My Monefit Review: 10.5% on my €11,000!

With interest rates falling, a call money account is hardly worth it anymore – luckily, Monefit offers you an exciting alternative with P2P lending! The company uses its experience in personal loans to pay you a juicy 7.25% interest.

I have been with them for more than two years and have over £11,000 invested, and my experience with Monefit has been mostly positive with very few negative experiences. Read this review to find out if Monefit could be right for you.

In brief:

- Monefit is an offer from the Creditstar Group, which has been successfully providing P2P lending for years

- You receive a solid interest rate of 7.25% and can withdraw your capital without notice

- Competitors sometimes offer double the interest – but also tie up your capital for months

- The Monefit offer is currently more attractive than Bondora Go& Grow, as it only offers 4 per cent interest for new customers

What is Monefit SmartSaver – My Monefit review

A glance at my P2P lending ranking immediately shows that investor demand is huge! This is hardly surprising, as personal loans consistently generate high returns and have also weathered times of crisis well! One provider that has been financing successfully for years is the Creditstar Group.

Active investors are probably already familiar with them from platforms such as Mintos or Lendermarket, where you can achieve impressive returns with the loans of the initiator.

Creditstar Group loans are also available via the P2P marketplace Mintos and are offered at interest rates of up to 16.5 percent.

If you haven’t had any experience with Mintos yet, here’s the most important information in a nutshell:

- The Creditstar Group is an extremely popular provider on the P2P marketplace Mintos.

- It pays very high interest rates of up to 16.5%.

- Investor sentiment was somewhat dampened during the COVID crisis, but the group has since returned to its path of success.

- Although repayments on Mintos had to be temporarily deferred, Creditstar has always been financially profitable – something that cannot be said of many of its competitors.

Given the group’s huge success, it was obvious to launch its own P2P portal. However, it did not opt for the high-interest segment, where companies such as Ventus Energy are already delivering incredible returns of up to 24% per annum!

Instead, it serves an exciting niche: investments with good interest rates of 7.25% and immediate liquidity. This means that you can withdraw your capital at any time if necessary. This makes them a competitor to lending providers such as Bondora, who made this model famous.

Monefit is also positioning itself as an attractive alternative to traditional instant access and fixed-term deposit accounts, as it offers much higher interest rates with equally good liquidity. However, the fundamental risk associated with P2P lending is also present.

| Established | 2006 |

| Headquarters: | Riga, Latvia |

| CEO: | CPO Kashyap Shah |

| Assets under management: | Over EUR 288 million |

| Loan volume financed: | EUR 19 million (10/2025) |

| Regulated: | P2P platform not regulated, loan originators are regulated |

| Annual report: | Available |

| Investors: | Over 26,000 |

| Return: | 7.25% with immediate availability Up to 10.52% for ‘Vaults’ with a term |

| Repurchase guarantee: | Not applicable |

| Minimum investment amount: | 10 EUR |

| Auto-Invest: | Yes |

| Secondary market: | No |

| Tax certificate: | No |

| Bonus programmes: | €5 instant bonus plus 0.5% for 90 days with my registration link |

What’s behind Monefit

Creditstar Group was founded in Estonia back in 2006. Since then, it has achieved considerable success in eight different countries with several lending products. One such product was Monefit: experience at the time showed that easily accessible, modern online solutions for P2P lending were the way forward.

