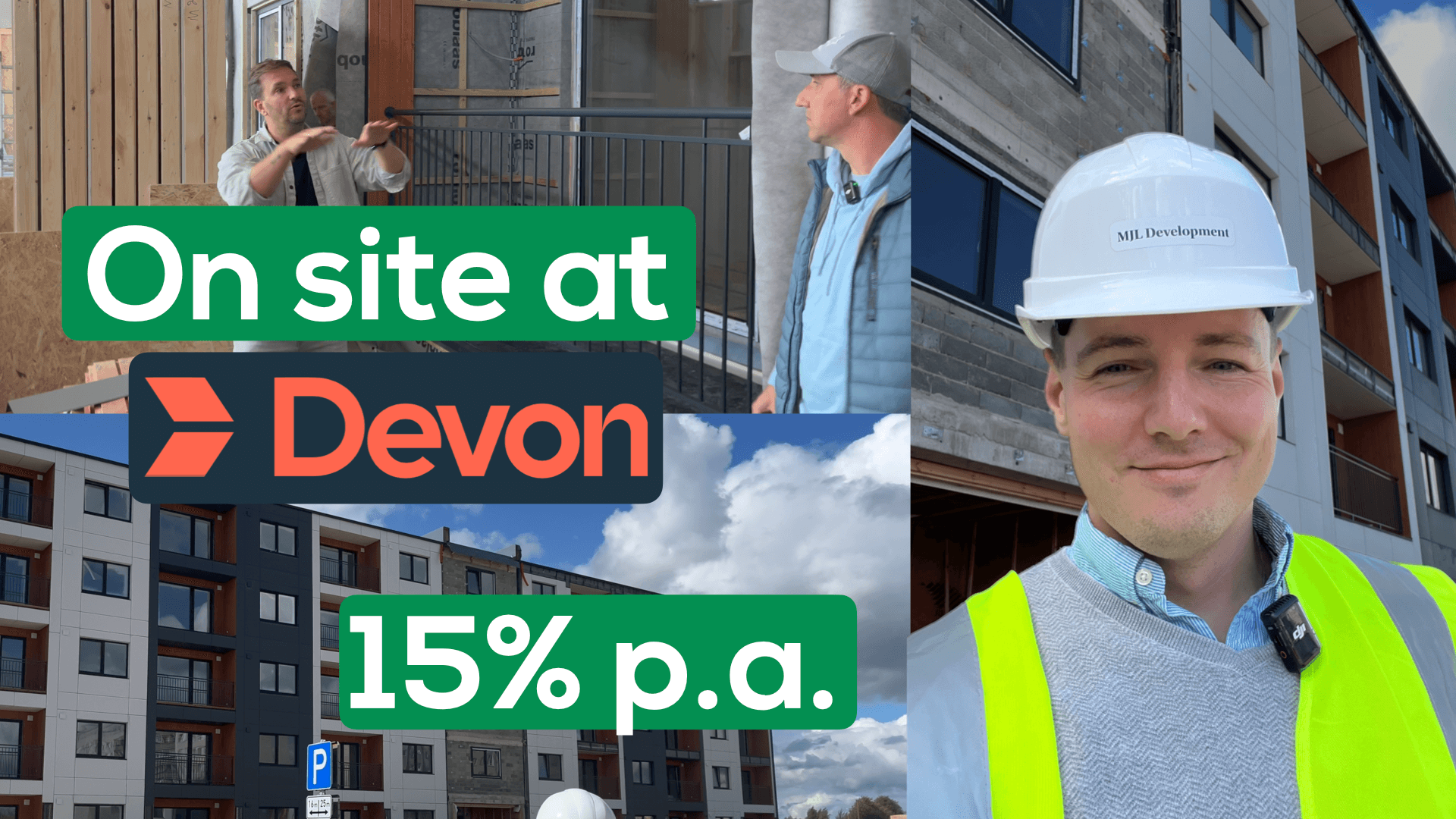

My Devon review: 16% interest | €2,600 invested

With Devon, you can invest in real estate projects from the highly successful MJL Group. In return, you receive 16% interest. The young platform wants to grow quickly and therefore offers attractive bonuses that provide an additional 5% interest. Attractive returns or a warning sign? Find out in my Devon review!

In brief:

- Devon is a P2P platform from Estonia that allows you to finance MJL Group real estate projects in Latvia. You currently receive 16% interest on your investment.

