages and even specialised loans for agricultural projects.

Investors, on the other hand, can diversify their portfolios according to their individual risk preferences and return targets. In addition, many P2P platforms have set up secondary markets where investors can sell their loans early to create liquidity.

P2P loans have established themselves as an attractive alternative to traditional bank loans in recent years, especially for those looking for higher returns or who have difficulty obtaining loans through conventional channels.

Are P2P loans worth it at all?

The question of whether P2P loans are worthwhile depends on several factors, including the investor’s personal investment objectives, risk tolerance and financial circumstances.

P2P loans offer an attractive opportunity to achieve higher returns than traditional savings or investment vehicles, especially at a time when interest rates on bank deposits are at historically low levels.

Many P2P platforms advertise returns of between 10% and 15%, making them an attractive option for investors who want to put their capital to work.

A key advantage of P2P loans is the opportunity for diversification. Investors can spread their capital across a large number of loans, which minimises the risk of losses. In addition, many platforms offer buyback guarantees, which further reduce the risk of loan default.

These types of investments are particularly attractive for conservative investors who are looking for higher returns but still want a certain level of security. However, the risk of loan defaults or delays in repayments remains, which is why it is essential to carefully select the loans and platforms.

Another aspect that can make P2P loans worthwhile is the flexibility they offer. Investors can decide for themselves how much they want to invest and in what types of loans they want to put their money.

Some platforms even allow you to start with small amounts, such as 5 or 10 euros per loan, which makes it easier for investors with limited capital to get started. In addition, many platforms offer the opportunity to invest in specialised niche areas such as real estate projects, business loans or agricultural financing, which opens up additional diversification opportunities.

Attractive addition of P2P loans to the overall portfolio

P2P loans offer an interesting opportunity not only to diversify your own portfolio, but also to reduce its volatility. Although there is a certain risk here, as loan defaults or economic fluctuations can affect repayment, the targeted addition of P2P loans in the amount of 20-30% of the total portfolio can significantly mitigate the fluctuations that typically occur in the equity markets.

In times when stock markets are experiencing strong fluctuations due to economic uncertainties or global events, the regular interest payments from P2P loans can have a stabilising effect on the overall portfolio.

While share prices often fall sharply in such phases, causing substantial book losses, P2P loans usually continue to perform stably. Borrowers generally pay their instalments regardless of stock market developments, which generates continuous income. This helps to ensure that the value of the portfolio fluctuates less and remains more robust overall in the face of market turbulence.

This form of diversification not only offers protection against extreme price fluctuations, but also opens up the possibility of building up an attractive passive income.

The regular interest payments can be reinvested, which increases the compound interest effect and allows the assets to grow over the long term. In addition, the return on P2P loans is often less dependent on short-term market developments, making them a reliable source of income.

By integrating P2P loans into the portfolio, you can not only reduce your dependence on the often volatile stock markets, but also increase the stability and predictability of your own finances. This strategy is therefore a valuable addition for investors who are looking to build up their assets over the long term while at the same time reducing the volatility of their portfolio.

This is how we have rated the providers of P2P loans

The market for P2P loans has developed extremely well over the past year: new platforms have been added and the number of investors has grown significantly. As the entire industry is becoming larger and more professional, it is worth making a direct comparison: which provider is the best, who has grown or declined and where are the general problems?

We have developed our own rating system to provide a better overview. This allows us to compare P2P lending platforms with different offers and focuses. We consider eight criteria with different weightings. In total, each service provider can earn a maximum of 100 points.

The platforms are evaluated on the basis of these 8 criteria:

| Category | Ideal value | Maximum points |

| Age | Over 5 years | 5 |

| Investors | More than 50,000 | 5 |

| Audited Annual Report | Available | 10 |

| Profitability | Achieved profit | 10 |

| Regulation | Platform and lender regulated by supervisory authorities | 10 |

| Features | Secondary market, auto-invest, German interface, tax report available | 20 |

| Stability in times of crisis | Full solvency and no defaults | 20 |

| Growth | Growth intact after the crisis and good current developments | 20 |

Important: the following assessment is a personal opinion and not investment advice.

1. Viainvest

Viainvest is a subsidiary of the Via SMS Group, which grants loans in Poland, Sweden, the Czech Republic, Latvia and Romania. Investors on the platform invest in consumer loans and currently receive up to 13% interest per year for a term of up to six months.