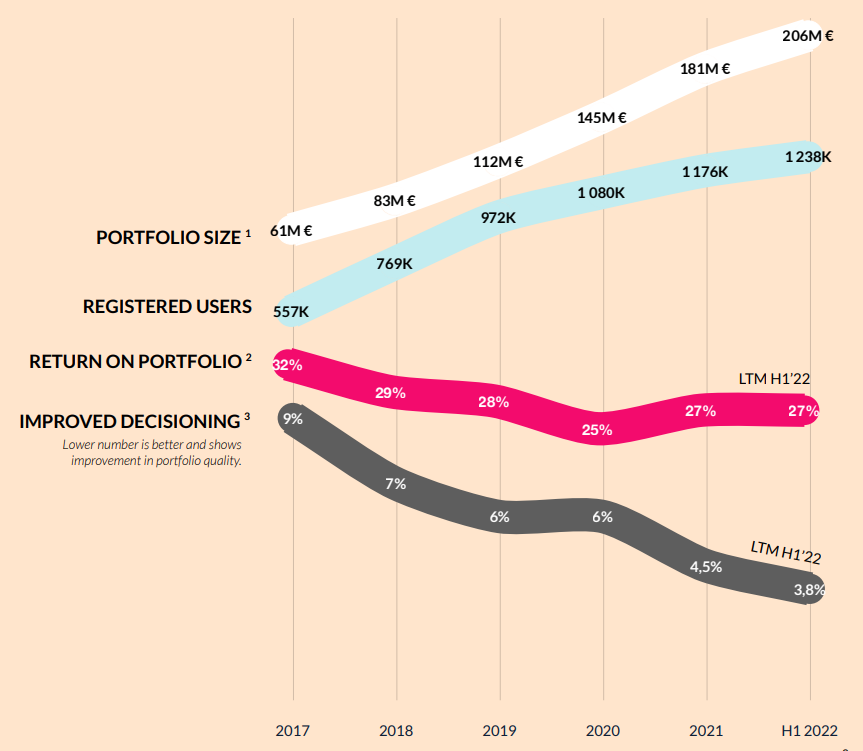

- Thanks to its simple registration and loan approval process, Monefit has already acquired more than 1.3 million customers.

- The managed loan portfolio is currently worth more than €300 million.

- The SmartSaver has opened up a new business area: investors who do not want to tie up their money for the long term but still want solid interest rates.

Monefit’s company data and experience are impressive.

The Monefit team has extensive experience in finance and the P2P market. CPO Kashyap Shah alone has been active in consumer lending for 22 years and has worked for some of the world’s largest banks. He answered my questions in an extensive interview.

The Creditstar Group can confidently be described as one of the oldest and most important companies of its kind in Europe: it has been active in its home country of Estonia for 19 years and has consistently generated profits since its inception – currently over €10 million per year!

This is unique in the P2P market, as many competitors are still in the red even after a decade of lending! The group regularly issues bonds to finance its operations, which are readily snapped up by investors.

How does the business model work?

Monefit has years of experience in granting consumer loans. Private individuals in:

- Spain

- Sweden

- United Kingdom

- Denmark

- Poland

- Czech Republic

- Estonia

- Finland

can obtain money for purchases or when they are short of cash at the end of the month.

The ‘credit line’ concept enables the company to build much closer ties with borrowers and, in many cases, turn them into regular customers. Creditstar’s success proves it right: despite the incredibly high interest rates of 73 percent per annum (in the United Kingdom, for example), business is booming.

Anyone who borrows money from Creditstar has to pay up to 73 percent interest per year. Nevertheless, demand is high.

The money for these loans comes from investors like you and me. We can finance these P2P loans via Monefit SmartSaver or the P2P marketplaces Lendermarket or Mintos. In return, we are rewarded with attractive interest rates.

Of course, the Creditstar Group also benefits from this:

- It skims off part of the interest for itself. Its profit was recently over 16%.

- Thanks to refinancing from private investors, the group can grow very quickly and issue further loans.

- The additional capital also enables it to operate even more efficiently, increase profits and take full advantage of the opportunities offered by the current market.

Monefit and the Creditstar Group naturally also make an important contribution: they grant the loans, ensure that payments are made on time and operate the stylish website through which everything is handled.

They also check who is eligible for a loan, thereby keeping default rates low. According to the company, this selection process is very strict: only around 30 percent of people who apply for a loan are accepted.

If you already have experience with P2P lending, you know how it works: register, deposit money, select loans, wait and profit. With Monefit SmartSaver, however, it works a little differently.

We make our capital available to the Creditstar Group. There is no need to select individual projects or loans for financing. This makes investing with Monefit extremely relaxed.

Register and secure your bonus

One important reason why my experience with Monefit has been so positive is that everything works really easily and without unnecessary options! The registration process is no exception. Use my link to get €5 and 0.5% extra interest for the first 90 days.

To register, you will need the following:

- Citizenship or residence permit in an EU country or Switzerland

- Smartphone with working internet connection

- Identity card, passport or residence permit

- An e-mail address

- A bank account to deposit and withdraw money

Monefit SmartSaver advertises its simple registration process on its website. As promised, registration is indeed very straightforward.