- The group behind it appears to be extremely solid and has already been successful for 30 years. However, there is still a risk with such a young platform.

- I visited the company and, based on the favourable impression I gained, have already invested 2,600€. My review so far has been clearly positive.

What is Devon?

For a long time, P2P marketplaces such as Mintos and Debitum were all the rage. But in recent years, providers that allow you to invest directly in a single company or group have also shown what they can do!

Very high interest rates at Ventus Energy and excellent flexibility at Bondora have shown that you can invest your money here with a clear conscience. Devon also falls into this category: through the brand-new platform, we can invest directly in MJL Group real estate projects and earn around 16% interest.

The buildings are all located in the Baltic States. However, these are no ordinary construction projects! They are built from prefabricated modules manufactured by MJL itself, meaning that production, construction and financing all come from a single source. This ensures enormous profit margins, which make such high interest rates possible in the first place!

The structure is as follows:

- The buildings we invest in are part of the MJL Group’s extensive portfolio.

- According to its own information, the company already has more than 22 million euros in real estate and over 30 years of experience.

- Tasks such as construction, administration or consulting for new projects are outsourced to separate companies within the group.

- Devon is the newest addition to this alliance and was founded to make financing even more effective.

So don’t be unsettled by Devon’s figures: only 550 investors and €3.7 million in financed P2P lending (as of autumn 2025) are completely normal for a young P2P provider ( <6 months old). The statistics of the MJL Group behind it are decisive!

| Foundation | August 2024 |

| Company headquarters: | Tallinn, Estonia |

| Management: | CEO Janis Lagzdins |

| Assets under management: | Over EUR 22 million (MJL Group) |

| Lending financed: | €3.7 million |

| Regulated: | Not yet regulated |

| Annual report: | No financial year completed yet |

| Investors: | 550 |

| Returns: | 16% + 1% cashback via my link + 4% cashback |

| Buy-back guarantee: | Repurchase obligation of the MJL Group after 90 daysEarly exit available after 6 months |

| Minimum investment amount: | 1.000 EUR |

| Auto-Invest: | No |

| Secondary market: | No |

| Tax certificate: | Yes |

| Bonus programmes: | Limited-time cashback bonus of 4% 1% bonus for 60 days when you sign up via my link |

Who is behind Devon?

In my experience, the management team is particularly important when investing in individual companies such as Devon. Unlike P2P marketplaces, there is no natural diversification here, and we are completely dependent on the success of the companies!

Devon appears to have a top-class team at the helm:

- CEO Janis Lagzdins previously worked as a manager for the German auditing firm PricewaterhouseCoopers. His review of risk assessment and real estate projects makes him an ideal candidate for the position at Devon.

- A project team consisting of civil engineers Mikus Tiss, Dainis Projums and project manager Madara Kuncina is responsible for managing the real estate projects. They had already successfully completed numerous projects before Devon was founded.

- The Modular Construction Team consists of Evija Vitola and Evalds Zunda. They are proven experts in this field, which is central to the success of the company.

The only thing missing from the management team is someone with P2P experience. However, a glance at my P2P lending comparison shows that this is by no means unusual. Numerous other providers have achieved great success without peer-to-peer experts!

How does Devon’s business model work?

Devon’s function is quickly explained:

- The MJL Group produces modular prefabricated components and uses them to construct attractive apartment buildings and other properties.

- Such construction projects must first be financed before a profit can be generated through subsequent sale or rental.

- The majority of the capital is provided by banks.

- Through Devon, investors like you and me can also participate in this financing. We take on the riskier mezzanine lending. In return, we receive high interest rates.

Devon itself could also generate profits from a portion of the interest in the future; however, it is also conceivable that the MJL Group will continue to finance the P2P platform on a permanent basis.

As the companies belong to the same group, any profits would in any case ‘stay in the family’.