The latest results from Viainvest look very positive.

The company has been in existence since 2016 and has always paid out its more than 40,000 investors on time during this period. Therefore, it receives the maximum score in the category ‘Age’ and 3 out of 5 possible points for ‘Number of Investors’.

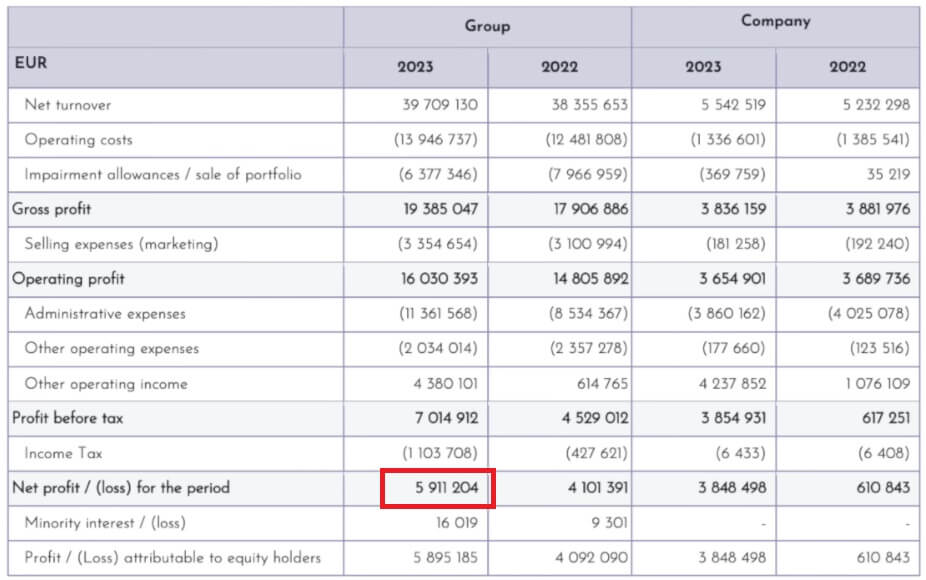

The company’s figures show a steady increase in profits since the end of the coronavirus crisis. In 2023, it was able to generate a proud 5.9 million euros in profits! However, the corresponding annual report has not yet been audited – as this was always the case with the reports in the past, it will certainly be done at a later date. Therefore, we are already increasing the score by another 10.

Both the platform and the Viainvest Group behind it are regulated by the financial supervisory authorities – in our P2P ranking, this gives a clear 10/10. Unfortunately, we miss a secondary market in terms of features – all investments must run until repayment; early resale is not possible.

During the past crises, Viainvest was a true anchor of stability in the P2P world and always paid all investors on time – a great sign! Here, the maximum score of 10/10 is awarded.

The future prospects also appear positive and investment volumes are rising steadily. We are awarding 15/20 points in the category ‘Growth after the crisis + current development’ for this strong growth.

Overall, Viainvest achieved an extremely strong 84 out of 100 points!

2. Monefit Smartsaver

On Monefit, investors invest in consumer loans from the Creditstar Group. The Creditstar Group has been active for decades and offers its loans, for example, on the P2P marketplace Mintos. However, its own platform Monefit Smartsaver for direct investment in P2P loans is still quite young, so it only receives 2 out of 5 possible points.

The number of investors is also only one point. Due to the company’s young history, there has simply not been enough time to attract users. However, an audited annual report is worth a full 10/10.

In a comparison of P2P platforms, Monefit is very similar to its competitor Bondora: investors receive a fixed interest rate of 7.25 per cent per year, which is credited to them daily. You have access to your money at all times (although the payout can take around 10 working days) and do not have to wait for credit periods or the like.

In addition, there is the option to deposit your capital in a so-called ‘vault’. This increases the interest rate to 8.33 per cent per year, but also comes with a minimum term and is therefore no longer as easily accessible. Overall, the business model here is also ‘solid interest rates and fast availability’. Compared to Bondora Go & Grow, there are no limitations here.

The parent company behind Smartsaver, Creditstar Group, has recently increased its profits to over 10 million euros, making it clearly profitable. Of course, it also gets full marks for that.