I was able to complete the registration in less than 10 minutes, but there are isolated reports of people who initially had to submit additional documents.

A look behind the scenes: Monefit SmartSaver uses the experience of the P2P platform Lendermarket (from the same group) for its infrastructure. This has a positive impact in various areas. You will also come into contact with Lendermarket when depositing your capital.

Deposit, invest, collect bonus

Monefit makes it difficult for analysts like me, because what can I say about using such a simple and clear platform? After registering and logging in for the first time, you immediately see a stylish, sleek dashboard:

My dashboard: Clear and with just a handful of options.

As a new customer, all your assets are still at €0, but we’ll change that right away! You’ll find the ‘Deposit money’ button in the middle of your dashboard. You can deposit any amount via your bank account or credit card – but the minimum investment is €10.

If you used my link to register, you will also receive €5 immediately. You will also receive an additional 0.5% interest, which will be credited to your account in one lump sum after 90 days.

What can I invest in?

Investing money with Monefit is kept very simple:

- Deposited funds are invested immediately and generate interest

- There is no function for temporarily storing your money without investing it

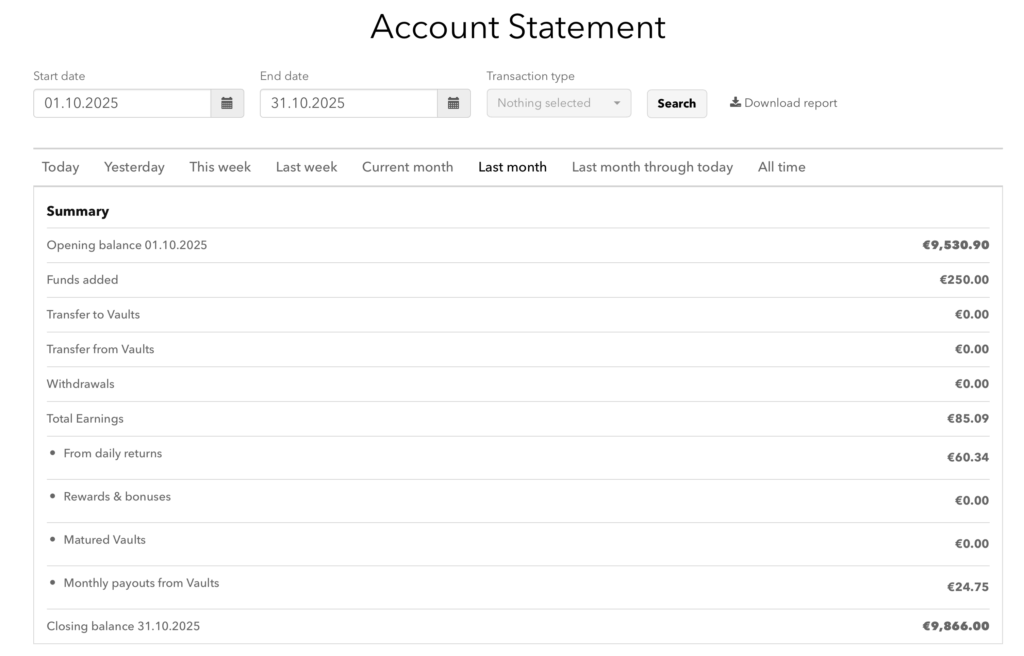

- Interest is paid monthly, always on the tenth day of the month.

- When making a withdrawal, make sure to include the next ‘interest round’ if possible, as you may otherwise lose out on returns.

For this ‘standard investment,’ you currently receive 7.25% interest per year. Other P2P platforms may offer more here, but they can’t compete in other respects! Daily payouts are a huge advantage that few competitors can offer.

In my experience, Monefit is therefore ideal for passive income from P2P lending – and really passive, with no loan selection, adjustments or anything else! Alternatively, you can also make very efficient use of the compound interest effect through regular payouts.

The second investment product is the so-called Vaults: they offer you higher interest rates, but also tie up your capital for longer and are therefore comparable to a fixed-term deposit account. They fit very well into Monefit’s product range, as it now offers alternatives for both instant access and fixed-term deposits!