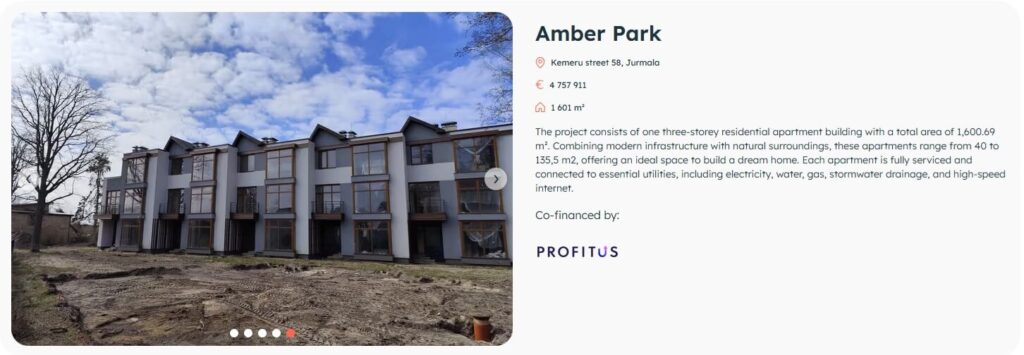

Available projects at Devon

At Devon, we invest in a single company and therefore cannot expect too much diversification. The available projects can be roughly divided into two categories:

1. High-priced apartments, such as the Amber Park project: This is a property located directly on the sea in the exclusive Jurmala district of Riga. Similar projects, such as Villa Astor, have already been completed and have proven that the concept works very well.

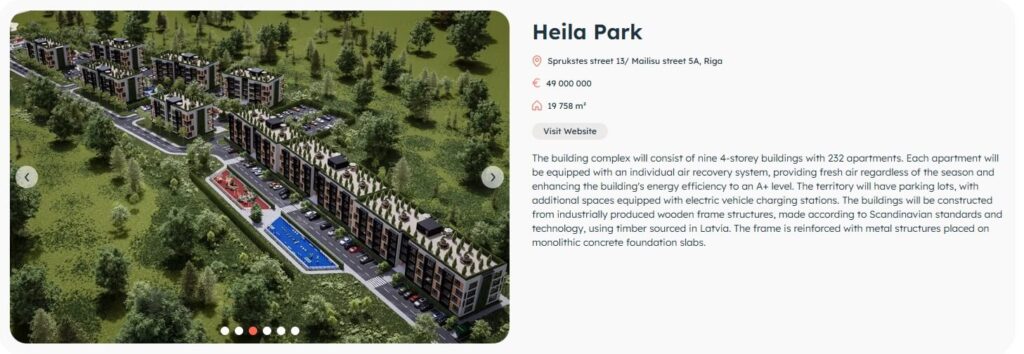

2. Affordable housing is also possible thanks to modular construction. Larger complexes with up to 232 flats, such as the Heila Park project, are significantly more affordable for tenants and buyers. Demand is correspondingly high!

As with its similarly positioned competitor Ventus Energy, most of Devon’s projects are divided into phases. This step-by-step financing reduces risk. It also means you can be sure that attractive projects are always available and your capital never lies idle.

Register with Devon and secure your bonus!

If you want to invest in the young Devon platform, now is the ideal time: you can currently get 4% cashback on investments and 1% additional interest for the first 60 days if you sign up via my link!

You will need:

- An identity document (passport, identity card or residence permit)

- A bank account for depositing/withdrawing money

- A smartphone with a camera and internet connection

- An email address

- A mobile phone number that you can use to receive text messages

The registration process itself is very simple.

1. Name and password: Click on the ‘Sign up’ button in the top right-hand corner to go to the relevant page. First select ‘Register with email’ and then you can enter your details:

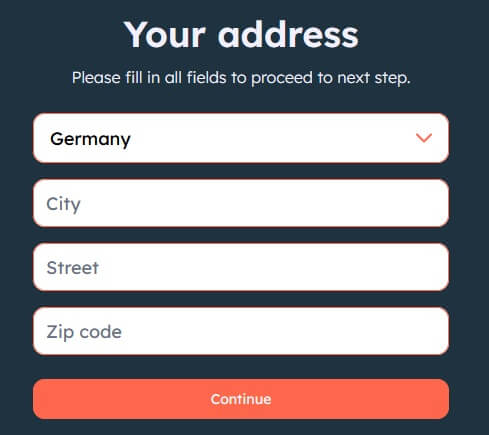

2. Confirm your email and enter your address: You will receive an email from Devon and must click on the confirmation link. You can then enter your address.

3. Politically exposed person and PIN: Devon is legally obliged to ask whether you are a ‘politically exposed person’. If, for example, you hold a high political office, you must click “Yes”. For most investors, however, ‘No’ is the correct answer. You will then need to assign a PIN code.

4. Verify identity. If you have already had a review of other P2P platforms or similar services, you know the drill: you have to verify yourself with an ID document and confirm your identity. Devon uses the service provider ‘veriff’ for this purpose. The entire process is quick and automatic, without any contact with a service representative.