Monefit itself is not regulated as a platform, but all lenders of the parent company Creditstar Group in their respective countries – as is the case with Bondora. Therefore, it also receives 5 out of 10 points. Except for the secondary market, the platform offers all relevant features – 15/20 points.

During the crisis years, the Creditstar Group was unable to service some loans on the P2P platform Mintos in a timely manner. The arrears rose to over 9 million euros! However, it was possible to work out of this unfavourable situation and settle all debts – a good sign that the provider is able to overcome problems. We therefore award 15/20 for crisis resistance.

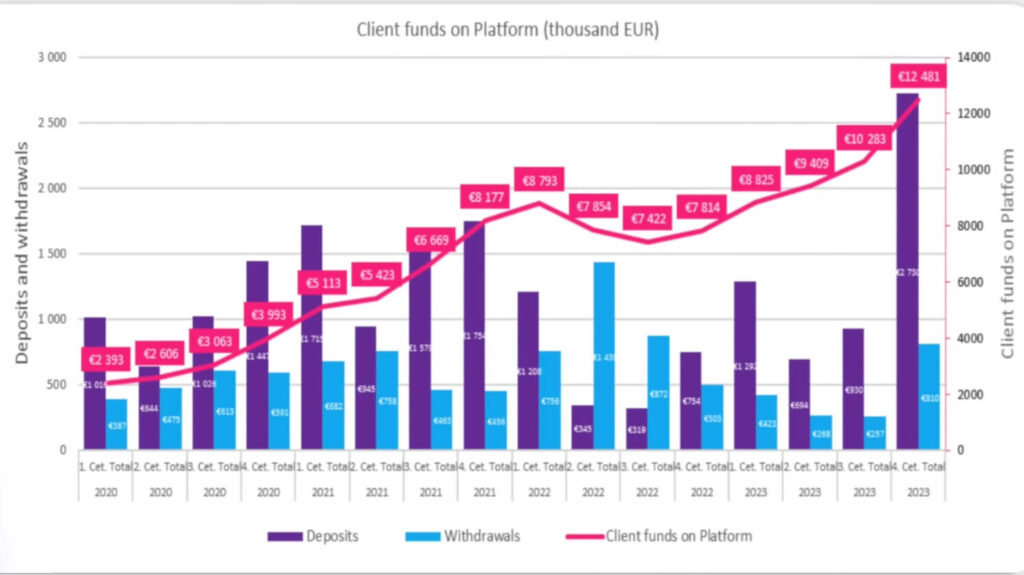

All the signs are currently pointing to growth – and it is succeeding quite well, as current figures show. We therefore award it full marks. Overall, the Monefit Smartsaver achieves a strong 78 out of a possible 100 points.

3. Swaper

In our ranking of P2P platforms, Swaper leads the way in terms of interest rates: up to 16 per cent are possible here! The provider has been on the P2P market since 2016, but has received little attention and has hardly attracted any investors. It therefore scores full marks for age, but only 1 out of 5 for investors.

The annual financial statement, which receives 10/10, shows a small but fine profit of 400,000 euros. This also receives full points in the ‘Profitability’ category. It should be emphasised that Swaper is focusing on growth and has nevertheless been able to achieve a positive result.

The credit provider is regulated, but the platform itself is not. We award 5 out of 10 points here. Investors will find all the important features, with the exception of a secondary market. However, it is possible to sell current loans to swapers. Nevertheless, only 15 out of 20 points for now.

Past crises have not shaken the provider, and all payouts have always been made on time. Here too, therefore, the full number of points is awarded. With regard to growth, a number of questions remain unanswered, for example regarding regulation in the important Polish market. For the time being, therefore, we are only awarding half the number of points in this category.

Overall, Swaper achieves a strong 76 out of 100 points.

4. Debitum

In our comparison of P2P platforms, Debitum stands out from the competition: it is the only provider to focus on business loans. Since 2018, you have been able to lend your money to companies and are rewarded with interest rates of around 12 per cent.

Unfortunately, not enough investors are active here – and that is a shame, because the platform has paid out consistently, even during the crisis years. Internally, however, things are not going so well, as the audited annual financial statements show a loss of over 350,000 euros. However, this could be related to the recent strong growth. Future developments should therefore be closely monitored.