The highest interest rates currently available are 10.52% for a two-year term. These can be worthwhile if you do not currently need the capital and trust Monefit or the Creditstar Group.

This is because there is no deposit protection! In the event of problems or even insolvency, your money could be lost. Given the company’s nearly 20-year track record and profits of more than €10 million per year, this is extremely unlikely, but you should still be aware of the fundamental risk.

My experience with Monefit SmartSaver: How I earn up to 10.5% on my €11,000

I have been with Monefit for over two years now and have had a very positive experience during this time. So positive, in fact, that I wish I had invested significantly larger sums much earlier!

I currently have over €14,000 invested, of which:

- Around €10,100 in the ‘main account’ with 7.25% interest and daily availability

- Over €4,300 in vaults with interest rates of up to 10.52%, but also terms of up to two years

My interest so far has been €1,400, which is very good for a two-year term! Of course, I would have been able to get more with providers like Ventus Energy, but I wouldn’t have had the money available there at all times.

Do you have to pay tax on your P2P earnings?

Income from P2P investments is subject to taxation. In the United Kingdom, this is usually capital gains tax of 25% plus the solidarity surcharge and, if applicable, church tax.

The good news: Monefit is based in Estonia, so you don’t have to worry about any withholding tax deductions or the like. Simply declare your profits on your tax return and you’re done!

Monefit also provides you with a tax certificate that you can flexibly adjust to the desired period and then download.

You can flexibly select the appropriate tax report for your tax return and download it with a single click.

Risks: How secure is my money with Monefit SmartSaver?

It goes without saying that you don’t get attractive interest rates and immediate availability without something in return. You have to take a risk with Monefit. Only you can decide whether an investment is worthwhile!

Regulations

The platform’s regulations present a mixed picture: Monefit itself is not monitored or regulated by any financial authority. This is not ideal, but it is by no means a cause for concern! The Creditstar Group, as the parent company, is subject to financial supervision in all countries in which it grants loans.

This at least gives us as investors the certainty that the parent company is acting according to the rules. As we are investing in the Group’s experience and success via Monefit SmartSaver, this is probably the most important aspect. Nevertheless, regulation of the platform itself would be desirable in the future.

Reports and annual financial statements

The Creditstar Group informs investors extensively about current business figures and developments. However, it does not do this purely out of kindness, but is obliged to do so: As the company issues bonds, it has to fulfil high requirements in terms of transparency and communication.

This is ideal for us as investors, as we can take a look at the independently audited annual reports or interim reports at any time. As with all P2P providers that only invest in products from a single credit originator, the financial health of the parent company is crucial!

There is currently no cause for concern here:

- More than €10 million profit last year

- Profit margin of 16.89%

- Assets under management of €288 million

Even in a serious crisis, Monefit and the Creditstar Group behind it should therefore perform very well. In my experience, only a very long dry spell or a change in the legal situation could pose a risk to the group. In both scenarios, however, our capital would be secure and normal payouts would be possible.

Guarantees

The terms of use of Monefit SmartSaver explicitly exclude financial claims against the company. This means that there is no guarantee that the promised interest will actually be paid out or that it will be available at the desired time.

The terms of use contain the suspicious point 7.8, which states that the promised return is not guaranteed.

Is this a standard safety clause from Monefit? In my experience, such exclusions are quite common; the wording chosen and the response from CPO Kashyap Shah in the interview did not give me the impression that the company wants to leave itself a back door open here.

Competitors also have similar clauses in their terms and conditions, so I don’t see any immediate cause for concern here. As always, however, you should be aware that your money is at risk in the event of financial problems within the group.

My Monefit experience: Clear advantages and disadvantages

While my experience with Monefit SmartSaver has been positive so far, some minor issues remain. The following advantages and disadvantages stand out particularly clearly:

Advantages

- With Monefit SmartSaver, you are investing in a group with extensive experience and sustained success. Even in the crisis year 2020, the group achieved a return on equity of 18 per cent and now manages a portfolio of over 200 million euros!

This means that insolvency – the greatest threat to our investment – is extremely unlikely in the near future. However, if the worst were to happen, there would be so much capital ‘up for grabs’ due to the huge volume that investors could hope for a repayment or two.