How to receive your bonus

Devon offers particularly attractive bonuses! Currently, you receive 4% cashback for every investment, which means that 4% of your investment is immediately credited back to you in cash.

You will also receive 1% extra interest if you register via my link. Both bonuses will be credited to your account automatically, so you don’t need to do anything else.

- The cashback bonus will be credited to your Devon account immediately when you invest money.

- My 1% bonus will be displayed immediately as a timer. To get the most out of your investment, you should invest a larger amount right from the start.

The additional interest you receive through my registration link is only valid for the first 60 days!

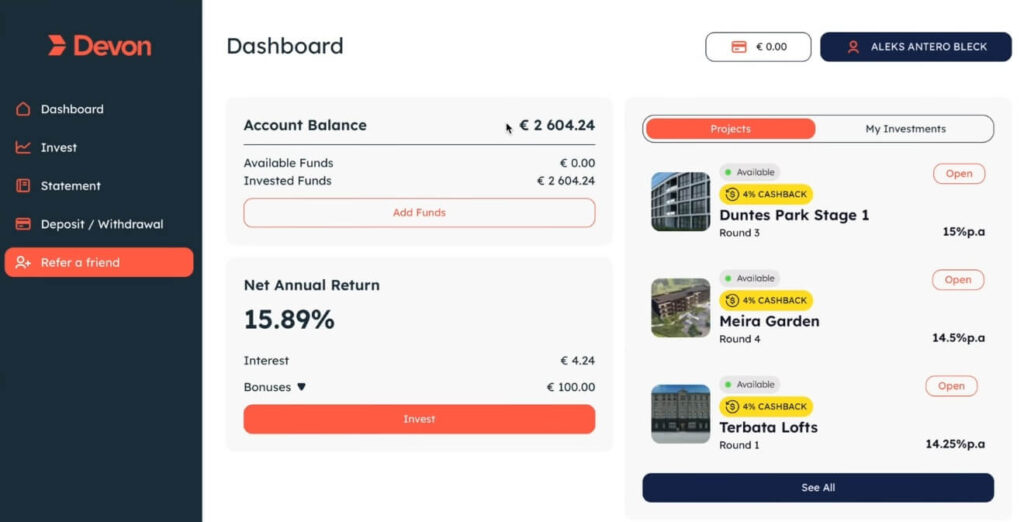

My Devon review: How I earn 15.89% interest on my €2,600 investment

Of course, I don’t just invest in platforms like Devon for fun, but to generate a strong passive income from P2P lending. You can see how well this works in my portfolio.

So let’s take a look at what Devon has to offer:

- After my personal visit to Devon and a review of similar projects, I have decided to invest €2,500 initially.

- I have invested in two projects, ‘Meira Garden’ and ‘Duntes Park Stage 1’.

- For this, I immediately received €100 (4% of €2,500) back as a cashback bonus.

- My cashback and all interest are immediately reinvested.

- I currently receive €1.06 in interest every day.

Of course, you can also choose to have your winnings paid out instead. However, the daily crediting and very high returns result in a very strong compound interest effect if you opt for automatic reinvestment!

What taxes are payable in Devon?

Anyone with experience of P2P lending will prick up their ears at the mention of Latvia or Riga: unfortunately, this small Baltic country levies a withholding tax of 15%. Although European investors can easily have this tax offset, the additional effort required to do so is extremely inconvenient.

Devon is therefore following the same path as many other P2P platforms: it has its own Company headquarters registered in Estonia without further ado! There is no withholding tax here. so that you can simply pay tax on your winnings in the United Kingdom without any further ado. Here’s how it works:

- You download a certificate of your winnings from your account area at Devon.

- You must declare the reported profit in your next tax return.

- For German users, this is line 19 in Appendix KAP.

- If you have any problems or doubts, you should contact a tax advisor.

You can also find answers to further tax questions in my article on P2P tax returns.

Devon Risk: How secure is my money?

The reason for Devon’s very high interest rates is a risk that should be taken seriously!

- We finance mezzanine lending (interim financing) for a company here.

- The majority of the capital comes from traditional banks and equity capital from the MJL Group.

- In the event of the bankruptcy of the company/group of companies, the banks will be paid first.

- It is questionable whether and how much capital will be returned to us investors in this case.

- The risk is further increased by the very high minimum amount: you must invest at least €1,000.