Repayments have always worked perfectly, even during the crisis. Only loans from Ukraine, which currently account for around 2.4 per cent of the portfolio, have not yet been repaid due to the ongoing war. However, in our view, this does not stand in the way of a full score in terms of crisis resilience.

Overall, Debitum achieved a very good score of 76 out of a possible 100 points.

5. Mintos

Mintos is a marketplace for P2P loans and is one of the oldest platforms in the industry. With this experience and over half a million users, it is no wonder that it easily scores full marks in the categories

- Age

- Number of users

- Annual report

- Profitability

- Regulation and

- Features

cleared.

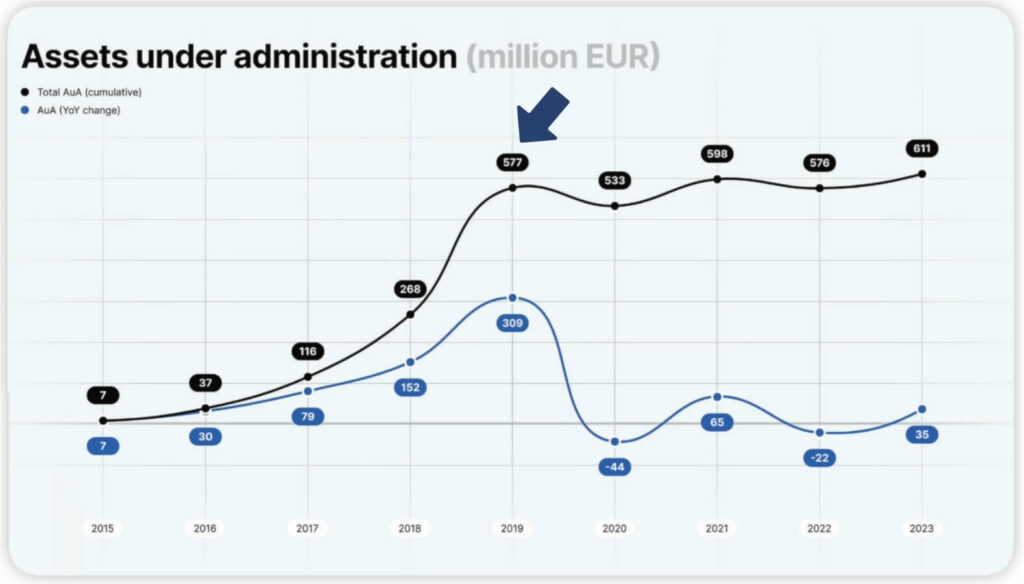

However, the interest rates on offer are less attractive: only 10.4 per cent is currently available. In view of the current base rate, that is simply not enough! Investors probably see it the same way, because there has been no significant growth for a long time – hence our rating of only five points.

The amount of capital under management has hardly changed since 2019 – not a good sign for the growth of the platform.

Mintos received a total of 75 out of a possible 100 points.

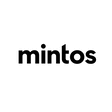

6. Lande

Lande is an agricultural credit platform that entered the market in 2020. This means that you lend your capital to farmers and receive an average of 10 to 11 per cent interest in return. However, individual loans with 13 or even 14 per cent are also available.

Lande offers a wide range of different projects. Borrowers need the money for land, machinery, seeds or livestock.

Agricultural machinery, livestock or land, for example, with a low loan-to-value ratio, can be used as collateral. In theory, these assets can be sold quickly to pay off the debts. Unfortunately, due to the young age of the platform, it is not yet possible to say whether this will actually work in a crisis.

Currently, there are only around 7,300 investors active on Lande. Audited financial statements from 2022 are available and show a small loss of €13,000. This means that the company was not yet profitable in 2022 and therefore receives 0 points in this category. The report from 2023 has not yet been published.

Growth, regulation and features all look very good and are rewarded with full marks. Thus, Lande manages a good 74 out of 100 points.

7. HeavyFinance

Similar to Bondora and Monefit, Lande and HeavyFinance are very similar competitors in our P2P lending comparison. HeavyFinance also operates in the field of agricultural loans and offers investors interest rates of around 13 per cent.

One special feature is the ‘green loans’, where investors receive no interest but CO₂ certificates from the respective farmers. The return then depends on the market price of these certificates. In the long term, their price seems to rise, which could lead to possible returns of more than 20 per cent.