- Monefit offers you a solid interest rate of currently 7.25%. You can earn significantly more with other providers, but you won’t get the same excellent flexibility!

- Liquidity is very good at Monefit: you can withdraw your capital at any time and have it in your account within a maximum of 10 days. In my experience, however, the payout is significantly faster and only took 2 working days for me.

- The platform is super easy to use. It is clearly laid out and limited to the main functions: depositing and withdrawing money and, if desired, using the ‘vaults’. A tax report can also be generated with a click of the mouse. The website is also available in a German version.

- Creditstar offers comprehensive transparency in the form of audited annual reports and other key figures.

- You get access to very attractive markets such as Denmark and the United Kingdom, which are hard to find on other P2P platforms.

- In my experience, Monefit SmartSaver currently has the best referral programme: you and the person you refer can each earn up to £2,500!

- With the Vaults, you also have the option of receiving even higher interest rates, but in return you have to tie up your capital for longer.

Disadvantages

- The parent company Creditstar has decided to temporarily suspend repayments via Mintos during the COVID crisis for security reasons. These loans are now being repaid bit by bit. Although investors are receiving excellent interest rates throughout this period, many investors are annoyed.

- The Monefit platform is not regulated or supervised by financial authorities, unlike the loan originator Credistar.

- There is no collateral or control for investors. The capital invested is made available to the parent company and can be used by it at its discretion. As investors, we cannot choose which regions, types of loans, etc. we want to use. The return also depends on the success of the Creditstar Group. This makes it very easy to use, but can also be restrictive.

- The purpose of ‘vaults’ is debatable: they offer slightly higher interest rates, but still significantly less than the competition. At the same time, you lose what is probably the most important advantage of daily availability. An investment in Ventus Energy, Debitum Network and other platforms is simply more worthwhile here.

Are there any alternatives to Monefit?

A glance at my current P2P lending ranking shows that the market has grown massively in recent years and now includes dozens of portals and providers. It is therefore hardly surprising that Monefit has several competitors pursuing a similar business model:

1. Bondora Go & Grow

Bondora’s Go & Grow offer is the most important competitor, as it follows exactly the same concept: solid interest rates with daily availability. Here, you can expect 6.75%, which is slightly less than with Monefit. You also have to do without extras such as vaults. You can find out more in my Bondora review or in the Monefit vs. Bondora comparison.

2. Fintown

With its focus on real estate projects, Fintown appears to be positioned quite differently at first glance, but also offers attractive and completely passive additional income. Here, too, you can earn around 7% on a permanent basis without any effort on your part. Find out whether it’s worth it in my Fintown review.

These are the experiences of the community

Of course, I’m not the only one who has experience with Monefit SmartSaver! Many members of the Northern Finance Community have an opinion about the P2P platform. These are mostly positive and look something like this

Given that all payments have always been made on time, this is hardly surprising! However, there are also disappointments, mostly when investors do not fully understand the Monefit concept (average interest rates but excellent availability).

And, of course, there are also serious disadvantages that some investors – quite rightly – criticise. For example, the waiting time of up to 10 days for payouts is far too long. Monefit needs to improve in this area!

Conclusion: My Monefit experience has been thoroughly positive

Monefit SmartSaver has carved out a very attractive niche for itself with its 7.25% interest rate and high liquidity thanks to daily availability. Easy to use and very low effort – no loans need to be selected or settings made – make the offer even more attractive.

At Monefit, we rely on the experience of our parent company Creditstar, as our capital is invested here without us having any influence. What is unusual for many ‘old hands’ in the lending business ensures very simple operation and high flexibility.

The company itself is very successful and manages a huge portfolio of more than €288 million. The Creditstar Group has been very successful even during crises and has recorded steady profits. However, a certain residual risk always remains with P2P lending.

Based on my experience with Monefit so far, I consider SmartSaver to be a very exciting offer. The interest rates alone are not the most important selling point, as other platforms offer significantly more. However, combined with high liquidity, this creates an extremely exciting product that is likely to find many followers.

If you are concerned about the security of an investment, I recommend taking a look at my report on the Monefit SmartSaver risk first.