So there is a chance that you could lose some or even all of your capital in the event of bankruptcy!

The key question: How likely is such insolvency? Janis Lagzdins has built an effective company and brought people with extensive experience on board. In addition, Devon operates as part of the highly profitable MJL Group.

The entire structure made a very solid impression on me during my visit. I therefore see very good prospects for the long-term success of the offering and have invested accordingly.

Individual annual reports within the MJL Group confirm the impression that the company is operating profitably. Due to its young age, there is no data available yet on the Devon platform itself.

Advantages and disadvantages of Devon

Devon is an exciting P2P project that should appeal to risk-tolerant investors with experience and larger assets. However, before you decide to invest, you should be aware of the advantages and disadvantages:

| Advantages: | Disadvantages: |

| Very high interest rates, currently over 16% per annum | High risk: In the event of insolvency, losses are likely. |

| Attractive bonus promotions can increase the interest rate to over 21%. | Buyback guarantees and similar arrangements offer no protection in the event of bankruptcy. |

| There is a buy-back guarantee (from the MJL Group) and the option of early exit. | Very high minimum investment of 1,000 euros per project |

| The concept works, and previous properties have already been lucrative. | You invest directly in a single company and are dependent on its success |

| High level of transparency for all projects, plans and figures to date | No annual report available from Devon yet |

| Your interest is credited daily, ensuring a strong compound interest effect. | Website available in English only |

| Good software/website, managed by Whitelabel Solutions (known for Ventus Energy). | Long capital commitment: The term of the loans is usually more than 2 years. |

Alternatives to Devon

Devon is already the second platform on the European market that combines very high interest rates, direct investments, high minimum amounts and considerable risk. You are not alone in the field of real estate loans either! It is therefore necessary to compare several alternatives at once:

1. Ventus Energy: Up to 17% interest + 6% bonus!

At Ventus Energy, we invest directly in energy projects such as power plants, solar installations and electricity infrastructure. In return, the company rewards us with 17% interest. Thanks to the now famous Ventus Energy bonus of 5% for new customers plus 1% cashback when you register via my link, you can earn up to 23% per annum!

Ventus Energy uses the same software platform as Devon and therefore looks quite similar. The very high minimum investment of €1,000 per loan is also the same for both providers. In addition, they offer similar buy-back guarantees. However, they are completely independent companies.

You can find all the important information in my Ventus Energy review.

2. Indemo: 25% interest through debt securities!

Indemo also offers very high returns through real estate, but focuses on ‘discounted bonds’. The company acquires defaulted real estate loans, auctions off the buildings and shares the profits with us. Individual projects can yield profits of over 40%!

The returns are not guaranteed, but in my experience they have been at least 20% and in most cases significantly higher. As with Devon, you need to be prepared to invest a considerable amount of time, as your money will be tied up for a while. However, in my opinion, it is a very attractive offer!

You can find all the details in my Indemo review.

3. Fintown: Up to 15% through rental properties

Devon is not the first company to generate high profits through rentals! Fintown has also been successfully using this concept for some time. Investors can earn around 15% here and get started with a minimum investment of just €1.

Here, too, there is a successful group of companies behind the platform. With two years of experience and over 5,500 investors, Fintown has already achieved good results. It is a sensible alternative for investors who consider Devon too risky but do not want to miss out on profits from real estate.

As always, you can find everything you need to know in my Fintown review.

Conclusion: Good experiences and high interest rates so far, but considerable risk

Devon relies on a similar concept to Ventus Energy: very high interest rates of over 21% (including bonuses), a minimum investment of €1,000 and the opportunity to invest directly in a successful company. The software platform is also shared, but otherwise completely independent.

We invest here in property projects that are professionally planned, built and let by the group of companies. The construction using in-house prefabricated modules offers enormous profit potential.

In addition, the group has more than 30 years of experience in this industry and has a real estate portfolio worth over €22 million. However, there is still a serious risk: in the event of bankruptcy, it is unclear whether and how much capital P2P investors will get back.

I already have extensive experience with such offers and am a big fan. Devon made a very good impression during a personal on-site visit. The figures to date, which are all presented transparently, also confirm this positive image.

That’s why I initially invested €2,600 in various projects on the platform. If my positive experiences continue, I will increase this amount.

This is because it is a highly interesting industry. And with the best-known real estate platform, EstateGuru, continuing to struggle with disappointing results and high defaults, demand is enormous!