Only around 13,000 investors are active on the platform, which was founded in 2020. This means that it scores only three points in terms of age and one point for the number of users. The audited annual financial statements for 2022 showed a loss of over one million euros. There are no current figures for 2023 yet, but the result is unlikely to be much better.

Thanks to large venture capital donors, there is no cause for concern, at least in the medium term. However, zero points for profitability are unavoidable.

HeavyFinance is fully regulated and scores 10 out of 10 points here. All conceivable features are also available and score a further 20 points. Like its competitor Lande, there is no historical data on its resistance to crises, so we are awarding a neutral 10/20. We have also described more about the HeavyFinance risk in a separate article.

The growth strategy seems to be working perfectly at the moment, so we are awarding full marks here. Overall, HeavyFinance achieves 74 out of 100 points – the same score as Lande. So anyone hoping for a final decision between the two agricultural credit providers will be disappointed.

8. Bondora Go & Grow

Founded in 2008, Bondora is one of the oldest P2P lending platforms for consumer loans in Estonia, Latvia, the Netherlands and Finland. There are now 225,000 active investors here, almost all of whom choose the ‘Bondora Go&Grow’ product.

Here you get 6.75% interest (4% interest for new customers) per year. The payout is daily, you can withdraw your capital at any time and usually have it in your account the following day. Accordingly, you can get by without any features here. Only functions for depositing and withdrawing are available.

However, this simple application seems to be one of the main reasons for the provider’s continued popularity. It is unlikely to be due to the interest rate, which is well below that of competitors – in our P2P loans comparison, it is at the bottom of the league. In addition, it must be critically noted that the Bondora platform itself is not regulated, only the credit provider behind it.

During the COVID crisis, the amount of deposits and withdrawals had to be restricted, but otherwise the company came through this difficult period unscathed. Since then, the situation has long since normalised again, but growth has been limited. Both the number of users and the number of P2P loans granted are rising only slowly.

The assessment is therefore as follows:

Full marks for age and number of investors, for the available annual accounts and the profitability of the platform. Half the points each for growth and crisis resistance. In terms of features, we give a generous 15/20. There’s not much here, but because of the simple way it works, it doesn’t necessarily need more.

Overall, it is enough for a solid 70 out of a maximum of 100 points.

PROVIDER*

Due to better interest rates, I am currently investing my capital in Monefit (obtained with this link*) instead of in Bondora. With Monefit I earn over 7.25% interest, which is significantly more than with Bondora. As a welcome bonus you will only receive €5 and 0.25% extra interest for 90 days on your investment via this link.

9. PeerBerry

The PeerBerry platform, founded in 2017, currently has around 80,000 active users. They can invest in loans from the Aventus Group. However, instead of an actual group of companies, it is more of a loose association of loan providers.

Audited annual reports showing the group’s profitability is also missing. There is also no regulation in place. which makes PeerBerry a risky platform – it is completely unclear how it stands financially!

During the various crises of recent years, PeerBerry has been able to benefit from its large financial reserves and has even almost fully repaid Russian and Ukrainian customers. This is a special feature that other providers could learn from. Therefore, full marks for crisis resistance.

The growth also looks very good. Recently, the amounts financed have collapsed, but these could be short-term changes. It is still too early for a detailed analysis.

Overall, PeerBerry receives a weak 65 out of a possible 100 points.

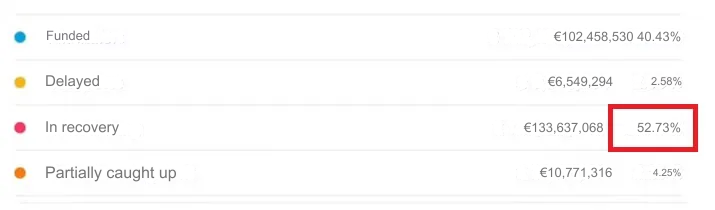

10. Estateguru

Estateguru is the largest property financing platform in Europe. Investors can expect interest rates of between ten and eleven per cent. For a long time, it had an excellent market position in the P2P lending comparison and was very popular among investors. But then came the current real estate crisis!

By 2022 at the latest, the entire property market had suffered greatly – and Estateguru was no exception. More than half of the portfolio currently consists of defaulted loans. The recovery process seems to work in principle, but it takes an extremely long time, especially for German loans.

It is interesting to note, however, that the new loans issued from 2023 onwards are performing extremely well again. So while investors who have been invested for longer are still hoping for their repayments, the ‘fresh’ P2P loans are more attractive again.

In view of the ongoing problems, it is not surprising that things are not going well financially either. According to the annual financial statement, a loss of a whopping 2.3 million euros was recorded in 2023. But that’s still better than the previous year’s results: minus 5.9 million!

The assessment is therefore also completed relatively quickly: full marks are awarded for age, number of investors, annual accounts, regulation and features.

However, with 0/10 in terms of crisis resistance and profitability, they clearly come away empty-handed. In the ‘Growth’ category, we award 10/20 points because there have recently been positive figures again.

This results in a weak overall score of 60 out of 100 possible points.

Due to the high level of loan defaults currently at EstateGuru, I am currently investing my capital in Viainvest (obtained with this link*). With Viainvest I earn over 13% interest, which is significantly more than with EstateGuru. As a welcome bonus, you will only receive 1% cashback on your investment after 90 days via this link.

Conclusion: P2P loans comparison with a new top position

After comparing all ten P2P platforms on the basis of all the important criteria, the following list emerges:

| Age | Investors | Audited annual report. | Profitability | Regulation | Feautures | Crisis resistance | Growth | Total | |

| Viainvest | 5 | 4 | 10 | 10 | 10 | 10 | 20 | 15 | 84 |

| Monefit | 2 | 1 | 10 | 10 | 5 | 15 | 15 | 20 | 78 |

| Debitum | 5 | 1 | 10 | 0 | 10 | 15 | 20 | 15 | 76 |

| Swaper | 5 | 1 | 10 | 10 | 5 | 15 | 20 | 10 | 76 |

| Mintos | 5 | 8 | 10 | 10 | 10 | 20 | 10 | 5 | 75 |

| LANDE | 3 | 1 | 10 | 0 | 10 | 20 | 10 | 20 | 74 |

| HeavyFinance | 3 | 1 | 10 | 0 | 10 | 20 | 10 | 20 | 74 |

| Bondora | 5 | 5 | 10 | 10 | 5 | 15 | 10 | 10 | 70 |

| Peerberry | 5 | 5 | 0 | 0 | 0 | 15 | 20 | 20 | 65 |

| Estateguru | 5 | 5 | 10 | 0 | 10 | 20 | 0 | 10 | 60 |

The leading platform for P2P lending in 2024 is Viainvest! And it is even quite a way ahead of the runner-up! The main reason for this is the consistency with which investors here always receive their interest of around 12 per cent, despite crises.

In second place is Monefit SmartSave, a provider that specialises in particularly simple P2P investments. Deposit money, receive interest and get at your money quickly when you need it – it really doesn’t get much simpler than this!

Debitum makes it into third place with its business loans. This form of credit is not only a good way to diversify your portfolio; the reliable 12 to 14 per cent interest rate is simply attractive! However, third place is shared with Swaper, which also does extremely well in the P2P ranking.

The following positions are very close together, with scores between 70 and 75. These P2P platforms each have their own drawbacks, such as lower interest rates or less crisis resistance. However, depending on your financial goals and needs, they can be worthwhile.

PeerBerry and Estateguru bring up the rear, each struggling with its own problems. PeerBerry lacks transparency as there is neither regulation nor audited annual reports for the group. EstateGuru, on the other hand, is suffering from a loan portfolio in which more than 50 per cent have defaulted and are only being recovered extremely slowly. Accordingly, we would currently advise against these P2P platforms.

FAQ – Frequently asked questions about the P2P lending ranking

Aleks Bleck is the face of Northern Finance and was already a shareholder, lender and ETF investor at the age of 18. His focus is on P2P loans and passive ETFs. Aleks founded Northern Finance in 2017 while studying business administration in Lu00fcneburg.

He built up the YouTube channel alongside his main job in investment and corporate banking before finally focusing full-time on Northern Finance.

Debitum proves that size isn’t everything. My experiences with Debitum show: Here you can count on more than 11 percent return (after deductions of possible failures)! How this works, what advantages and problems there are and what you should pay attention to, I’ll show you in my experience report. In brief: Debitum is a P2P […]